US stocks post biggest single-day drop in a month, what happened?

TechFlow Selected TechFlow Selected

US stocks post biggest single-day drop in a month, what happened?

Investors are taking profits from this year's top-performing stocks and shifting into sectors with lower valuations and greater defensiveness.

Author: Wall Street Horizon

The brief optimism following the end of the U.S. government shutdown quickly faded, as market focus shifted to a flood of delayed economic data, uncertainty over the Fed's rate cut outlook, and concerns about richly valued tech stocks, triggering broad selling in high-valuation tech shares and risk assets.

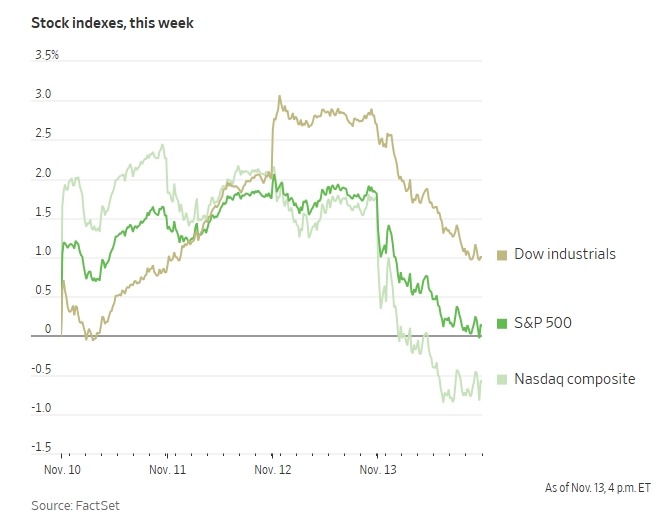

On Thursday, October 13, all three major U.S. equity indexes declined during the session, with the tech-heavy Nasdaq Composite closing down sharply by 2.29%.

Deteriorating risk sentiment also spilled into the cryptocurrency market, where Bitcoin fell below the $100,000 mark and Ethereum briefly dropped more than 10%.

The immediate catalyst for the sell-off was cautious comments from several Federal Reserve officials suggesting caution on rate cuts. According to CME data, interest rate futures now imply a rate cut probability of around 50%, down sharply from over 70% just a week ago.

This shift has intensified an ongoing market rotation that began earlier this month. Investors are reportedly taking profits from this year’s hottest-performing stocks and shifting toward lower-valued, more defensive sectors. This “risk-off mode” was clearly evident in Thursday’s trading activity.

U.S. Stocks Record Worst Single-Day Drop in a Month

With the U.S. government shutdown resolved and economic data delayed, investors are reassessing the likelihood of a December rate cut by the Federal Reserve. On Thursday, U.S. stocks posted their largest single-day decline in a month.

Benchmark U.S. stock indices:

S&P 500 closed down 113.43 points, or 1.66%, at 6,737.49.

Dow Jones Industrial Average fell 797.60 points, or 1.65%, to 47,457.22, retreating from its record closing high.

Nasdaq Composite dropped 536.102 points, or 2.29%, to 22,870.355. The Nasdaq 100 index fell 536.102 points, or 2.05%, to 24,993.463.

Russell 2000 Index declined 2.77% to 2,382.984.

The VIX volatility index rose 14.33% to 20.02, having climbed as high as 21.31 at 04:23 Beijing time before paring some gains.

Magnificent Seven tech giants:

The "Magnificent 7" tech index fell 2.26% to 203.76.

Tesla dropped 6.64%, Nvidia fell 3.58%, Alphabet A declined 2.84%, Amazon lost 2.71%, Microsoft slipped 1.54%, while Meta edged up 0.14%.

Semiconductor stocks:

The Philadelphia Semiconductor Index closed down 3.72% at 6,818.736.

AMD fell 4.22%, TSMC declined 2.90%.

Oracle dropped 4.15%, Broadcom fell 4.29%, Qualcomm lost 1.23%.

Fed Officials Turn Hawkish, Even 'Centrists' Show Hesitation

Several Federal Reserve officials have adopted hawkish tones, expressing concern about inflation and cautioning against future rate cuts.

Cleveland Fed President Loretta Mester (a 2026 FOMC voter) said she expects inflation will remain above the 2% target for the next two to three years. With signs of labor market weakness, the Fed’s employment mandate (part of its dual mandate) is under pressure. She expects tariffs to push up inflation into early next year and believes the Fed needs to maintain a degree of policy restrictiveness to bring inflation down.

Minneapolis Fed President Neel Kashkari said on Thursday that due to the economy's resilience, he opposed last month’s rate cut and remains uncertain about December’s decision. St. Louis Fed President Alberto Musalem reiterated that monetary policy must “withstand” inflation pressures.

Amid rising inflation concerns and views that the labor market remains strong, an increasing number of policymakers are showing hesitation about further easing—including some who were previously staunch supporters.

The latest development is that Boston Fed President Susan Collins and San Francisco Fed President Mary Daly—both of whom voted for rate cuts this year—have issued their clearest cautionary signals yet. Collins stated outright that the bar for additional easing is “relatively high,” while Daly said it is too early to conclude anything about the December decision and that she maintains an “open mind.”

The upcoming deluge of data—which may create more rather than less uncertainty—combined with the recent string of hawkish comments, has pushed market bets on a December rate cut back below 50%.

Two Possible Paths for December Meeting

Looking ahead to the December meeting, the outcome appears to be narrowing toward two possibilities: either holding rates steady or another 25-basis-point rate cut. According to Wall Street Journal reporter Nick Timiraos, another possibility is that the Fed could cut rates in December while simultaneously raising the bar for future easing through its policy guidance.

Regardless of the final decision, Powell may face more dissenting votes than at the October meeting (which saw two dissents). Krishna Guha, vice chairman at Evercore ISI, wrote in a report on Thursday that Collins’ clear opposition to a December cut “amplifies our concerns about Powell’s ability to manage divisions within the FOMC.”

Guha analyzed that if the Fed decides to cut, Kansas City Fed President Jeffrey Schmid might gain support from officials like Collins and Musalem. If the Fed opts to hold rates steady, then Governor Stephen Miran—who previously advocated for a larger cut—could join fellow dovish members Christopher Waller and Michelle Bowman in casting dissenting votes.

This further highlights deep fissures within the committee, making the December decision highly uncertain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News