Why is the current crypto market operation difficulty at a hellish level?

TechFlow Selected TechFlow Selected

Why is the current crypto market operation difficulty at a hellish level?

Over 90% of crypto assets are fundamentally driven by speculation, but pure speculation is not a perpetual motion machine.

Written by: @0xkyle

Translated by: AididiaoJP, Foresight News

As a trader, the core objective has always been to identify high-conviction opportunities with asymmetric return potential. I thrive on uncovering such high-risk-reward trades—like Solana at $20, Node Monkes at 0.1 BTC (which later rose to 0.9 BTC), and Zerebro at a $20 million market cap.

However, these asymmetric opportunities are becoming increasingly rare. There are many reasons for this, collectively forming a massive and stubborn problem.

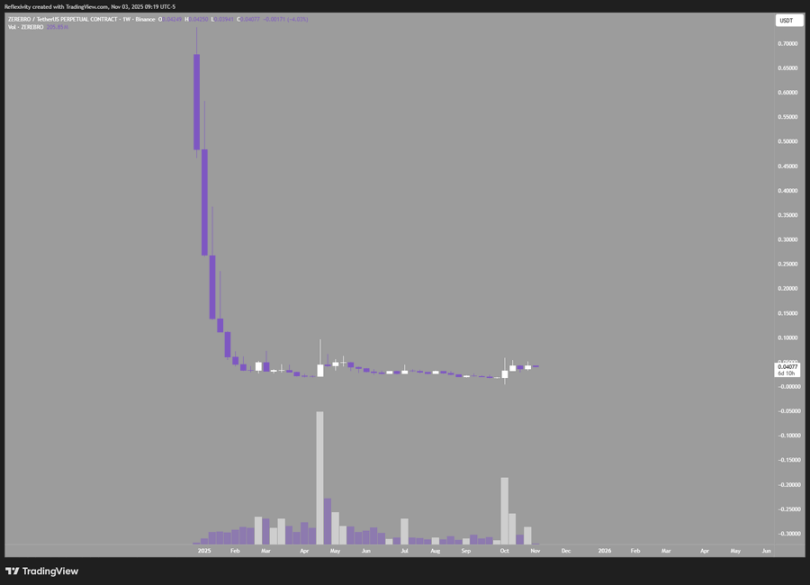

Take this chart as an example—it shows Zerebro surging from a $20 million market cap to a peak of $700 million, delivering a 30x return; yet it also crashed 99% from its highs, nearly returning to square one.

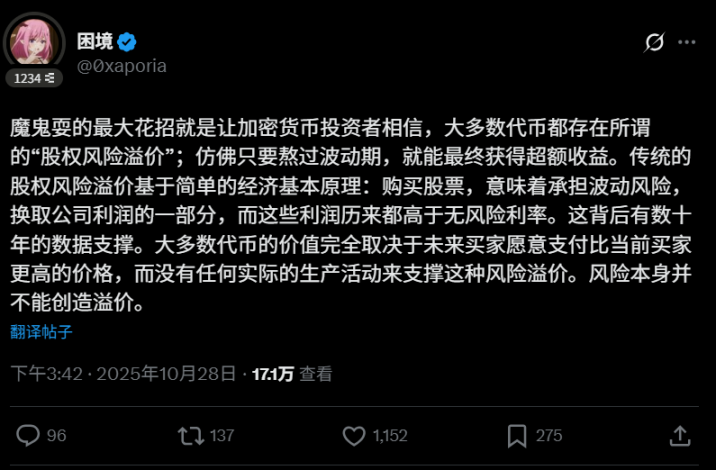

This leads to the first issue: it's well known that most tokens in this industry "must eventually be sold." This creates a vicious cycle that hinders the formation of long-term appreciating assets. Over 90% of crypto assets are fundamentally speculation-driven, but pure speculation isn't a perpetual motion machine. When market participants lose interest or can no longer profit sustainably, speculative demand dries up. As user @0xaporia perfectly put it:

The second issue lies in structural flaws within the crypto market. The October 10th price spike fully exposed this: major exchanges allowed massive losses for numerous users, with over $40 billion in open interest vaporizing instantly. It served as a harsh financial lesson for all participants: if something can go wrong, it will. This risk deters institutions and large capital—why take the risk if there's a chance of total loss?

The third and fourth issues have long existed: one is the overwhelming number of newly issued tokens each day, and the other is their excessively high initial valuations. Every new project dilutes overall market liquidity, while high initial pricing squeezes public market investors' profit margins. Sure, you can short them, but if the entire industry relies on shorting for profits, that’s unsustainable in the long run.

There are other unmentioned problems, but the above points are the most critical. Returning to the main theme: why are asymmetric opportunities so scarce in today’s crypto market?

-

High-quality projects launch at valuations already too rich—or even excessive—fully or over-pricing in expectations

-

Excessive token issuance dilutes value; one "perfect L1" appears today, another tomorrow, raising doubts about whether they truly deserve the hype

-

The industry evolves too rapidly to build long-term investment conviction; even leading projects may lose their edge within a year

-

Market structure issues deter capital inflows; investors demand higher returns to compensate for wipeout risk, and if actual returns fall short, the investment thesis collapses

Most fatally, most tokens are merely fundraising instruments—sold to finance operations—while real value accrues to equity holders. Tokens lacking value accumulation and without corporate rights are essentially speculative passing-the-parcel games, not genuine investments.

None of this is new. Why am I reiterating it? Because despite everyone knowing this, no one changes their investment approach. People still chase new narratives and hyped trends, repeating ineffective strategies. This is precisely the definition of madness: doing the same thing over and over while expecting different results.

I’m always searching for the next asymmetric opportunity. If you follow the crowd, you’ll only get average returns. In my view, the next crypto asymmetric opportunities lie in:

-

Mining yields

-

Equity investments in blockchain companies

-

Exchange platform tokens

-

Finding severely undervalued assets—these do exist, though they’re extremely rare

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News