When Chinese crypto millionaires start buying gold

TechFlow Selected TechFlow Selected

When Chinese crypto millionaires start buying gold

Three new forces are reshuffling the power structure in gold.

By: Lin Wanwan

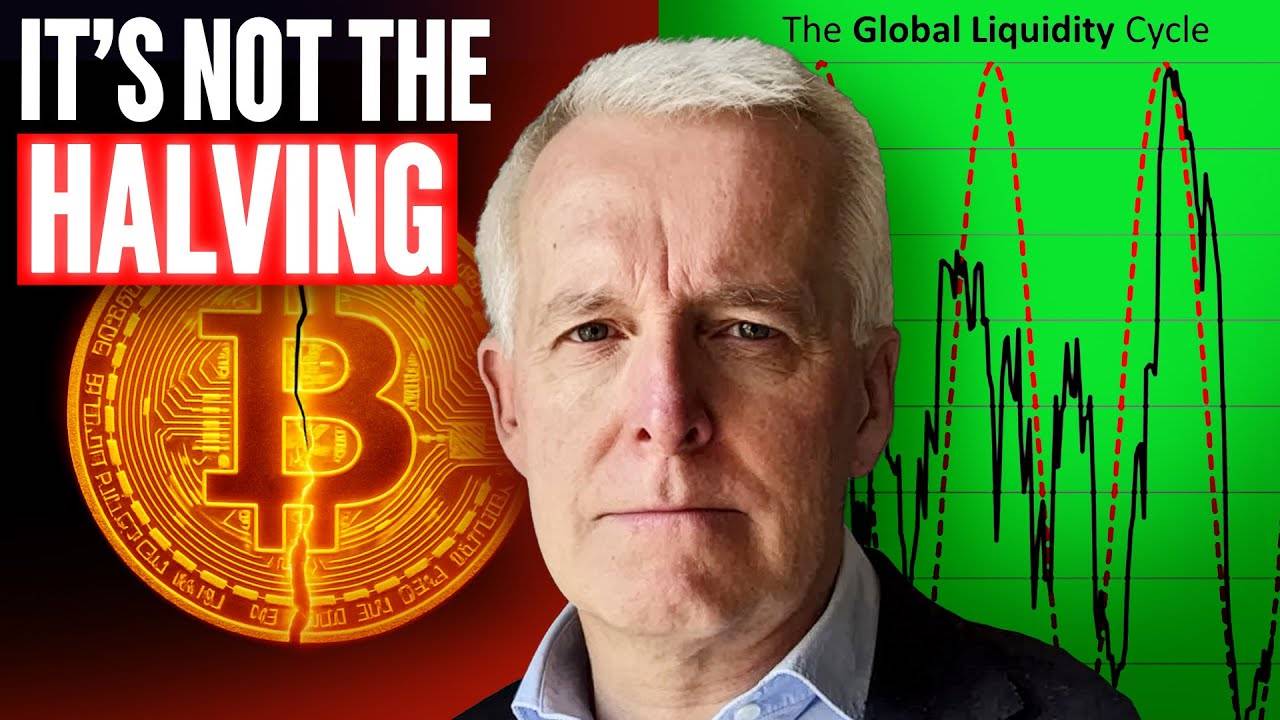

About twelve minutes by car north of Singapore's Changi Airport, at the end of the runway, stands one of the world's most privately secured vaults—Le Freeport.

This building, costing around 100 million Singapore dollars, is known as "Asia's Fort Knox." With no windows and a constant year-round temperature of 21°C and humidity at 55%, it offers the ideal environment for preserving artworks.

Behind its heavily fortified steel doors lie hundreds of millions of dollars worth of gold, silver, and rare art pieces—items that require neither customs declaration nor tax payments.

Three years ago, Wu Jihan, one of Asia’s youngest billionaire crypto entrepreneurs and founder of Bitdeer, acquired this vault—rumored to have cost up to 100 million SGD—for 40 million SGD (approximately 210 million RMB), a bargain deal.

Bloomberg confirmed the purchase at the time, with Wu Jihan’s Bitdeer operating behind the buyer. Few mocked it back then as a distraction from core business—why buy an off-chain vault when mining Bitcoin on-chain seemed more profitable?

But as gold surged past $4,000 per ounce in 2025, revisiting this acquisition reveals not a misstep, but a prescient masterstroke.

Yet what Wu Jihan bought with Le Freeport was far more than concrete and steel doors. From the outset, this fortress was custom-built for ultra-high-net-worth individuals and institutions—a bonded enclave offering top-tier security, discreet exhibition spaces, and elegant bypassing of tariff barriers.

It reveals a truth: Chinese billionaires made wealthy overnight by Bitcoin have long turned their gaze toward humanity’s oldest safe-haven asset—gold.

The Retirement Home for Gold

In May 2010, Le Freeport officially opened in Singapore. Designed from the start as critical infrastructure, its location adjacent to the airport allows internal corridors to connect almost directly to the runway—precious cargo can be moved from aircraft to vault within minutes.

Singapore government support is embedded in its equity structure. The National Heritage Board and the National Arts Council were among Le Freeport’s original shareholders.

At the time, Singapore was upgrading from a "trading port" to an "asset hub." Le Freeport was incorporated into the Global Art and Wealth Management Center initiative and joined the Zero GST Warehouse Scheme, becoming one of the few vaults globally with tax-free, bonded, and cross-border settlement capabilities.

Under such institutional arrangements, Le Freeport quickly drew attention from global elites and institutions. It could store high-value physical assets; it was open to non-Singaporean holders, required no entry procedures, and imposed no tariffs.

For example, a Picasso masterpiece valued at 50 million could save tens of millions in taxes—assuming tax rates between 10% and 30%—simply by being stored in Le Freeport.

Since Le Freeport has never released interior photos, we can only glimpse its inside through publicly shared images from The Reserve, another newly established vault nearby.

It once hosted a tier-one group of institutional tenants: JPMorgan Chase, one of the world’s major gold traders; CFASS, a subsidiary of Christie’s; UBS Group, Deutsche Bank, and other international financial institutions used it extensively for cross-border gold bar transfers and custodial services.

However, as some countries tightened regulations on luxury goods and offshore assets, these institutions began vacating one after another, pushing Le Freeport into prolonged losses.

Since 2017, Le Freeport had been classified as a “problem asset” in the market, with owners attempting to sell—until five years later, a real buyer finally emerged: Wu Jihan.

At that moment, the crypto market was undergoing a true winter. The collapse of LUNA’s algorithmic stablecoin triggered skepticism across the entire on-chain credit system; Three Arrows Capital went bankrupt, Celsius and BlockFi collapsed in succession, deleveraging cascaded down the chain, culminating in the fall of the FTX empire, fully exposing counterparty risks.

Amid this period, Chinese crypto entrepreneur Wu Jihan purchased this previously deemed “hot potato” vault via Bitdeer for approximately 40 million SGD (about 210 million RMB).

Wu Jihan co-founded Bitmain, the world’s largest cryptocurrency mining hardware manufacturer, once controlling about 75% of global Bitcoin hash rate, making him a central figure in the last mining cycle. After spinning off Bitdeer, he relinquished control of Bitmain under his status as a Singapore permanent resident, shifting focus to Bitdeer’s computing power and infrastructure operations.

He offered little public explanation for this acquisition, merely confirming it upon inquiry by Bloomberg.

Today, Le Freeport’s official website clearly states it is not just a vault, but a private, exclusive experience for a select few.

Think about how crypto enthusiasts spend their lives figuring out how to safeguard private keys; real wealth has long been resting in Singapore vaults—some represented by family trust documents, others by mnemonics etched onto metal plates.

Not only Chinese tycoons, but also emerging wealthy individuals from India and Southeast Asia are quietly becoming new regulars at Wu Jihan’s Le Freeport.

Le Freeport has never disclosed its client list, but clues emerge from side information provided by international auction houses: many artworks, after being sold, go “directly into storage,” never re-entering market circulation.

A similar pattern occurs across Southeast Asia, where listed billionaires transfer portions of their cashed-out proceeds directly into Le Freeport: gold and silver bars, haute joaillerie, limited-edition Patek Philippes, vintage classic cars, and rare artworks—all transported straight from transaction sites into this hidden warehouse.

Considering there may be aspiring “vault members” among readers, I’ll clarify the gold deposit process here.

Armed guards stand at the entrance; visitors undergo background checks via passport-linked systems to ensure they’re not wanted high-risk individuals. To enter the core vault area requires passing at least five checkpoints, including identity verification, biometric screening, bulletproof doors, and personal item inspections. Hundreds of high-definition cameras cover every corner, monitored 24/7. Combined with the sheer physical weight—one silver bar weighing 30kg, one gold bar 12.5kg—even if someone broke in, they could hardly carry anything away.

So while outsiders debate whether gold prices will rise further, insiders discuss matters like how many bottles of Romanée-Conti at 150,000 per bottle to store first, or which floor and shelf row should display Picassos and Rembrandts so wives can take better photo records.

The worker’s ultimate destination is a housing provident fund account; for Asian tycoons, it’s these windowless walls in Singapore.

Of course, owning a vault only grants physical space advantage. To gain greater influence over the gold industry, one must move upstream.

Fujian People Are Tapping Into Gold’s Veins

While Chinese aunties queue at jewelry stores chasing a 5-RMB-per-gram discount, old-money families and on-chain new money are already wrestling by the ton: who really controls this stuff?

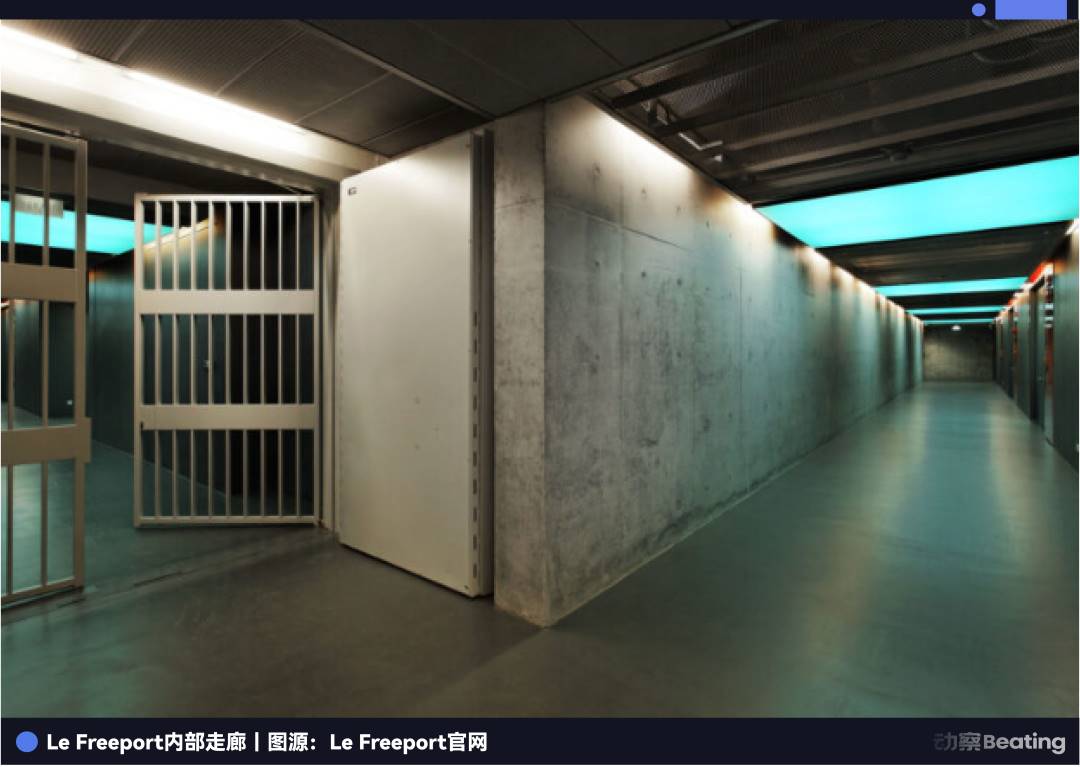

This May, a fintech company named Antalpha filed its IPO prospectus with Nasdaq. In the document, Antalpha referenced Wu Jihan’s former mining firm, Bitmain.

One sentence reads clearly: “We are Bitmain’s primary financing partner.” Both parties signed a memorandum of understanding, agreeing that Bitmain would continue using Antalpha as its financing partner and mutually refer clients.

The company once provided supply chain loans and customer financing for Bitmain, the world’s largest mining hardware manufacturer—an enduring commercial legacy from the Wu Jihan era.

Now, with Wu Jihan long gone from Bitmain, leadership has passed to another co-founder: Zhan Kechuan, a crypto billionaire from Fujian, China.

Many places in China hold deep faith in gold, but those who truly tie their personal destinies to gold? Fujian people lead the way: Chen Jinghe from Longyan transformed a “marginal mine” in Fujian into Zijin Mining, a global mining giant and ten-bagger stock; Zhou Zongwen from Fuqing founded Chow Tai Seng in Shuibei, scaling it via franchise chains into China’s top three jewelry brands; Putian artisans evolved from street-level goldsmiths to dominating nearly half of China’s gold wholesale and retail.

Gold mines in Fujian, gold shops in Fujian—endless rows of gold tycoons make one wonder if Fujian people don’t literally have golden blood in their veins.

Clearly, Zhan Kechuan’s ancestral lineage has awakened. How could Fujian people possibly miss out on the on-chain gold business?

He’s set his sights directly on Tether, the world’s largest stablecoin issuer, now also among the top 30 global gold buyers—the new “on-chain gold lord.”

This October, Tether announced a partnership with Antalpha to build a “Tokenized Gold Treasury,” aiming to raise $200 million, using gold-backed token XAU₮ as foundation, creating a “digital credit system backed by gold collateral.”

The division of labor is distinctly Fujian-style: Tether turns physical gold into tokens and stores reserves in Swiss private vaults; Antalpha transforms these tokens into tradable financial instruments, designing collateral structures, loan products, and expanding gold vault networks across Singapore, Dubai, and London—making “on-chain gold” a pledgeable instrument redeemable anytime for physical gold bars.

In short, it’s a living “modern gold standard”: Tether acts as the mint, Antalpha as the banknote house, with the backdrop shifted from Bretton Woods to Swiss vaults.

According to public reports, Tether has already stockpiled around 80 tons of gold in Swiss vaults—equivalent to the official reserves of some small-to-medium nations. Yet Tether claims, citing “security concerns,” the exact vault locations remain undisclosed.

Unlike central banks that “lock gold bricks underground for decades unseen,” XAU₮ breaks gold into digital fragments—traceable, divisible, tradable, and pledgeable. Gold that once lay dormant in vaults becomes a full suite of dynamic liquidity—rotatable, pledgeable, and wholesale-ready for institutions.

Antalpha even directed its subsidiary Aurelion to invest $134 million directly into XAU₮, aiming to become “the first listed treasury company using on-chain gold as reserve assets.” This rewrites the old-money playbook of “stuffing gold bars into Swiss vaults” into “inserting a line of XAU₮ onto a public company’s balance sheet.”

Tether CEO Paolo Ardoino summed up the logic: “Gold and Bitcoin are two poles of the same logic—one the oldest form of value storage, the other the most modern.”

Gold prices are amplifying this new highway’s presence: global gold investment rose over 50% this year, while XAU₮’s market cap doubled in parallel. Risk-averse investors and thrill-seekers rarely walk the same path—but this time, they do.

They’re attempting to answer a larger question: Can humanity’s oldest method of wealth preservation come alive again on the blockchain?

The Rules Are Changing

In October 2025, gold prices surged past $4,000 per ounce like a burst faucet, hitting record highs with over 50% gains for the year, ranking among the best-performing asset classes globally.

On the surface, it’s another “gold bull run”; beneath, three forces are reshuffling power dynamics over gold.

The first tier: central banks. Over recent years, global central banks have almost consistently “bought the dips,” treating gold as de-dollarization tools and hedges against sanctions. They care little about short-term fluctuations, focusing solely on one question: in worst-case scenarios, can this still buy food, weapons, or allies?

The second tier: Asian ultra-rich. Money from China, Hong Kong, the Middle East, and Southeast Asia is quietly stacking into a new wall of gold bricks via Singapore vaults, Swiss cellars, and family office trusts.

They’re no longer satisfied with buying a few kilos of “paper gold” at banks—they now buy entire walls: some park money in Singapore banks, others deposit gold bars directly into vaults. These two forms of fixed deposits offer entirely different levels of security.

Wu Jihan’s acquisition of Le Freeport marks a node along this path—from mining Bitcoin to safeguarding others’ gold bars and masterpieces, shifting from “on-chain returns” to “off-chain security.”

The third tier: crypto new money. What Zhan Kechuan, Antalpha, and Tether play is a different game: Wu Jihan bought the vault’s walls; they’re buying the variable inside—the XAU₮.

In this framework, Tether mints real gold into tokens and locks them in Swiss vaults; Antalpha turns those tokens into assets placed on corporate balance sheets and institutional collateral portfolios.

Thus, gold’s role is quietly rewritten: for central banks, it remains the ultimate “last-resort collateral”; for Asian tycoons, it becomes a “family cold wallet” for intergenerational inheritance; for crypto elites, it evolves into a financial layer capable of continuous structural stacking—earning interest spreads and liquidity premiums.

To most people, gold is just chart lines and gram weights; to these three groups, it represents a master ledger encompassing family, sovereignty, and national security.

Narratives keep changing, but what lies beneath remains ancient. No matter how the roads twist or stories spin, capital is ultimately the most honest—when the show ends and lights turn on, all they truly want is peace of mind that lets them sleep at night.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News