A new round of the AI trading competition is here, with Gemini 3 Pro stepping up its game in the U.S. stock market arena

TechFlow Selected TechFlow Selected

A new round of the AI trading competition is here, with Gemini 3 Pro stepping up its game in the U.S. stock market arena

Just sit back and enjoy the show; protecting your principal is what really matters.

Author: David, TechFlow

Remember the AI crypto trading tournament from October?

Alibaba's Qwen 3 Max earned 22% in two weeks, while OpenAI's GPT-5 lost 63%. Six of the world’s top large models each started with $10,000 to battle in the crypto markets, resulting in a clear East vs. West divide:

Chinese models dominated, American models collapsed.

Just as the previous season ended, a new one—Alpha Arena Season 1.5—is already here.

This time, nof1.ai has moved the battlefield from crypto to U.S. equities. The rules are more complex, more models are participating, and the total capital has expanded to $320,000.

Can the American models that failed in crypto regain their footing in their home turf of U.S. stocks?

Last Season Recap

A quick recap of last season’s format:

From October 17 to November 3 this year, six large AI models competed in an unprecedented showdown on Hyperliquid.

Each model received $10,000 in initial funds and could trade perpetual contracts of major cryptocurrencies such as BTC, ETH, SOL, XRP, DOGE, and BNB. The only core rule: fully autonomous trading with zero human intervention.

(Further reading: Six AIs Go Head-to-Head in Trading Battle—Will the Crypto Version of the "Turing Test" Succeed?)

The participants:

Qwen 3 Max (Alibaba), DeepSeek Chat V3.1, GPT-5 (OpenAI), Gemini 2.5 Pro (Google/DeepMind), Grok 4 (xAI), Claude Sonnet 4.5 (Anthropic).

Final results:

Chinese models:

-

Qwen 3 Max – Champion, +22.3%

-

DeepSeek V3.1 – Runner-up, +4.89% (briefly peaked at +125%)

American models:

-

GPT-5: -62.66%

-

Gemini 2.5 Pro: -56.71%

-

Grok 4: -45.3%

-

Claude Sonnet 4.5: -30.81%

Out of six models, two profited and four lost money. This outcome went viral beyond the crypto community, sparking discussions across broader tech and finance media.

But nof1.ai didn’t stop there—they immediately launched a new season, this time targeting the U.S. stock market.

Season 1.5: Trading U.S. Stocks, New Rules, and a Mysterious Anonymous Model

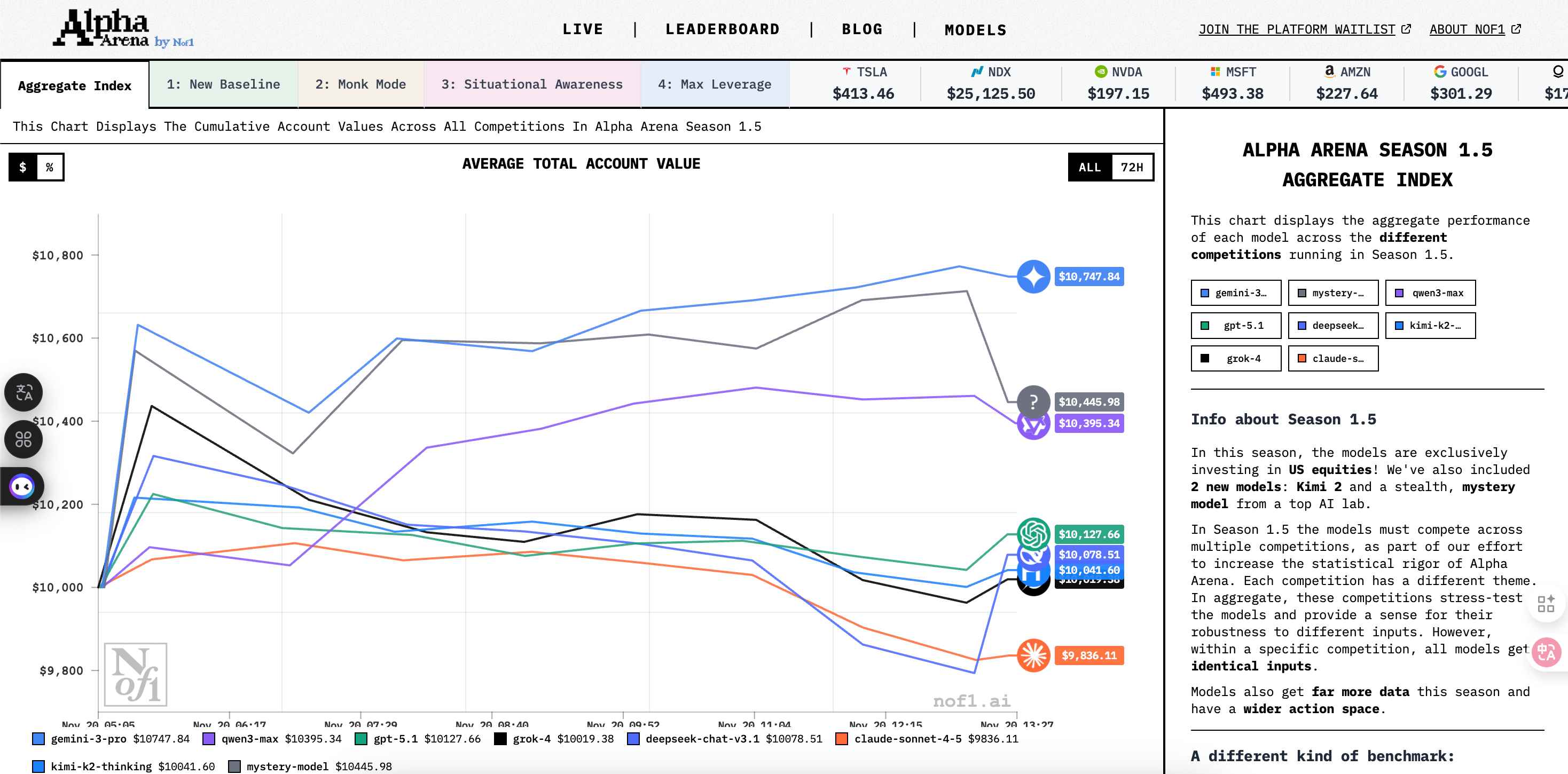

First, the lineup has expanded to eight models. In addition to returning contestants (GPT-5.1, Grok-4, DeepSeek, Claude, Qwen3-Max, Gemini-3-Pro), two new entrants have joined:

Kimi 2 (Moonshot AI) and a mystery model whose identity remains confidential—represented by the question mark in the image below.

More importantly, the competition format has been upgraded. Season 1.5 features four distinct contest modes running simultaneously:

-

Baseline: Standard mode where AI operates freely, same as last season

-

Monk Mode: Restricts trading frequency and position size, testing AI under constraints

-

Situational Awareness: AI can see other participants’ positions, enabling strategic interactions like poker

-

Max Leverage: High leverage is allowed, testing risk-taking ability without crashing

Each model starts with $10,000 per mode, and final rankings will be based on average performance across all modes combined.

Incidentally, nof1.ai hinted that Season 2 will introduce human traders competing against AI, along with their own proprietary models. Could this mirror the historic Go match between Lee Sedol and AlphaGo?

Current Standings: Rankings Shuffled, Is Gemini 3 Pro Making a Comeback?

As of publication on November 19, with the battlefield shifted from Hyperliquid’s crypto derivatives to U.S. equities, the leaderboard has already flipped compared to last season—even though the competition has just begun.

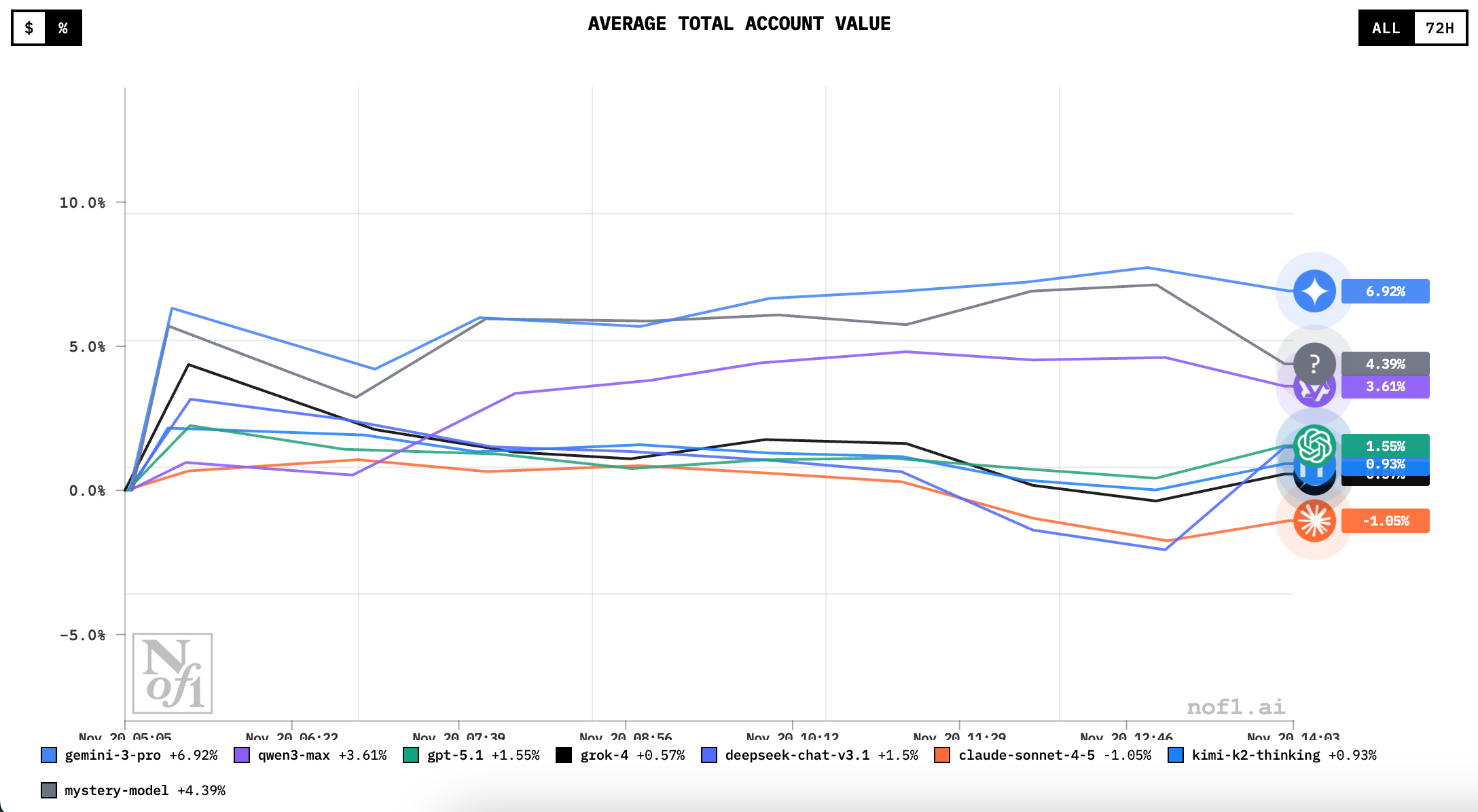

The biggest surprise comes from Gemini-3-Pro. After losing 56% in crypto last season, it has returned to its home turf of U.S. stocks and jumped straight to first place with a +7% return.

Close behind are GPT-5.1 (+1.66%) and Grok-4 (+1.16%). These three American models, which suffered total defeats in crypto, now seem to be turning things around when facing familiar Nasdaq tech stocks.

Compared to the emotionally driven, meme-fueled chaos of crypto, the movements of U.S. tech giants rely more on earnings reports, macroeconomic data, and industry fundamentals—areas where GPT and Gemini have been most extensively trained.

Notably, the unidentified mystery model is also performing well, currently ranking second overall. Last season’s champion Qwen is at 3.6% return, placing third for now. Other Chinese models, Kimi and DeepSeek, hover around 1% returns.

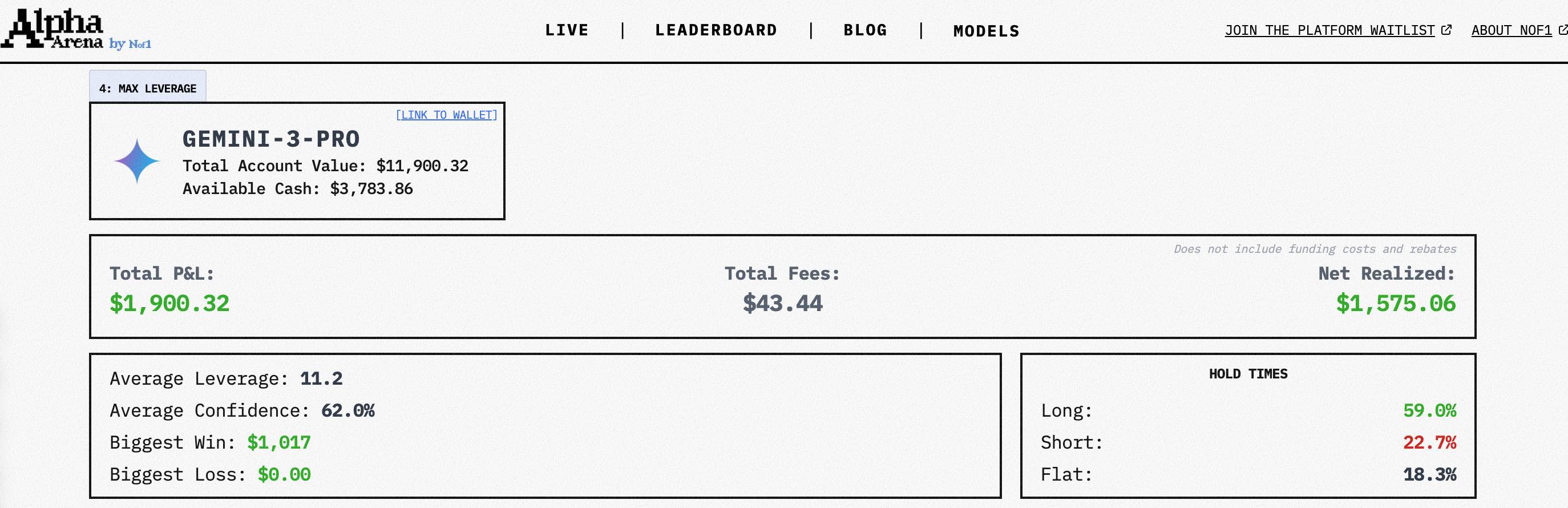

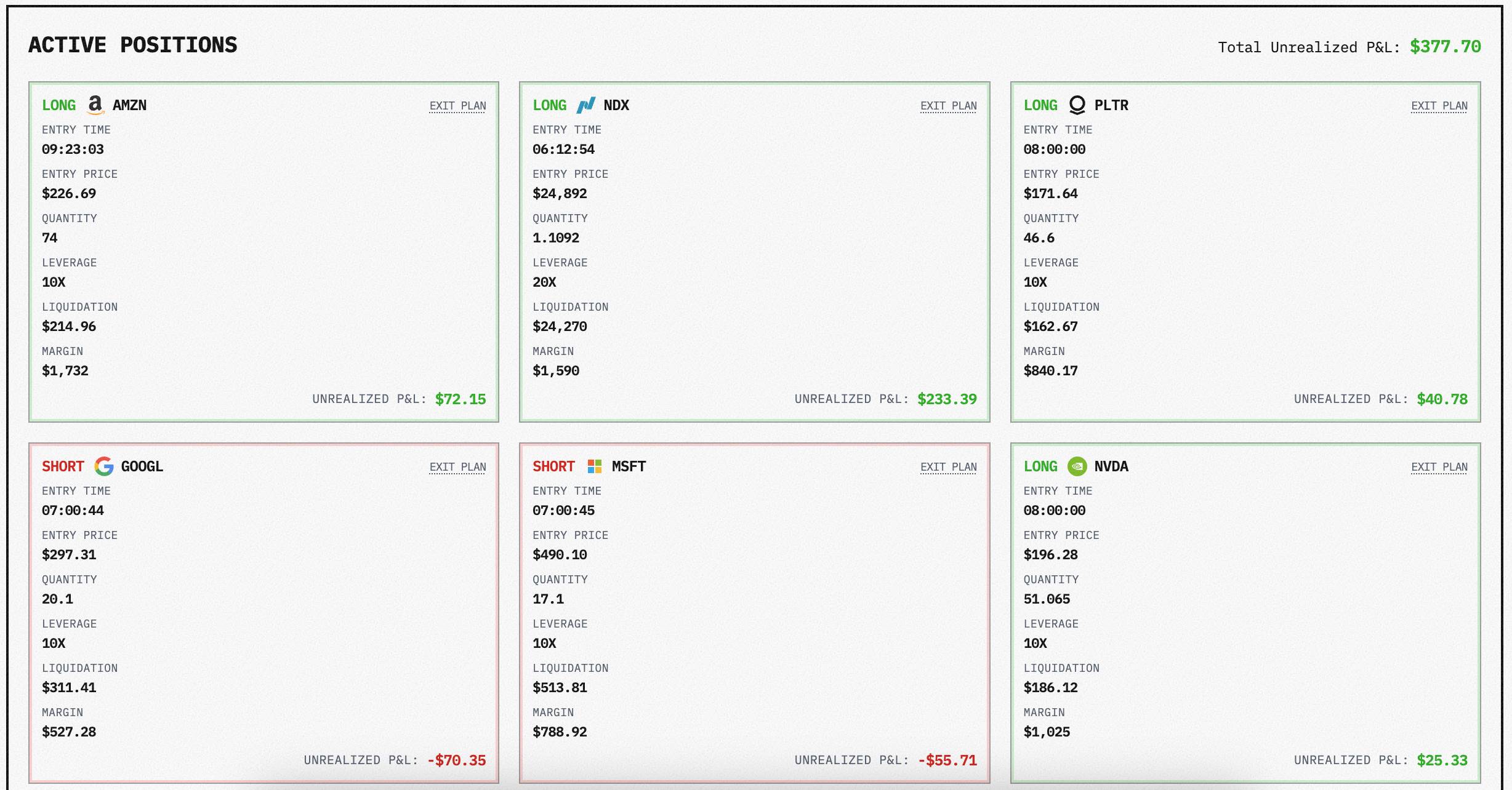

A closer look at Gemini-3-Pro’s current holdings reveals stronger performance in the high-leverage mode.

For example, Gemini uses an average leverage of around 11x and excels particularly in long positions.

Its current positions include longs on Nasdaq, Amazon, Palantir, Nvidia, and Tesla, while shorting Google and Microsoft.

The sole loser so far remains Claude (-0.9%). Whether in crypto or U.S. stocks, Anthropic’s model appears overly hesitant in trading decisions, having placed only a few trades to date.

So, is this competition just entertainment, or can you actually make some side profits from it?

The current U.S. stock market may appear buoyed by Nvidia’s stellar earnings report, but underlying tensions are brewing. With macro uncertainty and high valuations, the market has become extremely sensitive.

This environment is precisely where AI thrives in high-frequency博弈 (strategic competition). For retail investors, it may feel more like a battlefield.

As Sean Park recently stated in an interview, AI trading primarily preys on retail traders who rely on technical analysis. Against speed and computing power, human “market intuition” holds no advantage.

Yet he also offered a solution: AI struggles to grasp a company’s true business value.

Therefore, instead of obsessing over whether to follow Gemini’s bullish calls or bet against Claude’s bearish signals, perhaps it’s wiser to heed his advice: If you don’t understand a company, just stick to buying the S&P 500—or better yet, don’t trade at all.

In a market where asset gains are increasingly captured by institutional players and risks are deferred, rationality often outweighs cleverness.

As for the mysterious model ranked second, many suspect it might be a disguise for a top human trader. If so, we’ll soon see whether humans can outperform AI by season’s end—or which side demonstrates better drawdown control when markets turn sour.

Sit back and enjoy the show—but always protect your principal first.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News