"Solana 2022" Workshop Summary: Composability Is an Advantage, Not an Ethereum Killer

TechFlow Selected TechFlow Selected

"Solana 2022" Workshop Summary: Composability Is an Advantage, Not an Ethereum Killer

The Solana workshop covered a wide range of topics, with the most time spent on composability.

Compiled by: Lou Kerner

Translation: TechFlow

Workshop Participants:

Kyle Samani: Managing Partner at Multicoin Capital

Mike McGlone: Senior Commodity Strategist at Bloomberg

Joe McCann: Technology Expert

The Solana workshop covered a wide range of topics, with the most time spent on composability. Below are six key takeaways from the event:

1. Composability is Solana’s key advantage

Both Kyle and Joe expressed the view that composability is a defining feature of web3 and a significant strength of Solana.

During the workshop, Kyle referenced Jesse Walden’s definition of composability:

A platform is composable if its existing components can be used as building blocks and programmatically integrated into higher-order applications.

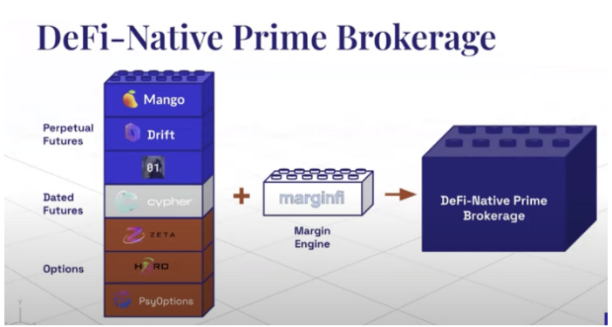

Kyle cited Margin-Fi as a prime example of high composability. Margin-Fi offers institutional brokerage services in web3 and integrates seamlessly with various DeFi protocols. The diagram below illustrates Margin-Fi’s architecture:

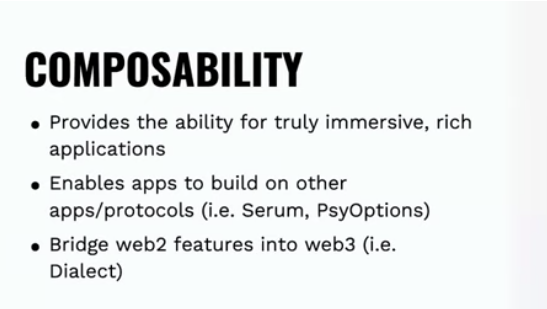

Joe also shared his own definition of composability: "1. The ability to deliver truly immersive and rich applications; 2. Applications should be able to build on top of other applications/protocols; 3. Bridging web2 features into web3." He pointed to Serum, an on-chain order book, as an example since many applications are now built atop it. Below is a screenshot from Joe’s presentation:

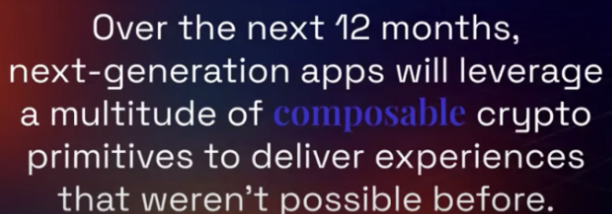

Overall, the most fitting analogy for composability is Lego bricks—just as one can build new structures using existing Lego pieces, developers can build new projects atop existing composable systems. Kyle painted an exciting vision of the near future:

In the next 12 months, applications will leverage a wealth of composable crypto technologies to deliver experiences previously thought impossible.

Objectively speaking, web2 is also gradually acquiring composable traits—for instance, certain apps can connect to Dropbox or Google Docs and support plugins like Grammarly.

While composability is currently a core feature of Solana, cross-chain composability remains a challenge. Although some platforms like Anyswap have achieved cross-chain composability, performance still lags significantly behind intra-chain composability.

2. Solana’s cultural orientation: targeting mass-market users rather than academic ones compared to other Layer 1s

In the early days of web3, Layer 1 protocols attracted builders by highlighting their academic or engineering achievements. In contrast, Solana is increasingly focused on the mass market. FTX, a major supporter of the Solana ecosystem, has taken numerous steps to expand Solana’s reach—such as Serum, a high-speed, order-book-based, non-custodial DEX. FTX has also sponsored prominent real-world venues including the Miami Heat NBA arena, MLB umpire uniforms, and UC Berkeley’s football stadium—efforts clearly aimed at mainstream appeal.

Solana’s push into NFTs is another move tailored to attract the mass market. Given Solana’s low cost and high throughput, as corporate entities roll out NFT strategies, Solana is positioning itself as the home for brands and artists in the NFT space.

The following image shows Joe’s full narrative on Solana:

1) Network culture is a powerful force (e.g., correlation between project Twitter followers and token price)

2) To date, Web3 has primarily been a playground for engineers, geeks, and academic experts.

3) FTX connects the real world with the crypto world through sports and entertainment.

4) NFTs bring normative creative culture into crypto and Web3.

5) Physical brands will lean toward the lowest-cost cultural marketing activities.

3. Solana is highly attractive to developers

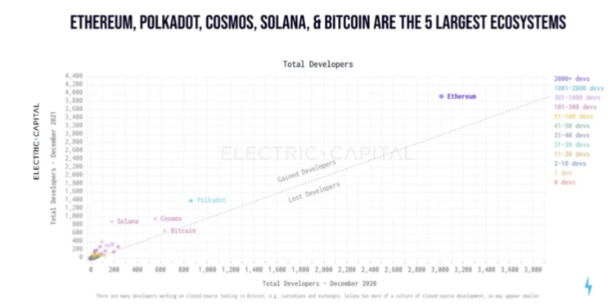

There are many reasons why Solana attracts developers, but the most notable is its programming language. Ethereum developers must learn a new programming model (Solidity), whereas Solana uses Rust—a language used by over 1.1 million programmers, several times more than those using Solidity. Rust is frequently ranked among the best programming languages, and due to high demand and limited supply, Rust developers commanded the highest average salaries in 2021 across all programming languages. This makes Solana an appealing choice for developers entering the crypto space. In fact, a recent report by Electric Capital showed that Solana saw a fourfold increase in developer count in 2021—far outpacing the other top four Layer 1 blockchains.

McCann believes there is a strong correlation between developer activity and profitability, and notes that Solana is seeing increasing availability of developer tools. Joe believes the emergence of these tools will create a flywheel effect, attracting even more developers into the Solana ecosystem.

4. DDoS attacks on the Solana network have not harmed it—in fact, they’ve had a positive effect.

One concern about Solana is that it has repeatedly suffered DDoS attacks. However, both Kyle and Joe view these attacks not as vulnerabilities but as features, because they indicate relevance. These attacks also serve as stress tests for the network. Many Layer 1s do not support chaos engineering because such testing must occur in production—exactly what Solana does. Frequent DDoS attacks allow Solana to patch vulnerabilities and strengthen performance. Ethereum faced similar DDoS attacks during the Shanghai attack in 2016, which led to protocol upgrades preventing future incidents. Thus, DDoS attacks can be seen as minor growing pains for successful projects.

5. Mike emphasized caution due to Solana’s current fifth-place ranking in total market cap (as of the end of the webinar), noting that previous tokens reaching fifth place did not sustain their momentum.

While both Kyle and Joe are bullish on Solana, Mike remains cautious. Solana’s price surged dramatically in 2021 (nearly 100x), and historically, other tokens that reached fifth place later declined. Mike noted that XRP was fifth in 2020 but now ranks eighth; BCH was fifth in 2019 and now ranks 26th; EOS was fifth in 2018 and now ranks 52nd; LTC once ranked fourth but now sits at 24th. Mike worries Solana could face a similar fate.

Kyle argues against this comparison, stating that Solana occupies a uniquely valuable space for developers, while Litecoin is “literally nothing,” and Ripple is akin to “borderline fraud.” In contrast, Solana’s ecosystem is growing across multiple metrics. Kyle believes Solana’s flywheel has already started turning and the ecosystem is on the verge of breakout. Mike counters that this mindset reflects a “highly speculative psychology” that needs to be “slightly cleared.”

6. While Solana competes with Ethereum, none of the panelists consider it an “Ethereum killer.”

Mike, Kyle, and Joe all agree that Solana is not an “Ethereum killer.”

Kyle acknowledges competition between Solana and ETH, but not 100% direct rivalry. He sees room for both to coexist. There are certainly use cases where Solana performs better—such as derivatives trading, where leverage demands low latency. Conversely, Ethereum excels in many areas, particularly NFTs.

Joe also believes long-term coexistence is likely, given the fundamentally different programming models of the two platforms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News