2026: The Year of Federal Reserve Regime Change

TechFlow Selected TechFlow Selected

2026: The Year of Federal Reserve Regime Change

The Fed will move away from the technocratic caution of the Powell era toward a new mandate explicitly prioritizing lower borrowing costs to advance the president's economic agenda.

Author: Alex Krüger

Translation: Block unicorn

Introduction

The Federal Reserve as we know it will end in 2026.

The most important driver of asset returns next year will be the new Fed, particularly the regime change brought by Trump's appointee to lead the central bank.

Hassett has emerged as Trump’s preferred candidate to chair the Fed (71% likelihood on Polymarket). Currently serving as Director of the National Economic Council, he is a supply-side economist and long-time loyalist to Trump, advocating a “growth-first” philosophy. He argues that maintaining high real interest rates, now that the battle against inflation is largely won, is political stubbornness rather than economic prudence. His potential appointment marks a decisive regime shift: the Fed will move away from Powell-era technocratic caution toward a new mission explicitly prioritizing lower borrowing costs to advance the president’s economic agenda.

To understand the policy regime he would implement, let us precisely assess his statements this year on interest rates and the Fed:

-

"The only explanation for the Fed not cutting in December is anti-Trump partisan bias." (November 21).

-

"If I were on the FOMC, I’d be more likely to cut rates, whereas Powell is less likely." (November 12).

-

"I agree with Trump that rates can be much lower." (November 12).

-

"Three expected cuts are just the beginning." (October 17).

-

"I want the Fed to continue cutting significantly." (October 2).

-

"The Fed’s rate cut is moving in the right direction toward substantially lower rates." (September 18).

-

"Waller and Trump are right about rates." (June 23).

On a hawk-to-dove scale of 1–10 (1 = most dovish, 10 = most hawkish), Hassett scores a 2.

If nominated, Hassett would succeed Barr on the Fed Board in January when Barr’s short-term term expires. Then, in May, upon the conclusion of Powell’s term, Hassett would be elevated to Chair. By historical precedent, Powell—after announcing his intentions months in advance—would resign his remaining Board seat, clearing the way for Trump to nominate Warsh to fill the position.

Although Warsh is currently Hassett’s main rival for the Chair nomination, my core assumption is that he will be incorporated into the change coalition. As a former Fed governor, Warsh has been campaigning on a platform of structural reform, explicitly calling for a “new Treasury-Fed accord” and criticizing the Fed leadership for succumbing to the “tyranny of the status quo.” Crucially, Warsh believes the current AI-driven productivity boom is inherently deflationary, meaning the Fed’s maintenance of restrictive rates is a policy error.

New Power Balance

This configuration would give Trump’s Fed a strong dovish core and credible voting influence on most easing decisions, though outcomes are not guaranteed and the degree of dovish tilt will depend on consensus.

-

Dovish core (4): Hassett (Chair), Warsh (Governor), Waller (Governor), Bowman (Governor).

-

"Persuadable middle" (6): Cook (Governor), Barr (Governor), Jefferson (Governor), Kashkari (Minneapolis), Williams (New York), A. Bolesn (Philadelphia).

-

Hawks (2): Harker (Cleveland), Logan (Dallas).

However, if Powell does not resign his Board seat (which he almost certainly will; historically all outgoing chairs have resigned—e.g., Yellen stepped down 18 days after Powell’s nomination)—this would be extremely bearish. Such a move would not only block the vacancy Warsh needs but also allow Powell to remain as a “shadow chair,” creating another power center outside the dovish core, potentially one with greater loyalty.

Timeline: Four Phases of Market Reaction

Considering all the above, market reactions should unfold in four distinct phases:

Immediate optimism upon Hassett’s nomination (December) and bullish sentiment in the weeks following confirmation, as risk assets welcome a high-profile dovish loyalist taking the chair.

Growing unease if Powell does not announce his Board resignation within three weeks, as each additional day revives the question: "What if he refuses to leave?" Tail risks re-emerge.

A wave of relief the moment Powell announces his resignation.

Approaching the first FOMC meeting under Hassett’s leadership in June 2026, markets grow tense again, scrutinizing every word from FOMC voting members (who speak regularly, offering glimpses into their views and thought processes).

Risk: A Divided Committee

Since the Chair does not hold the "deciding vote" many imagine (in reality, no such vote exists), Hassett must win over the FOMC to achieve a genuine majority. Every 50-basis-point move resulting in a 7-5 split would cause institutional damage, signaling to markets that the Chair is a political operator rather than an impartial economist. In extreme cases, a 6-6 tie or 4-8 opposition to rate cuts would be disastrous. Exact vote counts will be revealed in the FOMC minutes released three weeks after each meeting, turning these publications into major market-moving events.

What happens after the first meeting is the biggest unknown. My base case is that if Hassett secures four firm votes and a reliable path to ten, he will build a dovish consensus and execute his agenda.

Implication: Markets cannot fully front-run the new Fed’s dovish stance.

Rate Recalibration

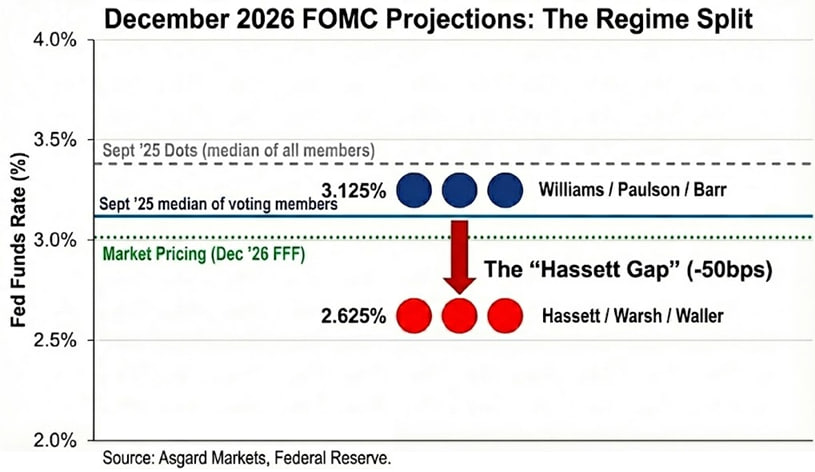

The dot plot is an illusion. Although the September dot plot projected a 3.4% rate for December 2026, this figure represents the median of all participants, including hawkish non-voters. By anonymizing the dot plot based on public statements, I estimate the median among voters is significantly lower—at 3.1%.

The picture shifts further when replacing Powell and Barr with Hassett and Warsh. If Barr and Waller represent the new Fed’s aggressive easing stance, the 2026 voting distribution remains bimodal but with lower peaks: Williams / Bolesn / Barr at 3.1%, Hassett / Warsh / Waller at 2.6%. I anchor the new leadership’s rate outlook at 2.6%, consistent with Barr’s official forecast. However, I note he previously expressed a preference for a “proper rate” in the 2.0%–2.5% range, suggesting the new regime’s inclination may be even lower than their projections imply.

The market has partially priced this in—by December 2, the implied rate for December 2026 stood at 3.02%—but has not fully absorbed the magnitude of this regime change. If Hassett successfully guides rate cuts, the short end of the yield curve will need to fall another 40 basis points. Moreover, if Hassett’s prediction of supply-side disinflation proves correct, inflation will decline faster than widely anticipated, prompting larger rate cuts to prevent passive tightening.

Cross-Asset Implications

While the initial reaction to Hassett’s nomination should be “risk-on,” the precise manifestation of this regime shift is “inflation steepening”—bets on aggressive near-term easing but expectations of higher nominal growth (and inflation risk) over the longer term.

Rates: Hassett wants the Fed to cut aggressively during recessions while sustaining growth above 3% during booms. If successful, 2-year Treasury yields should fall sharply to reflect lower rate expectations, while 10-year yields could remain elevated due to structurally higher growth and persistent inflation premia.

Equities: Hassett believes the current policy stance is actively suppressing an AI-driven productivity boom. He will sharply reduce real discount rates, causing valuation multiples for growth stocks to “explode.” The danger is not recession, but bond market turmoil triggered by a spike in long-end yields in protest.

Gold: A politically aligned Fed that explicitly prioritizes growth over inflation targets is a textbook bullish scenario for hard assets. As markets hedge against the risk that the new administration repeats 1970s-style policy errors through excessive easing, gold should outperform U.S. Treasuries.

Bitcoin: Under normal conditions, Bitcoin would be the purest expression of the “regime change” trade. However, since the October 10 shock, Bitcoin has exhibited severe downside skew, weak macro rebound momentum, and sharp sell-offs on negative news—primarily due to heightened concerns over the “four-year cycle” and an identity crisis within Bitcoin itself. I believe that by 2026, Hassett’s monetary policy and Trump’s deregulatory agenda will overcome the currently dominant self-fulfilling bearish sentiment.

Technical Note: The “Tealbook”

The Tealbook is the official economic forecast prepared by Fed staff and serves as the statistical baseline for all Federal Open Market Committee (FOMC) discussions. Produced by the Division of Research and Statistics, led by Director Tevlin and staffed by over 400 economists, most of whom are Keynesians. The Fed’s primary model (FRB/US) is explicitly New Keynesian.

Hassett could use his Board vote to appoint a supply-side economist to lead this division. Replacing a traditional Keynesian (who believes growth causes inflation) with a supply-sider (who believes the AI boom is deflationary) would significantly alter forecasts. For example, if the division’s models project inflation falling from 2.5% to 1.8% due to rising productivity, even less dovish FOMC members might become willing to support aggressive rate cuts.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News