Read 500 pages of reports from five institutions for you—this one article is all you need for the annual crypto outlook

TechFlow Selected TechFlow Selected

Read 500 pages of reports from five institutions for you—this one article is all you need for the annual crypto outlook

Structural maturity will replace speculative cycles, driven by liquidity convergence, regulatory clarity, and infrastructure development.

Author: Eli5DeFi

Translation: TechFlow

As the crypto industry moves toward 2026, leading research institutions are gradually reaching a consensus:

"The era of pure speculative cycles is coming to an end."

In its place comes structural maturity driven by liquidity convergence, infrastructure development, and industry consolidation—rather than market volatility led by short-term narratives.

Below are the core views from major crypto research firms on their 2026 outlook (saving you hundreds of pages of reports):

Key Summary:

-

"Death of the Cycle": Research firms agree that the traditional four-year halving-driven speculation cycle is fading. The future will be dominated by structural maturity, with value shifting toward "ownership coins" featuring revenue-sharing models and projects with real-world utility, rather than short-lived hype narratives.

-

Rise of Agentic Finance: Major institutions (such as Delphi Digital, a16z, Coinbase) predict that AI agents will become primary economic actors. This will drive the development of "Know Your Agent" (KYA) identity protocols and machine-native settlement layers—technologies that go beyond human manual operation capabilities.

-

Super-App Consolidation: As U.S. regulation becomes clearer (per research from Four Pillars, Messari, etc.), complex crypto experiences will be integrated into user-friendly "super-apps" and privacy-preserving blockchains. These technologies will hide technical complexity and enable mass adoption.

Delphi Digital's View: Infrastructure, Applications & Markets

Delphi Digital’s macro hypothesis centers on "global convergence." They predict that by 2026, divergence in global central bank monetary policies will end, shifting toward coordinated rate cuts and liquidity injections. After the Fed ends quantitative tightening (QT), improved global liquidity will benefit hard assets like gold and Bitcoin.

Outlook for 2026:

-

Agentic Finance

A major expansion in infrastructure is seen in the rise of "Agentic Finance." AI agents will no longer be mere chatbots—they’ll actively manage capital, execute complex DeFi strategies, and optimize yields on-chain without human intervention.

-

Social Trading & "Pump" Economy

On the consumer application front, Delphi highlights the stickiness of platforms like @Pumpfun and predicts the maturation of "social trading." The trend will shift from simple meme coin speculation to more sophisticated copy-trading tiers, where strategy sharing becomes a tokenized product.

-

Institutional Liquidity

Market structure will change due to the broader adoption of exchange-traded funds (ETFs). Traditional finance (TradFi) liquidity will enter crypto markets not just as a hedge, but as a standard portfolio allocation driven by macro liquidity easing.

Read full reports:

Messari: Crypto Industry Outlook 2026 – Market Structure & Utility Rise

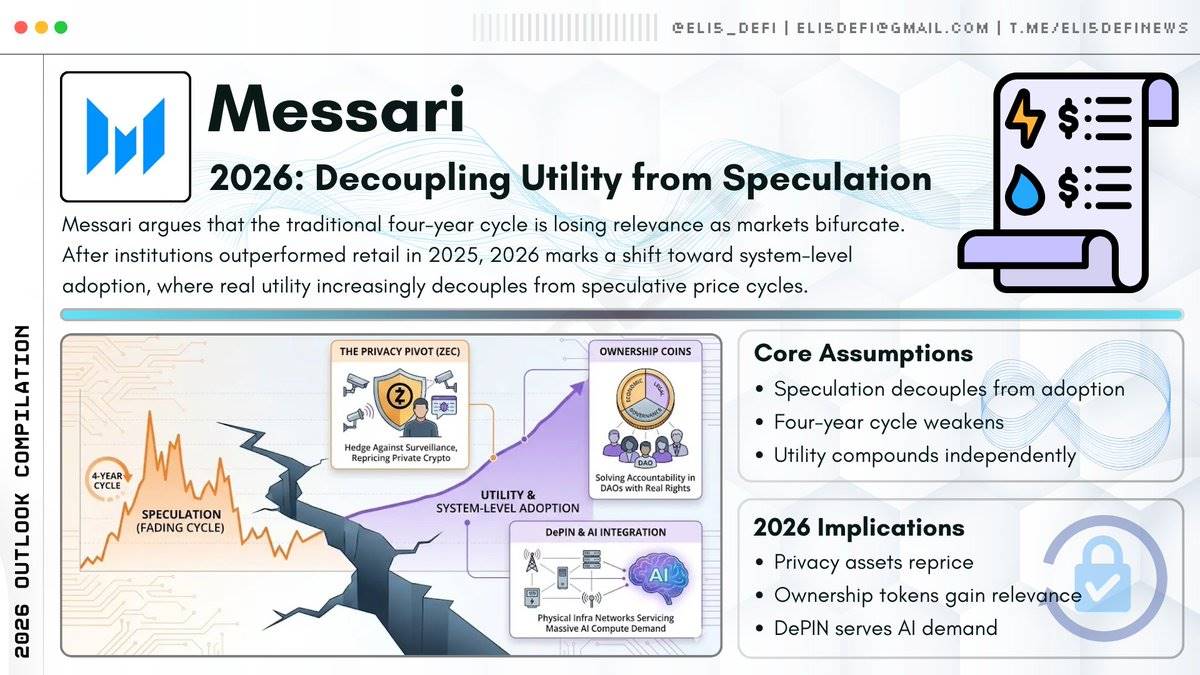

Messari’s core thesis is "the separation of utility and speculation." They argue that the traditional "four-year cycle" model is losing relevance, and the market is heading toward divergence. They posit that 2025 will be a year where institutional investors win and retail investors lose, while 2026 becomes the era of "system-level applications"—not just speculative games based on asset prices.

Outlook for 2026:

-

Privacy Turn ($ZEC)

Messari presents a contrarian growth thesis: the revival of privacy. They specifically highlight assets like @Zcash (ZEC)—not merely as "privacy coins," but as essential hedges against increasing surveillance and corporate control—and predict a repricing opportunity for "privacy cryptocurrencies."

-

Ownership Coins

2026 will see the emergence of a new token category—"ownership coins." These tokens combine economic, legal, and governance rights. Messari believes they could resolve accountability crises in decentralized autonomous organizations (DAOs) and potentially spawn the first billion-dollar-valued projects.

-

DePIN & AI Integration

The research also dives deep into the potential of DePIN (Decentralized Physical Infrastructure Networks), expecting these protocols to find product-market fit in the real world by meeting massive AI-driven demand for computing power and data.

Full report:Crypto Theses 2026 Report

Four Pillars: Regulatory Restructuring & Super-Apps

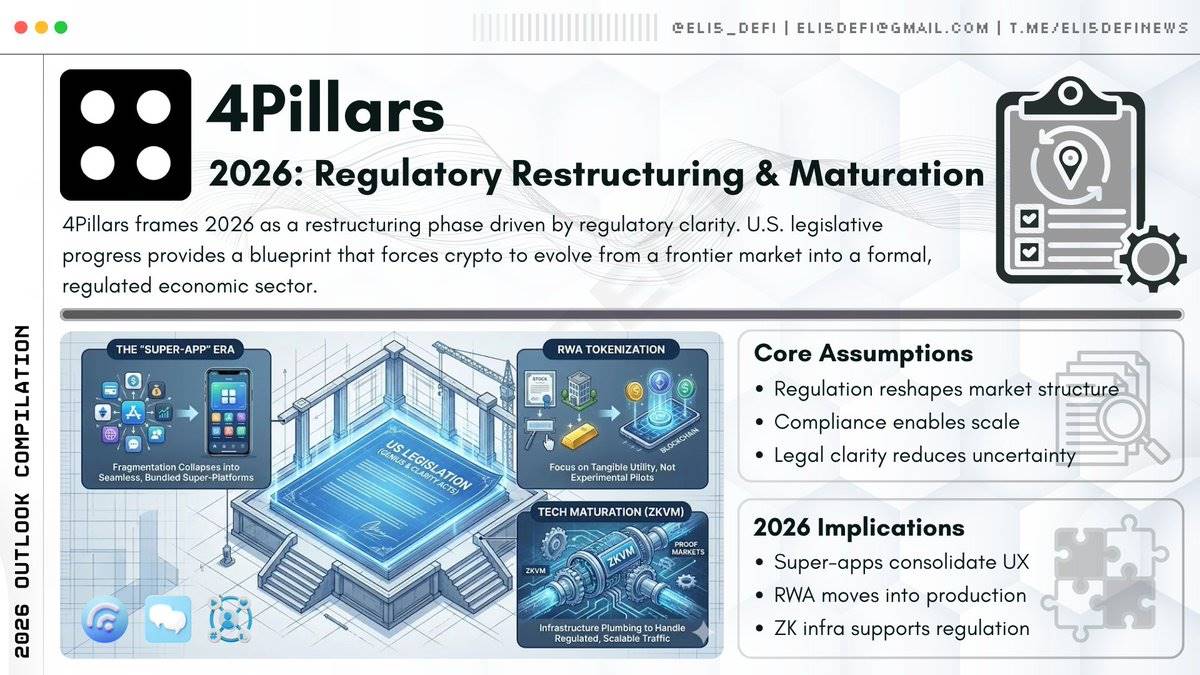

Four Pillars’ 2026 outlook revolves around "regulatory restructuring." Their core assumption is that U.S. legislative actions (specifically referencing the GENIUS and CLARITY bills) will serve as blueprints driving comprehensive market reform.

This regulatory clarity will act as a catalyst, transforming the market from a "Wild West" state into a formal economic sector.

Four Pillars’ 2026 Outlook

-

Era of Super-Apps

Four Pillars predicts that today’s fragmented crypto app ecosystem will consolidate into "super-apps." These platforms, powered by stablecoins, will integrate payments, investing, and lending functions—radically simplifying blockchain complexity and improving user experience.

-

RWA Tokenization

With market reorganization, tokenization of stocks and traditional assets will become a trend—but the focus will shift to practical utility rather than experimental projects.

-

Technological Maturation

On the technology front, the report emphasizes the importance of Zero-Knowledge Virtual Machines (ZKVMs) and proof markets on Ethereum. These are seen as critical technical infrastructures for handling the scale of traffic expected from emerging regulated entities.

Full report:2026 Outlook: Restructuring & A Century Perspective

Coinbase: 2026 Crypto Market Outlook – Markets, Regulation & Adoption

Coinbase’s report advances the "death of the cycle" thesis. They clearly state that 2026 will mark the end of the traditional Bitcoin halving cycle theory. Future markets will be driven by structural factors: macro demand for alternative stores of value and the formalization of crypto as a mid-sized alternative asset class.

Outlook for 2026:

-

Tokenomics 2.0

A shift from "governance-only" tokens to models tied to revenue. Protocols will gradually introduce buy-and-burn mechanisms or fee-sharing (compliant with new regulations) to better align token holder incentives with platform success.

-

Digital Asset Trading 2.0 (DAT 2.0)

The crypto market will move toward more specialized trading modes, particularly procurement and trading of "sovereign block space." Block space will be treated as a key resource in the digital economy.

-

AI & Crypto Convergence

Coinbase predicts that AI agents will heavily utilize crypto payment channels, driving demand for "crypto-native settlement layers." These layers can support continuous microtransactions between machines—something traditional payment systems cannot achieve.

Full report:2026 Crypto Market Outlook

a16z Crypto: 2026 Outlook – Internet-Native Finance & The Future of AI

a16z Crypto’s outlook is based on one core premise: "The internet becomes the bank." They believe value flows will become as free as information. The current friction between on-chain and off-chain worlds is the main bottleneck, and 2026 will be the year this barrier is removed through better infrastructure.

a16z Crypto’s 2026 Outlook

-

KYA (Know Your Agent)

As AI agents become major economic participants, identity verification will shift from traditional KYC (Know Your Customer) to KYA (Know Your Agent). AI agents will need cryptographically signed credentials to conduct transactions, spawning an entirely new layer of identity infrastructure.

-

"Asset Origination" vs. "Asset Tokenization"

a16z predicts the market will gradually shift from tokenizing off-chain assets (e.g., buying Treasuries and putting them on-chain) to directly issuing debt and assets natively on-chain. This shift would not only reduce service costs but also greatly enhance transparency.

-

Privacy as Moat

In a world of ubiquitous open-source code, a16z emphasizes that privacy tech—especially the ability to preserve state privacy—will become the most important competitive advantage for blockchains, generating strong network effects for privacy-enabled chains.

-

Democratized Wealth Management

The combination of AI and crypto payment rails will democratize complex wealth management (like asset rebalancing, tax-loss harvesting), making services previously available only to high-net-worth individuals accessible to ordinary users.

Full report:Big Ideas: What We’re Excited About in Crypto 2026

Summary

The 2026 crypto industry outlook shows that structural maturity will replace speculative cycles, driven by liquidity convergence, regulatory clarity, and infrastructure advancement.

Major research institutions agree that value will concentrate in settlement layers, aggregation platforms, and systems capable of attracting real users and capital.

Future opportunities will shift from chasing cycles to understanding capital flows. In 2026, rewards will go to those quietly building scalable infrastructure, distribution capacity, and trust.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News