Pakistan, from "Brother Pak" to "Blockchain Brother"?

TechFlow Selected TechFlow Selected

Pakistan, from "Brother Pak" to "Blockchain Brother"?

Pakistan has a population of over 240 million, with increasing adoption of digital payments and significant room for growth in cryptocurrency penetration.

Author: Chain Apocalypse

1. Pawn Crosses the River: Pakistan’s Initial Cryptocurrency Ambition

On December 12, 2025, the Pakistan Virtual Assets Regulatory Authority (PVARA) issued "No Objection Certificates" (NOCs) to two global top-tier cryptocurrency exchanges. This low-key administrative move is like a “pawn crossing the river” in chess—unassuming yet pivotal toward a larger goal. This action not only marks Pakistan's formal embrace of blockchain and cryptocurrency technology but also signals its ambition to claim a position in the global digital economy.

This “pawn,” however, is stronger than it appears. According to data from the country's Ministry of Finance, Pakistan already has over 40 million digital asset users, with an estimated annual trading volume exceeding $300 billion. Such a massive market scale gives Pakistan undeniable potential in the digital asset arena. These figures make every step Pakistan takes particularly significant.

The country long affectionately called "Brotherly Iron" by Chinese netizens is now using the language of blockchain and cryptocurrency to tell a story of economic revival on the global economic chessboard. Its 'pawn crossing the river' may well be the compelling opening chapter of this narrative.

2. From Grassroots Frenzy to National Strategy: Pakistan’s Crypto Story

Pakistan’s cryptocurrency story began on the “streets.” The crypto boom here was not driven by government initiatives but emerged organically from ordinary citizens. According to Chainalysis’ 2025 Global Crypto Adoption Index, Pakistan ranks third globally, behind only India and Vietnam—jumping six places from 9th in 2024 within just one year, making it a true “dark horse.”

2025 Global Crypto Adoption Index. Source: Chainalysis

Geopolitics and Economy: Pakistan’s Crypto Advantages

With a land area of 880,000 square kilometers and a population of 240 million, Pakistan is the world’s fifth most populous nation. It borders Iran to the west, Afghanistan to the north, faces India across its eastern frontier—a long-standing rivalry—and overlooks the Arabian Sea to the south, placing it in a highly strategic location. More importantly, it sits right at the center of a “crypto-friendly neighbors circle”:

-

To the west lies Iran—the Middle Eastern “spiritual ally” of El Salvador, which has adopted Bitcoin as legal tender (though Iran hasn’t formally recognized Bitcoin, it legalized mining back in 2019 and has used it to circumvent sanctions);

-

To the north is Afghanistan (where the Taliban regime tacitly allows Bitcoin transactions for cross-border settlements);

-

To the east is India, ranked first globally (also home to a vast grassroots user base).

This geopolitical setting naturally positions Pakistan at the intersection of three major crypto corridors: Central Asia, South Asia, and the Persian Gulf.

Therefore, Pakistan is almost inherently positioned as a node in regional on-chain capital flows.

Why does this matter? Because Pakistan receives over $30 billion annually in remittances from overseas Pakistani workers (ranking fifth globally). Traditional channels charge fees as high as 7–12%, while using USDT or Bitcoin costs less than 1% and reduces transfer time from days to minutes. Now consider the economic structure:

Traditional pillars include textiles and apparel (accounting for 60% of exports), agriculture (rice, cotton), and overseas worker remittances.

Yet all these sectors are highly vulnerable to rupee depreciation—in just three years from 2022 to 2025, the Pakistani rupee depreciated over 110% against the U.S. dollar.

Bank account penetration stands at only 27% (even lower among women), yet smartphone adoption exceeds 70%. The youth (under 30 years old make up 70%) have become natural “on-chain natives.”

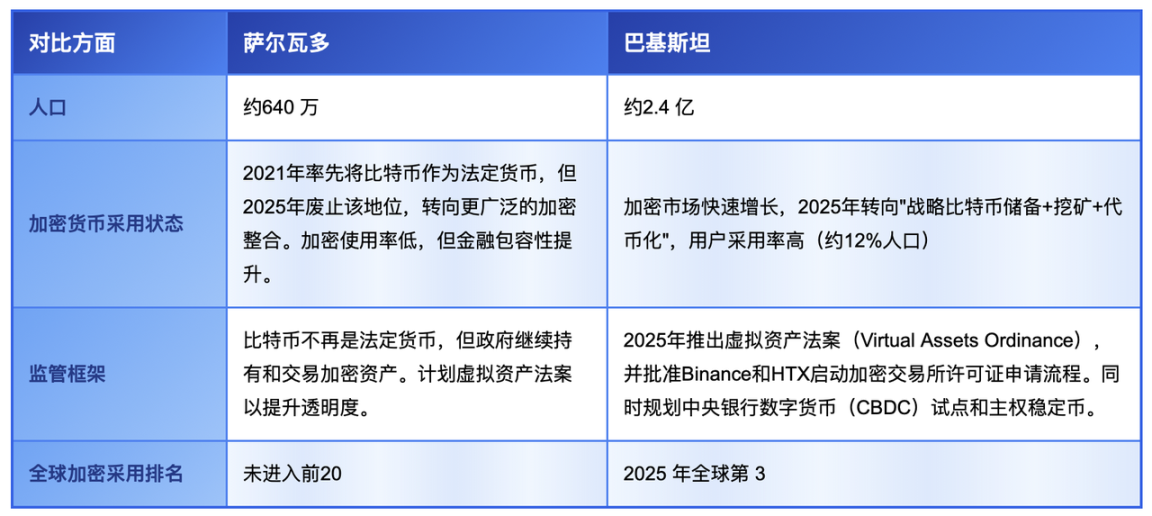

Pakistan vs. El Salvador: A Multi-Dimensional Comparison

El Salvador ran a “national experiment” with 6 million people; if Pakistan succeeds, it will directly impact 240 million—entirely different scales. PVARA Chairman Saqib’s widely quoted statement at the 2025 Bitcoin MENA Conference was made precisely in this context:

“My point is simple,” he said. “If El Salvador can do it with just 6 million people, imagine what Pakistan—with 40 times the population and one of Asia’s fastest-growing digital forces—could achieve?”

However, beneath the frenzy lie concerns. Due to prolonged regulatory absence, illegal transactions, money laundering, and fraud have occasionally occurred. As the market grew ever larger, the government could no longer stay idle.

-

In February 2025, Pakistan officially established the world’s first virtual asset regulatory authority (PVARA) utilizing AI-assisted oversight, alongside launching the “Virtual Assets Act 2025.”

-

In May 2025, Saqib announced the country was preparing to establish a strategic Bitcoin (BTC) reserve and moving toward more crypto-friendly regulatory policies.

From this moment onward, the street-level “grassroots carnival” began entering the national strategic vision—not aiming for suppression, but to transform the world’s third-largest grassroots on-chain economy into a transparent, controllable, taxable, and foreign-exchange-generating super engine.

National Asset Tokenization: An Economic Revival Experiment for Everything-on-Chain

If Bitcoin is the “new engine” of Pakistan’s economy, then blockchain technology is its “new runway.” Pakistan is attempting a $2 billion economic experiment—asset tokenization.

The issuance of these “No Objection Certificates” (NOCs) is more than just market access—it represents a deep collaboration between Pakistan and the global blockchain industry. The MOUs signed between the government and the approved exchanges feature a standout initiative: a national asset tokenization program aimed at digitizing sovereign bonds, treasury bills, oil, and natural gas via blockchain technology. Valued at up to $2 billion, this project seeks to convert traditional financial assets into digital assets tradable on blockchains.

* Pakistan signs MOU with Binance to explore $2 billion tokenization of state assets.

In simple terms, asset tokenization involves transforming Pakistan’s traditional assets—such as bonds, treasury bills, and commodity reserves—into digital assets tradable on blockchains through blockchain technology. Through asset tokenization, Pakistan can not only enhance asset transparency but also attract international capital. This innovative model could become a vital driver for Pakistan’s economic recovery, especially critical for a country struggling with dwindling foreign exchange reserves—this attempt might be key to escaping its economic困境.

Pakistan’s goal is clear: combine its traditional resource advantages with blockchain technology to forge its own path toward economic revitalization. Though bold, this experiment holds non-negligible potential. If successful, it could significantly boost the country’s economic recovery and even offer replicable lessons for other developing nations.

3. Exploring Incremental Markets: Hot Opportunities and Cold Reflections

PVARA Chairman Bilal bin Saqib, Binance co-founder Changpeng Zhao, Finance Minister Muhammad Aurangzeb, and HTX advisor Justin Sun (from left to right). Source: PVARA

As regulatory infrastructure gradually improves, Pakistan is attempting to transform its citizen-driven cryptocurrency boom into a new engine for national economic transformation. Recently, Pakistani authorities have begun regulating major global cryptocurrency exchanges and have granted preliminary licenses allowing several leading platforms to establish local branches.

The platforms receiving regulatory approval are key players in the global cryptocurrency industry, excelling in both market size and technical capabilities. In recent years, these exchanges have advanced compliance efforts and secured operating licenses in multiple countries. Their entry into Pakistan marks a crucial step in their emerging market expansion strategy.

The reality is, the global Web3 market urgently needs new incremental users.

Currently, cryptocurrency penetration in developed Western markets is relatively high. Most potential users have already entered the space; those remaining are either观望or firmly opposed. This means exchanges in mature markets can only compete fiercely for existing users, facing rising customer acquisition costs and shrinking growth potential.

More importantly, the massive user base accumulated during the Web2 era awaits “conversion.” Globally, billions still rely on traditional internet services but remain unfamiliar with blockchain and cryptocurrencies. Pakistan is a prime example—home to over 240 million people, with rising acceptance of digital payments and substantial room for cryptocurrency adoption to grow.

Despite Pakistan’s immense “Web2-to-Web3 migration potential,” not all exchanges currently view this market favorably. However, for those pursuing long-term growth and new frontiers, such emerging markets are vital components of their global strategy. Rather than fighting for diminishing returns in saturated developed markets, it’s better to enter early into markets with vast conversion potential. Here, the long-term value of a Pakistani user who has never touched crypto may far exceed that of a seasoned Western user hopping between multiple platforms.

Conclusion: The Game Begins, Moves Made Cautiously

On the grand chessboard of the global digital economy, Pakistan cautiously declares its entry with the posture of a “pawn crossing the river.” This move—from issuing initial NOCs to exploring potential asset tokenization partnerships, from planning a strategic Bitcoin reserve to iteratively refining its regulatory framework—activates only a fraction of its grassroots momentum, yet opens preliminary imaginative space for Web3 incremental markets.

For other emerging nations similarly grappling with high remittance costs, currency depreciation, and youthful demographics, Pakistan offers a cautious yet realistic model: Blockchain is not an unattainable privilege of wealthy nations, but a potential path toward revival—one that must be cautiously explored within a balance of compliance and risk, ultimately becoming controllable, taxable, and capable of generating foreign exchange. The interplay between regulation and innovation has only just begun. Pakistan’s blockchain experiment will stand as a case worthy of sustained observation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News