MiniMax Funding Story: 7 Rounds in 4 Years, Who Is Driving China's First AI Capital Feast

TechFlow Selected TechFlow Selected

MiniMax Funding Story: 7 Rounds in 4 Years, Who Is Driving China's First AI Capital Feast

An IPO is not a reward for the winner, but the starting drumbeat for the next round of competition.

Author: Cheng Manqi

For two consecutive days, large model startups Zhipu and MiniMax have gone public on the Hong Kong Stock Exchange. Compared to previous IPO bonanzas during the mobile internet era, initial public offerings in the large model sector are not occurring after a definitive battle has ended. They are not rewards for winners, but rather the drumbeats signaling the next round of competition.

Shortly after Zhipu and MiniMax enter the secondary market, both will launch larger-scale private placements. This is a field where commercialization remains uncertain, yet continuous R&D investment is absolutely certain. The real significance of an IPO here is to more efficiently secure greater resources.

On the eve of MiniMax’s listing, we spoke with members of the MiniMax team and several of its investors to reconstruct the diverse perspectives the market has held toward large model startup opportunities over the past three-plus years—and to understand the characteristics of this company.

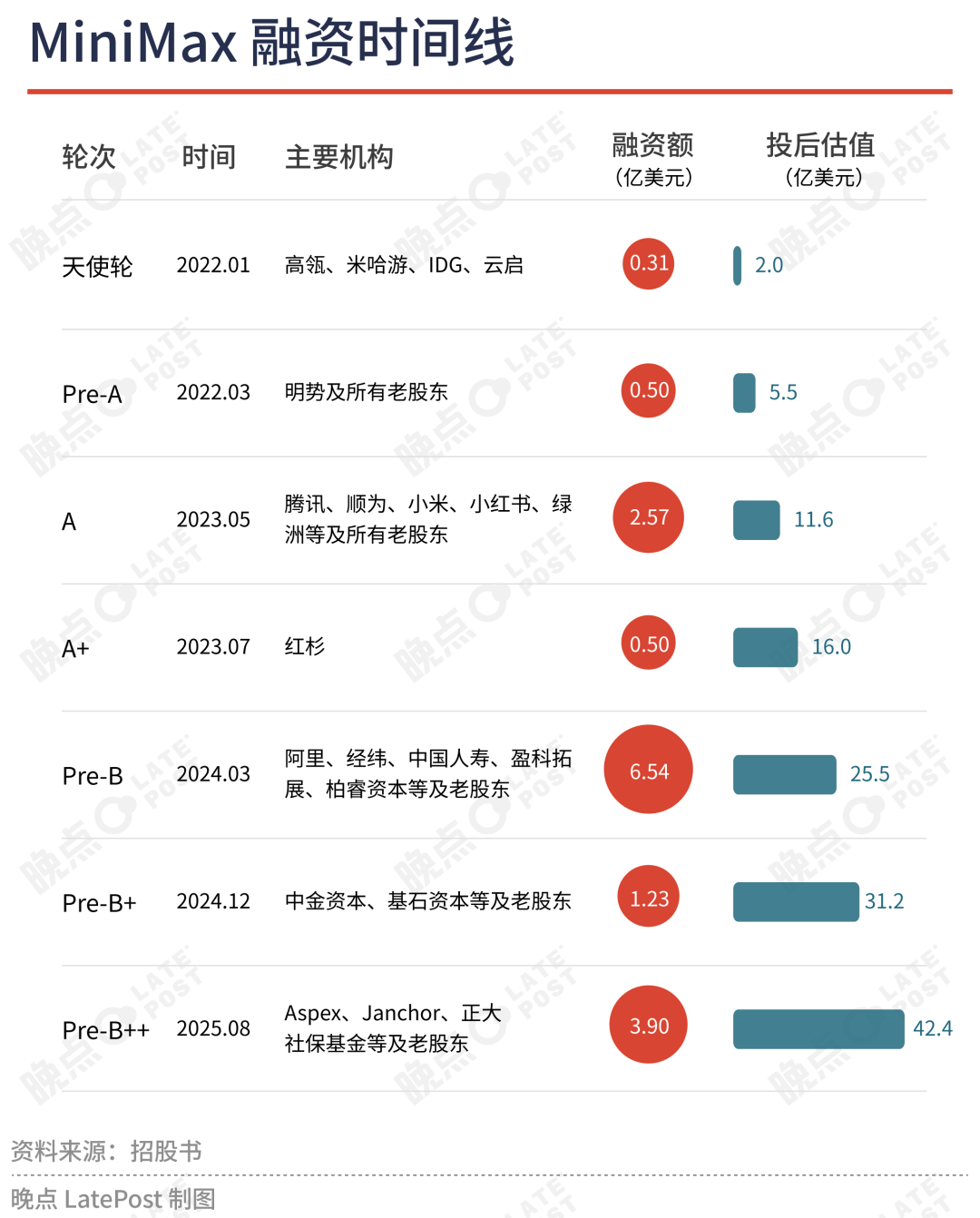

In the seven funding rounds prior to its IPO, 30 institutions collectively invested $1.5 billion into MiniMax. Alibaba invested the most; Hillhouse was the lead investor in the first round and, by shareholding, ranks second only to Alibaba as the largest external shareholder; Mingxi Capital participated in the most rounds.

Just before heading to ring the bell at the Hong Kong Stock Exchange this morning (January 9), MiniMax founder Yan Junjie shared his current thoughts with LatePost:

"We hope that in the future we can make even greater contributions to advancing the overall intelligence level of the industry. We’ve preliminarily explored a grassroots-only path for AI entrepreneurship. Though the road ahead remains highly challenging, it would be an honor if our journey could inspire the development of the AI innovation and entrepreneurship ecosystem."

As of midday trading, MiniMax's stock price had risen over 78% from its offering price of HK$165 to HK$294, giving the company a market capitalization of HK$89.8 billion.

Departing Before the Hype

Hillhouse: Earliest Investor, Largest External Financial Shareholder

MiniMax was founded in early 2022, just before the ChatGPT wave hit, and Hillhouse was its first investor.

During the startup phase, Hillhouse partner Li Liang met with Yan Junjie and Yuan Yeyi at MiniMax’s Beijing office. After a three-hour conversation, he presented them with a term sheet (TS) with a blank valuation field: “You can write down your desired valuation and funding amount.” Yan proposed their planned figures: raise $30 million at a $200 million pre-money valuation.

Before founding MiniMax, Yan Junjie and Yuan Yeyi worked together at SenseTime. Born in 1989 and raised in a county town in Henan province, Yan earned his Ph.D. from the Institute of Automation, Chinese Academy of Sciences. During his seven years at SenseTime, he rose from researcher to become the company’s youngest vice president, serving as executive dean of the research institute and overseeing businesses including smart cities and gaming. Yuan graduated from Johns Hopkins University and previously served as head of strategy in SenseTime’s CEO office.

Xue Zizhao, the first Hillhouse investor to engage with MiniMax, told LatePost that just days before meeting Li Liang, Yan delivered a nine-hour "technical lecture" to the Hillhouse team: covering Transformer architecture scaling laws, GPT-3 advancements, DeepMind’s reinforcement learning work, diffusion models for image generation, and how CLIP aligns images with language. “Back then, few people could piece all these technologies together. Personally, I didn’t fully believe success was guaranteed—but looking back, every technical judgment IO [Yan Junjie] made turned out to be correct.”

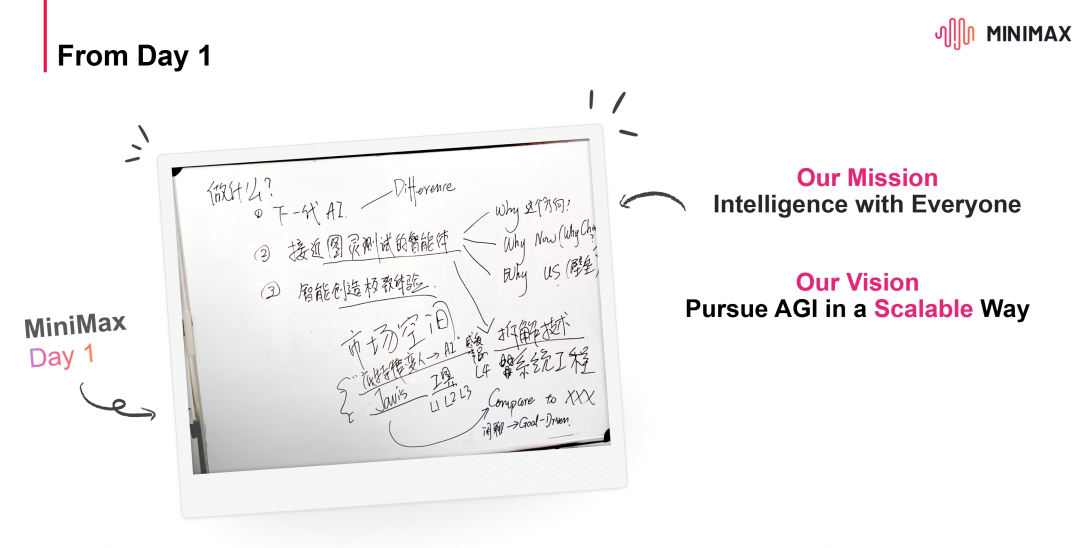

In MiniMax’s early days, the team broke down technological shifts and market opportunities on whiteboards.

MiniMax’s approach was to simultaneously develop text, speech, and image models—using large models and multimodal technology to build AI applications accessible to ordinary users. This became the founding vision: Intelligence with everyone.

Hillhouse judged at the time that this was a systems engineering challenge requiring not just algorithmic expertise, but also capabilities across hardware infrastructure, data, engineering, and application development. Yan Junjie had led teams of over 1,000 people at SenseTime, gaining experience in algorithms, engineering, organizational leadership, and AI commercialization.

Within less than two weeks, Hillhouse completed the TS and investment committee approval, securing the lead position in MiniMax’s angel round. Sequoia, which engaged with MiniMax about a week later, missed out on this round. It wouldn’t join until a year and a half later, in July 2023, investing in MiniMax’s fourth round at a $1.55 billion pre-money valuation.

In November 2022, Zhang Lei organized a small private trip to the Middle East. Among the few entrepreneurs invited were BYD founder Wang Chuanfu and Horizon Robotics founder Yu Kai—and Yan Junjie, who was then relatively unknown and had been running his startup for less than a year.

Inside a VIP lounge at the Qatar World Cup, Yan struggled through explanations in broken English about what AGI (Artificial General Intelligence) meant. Half a month later, this still-obscure term exploded globally with the release of ChatGPT.

Xue Zizhao, Hillhouse’s earliest MiniMax contact, officially joined MiniMax in 2023: “I invested myself into it.”

Hillhouse continued to invest in MiniMax after the angel round. Prior to the IPO, it held 7.14% of the company—second only to Alibaba—and became MiniMax’s second-largest external investor and largest financial investor.

Mihoyo’s Liu Wei: “Super smart is overrated, resilience underrated”

In early 2021, Mihoyo co-founder Cai Haoyu said in a speech: “By 2030, we aim to create a virtual world where 1 billion people live.” MiniMax’s original envisioned application form aligned closely with this: using multimodal technology to create AI agents (here meaning interactive AI characters, not today’s common notion of AI Agent) that engage with everyday users. Two of Mihoyo’s three founders—“Brother Dawei” Liu Wei and “Lord Luo” Luo Yuhao—had long known the MiniMax team. They learned about Yan Junjie’s venture almost simultaneously with Hillhouse, making investment a natural step.

Mihoyo is exactly the kind of investor founders love. As Yuan Yeyi told LatePost: “They don’t dig deeply into operational details. Every time we meet, they mostly talk about life philosophy—it’s trust in the team.”

Yan Junjie personally experienced the ups and downs of the last AI boom. “I’ve experienced a year and a half of constant losses, and also periods when once I got things right, I kept winning,” Yan reflected in a recent interview with Luo Yonghao, recalling the struggles of leading facial recognition efforts at SenseTime. After pushing forward against heavy pressure, he emerged with stronger technical confidence.

He also witnessed the broader computer vision industry rise high only to fall into stagnation. One founder of China’s “AI Four Dragons” once described Yan Junjie this way: “He’s tasted the bitterness of AI 1.0.”

Last year, during a discussion about large models, Liu Wei told us: “Among large model entrepreneurs, ‘super smart’ traits are often overvalued, while resilience is underestimated. But entrepreneurship is a marathon—resilience is invaluable.”

Yunqi and IDG Join, Closing the Angel Round

Yuan Yeyi had built relationships with multiple investors during his time at SenseTime, including Chen Yu, managing partner at Yunqi Capital and fellow alumnus from Johns Hopkins, and IDG partner Niu Kuiguang, who had backed SenseTime across multiple rounds.

Both firms quickly joined MiniMax’s angel round. Chen Yu had already discussed tech trends with Yan and Yuan earlier. When Yan formally decided to start up, after one dinner in Shanghai, Chen immediately expressed interest: “I want to bet on a technical path that could potentially disrupt existing solutions. Everyone used small models before—Yan was among the first to see the value of foundational large models.”

Niu Kuiguang reached out to Yuan shortly after Mihoyo and Hillhouse issued their term sheets. He called in the morning and flew to Shanghai that night to meet Yan and the core team, finalizing the investment swiftly.

The entire angel round raised $31 million at a $200 million post-money valuation—almost exactly matching the team’s initial plan of raising $30 million at a $200 million post-money valuation. MiniMax declined offers to take more money or accept a higher valuation.

Mingxi Capital: Sole New Investor in MiniMax’s Second Round, Most Frequent Backer

Before ChatGPT launched, MiniMax completed two funding rounds. The sole new investor in the second round was Mingxi Capital. When Mingxi founding partner Huang Mingming and partner Xia Ling first met Yan Junjie, he was sitting in the lobby of a Beijing hotel reading academic papers on an iPad. To this day, he maintains the habit of spending about one hour daily browsing new research.

Their first meeting lasted over two hours. Yan began by explaining technological shifts. Xia Ling recalls hearing about AGI from Yan for the first time—he listened while Googling concepts on the spot. Today, many people’s instinctive reaction in such situations is no longer to Google, but to ask ChatGPT or Doubao.

“To be honest, I wasn’t particularly sensitive to AGI at the time,” Xia said. “But he quickly moved on to explain how GPT is an end-to-end, data-driven model.” Mingxi had invested in NIO seven times, and since 2021, one major trend in autonomous driving has been dramatic improvements brought by end-to-end models.

Yan also discussed how technical changes alter business logic: The persistent challenge for previous AI companies was that models weren’t general enough—requiring retraining for different scenarios and tasks. Large models enable ‘One Model for All,’ meaning AI commercialization can move beyond the old custom-built B2B and B2G development model.

In early 2022, Xia met Yan twice more. At Mingxi’s year-end review meeting shortly before, Xia had laid out a five-year forecast of AI trends. When he shared ideas like “multimodal tech allows us to rebuild Adobe,” “Agency,” and “smarter robots” with Yan, Yan put down his chopsticks and revealed specific application directions MiniMax wanted to pursue.

At their next meeting, coincidentally on February 14, Xia wanted to test one key question: Did MiniMax lean more toward consumer (to C) or enterprise (to B)? “To C,” Yan replied firmly, ruling out the old path of customized B2B projects—the same answer Xia hoped for. So engrossed were they in conversation that neither touched their food. No flowers marked the holiday; Xia brought home a plate of squid blossoms for his family instead.

Like Hillhouse, Mingxi valued Yan’s comprehensive experience spanning algorithms, engineering, and business operations. This proved valuable within the same year: In late 2022, after training several versions of text models, MiniMax began searching nationwide for GPUs. Just as several autonomous driving startups exited the market, many GPU computing resources became available for sublease. MiniMax secured capacity at roughly half the price seen after the large model frenzy took off.

Huang Mingming, founding partner at Mingxi, described Yan’s determination at founding: “At that time, ChatGPT hadn’t launched yet, OpenAI wasn’t hot—Yan, already a senior executive at SenseTime, chose to jump out and start up.” Mingxi is one of the institutions that invested in MiniMax the most times. Of eight total rounds—including IPO cornerstone investment and seven pre-IPO rounds—Mingxi participated in six.

ChatGPT Arrives, Everything Changes

The Investment Boom Amid Rapid Consensus

In October 2022, MiniMax launched its first product, Glow. With minimal marketing, it accumulated over a million anime-style users within two months—an impressive start for a startup less than a year old exploring a new AI-to-consumer path. But soon after, ChatGPT launched in November and created a massive wave, turning Glow into little more than a ripple.

Under fast-forming consensus, MiniMax benefited directly: In early 2023, it rapidly closed its third round, raising $260 million—more than triple the sum of its first two rounds—at a post-money valuation of $1.157 billion. Strategic investors including Tencent, Xiaomi, and Xiaohongshu joined, alongside new financial investors such as Shunwei and Oasis Capital. All existing shareholders doubled down.

On the other hand, MiniMax was no longer one of just a few options in the market. The “hundred-model war” had begun, with a wave of startups emerging, each with distinct strengths: Wang Huimeng self-funded $50 million to found Guangnian Zhixiang; Wang Xiaochuan, creator of the Sogou input method, founded Baichuan Intelligence; Li Kai-Fu launched 01.ai. Among newer technical forces were Zhipu, which started earlier in 2019, and Moonshot AI, founded by Yang Zhiyun—a researcher whose academic background directly connects to large language models. These companies quickly secured funding. Some investors backed multiple players, including Alibaba, Tencent, and Shunwei.

MiniMax’s strategy was to retain more control and avoid excessive dilution too early. Tencent initially wanted to invest more during MiniMax’s third round but ultimately contributed $50 million.

ByteDance Passes, Sequoia Steps In

In May 2023, Wang Huimeng stepped back from Guangnian Zhixiang due to health issues. Around the same time, another pivotal player shaping China’s large model landscape made its decision: ByteDance.

ByteDance had already assembled a large model team but was also considering external investments—similar to Google investing in Anthropic, or Tencent and Alibaba pursuing both in-house development and external investments. By June 2023, ByteDance had sent investment proposals to two large model startups: MiniMax and Jieyue Xingchen, which had recently formed.

But after a senior leadership meeting mid-year, ByteDance decided against investing externally in large model companies. Zhang Yiming’s stance: “Why don’t we just build our own large models? We should do it ourselves—and we can do it well.”

Around the same time, Sequoia China led MiniMax’s A+ round. By then, Hillhouse’s three rounds of Super Pro-rata rights had expired.

This round raised $50 million for MiniMax, bringing its post-money valuation to $1.6 billion. Sequoia continued supporting in subsequent rounds and this became one of Sequoia China’s largest investments in the large model space. Pre-IPO, Sequoia China held 3.81% of MiniMax, ranking as the third-largest financial investor. Sequoia also invested in Guangnian Zhixiang, Moonshot AI, and Jieyue Xingchen.

According to LatePost, Sequoia and Hillhouse debated their respective share allocations in this round down to the third decimal place.

Alibaba’s Big Bet, That Fateful Spring Festival

During the last AI boom, Alibaba was both a key supporter and subtly competitive with startups—much like the current dynamic between big tech and AI startups.

Alibaba once sat on the boards of both SenseTime and Megvii. In 2017, both companies sought to acquire Uniview, China’s third-largest player in video surveillance, aiming to find a hardware platform for visual AI by acquiring its parent company Qihua Zhongtai. Ultimately, Alibaba acquired Qihua for RMB 3.7 billion, taking Uniview under its wing to help Alibaba Cloud expand into government and enterprise markets.

Times have changed. Alibaba Cloud has gradually withdrawn from private-deployment-focused government and enterprise businesses. After the large model wave, Alibaba’s #6 employee Wu Yongming returned in 2023 to serve as group CEO and cloud CEO, announcing a new strategy for Alibaba Cloud: AI-driven, public cloud first.

Alibaba began broadly investing in large model startups—key customers for its AI cloud computing power. In the second half of 2023, Alibaba successively invested in Zhipu, Baichuan Intelligence, and 01.ai.

By the end of 2023, Alibaba began engaging with both MiniMax and Moonshot AI.

This marked a pivotal round for Moonshot AI’s leapfrogging. Initially, Moonshot sought funding from Xiaohongshu at a $900 million pre-money valuation. Then, just before the Lunar New Year, Alibaba stepped in, raising the pre-money valuation to $1.5 billion and investing nearly $800 million.

Early-stage companies typically proceed cautiously with such large investments due to high equity stakes. But Alibaba’s influence was immediate: the $800 million deal quickly became headline news across the AI industry. Combined with Kimi’s product launches and user growth in the first half of 2024, Moonshot AI reached peak visibility.

Initially, Alibaba also aimed to take a 30–40% stake in MiniMax. Eventually, the two sides settled on Alibaba investing $400 million. This fifth round closed in March 2024, totaling $654 million in funding and bringing MiniMax’s post-money valuation to $2.55 billion. New investors joining this round included Matrix Partners China and China Life.

Pre-IPO, Alibaba held over 13% of MiniMax, becoming its largest external shareholder.

Insurers, Manufacturing Family Offices—When More Types of Institutions Invest in Large Models

After Alibaba’s major investments in large models in early 2024, fundraising frequency in the foundational model space noticeably declined from 2024 to 2025. Tech giants like ByteDance and Alibaba significantly ramped up comprehensive AI model and product investments, wielding manpower and computing power orders of magnitude greater than startups, along with control over traffic and advertising platforms. DeepSeek, focusing purely on model research without near-term commercial pressure, pursued an extreme, simple, and clean approach—pushing typical funding-dependent startups out of the spotlight. Fewer companies could raise funds, and fewer investors were willing or able to deploy large sums.

Beyond traditional VCs, new types of investors joined MiniMax’s cap table, including Guoshou Investment—the earliest insurance fund active in private equity in China; Yeo Kiat Holdings managed by Richard Li; and Bairui Capital, solely funded by CATL co-founder and vice chairman Li Ping. These investors brought fresh perspectives on large models.

China Life: Found a Reassuring Team

“Young, determined, always smiling, speaking calmly and steadily”—this was Gu Yechi’s first impression of Yan Junjie. Gu is head of equity investments at Guoshou Investment & Insurance Asset Management, with ten years of regulatory experience followed by a decade in private equity.

As an insurer, China Life cannot afford mistakes—this matters more than achieving outsized returns. After meeting nearly all top large model company founders, Gu and the China Life investment team selected MiniMax, investing in two rounds in early and late 2024.

Gu meets Yan approximately every two months. He describes Yan as a founder who is “authentic, deeply forward-thinking, technically committed, and consistent”: “In 2023, Junjie started talking about MoE (Mixture of Experts). Then he trained an MoE model—now the industry standard architecture. Over a year ago, he told me large model companies should rely primarily on technology, not user acquisition spending. That’s exactly what they did. Now, that’s the dominant narrative in the industry.”

“That makes us feel very confident,” said Gu.

Bairui Capital: Seeking Scientist-Entrepreneurs

“Without the MiniMax project, we probably wouldn’t have invested in large models,” Wang Limin, managing partner at Bairui Capital, told LatePost.

Bairui Capital is a venture firm backed solely by Li Ping, vice chairman of CATL. Li was a co-founder of CATL in 2010 and currently serves as vice chairman.

After ChatGPT, Bairui—which originally focused on advanced manufacturing and deep tech—began studying the generative AI revolution driven by large language models, though it didn’t rush to invest.

In November 2023, Li Ping and the Bairui team spent three hours with Yan Junjie at Jinjiang Hotel in Shanghai, forming an initial intent to invest. Bairui later participated in the closing of MiniMax’s fourth round in early 2024—its first investment in software and information technology.

Yan Junjie’s cost discipline, MiniMax’s early moves to secure computing power, and its strategy of exploring applications in batches to generate R&D funding resonated strongly with Bairui. CATL went through a similar process in the early days of automotive battery development: establishing an initial commercial loop via bus and commercial vehicle batteries, using early revenues to fund subsequent R&D, improving performance, and driving steep declines in battery costs.

“Yan Junjie clearly understands that today’s large model startups—especially those in China—don’t have unlimited money to burn or access to the most advanced computing clusters. Chinese large model companies must forge their own paths, developing foundational models under constraints of cost and computing availability.”

“One thing we learned from Robin (Zeng Yuqun) is that to build a great company, a top-tier scientist must also possess top-tier business thinking,” said Wang Limin.

“Staying in the Wave”

Over the past three-plus years, consensus has formed rapidly, only to be overturned even faster: 2023 was a race to follow—everyone benchmarking against GPT-4; 2024 began with Alibaba’s massive bets and ended with Doubao’s unexpected rise; in 2025, DeepSeek open-sourced a world-class reasoning model at extremely low cost, valuations of top global startups soared into hundreds of billions, and the question of “who will be China’s OpenAI” lost its relevance.

MiniMax’s survival strategy isn’t maximizing a single strength, but constantly adjusting its footing toward the goal of making AI serve ordinary people.

It builds large language models while maintaining multimodal generation capabilities, because Yan believes AI for everyday users needs both intelligence and multimodal interaction via vision and voice. It develops both models and applications; Yan once said, “Even if you achieve technical breakthroughs, if there’s no product to carry them, they ultimately aren’t yours.” It operates in both domestic and international markets.

Companion AI apps like Xingye/Talkie, multimedia content generators such as Hailuo AI and MiniMax Voice, and API services via its open platform each contribute roughly one-third of MiniMax’s revenue—a balanced 1:1:1 mix.

In the technical domain directly overseen by Yan Junjie, he embraces risk. In late 2023, MiniMax dedicated nearly all its R&D resources to building MoE (Mixture of Experts) models, failing twice in training. In 2024, it allocated 80% of resources to a new model based on linear attention architecture—later released in early 2025 as M1—betting heavily on what he saw as the highest-potential technical direction.

Exploring diverse commercialization paths and concentrating R&D efforts on singular technical bets are two sides of the same coin. Much like the name MiniMax itself—seeking minimal success probability with limited resources amid maximum uncertainty.

In early 2025, Yan Junjie said he hopes to remain within the wave: “First, so we can continue helping drive the wave forward; second, so our company can sustain its growth.”

So, first—stay in the wave.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News