From Bot Wallet to One-Stop Financial Ecosystem: The Evolution of Cwallet 3.0

TechFlow Selected TechFlow Selected

From Bot Wallet to One-Stop Financial Ecosystem: The Evolution of Cwallet 3.0

From the beginning, Cwallet has continuously evolved by building products centered around users.

Written by: TechFlow

"Our goal isn't packaging, but more effective communication"—this statement left a strong impression during initial conversations two years ago with the wallet project Cwallet.

At that time, the project had just completed its transition from 1.0 to 2.0: rebranded from CCTip to Cwallet, daily active users surpassed 100,000, and it began to emerge within the wallet space.

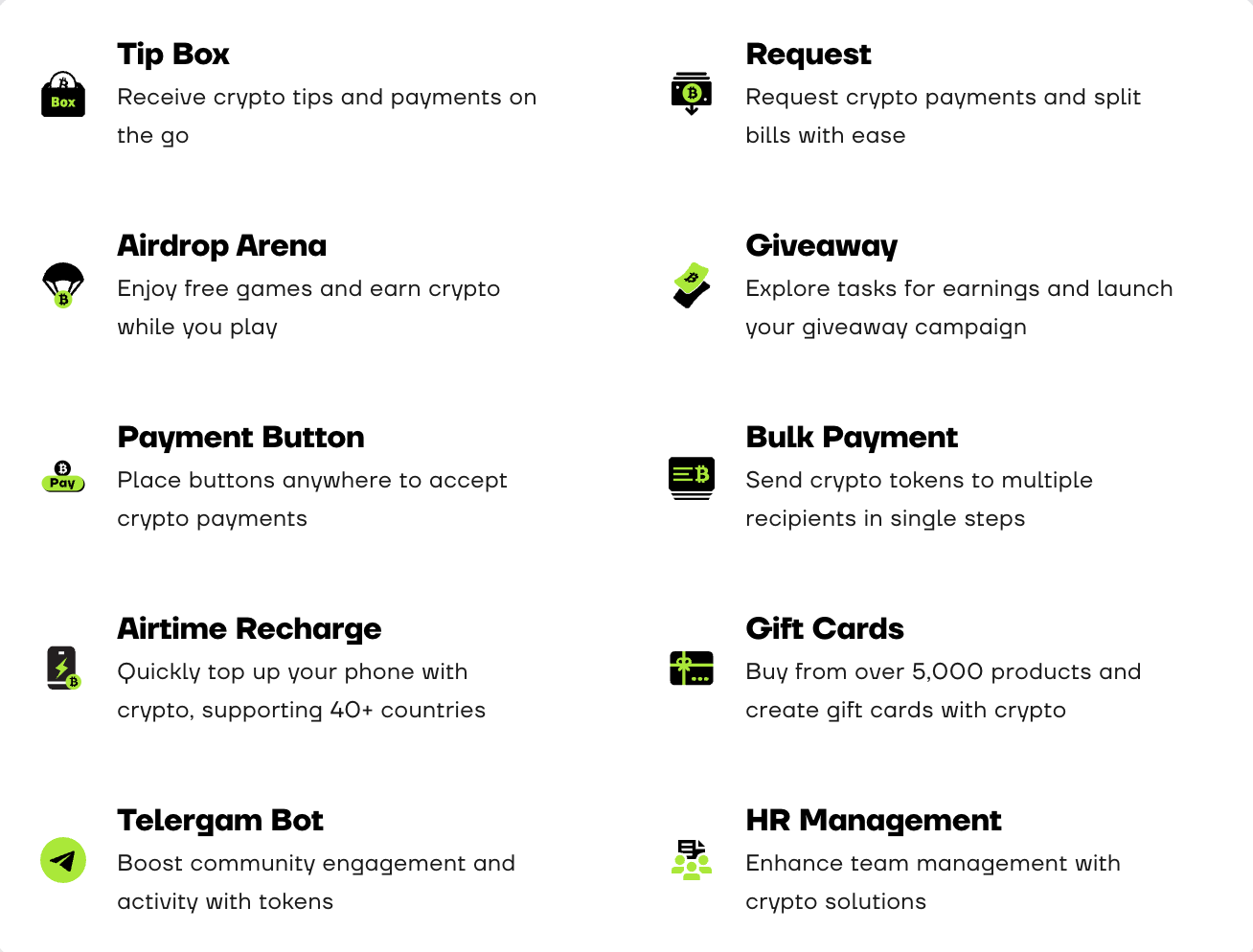

The conversation two years ago lasted several hours, during which Cwallet detailed its 2.0 product logic: on one hand, continuing its community roots by offering tools such as community airdrops, bulk transfers, and Giveaway; on the other, gradually expanding wallet features like instant swaps, top-ups, and gift card purchases, enabling users to utilize crypto assets in richer, real-world scenarios.

On product design philosophy, Cwallet stated:

"We started from social media bots, so we place greater emphasis on community and user voices. We believe that when genuine user needs are recognized and fulfilled, it will attract even larger user growth."

Today, two years later, Cwallet has evolved into a platform supporting over 60 blockchains and thousands of crypto assets, attracting more than 37 million users, and with a refreshed brand identity, is entering its transformative '3.0 era'.

When discussing new products and features for version 3.0, the Cwallet team remained characteristically talkative:

"We've done extensive work preparing for 3.0, including optimizing core transactions, launching financial products, a Meme market, XStocks trading, Cozy Card, and soon-to-launch contract trading, among others."

Clearly, from asset management and on-chain interactions to investment and payment, Cwallet 3.0 aims to build a Web3 financial platform usable anytime, anywhere—becoming a true all-in-one crypto finance partner for users, ensuring both Web3 newcomers and seasoned players have their needs met and find enjoyment in the process.

Reviewing Cwallet’s ecosystem progress since initiating its 3.0 transformation—from focusing on user experience as a Web3 traffic gateway to building an on-chain financial ecosystem targeting the next billion users—the results have been substantial.

7 Years, Zero Incidents: A Secure and User-Friendly Wallet Under the Web2.5 Product Philosophy

In the crypto world, wallets are users’ first step into Web3, making user experience critical. In an environment where giants like MetaMask and Trust Wallet, along with exchange wallets, are already mature, how did Cwallet—a project born from a bot—grow to serve tens of millions of users?

First, security. As an asset management tool, security is paramount. Having stood the test of the market, Cwallet has achieved stable operations with zero incidents over seven years—an exceptional feat in the perilous crypto "dark forest," providing reliable protection for millions of users.

The platform supports decentralized wallets where users manage their own private keys, while also offering centralized wallet services secured with 2FA and MPC technology, allowing password recovery (with a 24-hour asset transfer restriction to enhance safety).

Second, ease of use. Positioning itself as "Web2.5," Cwallet aims to bridge the gap between Web2 and Web3, lowering entry barriers. It supports convenient login methods such as email, phone number, and Apple ID; integrates and seamlessly switches between custodial and non-custodial services; enables gasless transfers; and offers both mobile apps and desktop web versions, all available on major app stores. These efforts aim to bring Web3 to the next billion users.

But these features seem standard for modern wallets. Cwallet’s ability to amass over 37 million users goes far beyond this baseline.

Cwallet treats the wallet as a bridge connecting Web2 and Web3, leveraging the massive user bases of mainstream Web2 social platforms—Telegram, Twitter, Discord—all of which boast hundreds of millions of users. This is a defining characteristic distinguishing Cwallet from other wallets.

Cwallet’s initial user growth stemmed from viral spread and network effects via its Telegram Bot, delivering a "foolproof" product experience that allowed even complete beginners to easily own a wallet. Subsequently, Twitter and Discord Bots were launched, providing integrated services from asset management and community creation to mass reward distribution, greatly improving community management efficiency while subtly guiding Web2 users onto the blockchain. Together, these three platforms form a vast influence network rooted in Web3.

As user aggregation drives increased transactional demands, Cwallet continuously innovates features and enhances usability through composability across tools. For example, the Giveaway tool focuses on community growth with automatic task verification, fair draws, and automated prize distribution; bulk payments allow one-click cryptocurrency transfers to multiple recipients; and Airtime top-up service enables users to recharge mobile phone credit anytime using crypto. Additionally, Cwallet’s Toolkit includes tipping codes, Airdrop Arena, payment buttons, gift cards, and more.

In short, every wallet feature you can think of, Cwallet has; every innovative wallet function you might not expect, Cwallet also provides.

From Basic Finance to Diversified Trading Modules: A One-Stop Crypto Financial Ecosystem Takes Shape

Building products, features, and tools that users truly need—this has always been Cwallet’s product team's conviction.

From 1.0 to 2.0, Cwallet initially grew by serving a long-overlooked market segment. This edge-in strategy enabled the team to carve out a unique position in the fiercely competitive wallet landscape.

Entering the 3.0 phase, Cwallet is now executing a "surround and consolidate" strategy by building a comprehensive Web3 financial ecosystem. This ecosystem fully addresses diverse needs—from Web3 beginners to experienced users—delivering continuous surprises and elevated experiences.

After establishing a secure and user-friendly wallet as a bridge between Web2 ⇆ Web3, Cwallet continues to prioritize user demands, exploring multi-scenario applications around yield generation, asset trading, and payment, gradually evolving from a wallet into a Web3 financial gateway covering the entire lifecycle of assets—trading, finance, lending, and investment.

Cwallet Earn: A Web3 Version of Yu’ebao with Up to 10% Annual Yield

In the crypto world, idle money is wasted money.

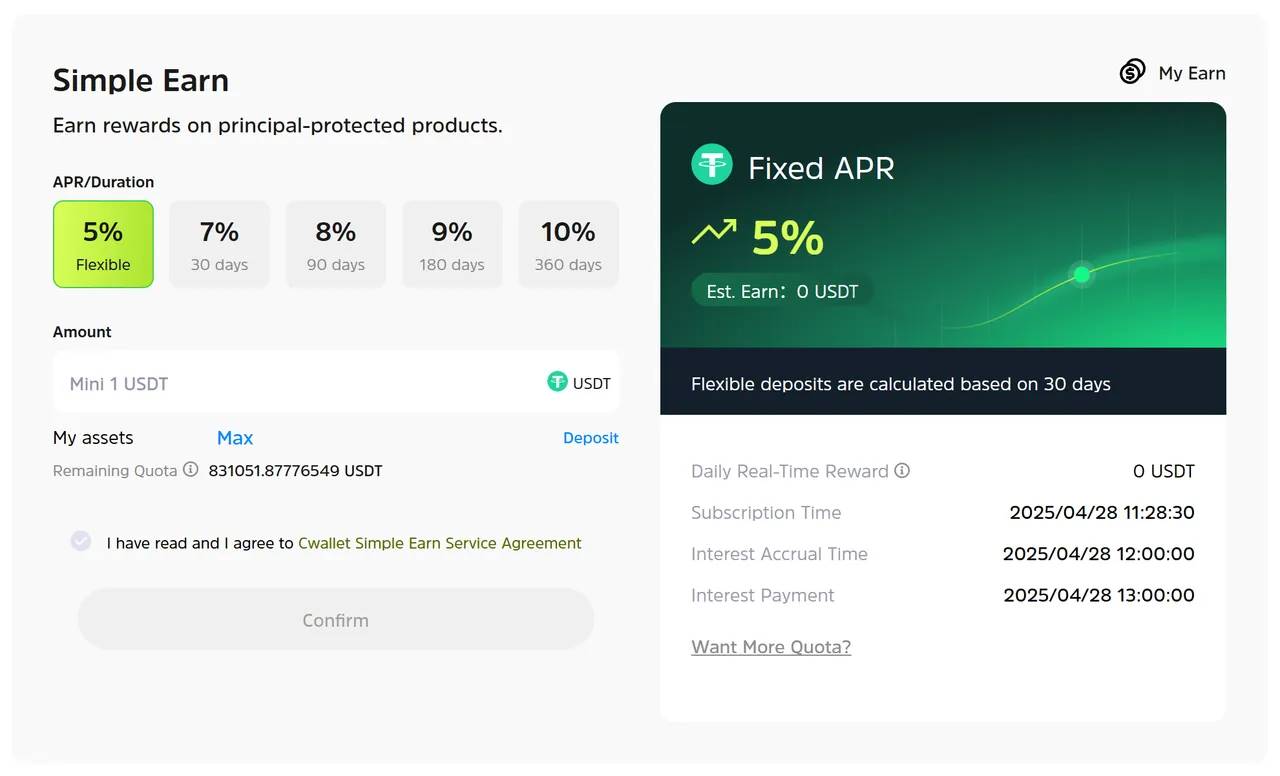

Hence, Cwallet launched its on-chain financial product, "Earn."

On Cwallet Earn addressing users’ fundamental financial needs, a Cwallet executive said: "Through this design, we hope users can experience in the Web3 world the same convenience and security as Yu’ebao, while also tapping into the earning opportunities offered by crypto finance."

Compared to manually navigating complex DeFi protocols, Cwallet Earn offers a simpler, more stable, and lower-barrier approach to wallet-based finance.

Cwallet Earn supports both flexible and fixed-term modes. Users simply lock assets on the feature page to start earning, with a minimum investment of just 1 USDT.

Flexible deposits yield up to 5%, fixed terms up to 10%, with different lock-up periods offering corresponding returns, all while maintaining stability. Interest begins accruing immediately upon deposit (flexible earnings viewable from the second hour, fixed from the next day), allowing users to track asset movements in real time. In emergencies, users can cancel orders anytime—offering flexibility and peace of mind.

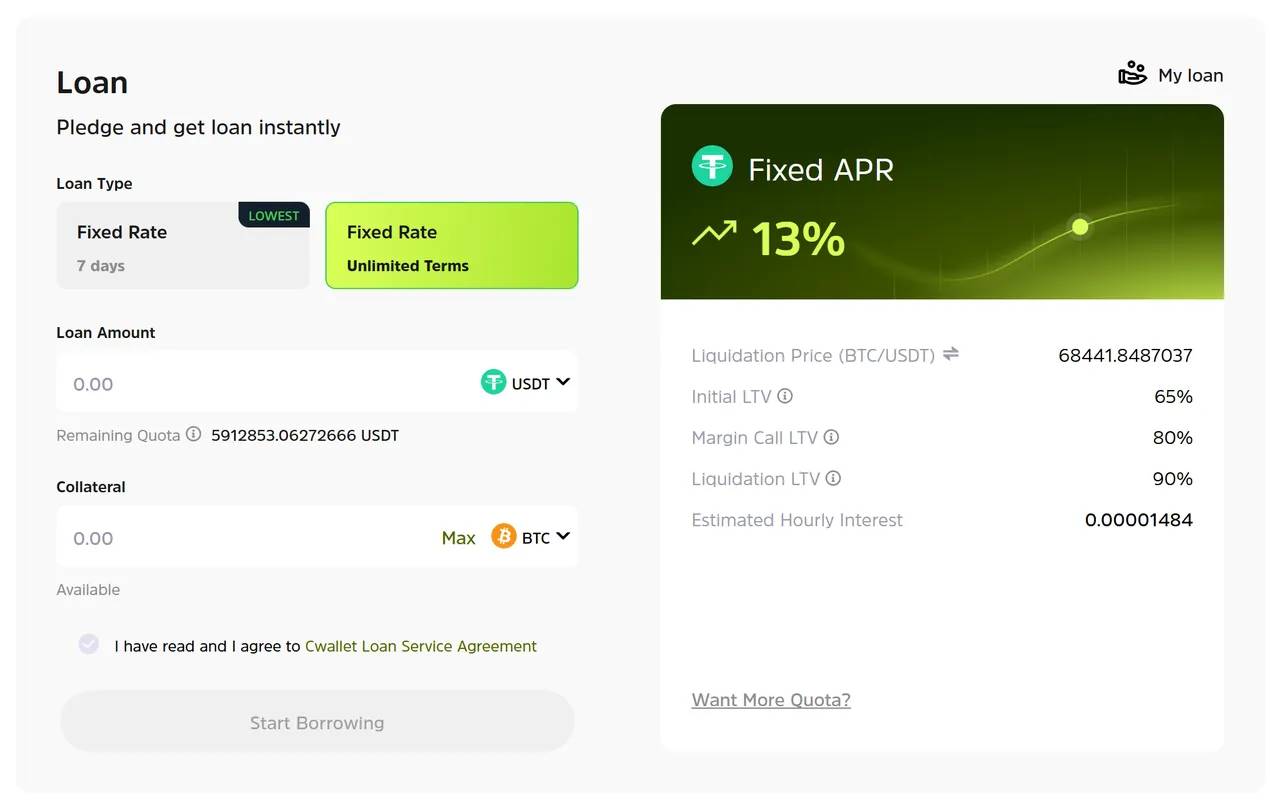

Cwallet Lending: Fixed-Rate Financing Unlocking Crypto Asset Flexibility

An excellent financial product should make users feel free, open, and simple, letting them genuinely experience the joy of growing wealth. Beyond "Earn," Cwallet Lending is another solid option for users engaging in on-chain finance.

The original intent behind designing Cwallet Lending was to help users manage assets flexibly and respond to market changes, enabling every dollar to "move," truly experiencing freedom and convenience in Web3.

The process is simple: users can quickly borrow other cryptocurrencies by using BTC, ETH, or USDT as collateral, seizing favorable trading opportunities. The entire process is transparent and secure, with collateral either returned or automatically liquidated within set terms—simple and hassle-free.

Meanwhile, Cwallet Lending offers short-term fixed rates for 7 days, as well as indefinite fixed-rate long-term options, giving users flexible choices based on personal needs. Interest is calculated hourly, with a flat annual rate of just 13%, helping users leverage more capital at low cost.

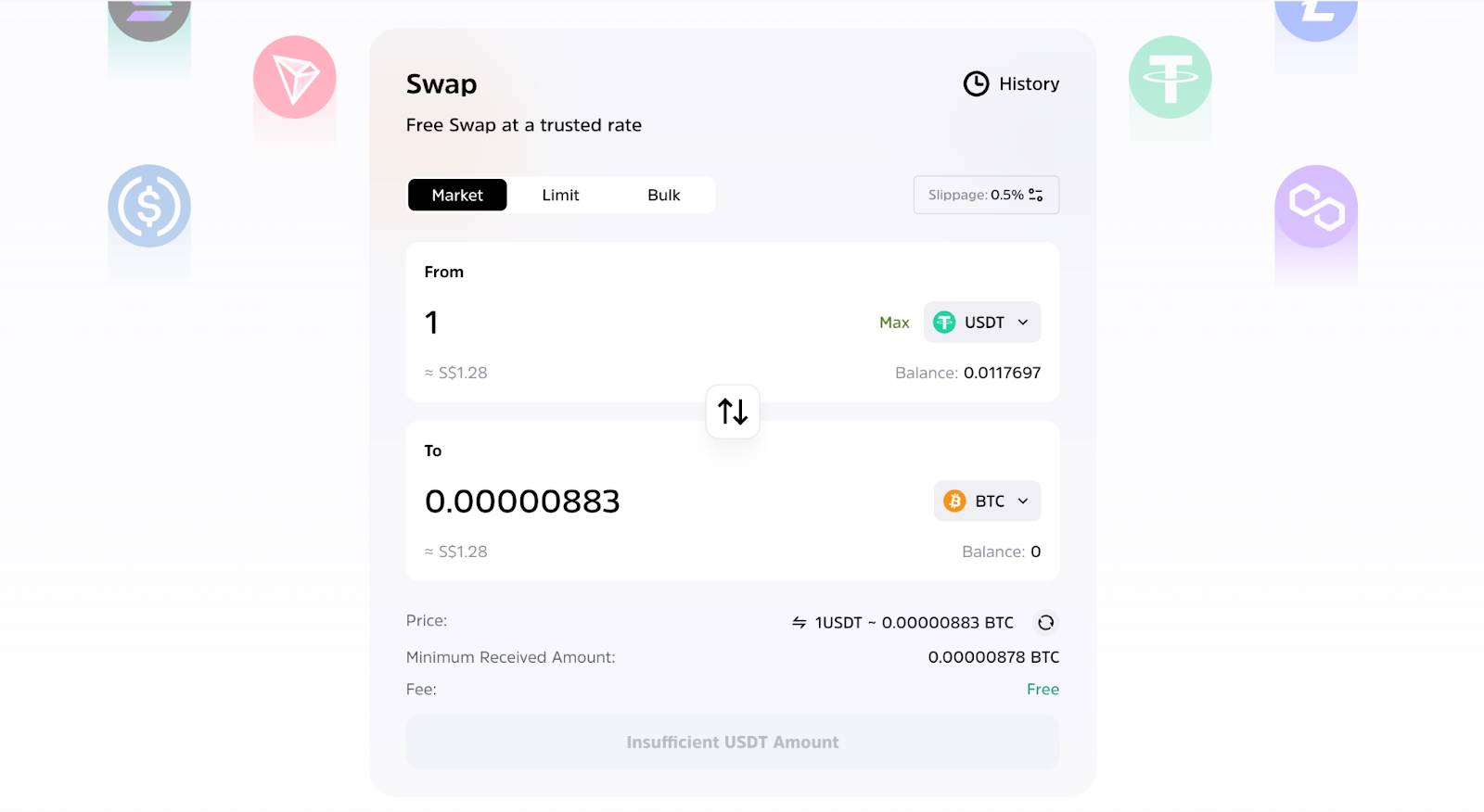

Optimized Trading Experience: Smoother, Simpler, More Efficient

The core function of a wallet is asset transfer. Cwallet’s built-in instant swap supports over 60 blockchains and 1,000+ assets, aggregating liquidity from major CEXs and DEXs to deliver optimal pricing, instant execution, and deep liquidity. Notably, swaps incur no service fees or minimum trade limits, further reducing transaction costs and increasing user freedom.

In today’s context where Web2 users want to enter Web3 and Web3 users want to exit, Cwallet strives to break down barriers between Web2 and Web3 assets, enabling users from any country to manage crypto assets as conveniently as operating a local bank account.

Fiat on/off-ramps are key to directly linking Web2 and Web3. Through the Buy & Sell section, users can easily convert fiat to crypto or vice versa, achieving seamless transactions. Today, this service covers over 150 countries and regions, supports more than 100 major fiat currencies (e.g., USD, HKD, THB) and over 50 payment channels (including PayPal, Apple Pay, Google Pay, Visa, Mastercard), allowing direct purchase of over 500 cryptocurrencies.

This comprehensive service makes Cwallet an efficient and secure bridge between the Web3 world and traditional finance, enabling global users to truly experience transactional convenience and freedom.

From Meme and XStocks to Gaming: Exploring Diversified Markets with Fun-Driven Engagement

After establishing basic cross-asset transactions between Web2 and Web3, Cwallet aims to make trading richer and more efficient. The recently launched Meme Market and XStocks trading represent two major initiatives in diversifying asset offerings.

The Meme Market allows users low-barrier access to popular Memecoins, enabling direct purchase with crypto or even fiat—delivering a "see-it, buy-it" one-stop experience.

XStocks Trading brings traditional financial assets into the crypto world, allowing users to trade cryptocurrencies and U.S. stocks side-by-side on the same platform. For users familiar with traditional finance, this intuitive interface enables quick adoption and faster integration into the crypto market.

While expanding the range of tradable assets, Cwallet is also actively introducing more engaging and entertaining interactive mechanisms. The newly launched price prediction feature in August, “Trend Trade” and “Market Battle,” serves as a key enhancement, transforming otherwise dull price fluctuations into lightweight, real-time, competitive, and immersive experiences—allowing users to explore the crypto world in a low-barrier, gamified way.

Trend Trade is a fast, low-entry game: users can participate with as little as 1 USDT, predicting whether the prices of over 20 cryptocurrencies—including $BTC, $ETH, $DOGE, and $SOL—will rise or fall. Outcomes are based on real-time market data, and correct predictors earn rewards.

If Trend Trade reflects individual judgment, then Market Battle is a duel of two opposing forces: two users bet on the short-term price movement of the same asset, with the winner taking the entire prize pool.

"Trend Trade" and "Market Battle" are key moves by Cwallet to gamify the crypto experience, lower entry barriers, and attract more new users to explore the ecosystem.

These features not only enrich trading dimensions within acceptable risk levels but also represent Cwallet’s proactive effort to reduce participation barriers in crypto through gamification, drawing younger generations into understanding and engaging with blockchain.

Cozy Card: From Crypto Niche to Mass Consumer Payment World

On consumer-level use cases, the Cwallet team holds a straightforward vision:

"We believe truly great products should be instantly usable even by ordinary people in countries with underdeveloped financial systems. Simply put, we want Indonesian users to be able to buy fried chicken with crypto."

For a wallet, trading and finance are basics—but enabling crypto assets to enter everyday life is the ultimate test. Cozy Card, Cwallet’s crypto payment card, is central to realizing the vision of "letting Indonesians buy fried chicken with crypto."

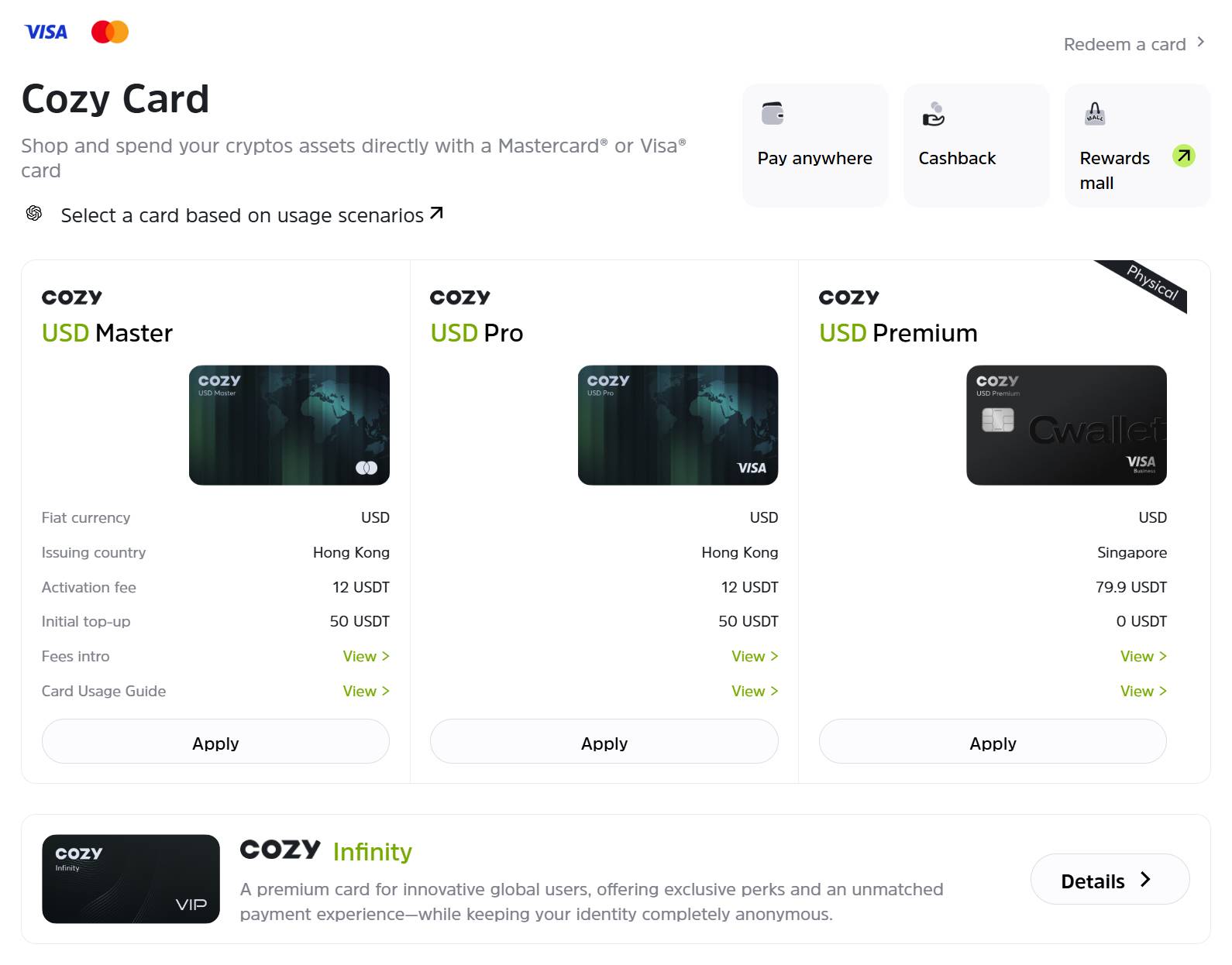

As a virtual debit card issued by Cwallet, Cozy Card supports direct spending using multiple cryptocurrencies including USDT, USDC, BTC, ETH, XRP, SOL, TRX, BNB, DOGE, ADA, LTC, and DAI. It also integrates with major payment platforms such as Google Pay, Alipay, WeChat Pay, PayPal, and Apple Pay. Users simply top up funds to the card and can spend at any merchant accepting Visa/MasterCard—no need to pre-convert to fiat, making cross-border or instant transactions seamless.

Cwallet enables Cozy Card with broad payment scenarios, allowing cardholders to effortlessly pay with crypto whether at home, traveling, shopping at supermarkets, or buying coffee (availability may vary slightly by version—details confirmed at time of card issuance).

Meanwhile, compared to potential frozen account risks from P2P withdrawals, Cozy Card offers a more direct and flexible payment experience.

Cozy Card maintains clear fee advantages: top-up fee only 1.6%, cross-border transaction fee 1.5%, regular transaction fee 0%, monthly fee 0, further delivering a low-cost, low-friction global payment experience.

To meet diverse needs, Cwallet offers multiple versions of Cozy Card: virtual cards include USD Master, USD Pro, and Cozy Infinity; physical card is USD Premium. Consumers can choose according to their needs, experiencing the charm of crypto payments and becoming "innovation pioneers" in the widespread adoption of crypto payments.

Traffic Gateway + Financial Ecosystem: Cwallet’s Continuous Evolution

From the 1.0 version’s Telegram Bot acting as a "social payment newcomer" accumulating initial traffic and reputation;

To the 2.0 upgrade into a full wallet platform, proactively responding to community needs, steadily growing users, and lowering barriers through enhanced tools;

To now accelerating into an all-in-one financial hub via C2C markets, Earn, Lending, Cozy Card, and increasingly rich trading modules—the evolutionary path of Cwallet 3.0 becomes clear: from wallet traffic gateway to one-stop financial ecosystem.

Throughout this journey, centered on users, Cwallet’s evolution never stops.

Looking ahead to Q4 2025, we see a clear roadmap emerging from Cwallet’s future plans:

-

Launch the perpetual contract (Perp Trading) engine, empowering every user to become a "professional crypto hunter"

-

Continuously expand spot trading (Spot Trading) functionality, building a comprehensive, high-performance "trading home ground"

-

Deeply optimize on-chain yield (On Chain Earning) strategies, enabling users’ assets to achieve "endless wealth generation"

-

Build a full-featured instant messaging (IM) system, advancing platform socialization and enabling users to "earn money while chatting"—a brand-new experience

All plans align with the goal of creating more usable, practical, and feature-rich products, consistent with Cwallet’s "user-first" positioning.

The massive scale of 37 million users strongly validates Cwallet’s success in adhering to "user-centricity," implementing "deep market penetration," and building a "one-stop financial ecosystem."

As each item on the roadmap rolls out, where will Cwallet’s next evolution lead?

"Our entire team embodies a deeply ingrained product and engineering mindset. From engineers to operations, every piece of feedback drives Cwallet’s self-renewal. Evolution has no end—our best is always at the next stop. We’ll keep striving for relentless iteration."

This is Cwallet’s answer to infinite evolution ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News