Fun fact: The first DApp on Ethereum was a prediction market

TechFlow Selected TechFlow Selected

Fun fact: The first DApp on Ethereum was a prediction market

Initially, it was a product of extremely rich imagination.

By Eric, Foresight News

In recent days, while compiling a list of Web3 prediction markets, I suddenly remembered Augur. After searching for related information, I found that Augur announced its revival in March this year—yet I had no idea when it actually ceased operations.

The reason this struck me is because Augur was the subject of my very first article as a translator in this industry. The article was published on March 19, 2019. I still remember being asked to add personal insights beyond mere translation. I also recall using the movie poster of *The Butterfly Effect* as the cover image for that WeChat article, because my interpretation was that prediction markets have the power to change the future.

I don’t know whether that casual thought from over six years ago could be called prophetic, but my view on why today’s leading Web3 prediction markets are approaching a valuation of nearly $10 billion remains unchanged: when an event will inevitably have a definite outcome, and economic interests are tied to betting on that outcome, the act of betting itself gains both the ability and motivation to alter the final result.

The First DApp and First ICO on Ethereum

Augur is unmatched in terms of "being early." Since Ethereum is a permissionless network, it's hard to definitively prove whether Augur was truly the first DApp on Ethereum—but some things are certain. For example, Augur began development on Ethereum’s testnet even before the mainnet launched, and it was arguably the first project to genuinely capture the attention of the entire industry (then not yet called "Web3"), later inspiring numerous ecosystem projects. Although Augur officially launched in 2018, calling it “the first DApp on Ethereum” is hardly an exaggeration.

It is verifiable that Augur hosted Ethereum’s first successful ICO. The Economist’s 2018 article “Blockchains could breathe new life into prediction markets” mentions that Augur’s ICO took place in 2015—the exact timing was August 2015.

This timing is absurdly early: Ethereum’s genesis block was created on July 30, 2015, and the ERC-20 standard wasn’t formally proposed until November 2015. This means that when Augur initially sold its REP tokens, REP did not conform to the ERC-20 standard.

There are many versions circulating about which institutional investors participated in Augur’s legendary ICO, including names like Founders Fund, Pantera Capital, Blockchain Capital, 1confirmation, and Multicoin Capital—but I couldn’t find any authoritative sources confirming this.

The ICO raised over $5 million. In 2015, Bitcoin traded around $300–400, and Ethereum dipped as low as $0.40 that same month. Over eight years ago, one Reddit user, x_ETHeREAL_x, commented under a thread asking “What was the first ICO/ERC20 token to run on an Ethereum smart contract?” that there were no wallets or GUI interfaces at the time—people had to use command lines via the Geth client to send funds. Another user quickly corrected this: there was no Geth client back then; they likely used CPP Ethereum, a client developed by Gavin Wood, Ethereum co-founder and later founder of Polkadot.

A Pioneering Yet Terrible User Experience

Three years after its ICO, in July 2018, Augur officially launched.

At launch, Augur offered both a desktop application and a web-based interface. The desktop app existed because Ethereum nodes were sparse at the time, so embedding a full node locally might improve performance. The Guesser team, an Augur ecosystem project, described the design:

The Augur App is a lightweight Electron application bundling the Augur UI and Augur Node together, deployed directly onto your local machine. The Augur UI is a reference client (similar to Geth for Ethereum) that interacts with the core smart contracts of the Augur protocol on the Ethereum blockchain. The Augur Node is a locally running program that scans Ethereum’s event logs related to Augur, stores them in a database, and serves the data to the Augur UI.

While other early projects like Crypto Kitties (the first NFT project) and pure gambling apps like Fomo3D also emerged around that time, Augur remained the industry’s golden child. Beyond implementing a real on-chain prediction market, Augur also built its own decentralized oracle to report outcomes—an entire year before Chainlink’s oracle officially launched.

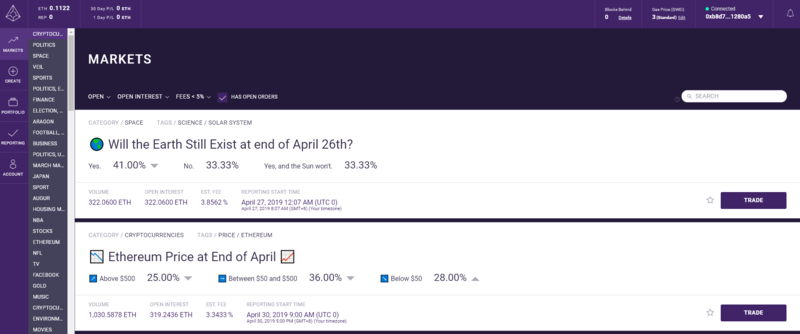

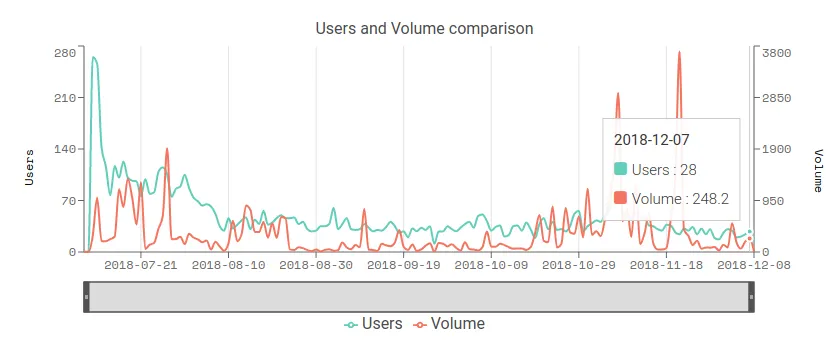

According to DappRadar, Augur reached a peak of 265 daily active users (DAU) at launch, but by August 8 that number dropped to 37, and by year-end, DAU fell below 30. As of December 11, 2018, Augur had seen 1,635 markets created, 11,825 orders placed, and 6,331 trades executed. During the 2018 U.S. midterm elections, it briefly saw over 200 trades in a single day. These numbers seem trivial today, but back then, they were considered solid results.

Besides, if you understand Augur’s implementation mechanism, the fact that dozens of people kept using it and thousands of orders were placed seems miraculous.

Saying Augur had a terrible user experience isn’t just about the poor state of tools like MetaMask at the time—Augur’s own design had fatal flaws. Unlike Polymarket, which uses arbitrage mechanisms to automatically balance probabilities, Augur required bets to match exactly one-to-one. In an era without market makers, you had to find someone who held the exact opposite belief.

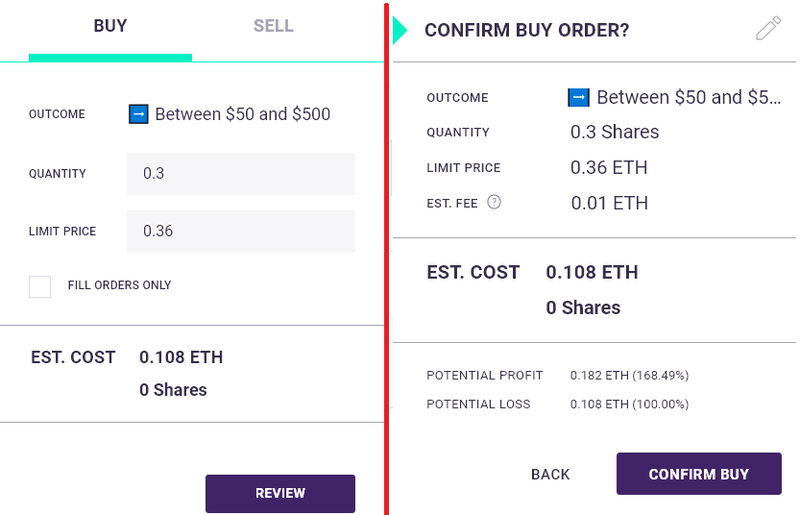

Take the second market shown in the trading interface above as an example: the bet is on ETH’s price at the end of April 2019, with three options—below $50, between $50 and $500, and above $500. If we select the second option, we see this page:

Users must choose shares and a limit price (probability). The figure indicates a bet of 0.3 shares at 36% probability that ETH will end between $50 and $500, costing 0.108 ETH total. Like Polymarket, Augur has an order book—but their meanings are entirely different.

The lowest sell price shown is 0.3605—not meaning someone believes there’s a 36.05% chance ETH won’t fall within $50–$500, but rather a 63.95% chance it won’t. So if you want to bet against it, you need to manually calculate the inverse probability, or your order won’t match. The previously placed bet requires another user who believes—or is willing to believe—there’s a 74% chance ETH won’t fall in that range to appear for a match, after which the winner takes the loser’s stake once the outcome is known.

This is where it gets confusing: Augur only allows a “yes” vote for each option. Users can either go long or short on “yes.”

Augur’s permissionless nature led to many invalid markets—for instance, setting an end date in mid-April. The oracle network allowed multiple challenges, causing some markets meant for quick settlement to drag on for nearly five months amid endless disputes before finally closing. Combined with the requirement to find perfectly matched opponents, only 6,331 out of 11,825 orders were ever filled.

Finally, costs on Augur were surprisingly high. Beyond gas fees and transaction costs for users unfamiliar with crypto who used fiat gateways, both reporters (who provide results via the oracle network) and market creators had to stake REP, and users paid fees to both parties.

Though market creators and reporters charged low fees (1–2%), users faced layered costs that added up significantly. These included reporting fees (0.01%), market creator fees (1–2%), Ethereum gas fees (variable based on order size), and fiat-to-ETH conversion fees (Coinbase charges 4% for debit card purchases, 1.5% for ACH). Total transaction costs on Augur ranged from 3.5% to 9%, sometimes higher.

Poor wallet UX, one-to-one matching, logical flaws, and high fees prevented Augur from scaling—but none of this diminishes its near-mythical influence in Ethereum and DApp history. Many of the developers behind Augur have since become key figures in the industry.

Internal Conflict and a $150 Million Lawsuit

Augur was launched by Forecast Foundation. Public records list its members as Jack Peterson (co-founder and core developer), Joey Krug (co-founder and chief architect), Jeremy Gardner (early marketing and community lead), Stephen Sprinkle (full-stack engineer handling frontend and contract integration), and Austin Williams (researcher who authored the game theory proofs in the whitepaper appendix).

Joey Krug has served as Co-CIO at Pantera Capital since June 2017 and is currently a partner at Founders Fund. Stephen Sprinkle left Augur in 2019 to join ConsenSys as a product manager, later becoming Engineering Director at BlockFi; after BlockFi restructured in 2022, he joined Coinbase focusing on institutional products.

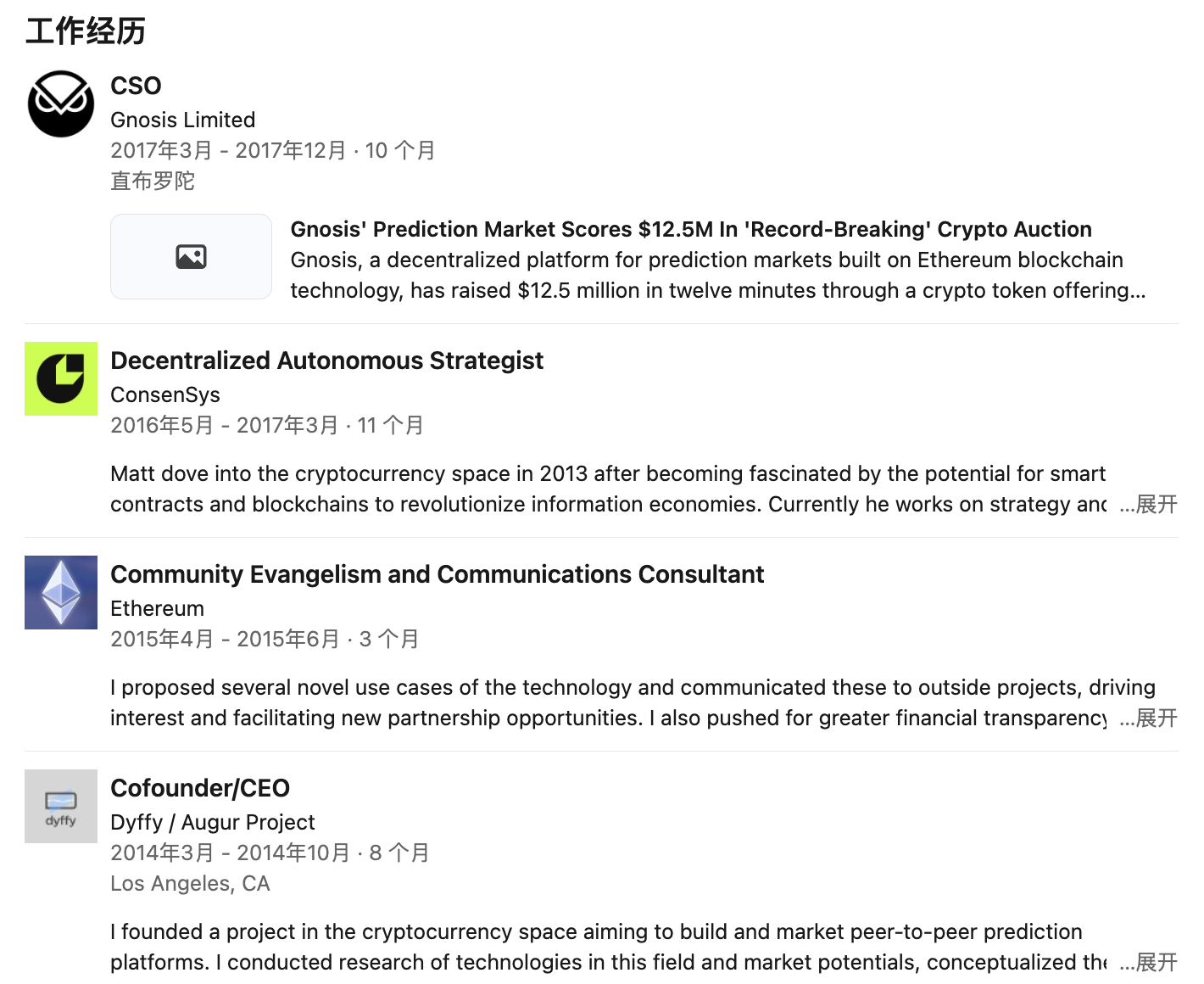

However, a 2018 lawsuit filed by Matt Liston revealed a pre-launch chapter in Augur’s story.

As reported by Blockchain News in 2018, Matt Liston claimed he originally registered a company named Dyffy in Delaware and hired Jack Peterson. At the time, Liston proposed building a blockchain-based prediction market, but Peterson initially opposed the idea.

Liston later came across Paul Sztorc’s Truthcoin whitepaper from Yale economist Paul Sztorc, believing it could serve as the foundation for a prediction market and token issuance. Liston successfully brought in investor Joseph Ball Costello and, through Paul Sztorc, convinced Peterson to support on-chain development. With this momentum, Liston hired Joey Krug and Jeremy Gardner—the latter suggesting the name “Augur.”

Over the following months, the team clashed over technical and business decisions, culminating in Matt Liston, the central figure connecting them all, being ousted in October 2014. Krug replaced Liston as director, and Peterson became CEO. In December that year, Forecast Foundation, a nonprofit based in Oregon, was established.

Liston alleged that Costello repeatedly pressured him to legally disavow Dyffy, acknowledge its acquisition, and exchange equity for cash or REP tokens. Under sustained pressure, Liston signed an agreement and, due to being “kept in the dark about the ICO’s specific allocation plan,” gave up 5% of REP in favor of $65,000 in cash. Based on Augur’s market cap at the time of the lawsuit, those forfeited tokens would now be worth over $20 million.

For Augur, then valued at over $450 million, Liston sought $38 million in compensatory damages and $114 million in punitive damages—totaling $152 million, more than a third of Augur’s market cap—and making it the highest claim in cryptocurrency history at the time.

The defendants were surprised Liston would reverse course three years after signing the agreement. Both Jack Peterson and Joey Krug denied Liston was a founder. Krug stated, “Liston has zero contributions in the GitHub repository or any other Augur codebase—he simply cannot be considered a founder of Augur.” Reports noted that doubts over his actual role left Liston struggling with unemployment; his LinkedIn profile shows no new positions after stepping down as Chief Strategy Officer at Gnosis in 2017.

According to insiders cited in the report, the core dispute stemmed from Liston advocating development on Ethereum, while the team insisted on Bitcoin. Ironically, Augur ultimately launched on Ethereum and became the first successful ICO on the Ethereum mainnet. Notably, there were no further public updates on the case afterward. Given that Augur operated until late 2021, the matter likely ended either in a quiet settlement or was dropped altogether.

Three and a Half Years of Silence, Then a Comeback

In March this year, Augur suddenly announced its return on X, the first post from that account since November 18, 2021.

In 2020, Augur released an updated v2 version, improving usability and other aspects. That July, Forbes called it “a major leap forward in the world of decentralized applications.” In the article *Ethereum’s First ICO Blazes Trail To A World Without Bosses*, journalist Michael del Castillo wrote: “Its functionality resembles the internet, but without trusted third parties. If successful, this profound upgrade wouldn’t just allow horse race betting without bookmakers—it could mark a turning point for the next-generation internet.”

Although Augur saw individual markets exceed $10 million in participation during the 2020 U.S. presidential election, DeFi’s explosive growth overshadowed it, and Augur ultimately collapsed at the peak of the 2021 bull market. Perhaps Polymarket’s resurgence brought prediction markets back into the spotlight after nearly a decade, prompting Augur’s new team to relaunch this year.

The revival will be led by two teams: Lituus Foundation will handle token and operational matters and develop the oracle, while Dark Florists will build the actual prediction markets. Lituus Foundation claims to consist of long-time Augur community members, though no details about its members are available.

Dark Florists is a notable Ethereum development team. Key members include Killari, who cracked an indistinguishability obfuscation scheme—a cryptographic method designed to turn programs into “black boxes” whose internal workings remain hidden—at Devcon 2024, winning a $10,000 bounty. Micah Zoltu gained fame in 2019 for discovering a critical vulnerability in MakerDAO and is also the author of EIP-3074 and EIP-2718.

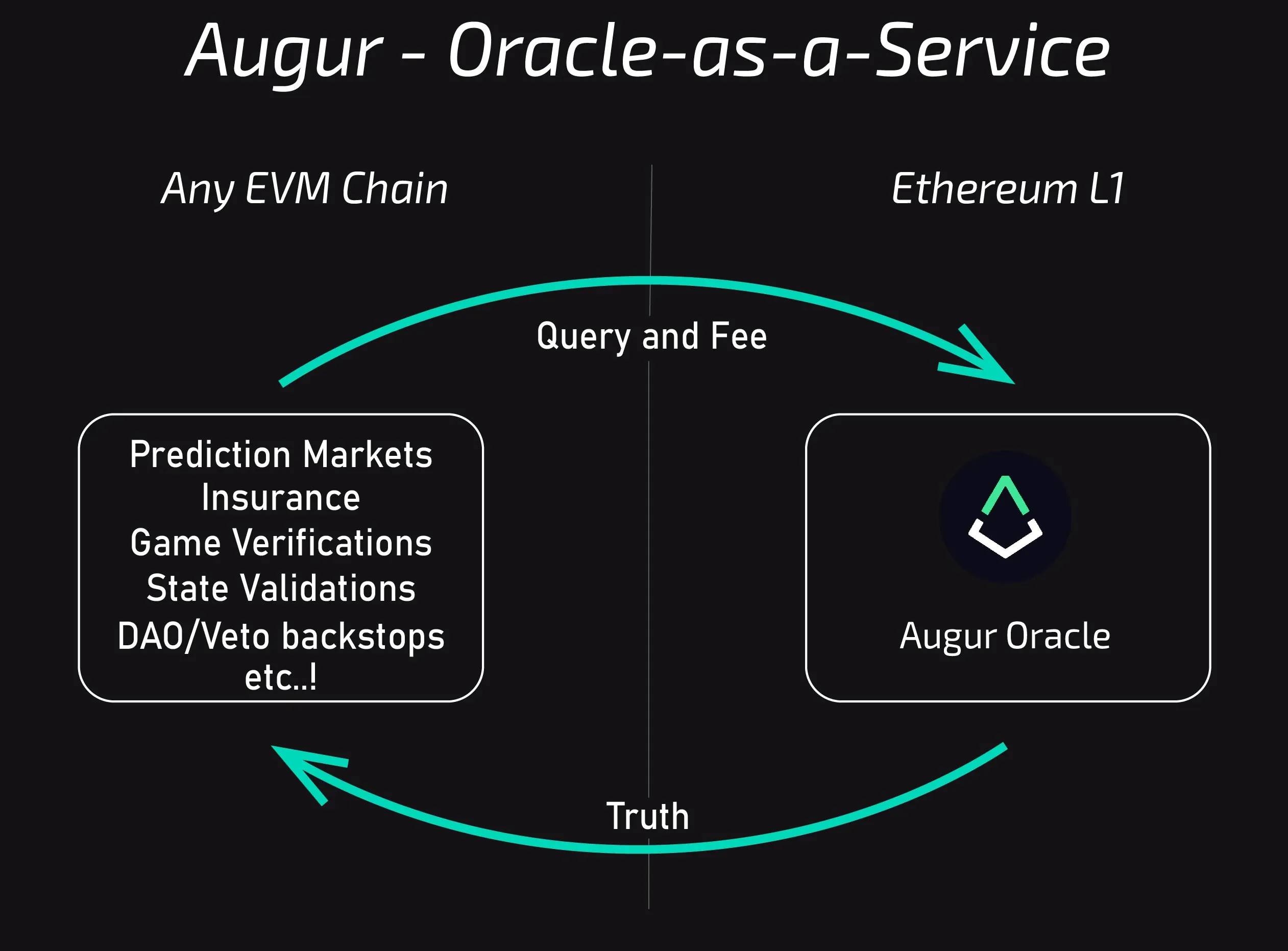

This team does not intend to launch a purely commercial platform. Instead, as Lituus Foundation puts it, they aim to create a cross-chain decentralized truth machine. They plan to decouple and modularize the oracle from Augur’s prediction market, allowing any application to use the Augur oracle.

From the beginning, Augur was designed as a fully decentralized application, relying on no multisig, admin keys, or fallback mechanisms. Even its token economics incorporated original game theory designs to ensure smooth operation through incentive alignment (this aspect wasn’t detailed earlier; interested readers can refer to the original Augur whitepaper and v2 update). The new Augur will uphold this spirit. Currently, the only confirmed details are that the new oracle will likely deploy on an L2, and the initial prediction market will be built on an AMM.

To date, Lituus Foundation has released two progress reports. In the first quarter after the relaunch announcement, Lituus increased REP holdings from 250,000 to 550,000 tokens, deployed $100,000 in liquidity on Uniswap v3, and planned CEX listings. In the second quarter, four key developments occurred:

-

Launched the website;

-

Oracle research is advancing along two complementary paths—one focused on consumer prediction markets, the other on enterprise-grade oracle use cases;

-

Micah Zoltu initiated a crowdloan to deliberately fund an algorithmic fork of REP, testing Augur’s core security model;

-

The foundation expanded its REP buyback program to 1 million tokens.

The algorithmic fork is a particularly interesting design, quite complex in detail. Here’s a simplified explanation:

In Augur’s design, “results” aren’t fixed. Augur allows REP stakers to dispute outcomes by voting. When disputes reach a threshold (2.5% of total staked REP), the system splits into two parallel universes, each representing a different outcome. REP holders must choose which universe they support and migrate their REP accordingly. If, after a dispute begins, the staked REP doesn’t meet the threshold within a given timeframe, participants backing the initial result receive rewards.

Micah Zoltu’s crowdloan aims to raise funds to bet on an obviously wrong outcome during a dispute—sacrificing some REP to test the mechanism’s enforceability. However, due to this test, plans to list on CEXs have been paused until the dispute is fully resolved.

Conclusion

“Time spares no one; even heroes meet dead ends.”

Vitalik Buterin, Ethereum co-founder, mentioned in his November last year article *From prediction markets to info finance* that he was once a loyal user and supporter of Augur. As Ethereum’s first ICO, Augur’s design still feels remarkably ahead of its time.

This foresight wasn’t just mechanical—it was rooted in an overly utopian premise. What were our discussions about prediction markets back then?

-

Farmers could create prediction markets on harvest-season weather to hedge against climate impacts on yield;

-

Use prediction markets to establish bug bounties and smart contract insurance;

-

Create incentivized opinion polls with conditional markets to guide policymaking (see Ethereum Foundation’s 2014 article);

-

Pair RealT (real estate tokens) with tokenized short positions on housing prices in prediction markets on Uniswap, allowing hedged positions to earn trading fees;

……

Today’s prediction markets are dominated by trading and arbitrage—that’s one approach, and perhaps currently the only viable one. We often complain that Web3 lacks innovation these days—but revisiting the thoughts of OGs from a decade ago, do we really have no room for innovation?

Web3 is a giant Polymarket. Once, we eagerly created new markets, endlessly fascinated. At some point, we shifted to market-making on order books, using bots to exploit millisecond gaps where probabilities didn’t sum to one, or profiting from stop-loss/take-profit orders before market resolution. Suddenly, everyone seemed to lose the courage to launch a new market—to bet on a bigger future.

The article I translated six years ago mentioned the “3P theory”: Predict the future, Prepare for the future, and Persuade toward the future. Back then, I wrote a line I’ve long forgotten: decentralized prediction markets lay out every possible parallel timeline before you. Everyone has the right to choose which door to step through into the future. The more people participate in choosing, the greater the chance of guiding time toward a more distant horizon.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News