The Economist: The battle for the DeFi market is intensifying

TechFlow Selected TechFlow Selected

The Economist: The battle for the DeFi market is intensifying

The idea behind DeFi is that blockchains—the databases distributed across many computers and secured through cryptography—can help replace centralized institutions like multinational banks and technology platforms.

By The Economist

Translated by Nanfeng

For believers, open public blockchains offer a second chance to build a digital economy. The fact that applications built on these blockchains interoperate and their stored information is visible to all recalls the idealism of the internet’s early architects, before most users had accepted the “walled gardens” offered by tech giants. Over the past year, as applications built atop various blockchains have flourished in scale and functionality, a new kind of "decentralized" digital economy has become possible.

Perhaps the most important part of this digital economy is decentralized finance (DeFi) applications, which allow users to trade assets, obtain loans, and store deposits. Now, the battle for market share in this space is intensifying. Most significantly, Ethereum, the leading DeFi platform, appears to be losing its near-monopoly status. This contest illustrates how DeFi is subject to the same kind of standards wars seen in other emerging technologies—think Sony Betamax versus VHS videocassettes in the 1970s—and also shows how rapidly DeFi technology is advancing.

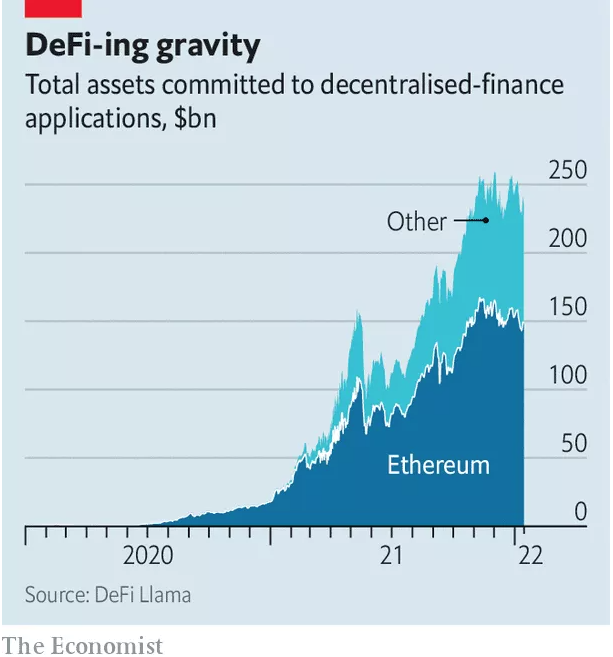

The idea behind DeFi is that blockchains—databases distributed across many computers and secured using cryptography—can help replace centralized institutions like multinational banks and tech platforms. The value of assets held within this nascent financial system has risen from less than $1 billion at the start of 2020 to over $200 billion today, as shown in the chart below.

Chart: Growth of assets held in DeFi applications since 2020. Source: DeFi Llama

Until recently, the Ethereum blockchain was the undisputed leader of all DeFi activity. Created in 2015, Ethereum is a more versatile version of Bitcoin. Bitcoin’s database records transactions of its associated cryptocurrency (BTC), providing proof of who owns what at any given time. In contrast, Ethereum stores more information, such as lines of computer code. Applications programmed on Ethereum are guaranteed to run exactly as coded, eliminating the need for intermediaries. But just as Ethereum improved upon Bitcoin, it is now being overtaken by newer, better technologies. Jeremy Allaire, boss of Circle, a company that issues the popular dollar-pegged stablecoin USDC, says the competition resembles battles between operating systems.

Current blockchain technology is both clunky and slow. Both Bitcoin and Ethereum use a mechanism called "PoW" (proof-of-work), where computers race to solve mathematical puzzles to validate transactions in exchange for rewards. This slows down the network and limits capacity. Bitcoin can process only seven transactions per second; Ethereum manages just 15. During peak times, transactions are either slow or expensive—or both. When demand for completing transactions on the Ethereum network is high, transaction fees paid to the computers (nodes) validating them rise, and settlement times increase. You might spend $70 to swap $500 into ETH and then wait several minutes to transfer it from one crypto wallet to another.

Developers have long tried to boost Ethereum’s capacity. One key direction involves changing the blockchain’s consensus mechanism. Later this year, developers plan to transition Ethereum to a more scalable mechanism known as "PoS" (proof-of-stake). Another idea is to split the blockchain via a process called "sharding." These shards would share the load, increasing overall capacity. Additionally, some developers are working on methods to bundle transactions (such as Rollups) to reduce the number that must be directly validated on the main layer (L1).

The problem is that every improvement comes at a cost. DeFi advocates tout its ability to enable secure transactions without centralized intermediaries. But scalability gains must be weighed against losses in security or decentralization. Aggregating transactions before they reach the blockchain is often done by centralized entities. For hackers, attacking a single shard may be easier than attacking the entire chain. As a result, Ethereum developers have proceeded cautiously with changes.

This caution has backfired in another way—spurring the rise of competitors. At the beginning of 2021, nearly all assets locked in DeFi applications were on Ethereum’s network. But a recent research report from JPMorgan Chase estimates that by the end of 2021, Ethereum’s share of assets locked in DeFi apps had fallen to 70%. Increasingly, other networks such as Avalanche, Binance Smart Chain, Terra, and Solana now use PoS to operate blockchains that perform the same basic functions as Ethereum—but faster and cheaper. For example, both the Avalanche and Solana blockchains can handle thousands of transactions per second.

The evolution of the US dollar stablecoin USDC illustrates these shifts. Launched three years ago on the Ethereum network, USDC has since been rolled out on numerous competing networks, including Algorand, Hedera, and Solana. Jeremy Allaire, CEO of Circle, the company behind USDC, notes that Ethereum transactions are limited by cost and speed, while transactions on Solana can handle “Visa-scale volumes,” with “settlement times of around 400 milliseconds and transaction costs of about one-twentieth of a penny.” Other DeFi applications, such as SushiSwap—an exchange originally built on Ethereum—have also launched on several other blockchain networks.

JPMorgan’s Nikolaos Panigirtzoglou writes that since some of Ethereum’s planned upgrades may take at least a year—if not longer—“the risk is…that the Ethereum network will lose further market share.” To Jeremy Allaire, the current landscape is highly competitive. “Just as in computing, where Windows, iOS, and Android all compete, so too do blockchain platforms.” He believes the ultimate winner will be the network that attracts the best developers to build applications and thus achieves network effects.

But the operating-system analogy may only go so far, partly due to the nature of open public blockchains. Anyone can access the data they generate and inspect their operational code, making it possible to build “bridges” or applications that span multiple blockchain networks, or that aggregate information across different blockchains. Some applications, such as the decentralized exchange aggregator 1inch, already “scan” exchanges across blockchains to find the best execution price for cryptocurrency trades; meanwhile, “multi-chain” blockchains like Polkadot and Cosmos function as bridges between different networks, enabling cross-network operations.

As long as DeFi has the potential to succeed, competition over which network becomes the preferred platform will naturally intensify. Yet the notion of a “winner-takes-all” scenario, gaining total control over the digital economy and its development, may one day seem as outdated as videotapes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News