Where should the Chinese prediction market explore?

TechFlow Selected TechFlow Selected

Where should the Chinese prediction market explore?

Human intentions are hard to fathom, yet Chinese people's expectations look toward the West.

Author: Zuoye

The theoretical origins of randomness emerged from gambling, inherently inferior by three points compared to geometry born from ancient Greek sages.

Quantifying uncertainty through expressions became probability theory's primal proposition—this is the greatest difference between prediction markets and casinos. Reviewing Polymarket’s documentation, its defense argues that casinos operate with a house edge (House), meaning that according to the law of large numbers, anyone who gambles long enough will inevitably lose.

Prediction markets are PVP two-way games. Polymarket charges no deposit or withdrawal fees, nor takes any cut from trades, completely avoiding self-inflicted disturbances on randomness.

But this isn't enough. PVP alone cannot make Market Price = Probability; expectation (Expectation) is also required. Only when quantified expected returns can cover speculative costs can prediction markets break free from the casino paradigm and become pure financial products.

Odds of Dying for Entertainment

All authority—politics, news—is merely digital gains and losses.

Monopolization of information does not stem from concealing sources but from controlling dissemination channels.

Modern journalism originated in WWII-era press censorship. Schramm established communication studies as an independent discipline, incorporating qualitative and quantitative methods from sociology and statistics, forming an unbreakable armor known as journalistic professionalism.

Meanwhile, as voter bases expanded continuously (women, Black people, youth), polls began genuinely influencing politicians' fates. Inferring overall voter tendencies from small sample spaces became commercially profitable—media needed it, political parties needed it, even opponents needed it.

Yet both polling and journalism have long followed a B2B business model: media sells users’/the public’s attention to enterprises, making users mere commodities in the transaction chain, unable to profit directly from their collective consciousness and inclinations—mirroring decentralized anger toward platforms.

Privacy invasion is just an excuse—the real issue is that platforms don’t pay.

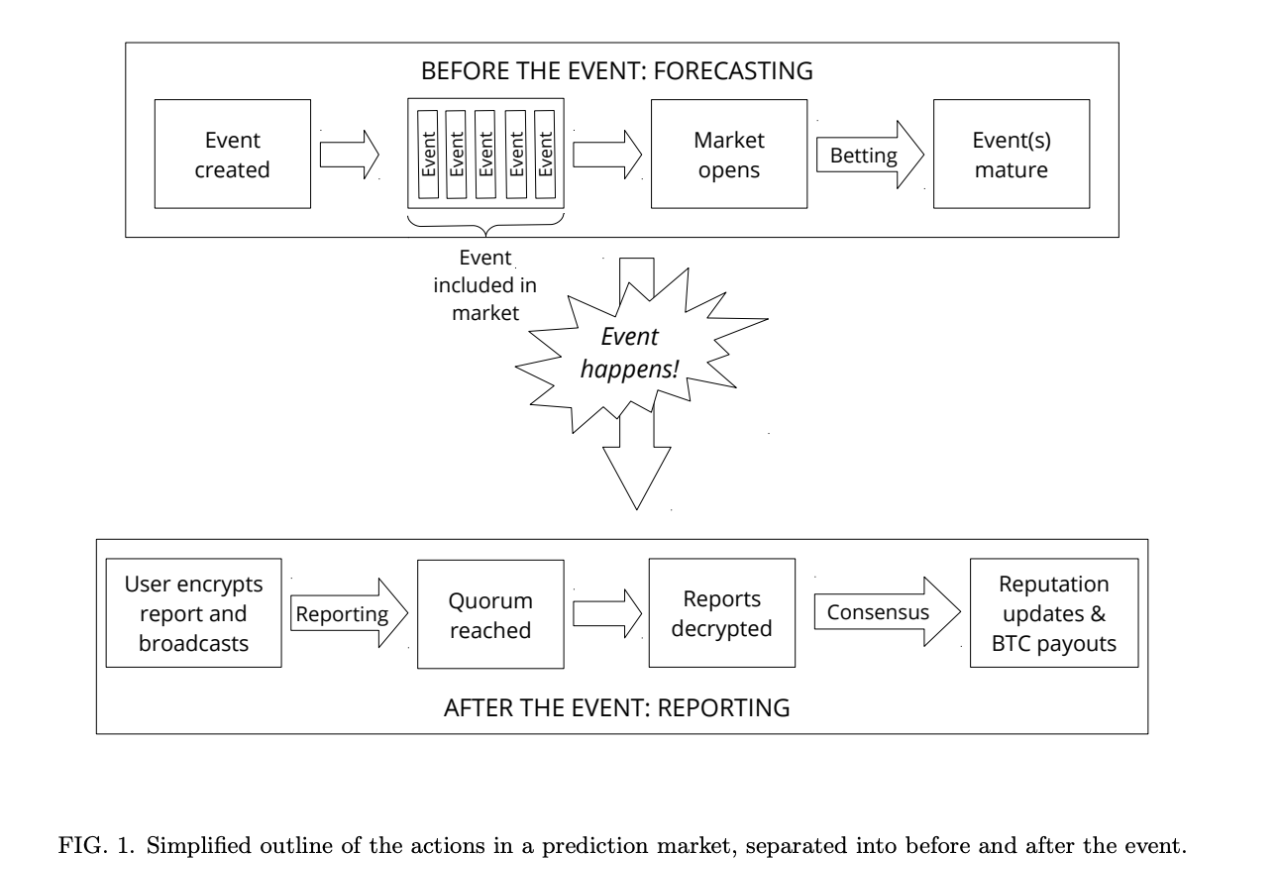

As early as 2014, academia had already begun exploring how to combine blockchain with prediction markets to escape the traditional centralized platform model of house take-cuts. Vitalik recalled that Augur v1, the first-generation prediction market, was born in 2015—a concrete manifestation of that intellectual wave.

Unfortunately, Augur v1’s whitepaper was built on a Bitcoin sidechain. Ethereum at the time wasn’t powerful enough to support large-scale applications on-chain, and Augur’s “excessive pursuit” of decentralization kept it confined to niche circles, unable to generate positive externalities, ultimately fading into obscurity.

Caption: Augur v1 Design

Image Source: @AugurProject

By 2020’s DeFi Summer, beyond DEXs and lending, figures like Hyperliquid’s Jeff and Polymarket’s Shayne Coplan were experimenting with next-gen prediction markets. Ethereum + L2 + governance centralization made technical efficiency no longer a bottleneck—the real challenge lay in insufficient consumer adoption.

When timing aligns, all forces unite.

-

• The global lockdowns of 2020 normalized online lifestyles worldwide, naturally including prediction markets;

-

• The 2022 World Cup brought a cyclical peak in global gambling activity, with the $100 billion online betting market significantly driven by the tournament;

-

• The 2024 U.S. presidential election, with Trump’s constant drama creating unprecedented plot twists, turned into a global spectacle where even 1% of traffic meant windfall riches for Polymarket.

After the election, Polymarket maintained stable market share through continuous fundraising, user incentives (free access), and expansion into sports markets—just like Hyperliquid maintaining its position post-token launch. Polymarket has now passed its most dangerous phase.

The upcoming 2026 World Cup will be the life-or-death battle determining whether Polymarket can become a giant in online prediction markets. Political uncertainty is too high—sports offer safer, higher yields.

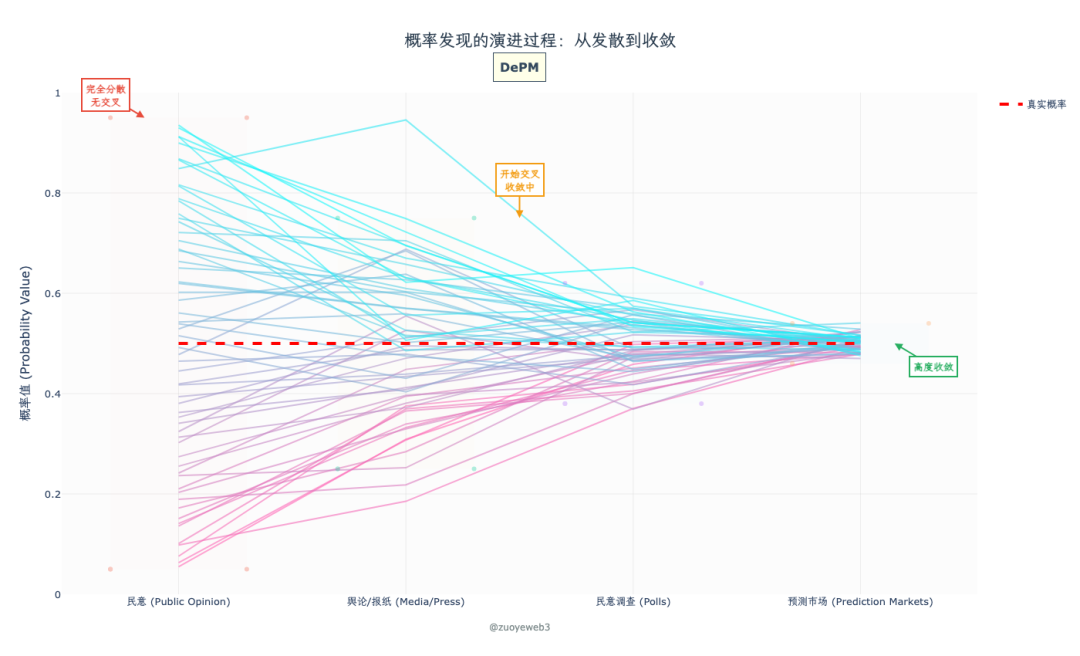

Caption: Prediction ≠ Gambling

Image Source: @zuoyeweb3

To clarify why prediction markets are efficient, consider the Trump campaign: the total population of 240 million American voters constitutes the full sample space, yet only 150–160 million actually vote (effective sample space). Beyond fixed red and blue states, presidential outcomes hinge on a few swing states, which can further be broken down into individual swing counties.

Hence, polls in swing states are critical. Mainstream polling institutions like Gallup design ever more “scientific and reasonable” sampling methods because surveying every voter is impossible—extrapolating from small samples remains a massive challenge.

The paradox lies in the fact that a key minority always influences the majority’s choices, while prediction markets continuously refine parameters derived from sampling, allowing earlier bets on higher probabilities before final results emerge.

In other words, prediction markets don’t necessarily have superior sampling capabilities—but they constantly recalibrate sampled parameters, ensuring every opinion instantly reflects in real-time odds.

That is, Polymarket functions as a “swarm algorithm,” repeatedly extracting the highest probability value from discrete data and cross-validating it against actual outcomes to enhance accuracy.

Odds price disagreement/agreement, bullish/bearish positions. In Polymarket’s market, events (Events) are the basic units, with each standard contract minted at 1 USDC, such that Yes + No = 1—for example, 0.5 Yes must correspond to 0.5 No.

Suppose Alice and Bob buy at 0.1 Yes and 0.1 No respectively, while the current market price is 0.5:

-

• If Alice believes the future probability will exceed 0.5, upon final resolution she profits net 0.9U;

-

• If Bob believes the future probability won’t exceed 0.5 and sells his share, he locks in 0.5U early, netting 0.4U.

Of course, initial price formation and subsequent fluctuations require market makers, along with Polymarket’s permission to open markets. Using a CLOB mechanism similar to Perp DEXs, Polymarket also supports limit orders and more complex trading strategies.

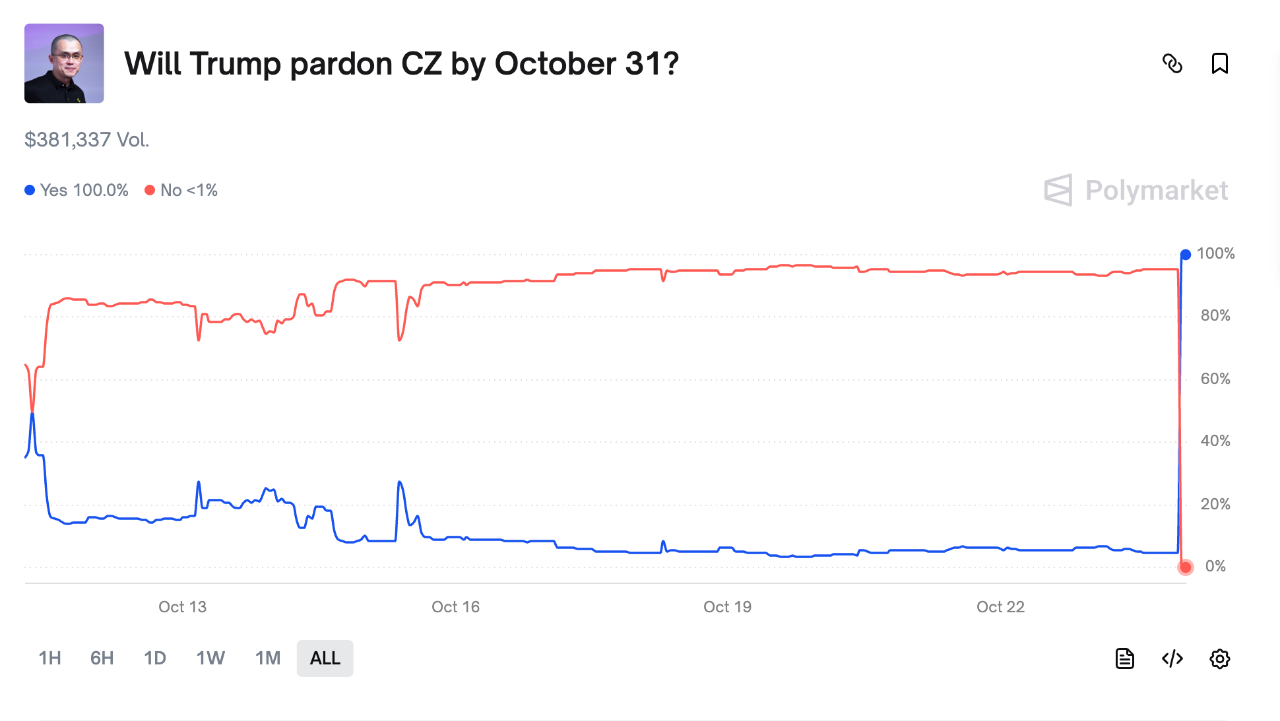

Polymarket’s mechanism isn’t complicated: total equals 1. The difference between the current Yes/No prices and 1 represents potential profit. For instance, a 93% probability means 0.93 Yes + 0.07 No = 1 USDC. If the outcome reverses to No, the 0.93 becomes an upset profit.

Caption: Upset Events

Image Source: @Polymarket

After placing bets, users can still buy/sell anytime, becoming part of market liquidity—an even more efficient market-making method than “bet-and-hold.” Yes and No positions derive profits/losses directly from each other, forming an ultimate PvP market where the platform only needs to ensure fair matching.

Certainly, details around oracles, governance, market listing/closure, and dispute resolution aren’t covered here. Broadly speaking, Polymarket is an internet-commercialized prediction product that happens to use blockchain and stablecoin technology—having little to do with true decentralization.

Entertainment Lies in People, Not Events

Much of monopoly expansion stems from deliberate collusion between organized capital and organized labor.

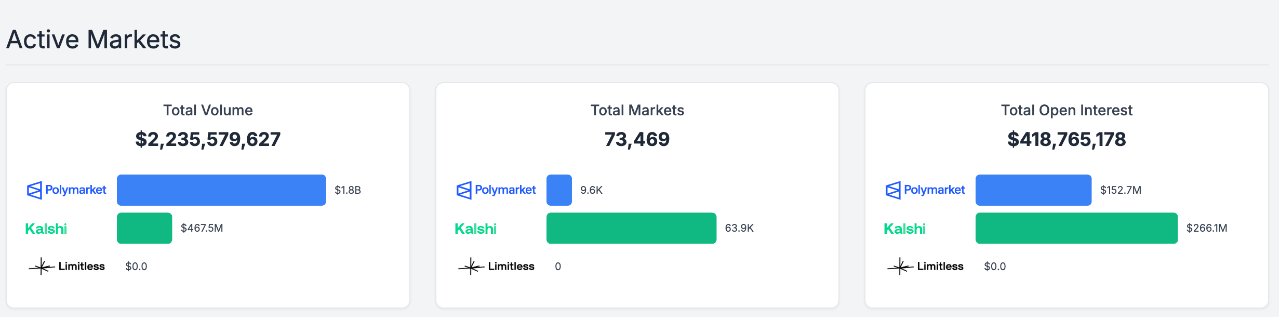

Polymarket’s current three pillars are political elections (U.S.), news events (Event), and sports. Its biggest competitor, Kalshi, emphasizes compliance and partners with Robinhood, Jupiter, etc., prioritizing traffic over profits.

Caption: Data Comparison

Image Source: @poly_data

Among numerous emerging prediction markets, most aim to become the Blur to OpenSea’s NFT marketplace—using anticipated token airdrops to attract retail participation and complete their own token launches—making direct confrontation with Polymarket or Kalshi nearly impossible.

This has little to do with compliance. Polymarket’s compliance is a pricing issue; Hyperliquid’s compliance poses far greater challenges. Their liquidity levels aren’t even comparable.

Ultimately, U.S. elections are a niche, America-specific market. Sports represent the global mass market. Polymarket reflects the collective usage preferences of young Americans—atomized individuals who avoid physical betting shops and may only watch esports streams, yet still bet on ball games.

Prior to Polymarket, Kalshi, and NFL collaboration, the NBA had already partnered with DraftKings and FanDuel for sports betting in 2023. Meanwhile, NYSE’s parent company invested in Polymarket, and FanDuel teamed up with CME—organized capital has already moved.

Enforcement actions against NBA game-fixing are merely noise following the 2018 Supreme Court decision legalizing “sports betting”—they won’t stop PL or Kalshi. Unfortunately, the scale of sports betting remains limited with unclear future prospects.

It’s the same dilemma as Eastern Moutai: youth virtualization and atomization are irreversible trends. To them, events (Event) are boring old-people games. Beyond liking or disliking Trump, there’s a vast population indifferent to him altogether.

People may rally together in cyberspace to defend Shanghai, while U.S. Marines chant lines from *Helldivers 2*, though their real lives may never intersect.

Beyond generational sentiment, casinos and gray-market operations have ironically become prediction markets’ smallest issues. Polymarket valued at $1.5 billion and Kalshi at $1.2 billion have likely peaked.

Organized capital only invests in predictable politics, news, and sports. What else will gather youth in cyberspace—and thus shape the future of prediction markets?

Don’t try to understand Gen Z—create space for Gen Z. Old-people marketing will backfire.

Organized labor doesn’t only seek economic value. Or rather, what’s most valuable in the 21st century?

Emotional value—the projection of personal emotional needs. The pursuit of overseas identity is a consequence of household registration systems being too successful, so much so that some develop side effects. The success of family planning isn’t reflected in declining marriage rates, but in young people consciously choosing to be the last generation, seeing it as resistance rather than obedience.

Atomized individuals haven’t diminished their need for collective emotion—in fact, it grows in secrecy. Look at packed conferences—not attending panels, but seeking authentic interactions among lonely individuals.

Globally, the only remaining domain capable of uniting young people collectively, engaging both effort and money, is entertainment figures—not entertainment events, but entertainment figures. Taylor Swift’s pre-engagement breakup in the U.S.—if integrated across Xiaohongshu and Instagram—would convert far better than Trump ever could.

And during a celebrity’s viral cycle, daily drama is guaranteed—fan wars, de-friending, comebacks—like Disney’s evergreen merchandise, stars can build secondary markets.

This isn’t fantasy. Financialized participation in entertainment has become a global consensus: Film飓风 selling T-shirts, MrBeast registering MrBeast Finance, G.E.M. investing in AI startups, Kanye selling memes.

This approach is safer than celebrities selling NFTs or pumping tokens. People are betting on people—even insider information gets internalized into the market because people have their own minds. The core point: fans don’t care.

K-pop fan wars are already routine. The key is winning at all costs—financial loss or gain is irrelevant. Fulfilling emotional value matters most. Prediction markets can be the financial projection of fan economies.

One could even build sophisticated hedging strategies—buying No on a movie before release effectively hedges against reputational risks for your brother/sister, since quality and profitability often become apparent during production.

Financial entertainment isn’t about making finance entertaining—it’s already highly entertaining. In a fractured world, some celebrate prediction markets getting licensed, others debate whether they’re gambling, while some have already moved on to new frontiers.

The Trump family has already invested in Polymarket. Outsiders still hesitate—why not just make money together?

Conclusion

The end of globalization means gradual decoupling of goods and services, now entering the service trade phase. But Homo sapiens naturally love gathering. Simply “localizing” U.S. elections into Thai elections holds little meaning—it shrinks market size instead.

Finding consensus in a fractured world creates unique opportunities. Especially for Chinese entrepreneurs, politics and sports are high-risk choices—underground operations always face bottlenecks. The entertainment industry, however, offers the lowest-risk entry point.

CZ faces Western scrutiny due to his Chinese identity. But at least, predicting how many inches Kim Kardashian’s buttocks measure won’t threaten national security.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News