Pakistan follows up with national-level Bitcoin strategic reserve, why are small countries all in?

TechFlow Selected TechFlow Selected

Pakistan follows up with national-level Bitcoin strategic reserve, why are small countries all in?

Small nations are trying to find their place in the global financial system through Bitcoin.

Author: Luke, Mars Finance

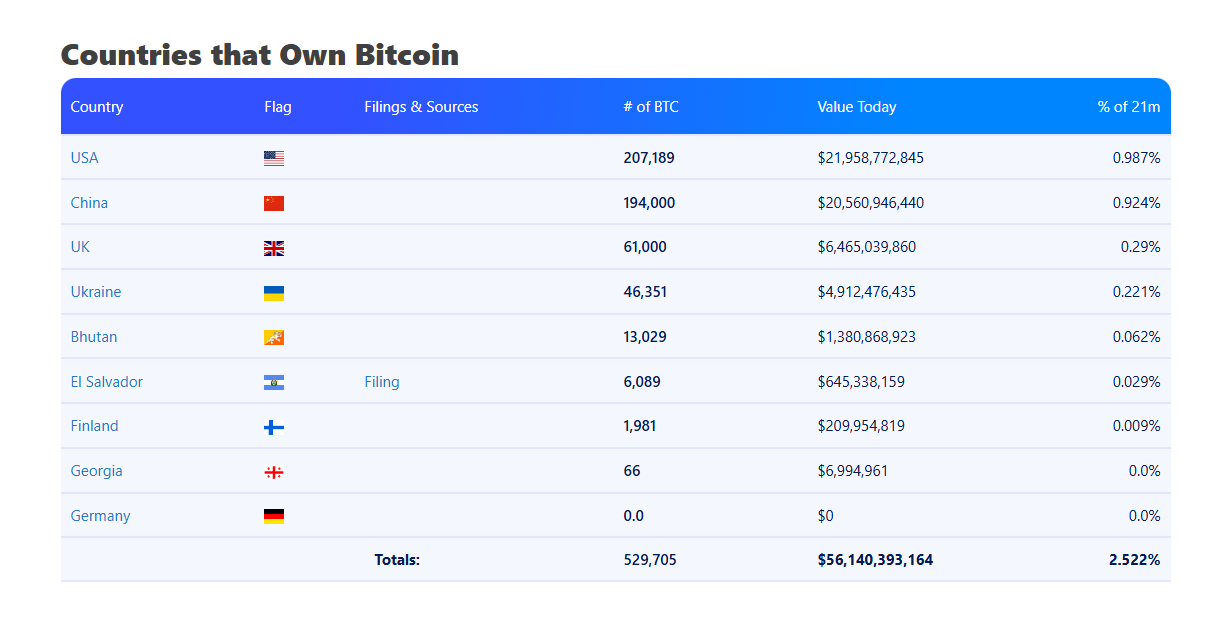

On the global financial stage, Bitcoin is no longer just a "toy" for investors—it is gradually becoming part of national strategy. In May 2025, a table titled "Countries Holding Bitcoin" circulated online, revealing governments' Bitcoin holdings worldwide: The United States leads with 207,189 BTC, worth nearly $2.2 billion; China follows closely with 194,000 BTC; small nations like Bhutan and El Salvador also appear on the list, holding 13,029 and 6,089 BTC respectively. In total, governments globally hold 529,705 BTC—about 2.522% of Bitcoin's total supply. Yet one notable absence from the chart has recently sparked debate—Pakistan. This South Asian nation has announced plans to establish a national strategic Bitcoin reserve, pledging to "never sell." This move not only places Pakistan at the forefront of the cryptocurrency wave but raises an important question: Why are so many small countries increasingly embracing Bitcoin?

Pakistan’s Bitcoin Ambition: From Energy to National Reserves

Pakistan's Bitcoin strategy launched amid great fanfare. In May 2025, at the "Bitcoin 2025" conference in Las Vegas, Bilal Bin Saqib, Special Assistant to Pakistan's government and advisor on blockchain and cryptocurrency affairs, announced that Pakistan would create a national strategic Bitcoin reserve and follow the U.S. model by holding these assets long-term. The inspiration is clear: The U.S. government holds 207,189 BTC—worth approximately $2.196 billion—representing 0.987% of Bitcoin’s total supply, serving as a benchmark for many nations. Although Pakistan has not yet disclosed its exact holdings, its ambition is unmistakable.

Pakistan’s Bitcoin strategy extends beyond reserves. The government also announced it will allocate 2,000 megawatts of surplus electricity to Bitcoin mining and AI data centers. This directly addresses the country’s energy challenges: Coal-fired power projects such as Sahiwal and Port Qasim currently operate at only 15% capacity, resulting in massive power waste. By using this excess energy for mining, Pakistan aims to convert idle resources into economic value. At current Bitcoin prices (around $106,000 per BTC), each mined Bitcoin generates significant revenue. More importantly, this initiative has attracted foreign investors, with tax incentives already drawing delegations from multiple mining firms.

Meanwhile, Pakistan’s digital asset regulatory framework is rapidly evolving. On May 22, 2025, the Pakistan Digital Assets Authority (PDAA) was officially established to regulate cryptocurrency trading, DeFi applications, and asset tokenization, while promoting blockchain adoption in governance, land records, and finance. Proposed by the Pakistan Cryptocurrency Committee—with advisors including former Binance CEO Changpeng Zhao—the PDAA brings international expertise into policymaking. It is also tasked with advancing sovereign debt tokenization and supporting Web3 startups, aiming to position Pakistan as a crypto hub in South Asia.

Pakistan’s growing base of crypto users is equally impressive. By 2025, the number of crypto users in the country is expected to exceed 27 million—over 10% of its total population (247 million). This figure reflects young people’s enthusiasm for digital assets and provides public support for the government’s push toward a crypto economy. From energy to policy and user adoption, Pakistan’s Bitcoin strategy is advancing across multiple dimensions.

The Small Nation Bitcoin Boom: From Bhutan to El Salvador

Pakistan is not alone. Around the world, small nations have been actively exploring Bitcoin for years. Bhutan, the Himalayan kingdom, has become a quiet powerhouse in Bitcoin mining thanks to its abundant hydropower. According to recent data, Bhutan holds 13,029 BTC—worth about $138 million—0.062% of the total supply. These Bitcoins were accumulated through mining by state-owned enterprise Druk Holdings, which benefits from low-cost hydroelectric power, giving Bhutan a competitive edge.

El Salvador stands as the pioneer among small nations in Bitcoin strategy. In 2021, this Central American country became the first in the world to adopt Bitcoin as legal tender and has continued accumulating reserves. As of May 2025, El Salvador holds 6,089 BTC—worth approximately $645.3 million—0.029% of total supply. Its unrealized gains on Bitcoin reserves have reached $357 million, demonstrating returns driven by price appreciation. However, El Salvador’s path hasn’t been smooth. In December 2024, the International Monetary Fund (IMF) approved a $1.4 billion loan agreement but required El Salvador to maintain its current Bitcoin holdings and revise its Bitcoin Law by removing mandatory private-sector acceptance of Bitcoin. The IMF’s cautious stance highlights Bitcoin’s dual nature: both an opportunity and a potential financial risk.

Ukraine’s Bitcoin holdings bear the mark of war. During the Russia-Ukraine conflict, Ukraine raised over $100 million in cryptocurrency donations—one of the main sources behind its 46,351 BTC (worth about $491 million). With relatively open crypto policies, Ukraine has attracted numerous Web3 startups. Its Bitcoin holdings represent 0.221% of the total supply—among the highest for small nations.

In contrast, Georgia’s 66 BTC (worth about $6.99 million) seem insignificant, likely symbolic holdings from early asset seizures, without a clear national strategy yet.

Why Are Small Nations Embracing Bitcoin? The Interplay of Economy and Geopolitics

Behind small nations’ embrace of Bitcoin lies a complex mix of economic, geopolitical, and technological factors. First, Bitcoin is seen as a hedge against economic hardship. Many small countries face challenges such as insufficient foreign exchange reserves, high inflation, or heavy debt burdens. For example, El Salvador’s public debt exceeds 90% of GDP, while Pakistan also carries a significant debt load. Volatility in traditional markets—such as falling stock prices and low bond yields—has driven these nations to seek alternative assets. Bitcoin’s decentralized nature shields it from any single country’s monetary policy, offering small nations a way to enhance economic autonomy within a dollar-dominated financial system.

Second, energy utilization is a direct driver of small nations’ Bitcoin strategies. Bhutan’s hydropower mining and Pakistan’s 2,000-megawatt power allocation plan share the same logic. Many small countries possess underutilized renewable energy or surplus electricity. Bitcoin mining allows them to monetize these resources and attract international miners and tech companies. If Pakistan’s coal plants achieve full operation via mining, it could reduce energy waste and generate substantial foreign exchange income.

Third, Bitcoin-friendly policies act as magnets for foreign investment. Amid the global Web3 and blockchain boom, small nations use lenient crypto regulations to draw startups and capital. Ukraine’s crypto ecosystem has already nurtured multiple Web3 startups, and Pakistan’s PDAA similarly aims to support emerging ventures. This strategy brings not only direct investment but also technology transfer and job creation.

Finally, geopolitical considerations play a key role. Within the dollar-centric global financial system, small nations often find themselves in a passive position. Bitcoin’s decentralization makes it a potential “financial tool” that can help smaller countries gain greater voice in global affairs. Pakistan explicitly stated its strategy was inspired by the U.S. reserve model, while the Trump administration’s 2025 push for Bitcoin reserves further encouraged other nations to follow suit.

Big vs. Small Nations: From Seizures to Strategic Holdings

Unlike small nations, large countries mostly acquired Bitcoin through law enforcement seizures. The U.S.’s 207,189 BTC largely came from FBI confiscations related to the Silk Road case; China’s 194,000 BTC originated from seized illegal assets; the UK’s 61,000 BTC were also primarily obtained through enforcement actions. For major powers, Bitcoin holdings are more of an “accidental windfall” than a deliberate strategy.

Small nations, by contrast, tend to accumulate Bitcoin through mining or policy-driven purchases. Bhutan’s 13,029 BTC come from hydropower mining; El Salvador’s 6,089 BTC are the result of national strategy. Ukraine’s 46,351 BTC, though partly donated, reflect its proactive crypto adoption. While small nations collectively hold a small percentage (2.522%), their strategic intent is stronger—aimed at economic diversification or risk hedging.

Notably, Germany liquidated its entire Bitcoin reserve (around 50,000 BTC) in 2024 to pay off debt—a stark contrast to small nations’ long-term holding strategies—and illustrates divergent approaches among major economies.

IMF Scrutiny and Small Nations’ Resolve

The path for small nations embracing Bitcoin is far from smooth, with constant scrutiny from the International Monetary Fund (IMF). El Salvador’s case is most emblematic. In December 2024, the IMF approved a $1.4 billion loan but required El Salvador to freeze its Bitcoin holdings and amend its Bitcoin Law by eliminating mandatory private-sector adoption. The IMF warned that Bitcoin reserves could exacerbate El Salvador’s debt risks. Nevertheless, El Salvador demonstrated strong performance in economic reforms and secured the next $120 million disbursement.

Pakistan’s situation appears more forward-looking. From the outset, its Digital Assets Authority (PDAA) emphasized compliance with FATF (Financial Action Task Force) standards, aiming to carve out policy space under IMF oversight. Pakistan’s crypto strategy goes beyond Bitcoin reserves, encompassing broad applications of blockchain in governance and finance. This “comprehensive approach” may give it greater flexibility in negotiations with the IMF.

The IMF’s caution underscores Bitcoin’s dual nature: an opportunity for economic transformation, but also a potential threat to financial stability. Small nations must strike a balance between innovation and regulatory compliance.

Pakistan’s Unique Advantages and Challenges

Compared to other small nations, Pakistan’s Bitcoin strategy has distinct features. First, its demographic dividend and growing crypto user base offer vast market potential. The 27 million crypto users are not just consumers—they are a driving force for blockchain innovation. Second, Pakistan’s energy resources and geographic location position it as a potential crypto hub in South Asia. The 2,000-megawatt power allocation plan not only absorbs surplus energy but could also attract mining investments from the Middle East and China.

Yet challenges remain significant. Pakistan’s aging power infrastructure and environmental concerns around coal projects pose risks. Moreover, cryptocurrency market volatility threatens the value of its reserves. While El Salvador’s Bitcoin holdings have gained $357 million on paper, they’ve also endured extreme price swings. Most importantly, Pakistan must carefully advance its policies within the IMF’s regulatory framework to avoid restrictions on future financing.

Conclusion: The Small Nation Bitcoin Gamble

Pakistan’s Bitcoin strategy epitomizes how small nations are embracing the digital economy. From Bhutan’s hydropower mining and El Salvador’s legal tender experiment to Ukraine’s wartime donations, these countries see Bitcoin as a beacon of economic revival. Bitcoin is more than an asset—it sits at the intersection of energy, technology, and geopolitics. Through Bitcoin, small nations strive to claim their place in the global financial system.

Yet this gamble is not without risk. Bitcoin’s volatility, IMF oversight, and infrastructural constraints could all undermine their ambitions. But as Bilal Bin Saqib declared at the "Bitcoin 2025" conference: "Once misunderstood, now unstoppable." For Pakistan and countless small nations, Bitcoin is not merely an asset—it is a belief: In the future of the digital economy, they refuse to be left behind.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News