Bitcoin franchit la barre des 100 000 dollars ! Jusqu'où la politique américaine favorable aux cryptomonnaies poussera-t-elle le marché ?

TechFlow SélectionTechFlow Sélection

Bitcoin franchit la barre des 100 000 dollars ! Jusqu'où la politique américaine favorable aux cryptomonnaies poussera-t-elle le marché ?

Chaque étape de la politique américaine favorable aux cryptomonnaies est une « fête » pour le marché des cryptomonnaies.

Production|OKG Research

Authors|Hedy Bi, Jason Jiang

Even before Trump officially returns to the White House, the crypto market has already begun celebrating in advance, pricing in anticipated policy shifts. This morning, following Trump’s formal nomination of Paul Atkins as SEC Chair, Bitcoin surged past $100,000. Since Trump's election victory, Bitcoin has risen from $68,000 on November 5 to $100,000—a 47% return within just one month. In this article, the authors analyze how changes in U.S. crypto policy are reshaping the market landscape and identify promising sectors under this new paradigm.

"Harsh and brutal" crypto regulation shifting toward openness and friendliness

During his campaign, Trump made ten pro-crypto commitments, including establishing a strategic Bitcoin reserve. His nominee for SEC Chair, Paul Atkins, is known for his favorable stance toward cryptocurrencies, advocating reduced regulation to support market innovation. Today, Trump emphasized that Paul "understands that crypto assets and other innovations are crucial to making America greater than ever before, and believes in the promise of strong, innovative capital markets." Atkins previously criticized the SEC's massive fines for harming shareholder interests, promoted flexible regulatory approaches, and served as Co-Chair of the Token Alliance. By appointing Atkins—whose experience lies in advancing the crypto industry—Trump aims to transform the SEC from an agency focused on penalties over the past year into one embracing the principle of "financial freedom," bringing this ethos into America’s financial regulatory institutions.

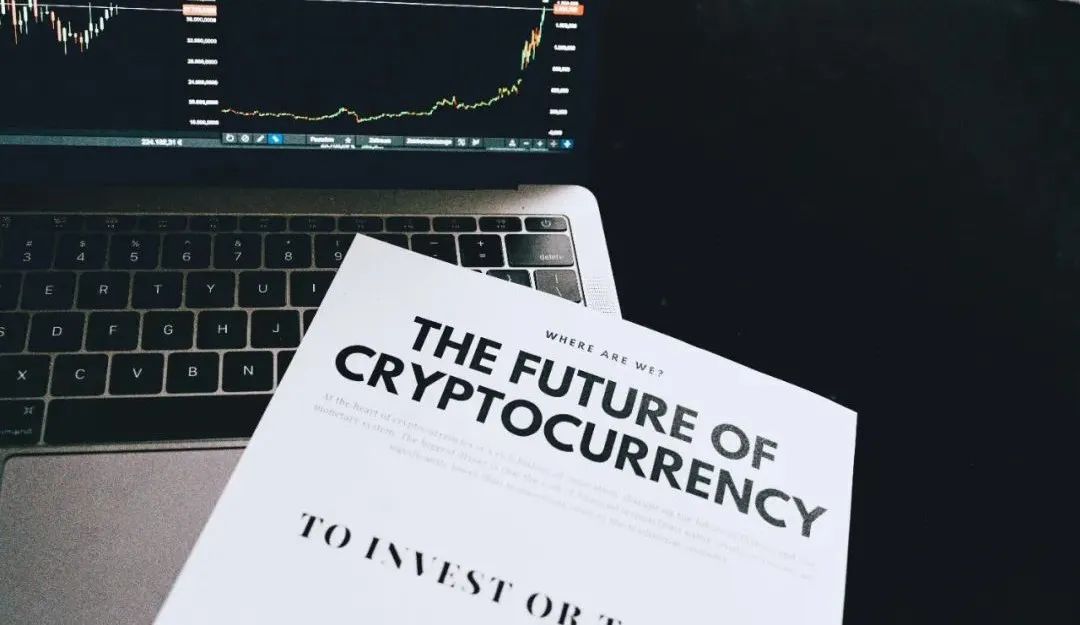

Moreover, other members of Trump’s team provide strong support for specialized crypto financial regulation: more than 60% of his cabinet nominees have publicly stated they own Bitcoin, support the development of crypto finance, or indirectly endorse the growth of crypto assets.

Beyond Trump’s promises to the crypto market and his earlier proposal of the FIT 21 Act (Financial Innovation and Technology for the 21st Century), recent developments such as the Tornado Cash case also signal a shift toward a more open and friendly U.S. crypto regulatory environment. At the end of November, the U.S. Fifth Circuit Court of Appeals ruled that the Treasury Department’s sanctions on Tornado Cash’s immutable smart contracts were unlawful, stating these contracts do not meet the legal definition of “property.” This ruling provides critical validation for the legality of smart contracts, reducing direct conflicts between developers and users and traditional legal frameworks, thereby promoting a more inclusive and freer financial ecosystem—and directly benefiting the flourishing of decentralized finance (DeFi).

"America First" industrial and financial capital both demand greater freedom

Financial freedom not only opens up broader space for the crypto market but also signals a profound market integration brewing between crypto assets and traditional financial assets (TradFi). As digital society evolves, driven by future technologies like artificial intelligence (AI), methods of value creation are rapidly transforming. Former Alibaba strategist Zeng Ming pointed out that artificial general intelligence (AGI) will become the core technological breakthrough in productivity, closely integrated with crypto assets to generate numerous new forms of digital assets.

As a value network technology connecting the digital world with the real economy, blockchain will play a pivotal role in this transformation. Under the "America First" agenda, Trump has proposed an AI version of the "Manhattan Project," elevating AI technology to a national strategic level and accelerating its industrialization.

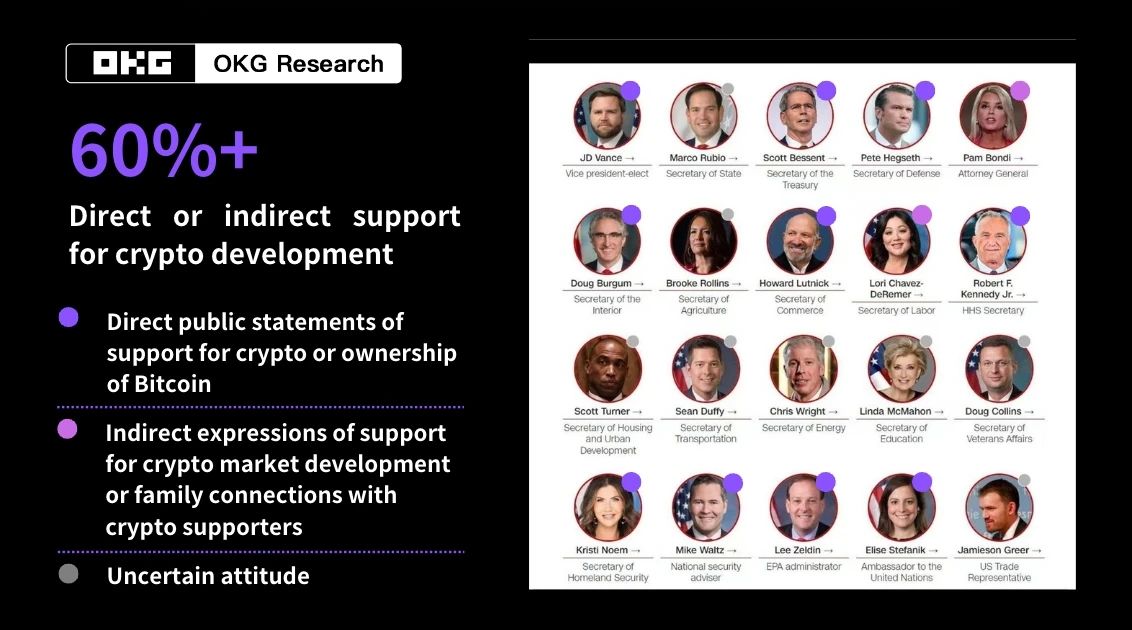

Beyond the inevitable role of crypto assets in a future AI-driven digital society, Standard Chartered Bank has noted that virtually any real-world asset can be tokenized and predicted that global demand for tokenized assets could reach $30 trillion by 2034. Whether it’s the future needs of a digital society or the circulation requirements of real-world assets through tokenization, the convergence of crypto and traditional finance holds market potential far exceeding the 1930s "Great Merger Era" and the 2000 "Internet Merger Era," which generated $600 billion and $3 trillion in market value respectively.

This integration trend is now unstoppable. From the advancement of crypto ETFs to emerging sectors represented by RWA (Real World Assets), stablecoins alone have already created a market cap exceeding $200 billion. As crypto technology continues to penetrate deeper, the "cryptoization" of the entire financial market has begun, poised to reshape the global financial landscape and foster a more open and integrated capital ecosystem.

How the three key crypto "commitments" will shape the market

Whether announcing a strategic Bitcoin reserve or nominating a crypto-friendly SEC chair, Trump’s election appears to herald the most favorable regulatory environment in crypto history, opening upward momentum for Bitcoin. However, in the medium to long term, what truly drives sustained progress in the crypto industry isn’t Bitcoin’s price—but whether Trump can turn rhetorical promises into reality, creating more room for the crypto market through legislative reforms. If Trump leverages his high party authority and the Republican sweep in both chambers of Congress to actively push forward key legislation—such as the three major bills outlined below—he may usher in a transformative era for the crypto industry.

-

FIT 21 Bill likely to be prioritized, enabling DeFi innovation to "return" to the U.S.

The FIT 21 Act may be among the first laws pushed forward after Trump takes office. This bill, hailed as "the most significant crypto legislation to date," would clearly define when a cryptocurrency qualifies as a commodity versus a security, ending the long-standing tug-of-war between the SEC and CFTC over crypto oversight. The U.S. House previously passed the bill by overwhelming majority and sent it to the Senate, which took no decisive action. But with Trump’s return, market expectations are rising that the legislative process will accelerate.

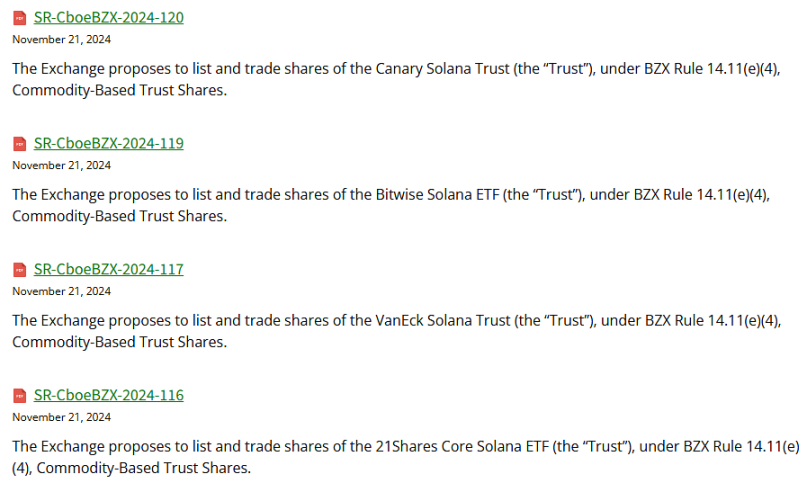

Once enacted, compliant trading platforms and publicly listed crypto firms will proliferate, and clear classification standards will expand the range of tradable tokens. It will also create new opportunities for spot ETFs and other crypto financial products. One reason Ethereum ETF applications faced delays was ambiguity in classification—SEC long considered PoS-transitioned Ethereum more akin to a security. Only after finding a "balance point" with Wall Street—clarifying that non-staking Ethereum ETFs aren't securities—did progress resume. After passage, clearly defined "digital commodities" could more easily launch spot ETFs and related financial products under certain conditions. We may see spot ETFs next year for Solana (SoL), XRP, HBAR, LTC, and others.

Multiple institutions have already filed applications for Solana ETFs

The FIT 21 Act will also boost innovation in decentralized applications, especially in the DeFi sector. The bill specifies that tokens deemed decentralized and functional would be classified as digital commodities exempt from SEC oversight. Projects meeting decentralization thresholds would gain a grace period, encouraging more DeFi protocols to evolve toward greater decentralization. The law also requires the SEC and CFTC to study DeFi’s development, assess its impact on traditional finance, and explore potential regulatory strategies. Combined with the grace period, this could attract more DeFi projects back to the U.S.

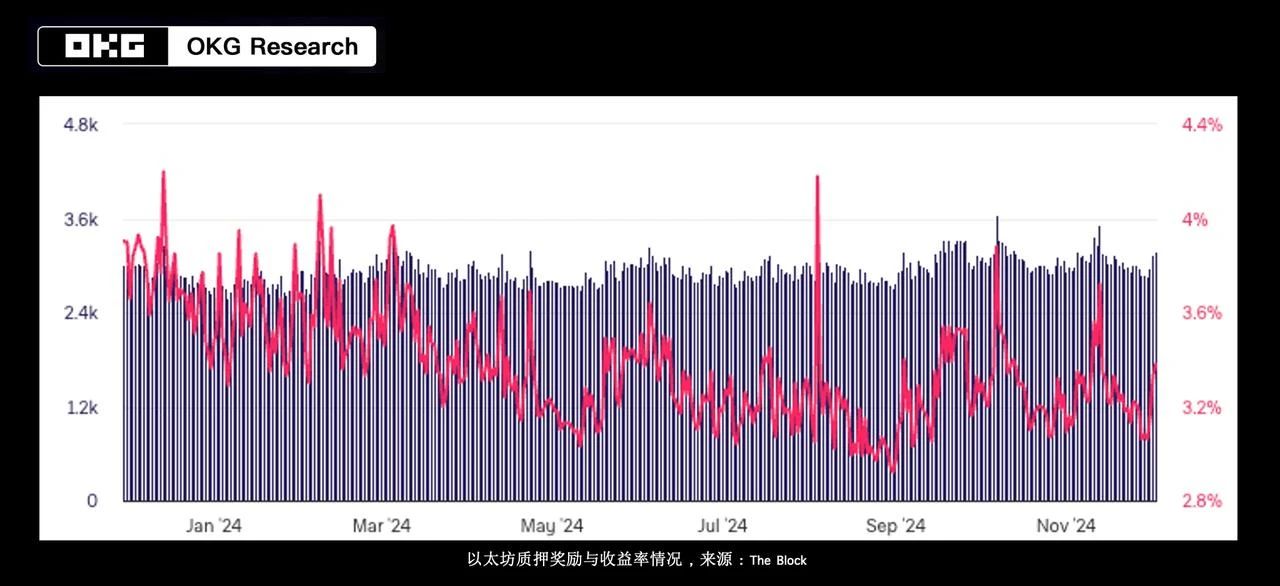

Additionally, driven by favorable policies and rate-cut expectations, more traditional capital will flow into DeFi seeking higher yields, fueling further innovation. A clear trend is that DeFi will continue expanding collateral options, bringing more off-chain liquidity on-chain. This will deepen integration between DeFi and RWA, allowing tokenized assets like U.S. Treasuries and real estate to be used as collateral or for lending, enhancing composability and expanding possibilities within on-chain finance, while extending DeFi’s influence beyond the chain. The RWA sector will benefit from synergies with DeFi, achieving higher returns and accelerating two-way expansion across on- and off-chain environments.

The value of DeFi in the Bitcoin ecosystem should not be overlooked. While ETFs help Bitcoin penetrate off-chain markets, its on-chain ecosystem also shows growing potential. Given that Bitcoin’s investor base consists largely of long-term holders, and spot ETFs keep circulating supply low, this may create new opportunities for Bitcoin lending. With the SEC potentially allowing staking for Ethereum spot ETFs, staking projects within the DeFi ecosystem could gain widespread attention.

-

U.S. stablecoin-related legislation set to return to agenda

In 2023, the House Financial Services Committee passed the "Clarity for Payment Stablecoins Act," but it never gained full House approval. In October this year, pro-crypto Senator Bill Hagerty reintroduced a similar draft. With Trump’s prior pledge against a Fed-issued CBDC, and FIT 21 defining licensed payment stablecoins and emphasizing licensing importance, stablecoin legislation may regain momentum under a Trump administration.

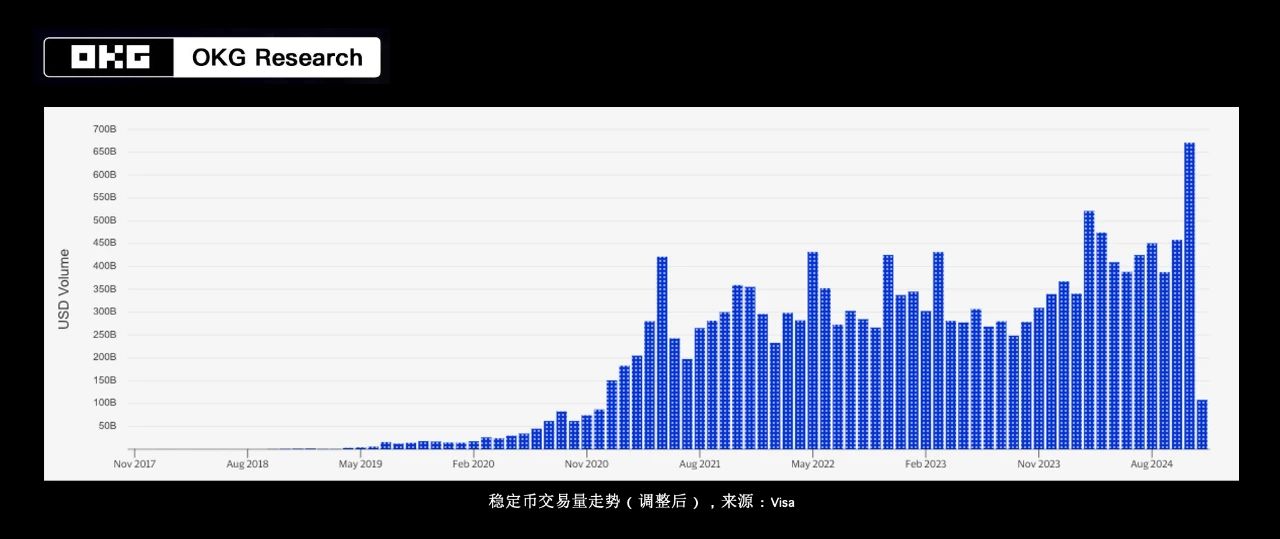

Stablecoin regulation will directly affect dollar stablecoin issuers and associated payment providers. Smaller or algorithmic stablecoins may exit the market, while compliant ones like USDC gain larger share. As regulations clarify compliance requirements, traditional payment providers will accelerate adoption of regulated stablecoins, improving their availability and usability in daily transactions. Businesses and users alike will grow more confident using stablecoins as complements—not just tools—for crypto trading. Stablecoins’ market share in cross-border payments and settlements will keep rising, with user volume and transaction scale approaching or even surpassing giants like Visa.

Furthermore, whether earning yield directly through underlying assets (e.g., government bonds, money market funds) and distributing returns, or leveraging DeFi protocols for on-chain yield, various yield-generating products based on compliant stablecoins will continue to emerge and attract users—though care must be taken to avoid giving stablecoins characteristics of investment contracts.

-

Proposal to repeal SAB 121 may restart, solving crypto custody challenges

Growth in crypto financial products like spot ETFs, along with advances in RWA, stablecoins, and DeFi, will increase demand for crypto custodial services. This pressure may revive efforts to repeal SAB 121 (Staff Accounting Bulletin No. 121). Issued by the SEC in 2022, SAB 121 requires companies to record custodied crypto assets as liabilities, significantly increasing debt ratios and negatively impacting financial health and credit ratings—discouraging firms from offering custody solutions.

Trump pledged during his campaign to rescind this bulletin upon taking office. Repealing SAB 121 would directly reduce compliance burdens for crypto custodians, enabling banks and regulated institutions to enter the custody space more easily and attracting more institutional investors into the market. Due to SAB 121’s accounting rules, many banks and financial institutions had been cautious about spot ETFs and other crypto products. Its repeal would simplify asset management complexities. Stablecoin issuers and payment-related businesses would also benefit, particularly those integrating with traditional finance. Repeal could create a more lenient regulatory environment, supporting the development of core functions like payments and settlement. The popular RWA narrative would gain particular traction, enabling more traditional custodians to manage tokenized assets flexibly and encouraging broader financial participation.

Undeniably, each pro-crypto step in the Trump 2.0 era is profoundly reshaping the boundaries of the crypto market. From regulation to accounting standards, every seemingly minor change carries deep strategic implications. The nomination of Paul Atkins signals a loosening of crypto regulation, while institutional reforms at the asset level are equally significant. The upcoming FASB rule ASU 2023-08, effective December 15, 2024, mandates that companies record their crypto holdings at fair value. This means fluctuations in the value of Bitcoin and other crypto assets held by corporations will directly impact their income statements. This change may incentivize more companies to include mainstream crypto assets on their balance sheets. Moreover, Microsoft convened a board meeting on December 10 to formally discuss whether to include Bitcoin in its corporate strategic reserves—an industry signal of high visibility reinforcing this trend.

Just as Bitcoin broke $100,000 today, OKX CEO Star remarked on X that this demonstrates the "power of vision and technology." The path bridging tradition and innovation is destined to reshape the new order of global capital markets.

Bienvenue dans la communauté officielle TechFlow

Groupe Telegram :https://t.me/TechFlowDaily

Compte Twitter officiel :https://x.com/TechFlowPost

Compte Twitter anglais :https://x.com/BlockFlow_News