ビットコイン以外の暗号資産が過去数回のブルマーケットで示した教訓の振り返り

TechFlow厳選深潮セレクト

ビットコイン以外の暗号資産が過去数回のブルマーケットで示した教訓の振り返り

好況の「罠」の中でどう生き延びるか?

執筆:BowTied Bull

翻訳:白話ブロックチェーン

2025年の到来とともに、新旧交代の時期を迎えるにつれ、私たちは習慣的に過去を振り返り、未来を見据えることになる。

暗号資産業界の過去を振り返ると、興味深い現象が見えてくる。それは、4年ごとに「アルトシーズン(Alt Season)」と呼ばれる時期が訪れるということだ。この時期には、業界内のあらゆるものが上昇し、酒好きの叔父さんでさえも何か動物の絵文字のようなコインを買って大儲けしたという話を耳にするかもしれない。しかも酔っ払った状態で取引を行ったにもかかわらずだ。

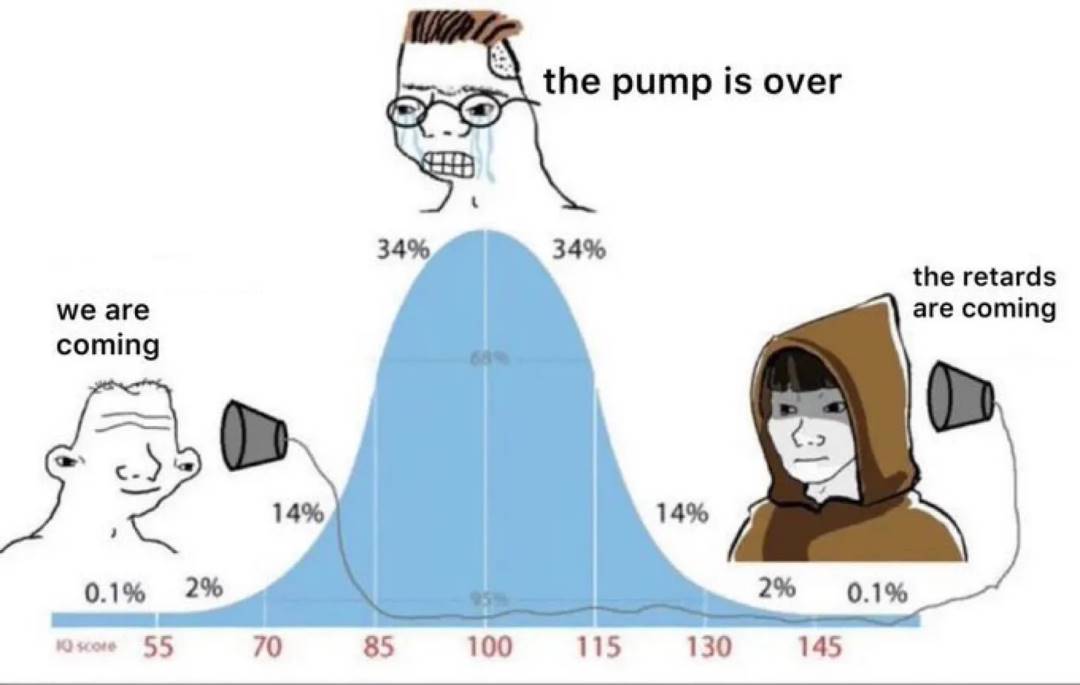

2025年現在、真の意味でのアルトシーズンはまだ本格的には始まっていない。誰も今回のアルトシーズンがどの程度過熱するか予測できないが、ここで注意しておきたいのは、アルトコイン相場の動きは通常非常に急速に暴走し、また突然終焉を迎える可能性があるということだ。一度崩壊が始まれば、価格下落率が-99.99%にとどまらず、完全に価値がゼロになる可能性さえある。

しかし、その前には誰もが繁栄と娯楽の雰囲気に包まれている。それでは、これまでのアルトシーズンを振り返り、その展開から何か学べる教訓はないだろうか?

2012-2013年のアルトシーズン:初期の熱狂的投資家たち、時価総額最大150億ドル

現在、市場で無謀な追随者が再び現れようとしている可能性がある。これは2013年にすでに起きたことであり、その展開は非常に興味深いものだった。

2013年の「アルトシーズン」当時、ビットコインはまだ初期発展段階にあり、時価総額は約10億ドル程度で、大型取引(ホエール取引)でもせいぜい10万ドル規模だった。当時はCEXであるMt.Goxが運営されており、投資家の多くは『マジック・ザ・ギャザリング』などのトレーディングカードゲームに参加していた人々だった(これが後にMt.Gox事件の背景ともなる)。

当時、人々はビットコインの取引速度改善策として、ブロック生成時間を短縮すれば取引が早くなると考え、これを画期的な革新と見なしていた。

ライトコイン(Litecoin):今も存在しているが、そのアイデア自体(Charlie Lee氏による)は、ビットコインの10分間隔のブロック時間を2.5分に短縮することであった。

ライトコインの価格は約10セントから48ドルまで上昇し、約47,900%の上昇を記録。2017年にも再び大幅に上昇した後、Charlie Lee氏は保有株すべてを売却。「彼がいなくてもビットコインネットワークはうまく機能している」と述べた(創設者が100%の保有を処分した意味については、周知の通りである)。

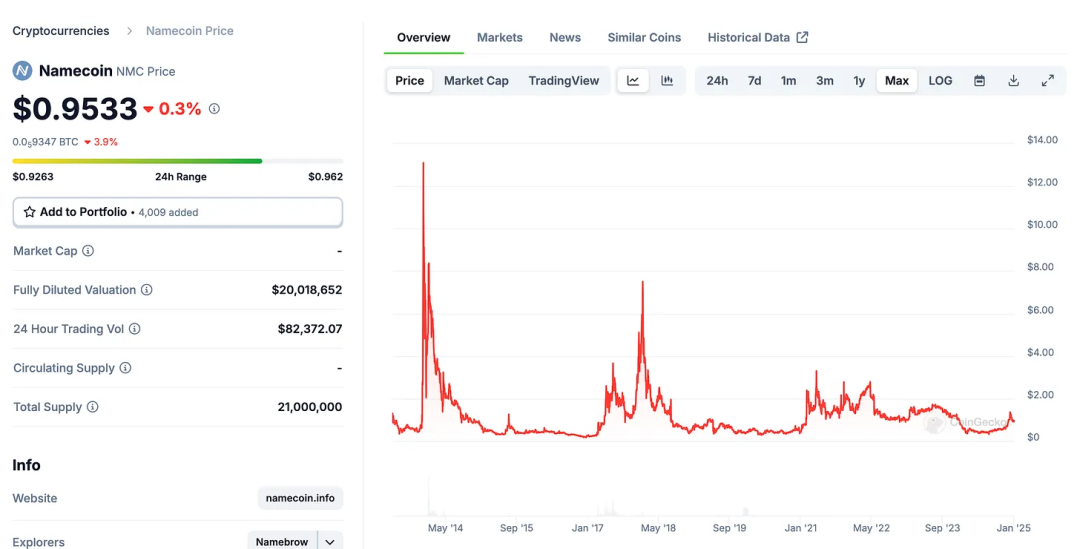

Namecoin:ビットコインのフォークコインであり、「.eth」のようなENSの概念に近い、分散型ドメイン名システムの構築を目指していた。価格は一時13ドル近くまで上昇したが、すぐに低迷。最低値から最高値までで約30倍の上昇を記録。実際、今も存在しており、現在の取引価格は1ドル前後である。

Peercoin (PPC):初期のプルーフ・オブ・ステーク(Proof-of-Stake)トークンの一つであり(このメカニズムは現在ETHのセキュリティ確保にも使用されている)、2度の急騰を経験した。1回目は2013年、もう1回は2017年のETH 1COバブル時。価格は一時7ドル近くまで上昇し、60~70倍の上昇となった。当然ながら主流化には至らず、最終的には0.42ドルまで下落した。(ただし現時点での結論としては、BitconnectやLUNAのような純粋なポンジースキーム以外のものは、ほぼ完全にゼロになることはないだろう。)

バブルの全盛期:ビットコインは最終的に1200ドルに到達し、暗号資産への関心高まりによりこれらのアルトコインも次々と上昇した。BitcoinTalkフォーラムに投稿されたプロジェクトであれば、投機だけで価格が急騰した。今日に最も近い例は、有名人が宣伝するメモコイン、あるいは有名人の名前にちなんだメモコインだろう。

Mt.Gox崩壊:Mt.Goxの崩壊によって、この賑わいは終わりを告げた。重大なハッキング事件が原因で、ビットコイン価格は大幅に下落(底値の見方によるが、85~90%の下落)。アルトコインはそれ以上、99%を超える下落を記録した。

2017年のアルトシーズン:1COバブルとイーサリアムの台頭、時価総額最大8000億ドル

その後の熊市期間中に、多くの興味深い出来事が起こった。イーサリアムはスマートコントラクトプラットフォームとして登場し、プログラム可能な通貨の創造を目指した。これは真の革新であり、単にトークンの送金だけでなく、スマートコントラクトの作成を可能にしたことで、ゲームのルールを完全に変えた。

暗号資産分野の多くの事象と同様、イーサリアムもまた一般的なリスクを伴っていた。イーサリアムのDAO(分散型自律組織)はハッキングされ、1億ドル以上の損失を出した。その結果、ブロックチェーンは分裂し、ETHとETCという2つのチェーンが生まれた。今なお一部の人々は、この分割が誤りだったと考えているが、ここでは議論せず、歴史としてのみ言及する。

2016年頃、人々はイーサリアムブロックチェーン上で新しいトークンを発行できることに気づき、それが初回トークン発行(1CO)の誕生につながった。1COでは、プロジェクト側が直接投資家にトークンを販売した。2017年、1COバブルが本格的に勃発し、思いつく限りの詐欺プロジェクトが続出することになった。

イーサリアム(ETH):これらのトークン発行にはETHが必要だったため、ETH価格は急騰。約8ドルから2018年1月の1400ドルまで上昇し、当時としては想像を絶するリターンとなった。現在のETH価格は約3650ドル。

リップル(XRP):今も「銀行向けコイン」として位置づけられている。理論上、リップルがSWIFTを一夜にして置き換え、金融の事実上の標準になるとされていた。中心化されているにもかかわらず(ほとんどの人は気にしなかった)、数百万ドルの資金が流入した。価格は約1セントから3.80ドルまで上昇。現在の取引価格は2.41ドル。

奇妙なことに、リップルの投資家層は依然として個人投資家が中心だ。最近の上昇局面でも同様の現象が見られ、TikTokで話題となり、活発な議論が交わされた。「もしリップルの時価総額がビットコインと同じレベルに達したらどうなるか?」といった、「4兆ドル時価総額」論はやや理解しがたいものがある。

ライトコイン(Litecoin):前述の通り、再び上昇し、一時360ドルまで到達。Charlie Lee氏がすべての保有を売却したにもかかわらず、2021年にはさらに384ドルまで上昇した!

EOS:1COで40億ドルを調達し、「イーサリアム殺し」と自称した。価格は一時22ドルまで上昇したが、それ以降新たな高値を更新することはできなかった。

NEO:もう一つの「イーサリアム殺し」を名乗ったプロジェクトで、「中国のイーサリアム」と呼ばれた。NEOの価格は0.20ドルから200ドルまで上昇し、1000倍のリターンを実現した。

ビットコインキャッシュ(Bitcoin Cash):Roger Verはビットコイン界隈の有名人であり、大規模ブロックの議論に参加し、ビットコインキャッシュを支持した。2017年8月のブロック478,559にて、1BTC保有者は1BCHを受け取った。Roger Verの支援もあり、ビットコインキャッシュの価格は一時約3800ドルまで上昇したが、その後徐々に注目を失っていった。

その他のイーサリアム殺し:この時期、他にも「イーサリアム殺し」と称されるトークンが多数登場(ADA、Tronなど)。白書さえあれば、価格が10倍、100倍に跳ね上がるような時代だった。FilecoinやTezosなどもこの時期に登場した。

利回り詐欺:BlockFi、LUNA、Celsius、Voyagerが最初の利回り詐欺だと考えているなら、それは間違いだ。実は最初の大規模な利回りポンジースキームはBitconnectであり、多くの人が何百万ドルもの損失を被った。

規制当局の介入:2021年のサイクルと同様、規制当局の介入とポンジースキームの崩壊が再び業界を破壊した。米国証券取引委員会(SEC)はEOSのようなプロジェクトを追及し始め、市場は確固たる85%の調整を経験。2020年3月にはビットコイン価格が約3500ドルまで下落した。

当時の大多数のトークンは詐欺だったため、アルトコイン市場はほぼ -99.999999%の暴落を経験した。スーパーボウルの広告に登場するだけで、価格が瞬時に5倍になることもあった。VIBEがその典型例だ。

VIBEの価格は0.04ドルから2ドル以上まで上昇したが、最終的に時価総額はわずか262ドルまで下落した。

2021年のアルトシーズン:DeFi、NFT、メモコイン、時価総額最大3兆ドル

2021年、皆が自宅で仕事をし、パソコンやスマホを眺めて暇を持て余していた。アメリカ政府は10兆ドルものマネーを刷ったが、これはあくまで米国の支出に過ぎない。

DeFiプロジェクトが流動性マイニングを推進し、NFTがJPEG画像を主流に押し上げ(数百万ドルで取引)、メモコインの評価額も異常な水準に達した。ビットコインは69,000ドルを突破、ETHは4,800ドルに到達。2021年11月には暗号資産全体の時価総額が3兆ドルを突破した。

Dogecoin:当初は冗談で始まったが、イーロン・マスクの関心をきっかけに価格が放物線的に上昇し、Redditのフォーラムで人気話題となった。今やイーロンのメモコインとして、政府の効率部門を象徴する存在となっている。価格は約0.5セントから74セントまで上昇し、約15,000%の上昇。

Solana:「次のイーサリアム殺し」として宣伝され、高速取引と低手数料で注目を集めた。主にSBF(現在服役中)によって宣伝された。価格は1ドルから約260ドルまで上昇し、26,000%の上昇を記録。

Shiba Inu:ドージコインを模倣したメモコインで、多くの億万長者を生み出した。時価総額がほぼゼロからのスタートと考えれば、500,000%の上昇に相当する。

DeFi トークン:AAVE、UNI、SUSHI、YFIなどのDeFiトークンは10倍から50倍の上昇を記録。分散型金融(DeFi)のロックアップ資金(TVL)は数千億ドルを突破。現在でも、多くのDeFiプロジェクトのTVLは当時よりも高い水準にある!

NFT:

CryptoPunks:数百万ドルで販売され、最も安いCryptoPunkですら100ETH以上で取引された。

BAYC(ボーリング・エイペ・ヨット・クラブ):文化的現象となり、最低価格さえ信じられない水準に達した。

Airdropの狂乱:あるプロジェクトの旧ユーザーが、100ドルの.ethドメインを持っているだけで、40,000ドルのAirdropを受け取れた。橋を渡る操作(特定のアクション)を行うだけで、1日または1週間で2%のリターンを得られることもあった。BAYCのようなNFTプロジェクトは、高評価の他のNFTシリーズを大量にAirdropし、全体のAirdrop額は数十億ドルに達した。

さらに驚くべきことに…ほぼすべてのトークンが上昇した。SAFEMOONのようなトークンはDave Portnoyらに支持され、Snoop DoggやParis Hiltonといった有名人がさまざまなプロジェクトを宣伝した。Tom BradyやStephen Curryは暗号資産取引所をプロモーションした。倒産したFTXでさえ、マイアミ・ヒートの命名権を購入していたほどだ。

ポンジースキーム:大量のポンジースキームが出現した。私たちがこうしたスキームに関与していたと非難する声もあるが、事実ではない。幸運にも、多くの人が大きな損失を回避できた。他人に資産を預けることや、こうした商品に投資することは、常に賢明とは言えない。

デススパイラル:流動性が枯渇し始めた(これらのプロジェクトへの資金供給が停止)ことで、前述のポンジースキームが崩壊。さらに、FTXがユーザーファンドを盗用したことで倒産。直後、米国証券取引委員会(SEC)が再び規制に乗り出した。大規模な詐欺やリーダーによる搾取事件が相次ぎ、最終的に暗号資産業界の出入り口は厳しい規制下に置かれることになった。

重要な教訓

1)利益確定を忘れずに:市場の変化は速く、あなたはきっと貪欲になるだろう。もし「あのトークン、あと2倍買えばよかった」と感じたら、おそらくすべきことは半分のポジションを売却し、満足して利益を確定することだ。ビットコインでも、イーサリアムでも、ステーブルコインでも構わない。肝心なのは、貪欲にならないことだ。

2)バブルのサイクルは繰り返される:各アルトシーズンには物語のテーマがある:ビットコインフォーク、1CO、DeFi、NFT、メモコイン。テーマを見つけたら、それに集中するのが良い。その分野で蓄積した知識は、サイクル終了と共に急速に陳腐化する。飛び回るより、一つの分野に集中し、最後の勝利を収めることが重要だ。

3)リスク管理が不可欠:リターンは魅力的だが、人それぞれ状況は異なる。あなたと私は違うし、私も隣人とも違う。自分に合った計画を立て、それを貫くこと。10万ドル持っている人が「1000万ドルじゃ引退できない」と言っても、自分の目標を無闇に変更してはいけない。

4)生き残った者が繁栄する:アルトコインは入れ替わりが激しいが、ビットコインとイーサリアムは各サイクルで主導的地位を維持してきた。あるプロジェクトがこれほど長く存在していれば、ゼロになるリスクは比較的低い。もしSolanaが2025年にPump.funを超える実用性を見つけ出せれば、それも同レベルに近づくかもしれない。

私たちはポンジースキームから何かを学んだのか? 実は、ほとんど学んでいない。私たちが見てきたように、人々は依然として「Not Your Keys, Not Your Coins(鍵がなければ、あなたのコインではない)」という概念を理解していない。仲介業者を通じて暗号関連株式やレバレッジのある暗号資産に投資することはできるが、株式や暗号ETFを保有しても、実際に暗号資産を所有しているわけではないことを認識すべきだ。また、こうした企業やプロジェクトがあなたの資産をどう扱うか、あなたには永遠に分からない。

好況期には、最新のメモコインに参加しなかったことで批判されることもあるだろう。確かに今の投機は華やかに見えるが、よく観察すれば、自分の戦略を守り、冷静さを保っている人々が着実に資産を積み上げていることに気づくはずだ。

一方、短期間で「10倍リターン」を目指して富を急ぐ投機家たちは、一時的に注目を集めても、その資金規模や戦略は、毎月着実に積み立て、財産を築いていく匿名の富裕層とは比べものにならない。彼らは通常、より堅実な財務基盤と明確な長期計画を持っている。最終的に、市場の動きとデータが、どの戦略が真に成功を収めるかを証明するだろう。

最後に、2025年が皆さんにとって幸多き年でありますように。

TechFlow公式コミュニティへようこそ

Telegram購読グループ:https://t.me/TechFlowDaily

Twitter公式アカウント:https://x.com/TechFlowPost

Twitter英語アカウント:https://x.com/BlockFlow_News