DappRadar Report: Why NFTs and Blockchain Games Can Grow Against the Trend?

TechFlow Selected TechFlow Selected

DappRadar Report: Why NFTs and Blockchain Games Can Grow Against the Trend?

In this ever-evolving industry, each sector is welcoming a new group of users.

Author: DappRadar

Translation: Heimi, Baize Researcher

In 2021, blockchain users grew significantly.

Across this evolving industry, new user groups emerged in various sectors. As the world’s largest Dapp store, we saw a 1,028% increase in traffic over the past year, now approaching nearly 1.4 million monthly visits. With this growing audience, we sought to study the most critical user behavior patterns from the second half of last year—patterns that may become even more important in 2022.

In this report, we analyze global trends, including correlations between demographics, macro indicators, and on-chain metrics, using behavioral insights to forecast key developments in the crypto space for 2022.

Key Takeaways:

1) NFTs have been almost unaffected by the crypto market downturn; trading volume continues to rise, while the number of unique active wallets (UAW) connecting to NFT dapps on Ethereum has increased by 43% since Q3 2021.

2) In contrast, DeFi usage shows a clear correlation with cryptocurrency prices. When ETH, SOL, AVAX, and LUNA hit all-time highs, over 1.25 million UAWs connected daily to DeFi dapps, but recently dropped to as low as 800,000 during the bearish market phase.

3) Despite recent negative crypto trends, blockchain gaming remains widely used. Games now account for 52% of total dapp usage across the industry, widening the gap with DeFi dapps.

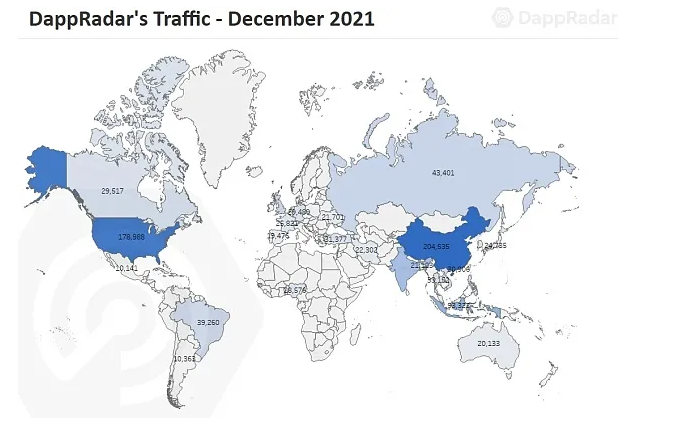

4) China is currently the leader in dapp traffic, up 166% compared to November 2021. The U.S. led in this category throughout 2021.

Asia's Footprint Across the Industry Is Becoming Increasingly Evident

By the end of 2021, dapps attracted over 2.5 million unique active wallets (UAW) per day—a 707% increase compared to the end of 2020. This surge in adoption was driven by waves of interest, primarily fueled by NFTs and blockchain gaming.

Analyzing 1.4 million visits to DappRadar in December last year reveals emerging user source trends, differing from what we observed mid-year.

First, China now leads in terms of user base. In December, 204,000 users accessed DappRadar—an increase of 166% from November. Traffic from Indonesia and India also stands out, with both countries seeing more than a doubling of metrics in December. Asia continues to expand its footprint across the crypto industry. Given strong interest in blockchain gaming and the potential of NFTs, Asia is undoubtedly a region to watch closely.

The U.S. is no longer the top traffic source, now trailing behind several Asian nations. Nonetheless, U.S. traffic grew by 38% in December, reaching over 175,000 users, and remains the most significant market for collectible NFTs.

The UK, Russia, the Philippines, and Brazil follow after India, each still contributing substantial user numbers. Combined, these four countries surpassed 168,000 users, averaging around 30% growth, with Russia showing the most notable increase.

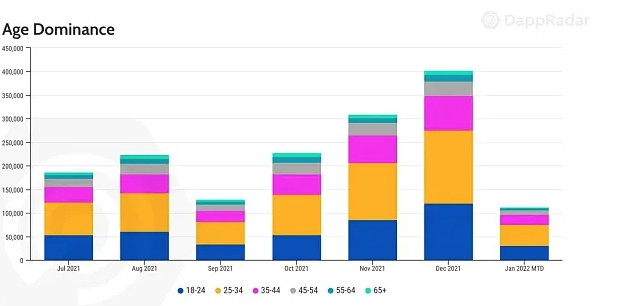

Millennials and Gen Z Dominate the Blockchain Space

Continuing our demographic analysis, we focus on age ranges to gain deeper insights into user interests within blockchain.

Gen Z (born 1997–2012) continues to accelerate their participation in the industry. In December, 30% of DappRadar’s users came from this age group, up from an average of around 26% throughout most of 2021.

Millennials (born 1980–1994) maintain dominance as well, accounting for 38% of traffic. Given millennials’ strong interest in areas like NFTs and gaming, the future looks bright for both sectors.

On the other hand, the most noticeable decline occurred among users aged 45 to 54, whose share dropped from 11.5% in January 2021 to just 7% in December.

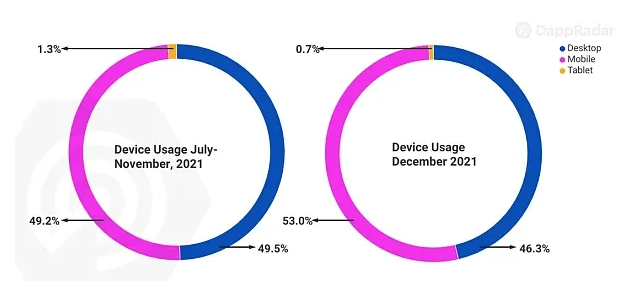

Another exciting insight emerges when analyzing users’ preferred devices. Although we gained many visitors following the launch of the RADAR token, approximately 53% of connections still occur via mobile phones. Despite most users preferring desktop wallets for security reasons, desktop devices accounted for only 46% of traffic. This could signal an important behavioral trend—one likely to grow in significance as blockchain gaming takes center stage in 2022, especially with expected breakthroughs in mobile wallets (like Ronin) and mobile blockchain games.

NFTs and Gaming Are More Resilient Than DeFi Against Macro Trends

While the three main dapp categories—DeFi TVL, NFT trading volume, and gaming usage—all exploded in 2021, recent macroeconomic factors (such as surging pandemic cases, the Fed's intention to raise interest rates, and Kazakhstan’s gas crisis affecting nearly one-fifth of Bitcoin mining) have plunged the crypto market back into a cyclical bear phase.

We analyzed how major blockchain macro indicators—such as prices of leading cryptocurrencies, Ethereum gas fees, and Bitcoin’s Fear & Greed Index—affect on-chain metrics. How significant are macro indicators in shaping user behavior?

Despite Crypto Asset Declines, NFT Metrics Continue to Surge

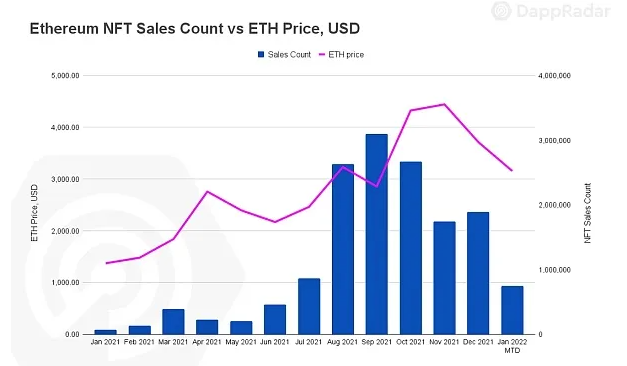

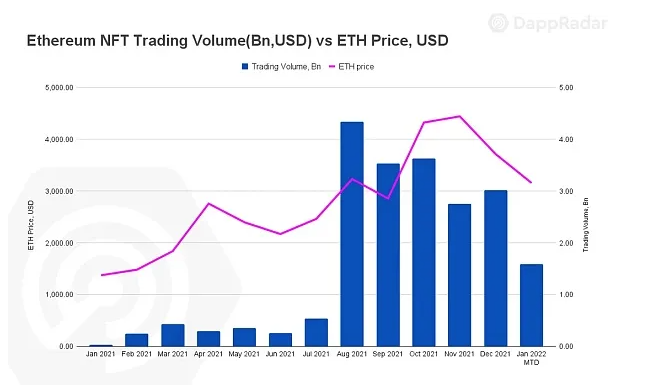

In Q3 2021, NFTs generated $10.7 billion in trading volume, followed by $11.9 billion in Q4—demonstrating sustained strength. Meanwhile, ETH prices have been declining since hitting an all-time high of $4,878 in November. Despite volatility in crypto asset prices, NFTs continue their positive trajectory.

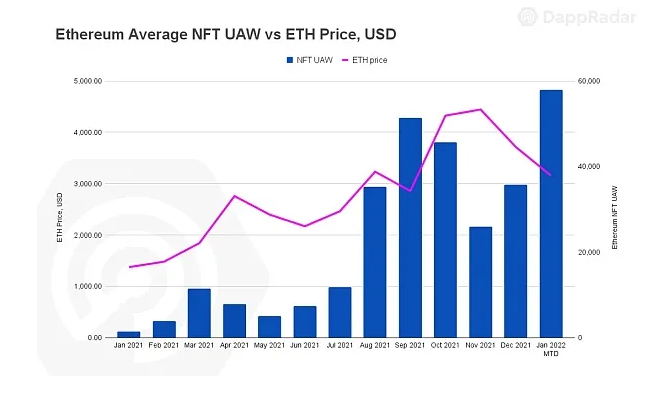

Not only did NFT sales on Ethereum increase, but so did the number of UAWs connecting to NFT dapps (marketplaces and collectibles). Since December, an average of 46,800 UAWs have connected to Ethereum-based NFT dapps—43% higher than in Q3.

Despite unfavorable macro conditions, NFTs’ indispensable role in the metaverse and gaming has driven positive on-chain metrics. Additionally, established projects continue meeting milestones, strengthening community outlooks. Coupled with a steady stream of celebrities and major brands entering the space, NFTs appear as solid as ever.

Moreover, communities are uniting—exemplified by the recent launch of the LooksRare marketplace, which strengthens the NFT ecosystem. Given the undeniable strength of NFT fundamentals, investors may view the current crypto downturn as a buying opportunity, as lower native asset prices (e.g., ETH) reduce the real cost of acquiring NFTs.

Lastly, as collectors, users from the U.S. remain the most active region. The U.S. leads significantly in NFT traffic on DappRadar, with Brazil and Mexico—both in the Americas—ranking in the top four. Meanwhile, users from the Philippines translate their strong interest in sports, fashion, and celebrities into engagement with NFTs.

Strong Correlation Between DeFi and Macro Indicators

Although trailing behind blockchain gaming and NFTs, DeFi’s total value locked (TVL) reached an all-time high by the end of 2021. Driven by attractive programs such as liquidity mining, competitiveness in the sector rebounded significantly.

However, no sector is more sensitive to crypto market movements than DeFi. Thus, macro indicators and DeFi on-chain data can offer clues about user behavior patterns.

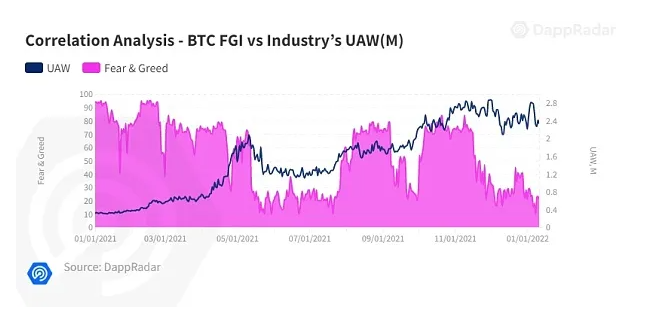

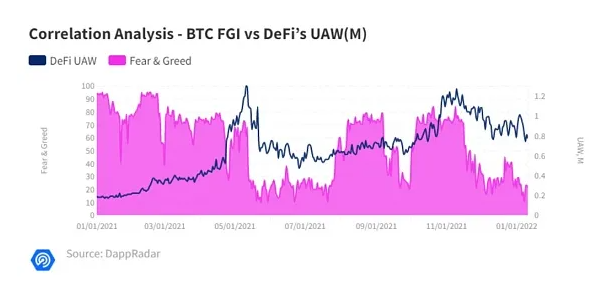

While native tokens significantly impact TVL, they do not directly correlate with user activity. Comparing macro indicators like Bitcoin’s Fear & Greed Index (FGI) with user behavior reveals DeFi’s heavy reliance on broader crypto market sentiment. [Note: FGI is a widely used analytical tool in crypto trading that measures market emotion on a scale from 0 (extreme fear) to 100 (extreme greed).]

The two charts below illustrate the correlation between FGI, overall dapp industry UAWs, and UAWs connecting exclusively to DeFi dapps. Unlike the broader dapp industry, where no clear correlation exists, DeFi usage closely follows market sentiment. As previously noted, NFTs operate independently of crypto market swings, influenced instead by utility, maturity, and use cases—and the same applies to blockchain gaming. In DeFi, however, usage and value are tightly linked.

A closer look at the relationship between FGI and DeFi users shows DeFi usage surged to a record high of 1.25 million in November—coinciding with price spikes in AVAX, SOL, and LUNA. As the crypto market cooled toward year-end, usage fell back below 1 million UAWs.

A similar pattern emerges when analyzing the top three blockchains by TVL and their native assets.

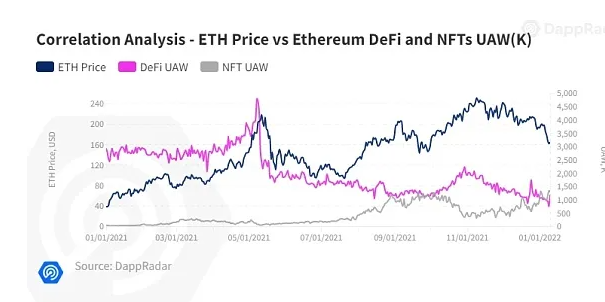

Starting with Ethereum, ETH’s price shows no correlation with NFT activity. However, examining ETH price against DeFi usage reveals a slight correlation between DeFi and its underlying native asset.

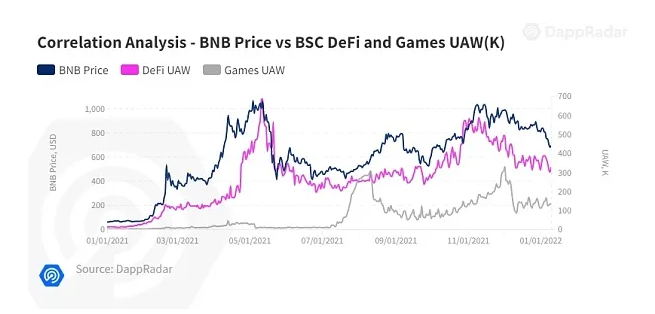

On BSC, UAWs connecting to DeFi dapps follow a trajectory similar to BNB’s price, again highlighting the link between DeFi and its native asset.

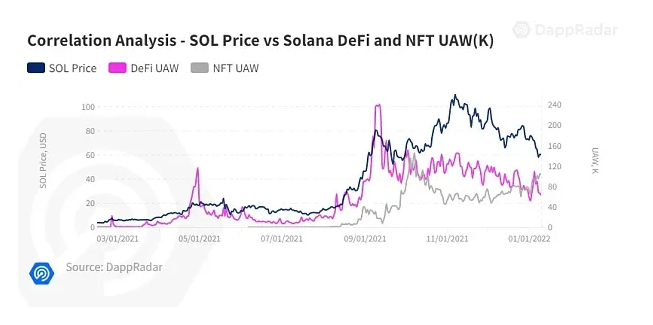

The final example is Solana. Comparing DeFi and NFT usage on Solana further confirms that user behavior in DeFi is largely dependent on crypto market trends.

Blockchain Gaming Adoption Remains Stable

DeFi and NFTs follow divergent paths. For DeFi, macroeconomic indicators play a significant role in user engagement. NFTs, however, appear more independent—and the same holds true for blockchain gaming.

Last year, we witnessed rapid growth and widespread adoption of blockchain gaming, driven by P2E (Play-to-Earn) and the metaverse concept. Like in the NFT space, these external trends influence user behavior. Positive sentiment around P2E and the metaverse motivates people to participate in blockchain gaming.

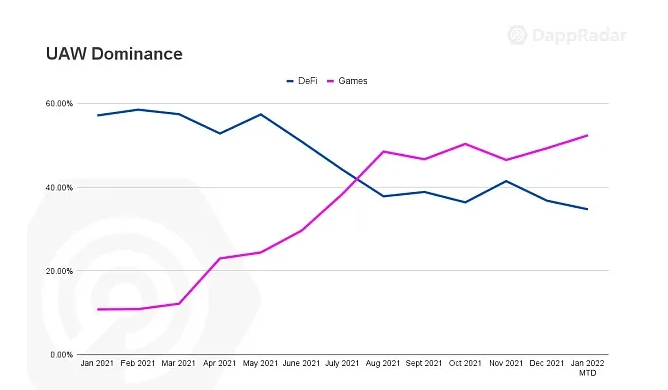

In the summer of 2021, gaming surpassed DeFi as the most-used dapp category. Throughout most of Q3 and until mid-Q4, these two dapp types dominated the industry, collectively accounting for nearly 90% of usage. However, as negative crypto trends emerged, DeFi usage began to decline. Since November, the gap between gaming and DeFi has widened: gaming now accounts for 52.4% of industry activity, while DeFi has dropped to 34.7%.

Undoubtedly, blockchain gaming attracts more users every month, significantly expanding its player base. With widespread expectations that P2E and GameFi will flourish in 2022, we can predict that gaming will continue driving dapp usage in the crypto industry this year.

Conclusion

User behavior patterns offer valuable insights for predicting industry-wide trends in the coming months.

Demographic analysis reveals growing interest from Asian markets, particularly in gaming and NFTs. Age and device usage data also help monitor short-term demand shifts.

Additionally, combining macro indicators with on-chain metrics offers clues about user behavior. In this context, we observe how NFTs and gaming operate independently of broader industry forces such as crypto market trends and related indicators.

Both NFTs and blockchain gaming showed strong performance in 2021, and this trend appears set to continue into 2022. While crypto asset prices are inherently volatile, usage of blockchain gaming and NFTs continues to rise. Whether increasing maturity in these sectors will make them more sensitive to fluctuations in their native tokens remains to be seen.

Meanwhile, DeFi will continue evolving alongside crypto market volatility. Undoubtedly, the DeFi space is more complete and mature than it was a year ago, but it faces greater challenges than other sectors. Beyond macro pressures, compliance and competition from traditional finance remain significant hurdles.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News