DappRadar: Why Have NFTs Avoided the Cryptocurrency Market Crash?

TechFlow Selected TechFlow Selected

DappRadar: Why Have NFTs Avoided the Cryptocurrency Market Crash?

The crypto market is currently in a challenging period. Market sentiment signals fear. However, metrics related to the performance of specific blockchain verticals such as NFTs may suggest otherwise.

By Pedro Herrera, DappRadar

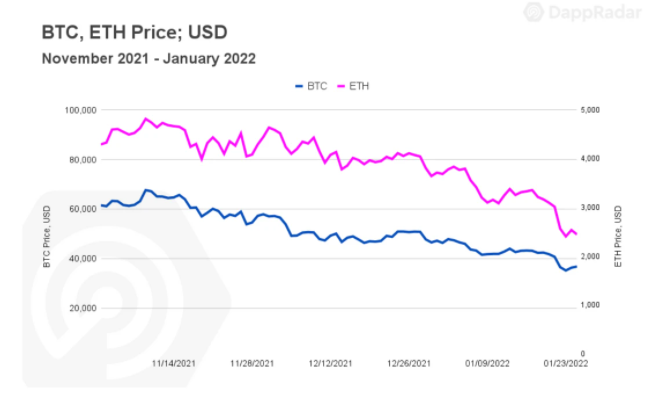

In recent weeks, a series of macroeconomic events have shaken markets, reminding everyone of the sector's inherent risks and pervasive volatility. Issues surrounding BTC mining in Kazakhstan made headlines. Combined with new COVID outbreaks, anxiety over potential rate hikes by the Federal Reserve, and the latest political tensions in Ukraine, these factors created a hostile environment dragging down capital markets.

The correlation between cryptocurrency and traditional markets has widely felt this impact across blockchain assets. Both Bitcoin (BTC) and Ethereum’s ETH have lost half their value since reaching all-time highs in November. The same is true for BNB, ADA, SOL, AVAX, SAND, MANA, GALA, and several other cryptocurrencies that historically performed well. During this period, the total market capitalization of crypto dropped from $2.9 trillion to $1.6 trillion.

Undoubtedly, the crypto market is currently going through a challenging phase. Market sentiment reflects fear. However, performance metrics related to specific blockchain verticals like NFTs may suggest otherwise.

Understanding NFT Macroeconomics

While a series of events have hindered the broader crypto market, several factors are positively influencing the outlook for NFTs at the macro level.

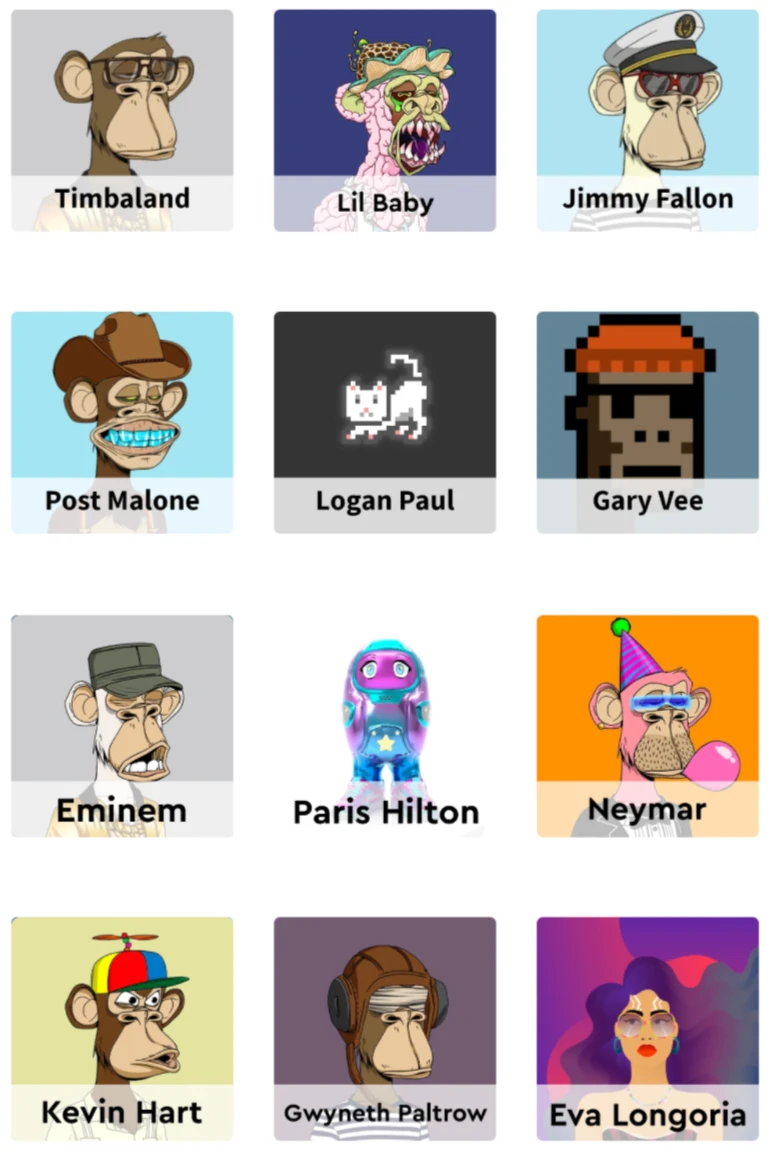

First, celebrity and major brand adoption into the NFT space continues to grow. High-profile influencers with massive social followings—such as Neymar Jr. (over 200 million followers on Twitter and Instagram) and Kevin Hart (over 192 million followers)—have publicly announced joining the Bored Ape Yacht Club (BAYC), one of the premier NFT projects.

To amplify this effect, Twitter—perhaps the most popular social media platform among crypto and NFT enthusiasts—recently launched its first web3 feature directly within the app. Social platforms Instagram and Facebook are expected to follow suit. Meanwhile, retail giant Walmart has filed multiple trademarks related to NFTs.

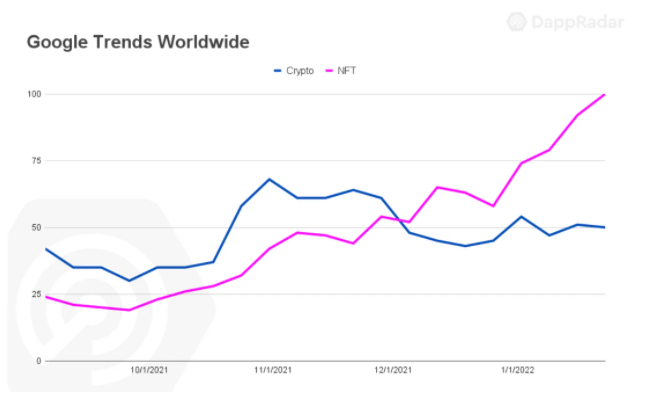

Interest in these assets is higher than ever before. For the first time, search volume for “NFT” has surpassed that of “crypto.” Additionally, rising interest from Asia is promising. Markets once dominated by North American and European users are now welcoming Asian NFT audiences.

On-Chain NFT Metrics Tell a Bullish Story

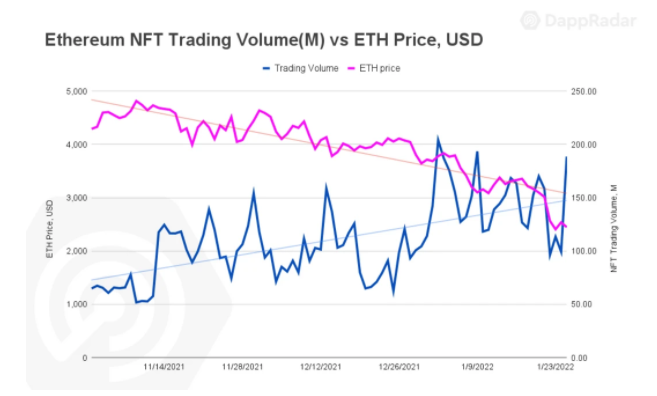

NFTs single-handedly produced one of the most impressive metrics we saw in the blockchain industry last year. In 2021 alone, these assets generated a total of $25 billion—18,414% more than the previous four years combined.

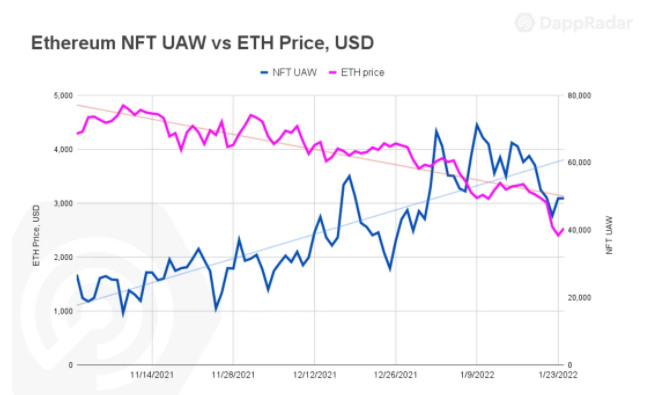

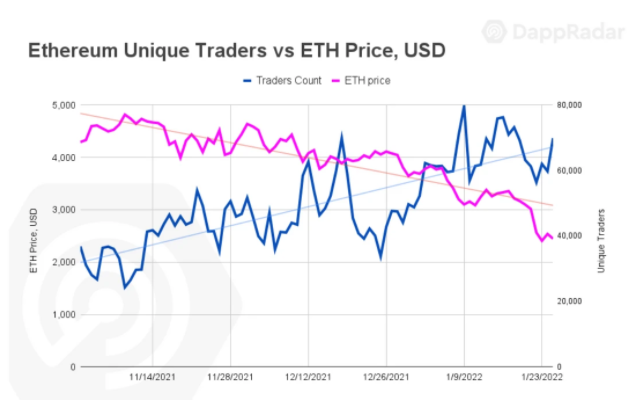

While cryptocurrencies struggle, NFTs appear to be thriving. Zooming in on Ethereum, which accounted for 75% of last year’s trading volume, reveals positive trends. Both NFT sales and user numbers have increased on this blockchain, resulting in more unique active wallets (UAWs) connecting to NFT dApps (collections and marketplaces).

Since December 2021, an average of over 53,300 UAWs have connected daily to Ethereum-based NFT dApps—an increase of 43% compared to Q3 of the previous year.

Beyond favorable macro developments, NFTs’ central role in profitable and metaverse narratives contributes to bullish on-chain indicators—even amid negative crypto metrics. The pursuit of decentralized and interoperable metaverses benefits NFTs.

Additionally, individuals might view declining prices of underlying crypto assets supporting NFTs as buying opportunities. Despite January not yet being over, unique traders are at an all-time high.

A record 1.6 million independent traders drove Ethereum NFT sales to over $3.7 billion—excluding volumes from LooksRare—and are on track to surpass the $4.5 billion record set in August 2021.

This set of on-chain metrics tells a story of growing adoption and positive market sentiment toward a new asset class. Yet another metric makes NFT appreciation even clearer: floor price.

Floor Price Analysis

Floor price is one of the most important indicators for evaluating an NFT collection, especially from an investor’s perspective. The floor price of an NFT collection refers to the lowest listed price—the minimum entry threshold.

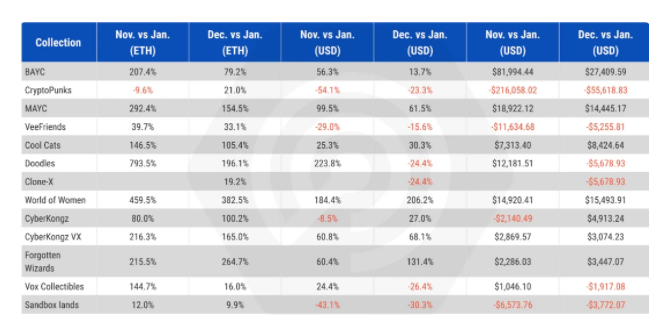

Recent analysis of floor prices for key Ethereum collections shows that NFTs behave similarly to value-storage assets. Some have outperformed major cryptocurrencies—and even traditional assets like gold or the S&P 500.

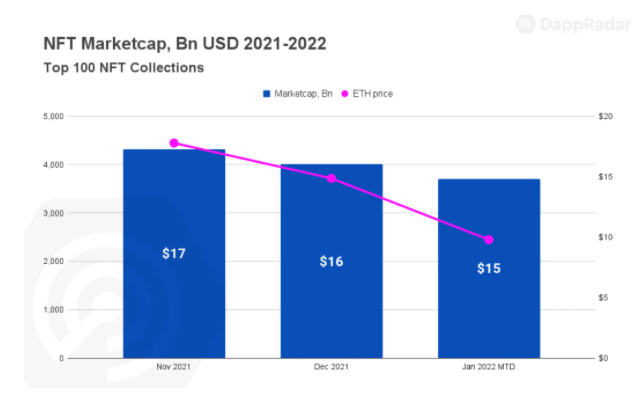

The overall value of the NFT space is increasing. Based on the market cap derived from the floor prices of the top 100 NFT collections, NFT value declined by $2.4 billion from November, now estimated at $14.8 billion. Despite ETH losing 50% of its value, the most traded collections were impacted by less than 15%, indicating resilience against the crash.

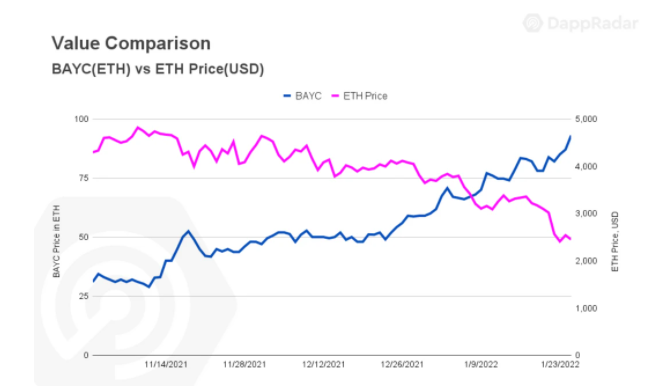

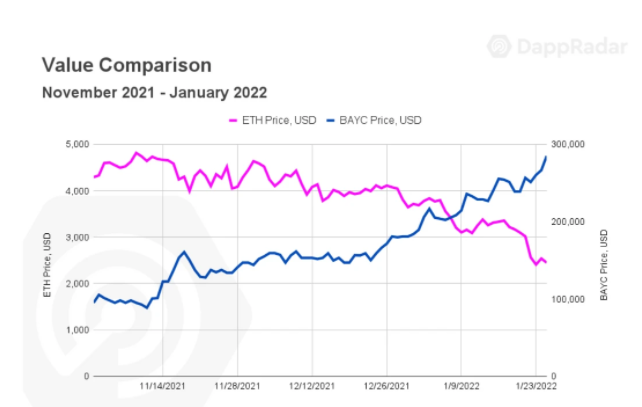

One prominent NFT collection directly contributing to this positive trend is BAYC. In early November, when BTC and ETH peaked, BAYC’s floor price hovered around 30 ETH. One week later, despite ETH dropping 15%, BAYC’s floor surged over 60% to exceed 50 ETH.

By year-end, the cheapest BAYC could be bought for 60 ETH—now exceeding 90 ETH—meaning purchasing the most affordable Bored Ape would cost over $225,000 at current ETH prices.

While major cryptocurrencies lost about half their value over the past two months, BAYC rose 207% in ETH terms since November 10. More importantly, in real dollar value, the collection’s floor price increased by 14%. Holding BAYC from November 10 to February 2 would have yielded a 14% capital gain, whereas holding any correlated cryptocurrency would result in roughly a 50% net loss. Clearly, BAYC has become a value-preserving asset class.

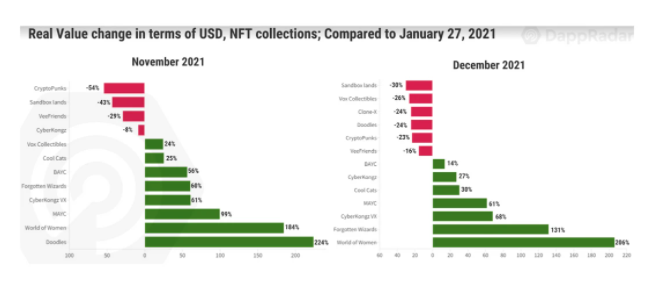

BAYC isn’t the only avatar series increasing in value. Since November 10, another Ethereum-based collection, World of Women, appreciated 383% in ETH and 185% in real value during the same period. Since December last year, Cyber Kongz and its voxel (VX) version saw real-value floor price increases of 27% and 68%, respectively. Doodles also rose 224% in floor price since November.

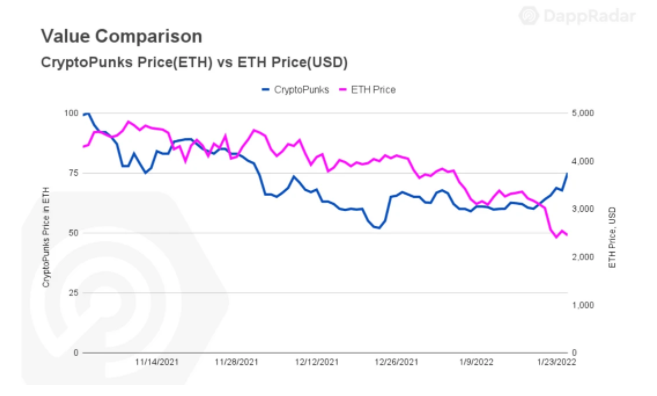

CryptoPunks, a historically significant NFT collection, presents a trickier analysis. Although it underperformed relative to peers, punks still outpaced several crypto-based assets. The CryptoPunks floor hit 100 ETH on November 2, then dropped to 83 ETH a week later—the same day BTC and ETH reached all-time highs.

Since then, the ETH-denominated floor price has declined by 9.6%, while real value only shrank from $254,000 to $229,000. Nevertheless, it’s safe to say CryptoPunks remain a store of value.

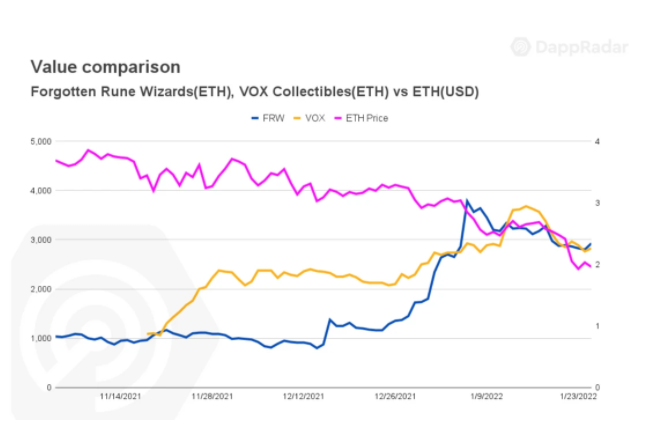

Avatar values have significantly increased, but NFTs tied to virtual worlds and gaming have performed exceptionally well. Forgotten Rune Wizards, for example, saw its ETH floor price rise 210% since November 10, with real value up 132% since December. Similarly, Gala Games’ VOX NFT floor price increased 145% in ETH since November.

NFTs representing virtual worlds gained value from the metaverse hype cycle. For instance, land parcels in The Sandbox and Decentraland maintained their floor prices after Facebook announced its rebranding, although their USD values declined.

Meanwhile, despite negative crypto trends, floor prices for virtual apartments inside Worldwide Webb rose 242% in ETH since November, while Cryptovoxels plots are priced 17% higher in ETH than in November.

Analyzing collection floor prices provides insight into project stability from an investment standpoint. Recent data confirms some NFTs resisted broader market downturns. But why? Why have NFTs proven resistant to changes in crypto prices?

The answer may not be straightforward. A combination of factors attracts rational investors to certain NFTs.

Cultural Value and Adoption

One view holds that certain NFTs should be seen as cultural artifacts rather than digital assets. Like fine art, some NFTs are perceived by many as legitimate investment vehicles. Beeple’s “Everydays: The First 5000 Days” introduced non-fungible tokens to new audiences through a $69 million Christie’s auction. Generative art collections like Fidenza, Ringers, or Autoglyphs are emerging as new forms of expression, each valued at thousands of dollars.

Likewise, BAYC and CryptoPunks have reached mainstream status. On August 23, VISA solidified punks as value-preserving assets by acquiring CryptoPunk #7610 for $150,000. Additionally, 101 pieces from the BAYC collection were auctioned at Sotheby’s for $24 million.

Currently, only a few collections have achieved such status. Nonetheless, potential applications in music, ticketing, sports, and fashion are imminent. Overall, NFTs tap into deep human emotions. Only time will tell whether certain NFTs will generate cultural impacts that transcend generations.

Utility

One critical aspect shared by successful NFT projects is utility—the added value or benefits granted to community members simply by holding an NFT from these projects.

For example, Larva Labs popularized the utility blueprint when CryptoPunks owners received free Meebits, adding tangible capital gains to their initial investment. The same applies to Cool Cats (ETH floor up 150% since Nov 10), The Meta Key (370%), Doodles, and BAYC itself.

Utility can also be found in yield-generating NFTs. Projects like CyberKongz distribute native utility tokens daily. Genesis Kongz holders receive ten BANANA Tokens per day, each worth $24. Similar models exist in SupDucks (35%) with VOLT Token, and Cool Cats with their upcoming MILK Token.

Moreover, NFTs are converging with other categories like DeFi and gaming. A clear example is platforms like NFTfi, which allow users to use NFTs as collateral. Fractionalization of NFTs, or staking them for rewards—as seen with Pixel Vault’s MetaHero Universe (57%) NFTs that can be staked to grow POW Tokens—adds further utility.

Of course, fully integrated gaming elements also play a role. Despite steep declines in ETH, SOL, GALA, and AURY prices, both Mirandus NFTs and Aurory Villagers have maintained their floor prices. We previously observed Forgotten Rune Wizards, another NFT collection with strong game mechanics. While maintaining floor prices across numerous gaming alternatives remains challenging, demand for blockchain gaming is clearly rising—adding value to these types of NFTs.

Celebrity and Traditional Big Player Involvement

Another influential trend benefiting NFTs is involvement from celebrities and established brands. BAYC gained momentum as sports stars like Dez Bryant (NFL), Stephen Curry (NBA), Post Malone, Snoop Dogg, and Eminem joined the exclusive club.

After welcoming Jimmy Fallon, Paris Hilton, Neymar, and Kevin Hart, the BAYC community became even more distinctive. The positive influence of celebrities was evident in World of Women, whose floor price surged 250% within hours of Eva Longoria announcing her purchase. Doodles is another project benefiting from prominent NFT figures like Pranksy, Loopify, and Steve Aoki.

Similarly, major traditional players are making an impact. Adidas, Coca-Cola, Pepsi, Budweiser, and several others have either launched their own collections or partnered with leading NFT teams to establish presence in this space. Luxury fashion brands like Gucci, Burberry, and others leveraging metaverse hype follow the same path.

Teams Becoming Brands

The teams behind NFT collections bear significant responsibility for their projects' success. Some teams discovered that assembling talented artists and experienced developers is a recipe for success. Once successful, these teams evolve into genuine brands within the space.

RTFKT, the team behind Clone-X, exemplifies this—collaborating with Jeff Staple and Fewocious to create unique NFT works. This digital design and fashion brand consistently met expectations and navigated challenges effectively. RTFKT became one of the most influential brands in Web3 and was acquired by Nike in December last year for an undisclosed sum.

Scarcity as an Asset

Finally, scarcity plays a crucial role, directly tied to human psychology—specifically the anxiety of missing out (FOMO). Scarcity links deeply with investment markets, and NFTs combine both aspects perfectly.

Most collections release a fixed number of NFTs—whether 10,000 or 20,000—that remain unchanged forever. This immutability is part of blockchain’s appeal.

As a result, NFTs are gradually becoming their own asset class. While correlations with cryptocurrencies persist due to technological ties, NFTs are slowly building their own economy—where macro events and market forces independently influence the space.

The convergence of cultural value, added utility, celebrity participation, brand recognition, and scarcity drives the latest wave of NFT adoption.

The best part? What we’ve seen so far is just the tip of the iceberg. Projects like Larva Labs, BAYC, Cool Cats, RTFKT, Cyber Kongz, and Doodles will remain deeply embedded in the metaverse narrative. As products emerge to reduce friction for users—like Coinbase’s anticipated marketplace integrating Mastercard payments—barriers for non-crypto users will diminish. Numerous potential use cases will integrate NFTs into traditional business models.

It remains unclear whether the current bearish trend in crypto markets will last weeks or years. Nevertheless, NFTs continue to retain and increase their real-world value under current conditions, proving themselves as digital assets capable of storing value.

Original link:

https://dappradar.com/blog/why-are-nfts-sidestepping-the-crypto-crash

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News