TACO Trading Resurfaces: When Trump's "Game of Chicken" Becomes a Deadly Swing for Crypto Markets

TechFlow Selected TechFlow Selected

TACO Trading Resurfaces: When Trump's "Game of Chicken" Becomes a Deadly Swing for Crypto Markets

Uncertainty is the only certainty.

Introduction

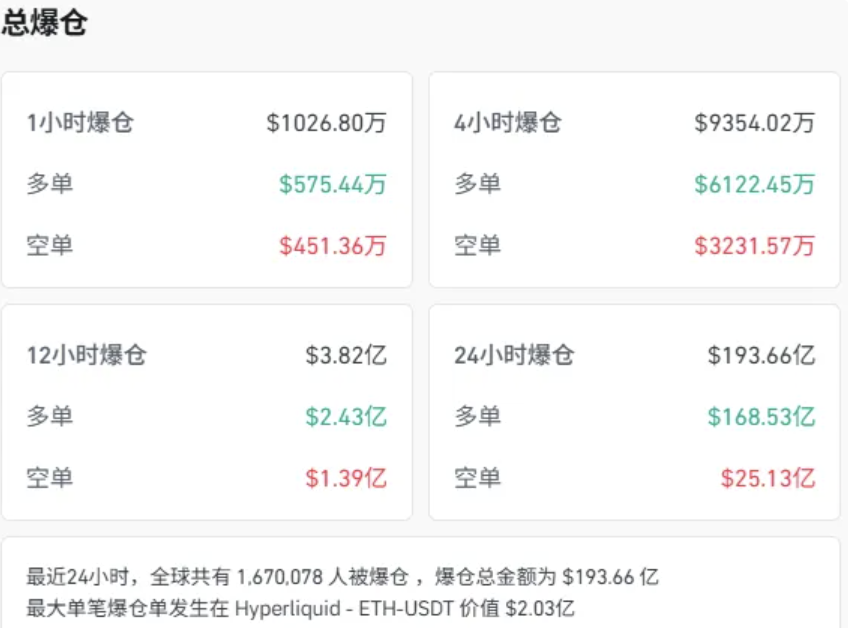

On October 11, 2025, the crypto market experienced a historic bloodbath, with various crypto assets plummeting overnight. Bitcoin briefly crashed by 15%, Ethereum dropped over 20%, and many altcoins fell more than 70%. According to Coinglass data, within just 24 hours, total liquidations across the entire network reached as high as $19.3 billion, with over 1.67 million investors liquidated—wiping out more than $500 billion in market value from the global crypto market, setting a new record in cryptocurrency history.

Data source: Conglass, Date: October 11, 2025

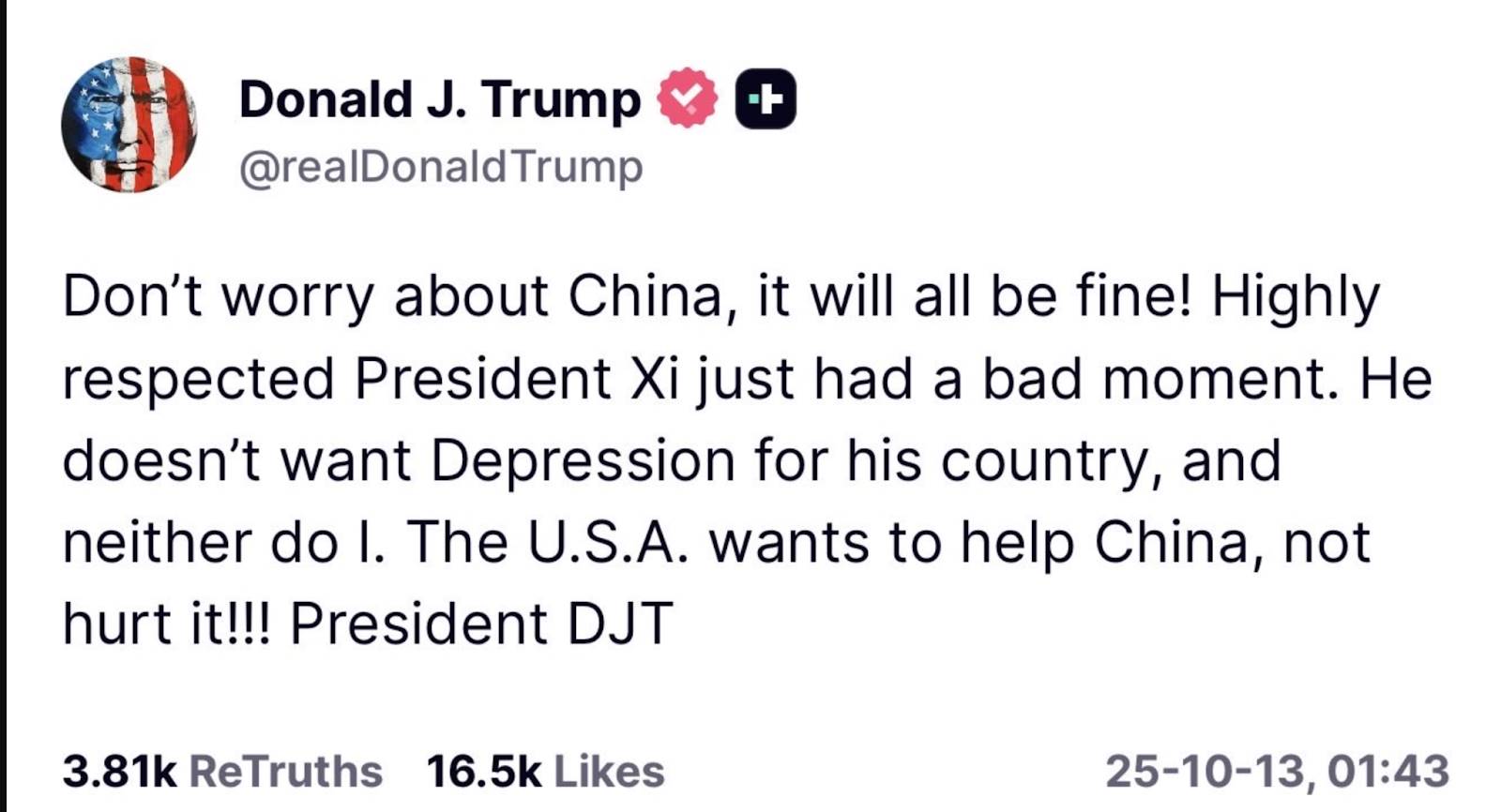

The trigger for this storm was widely attributed to a social media post by U.S. President Trump, claiming he would impose a 100% tariff on all Chinese goods. However, as the script has repeatedly played out before, shortly after triggering extreme market panic, Trump quickly shifted tone and signaled that he would pursue peace talks with China. Market sentiment rebounded after the crash, with Bitcoin recovering above 11,000 and major cryptocurrencies generally rebounding over 10%.

This is no random market fluctuation, but rather another classic execution of what veteran traders call the "TACO" (Trump Always Chickens Out) strategy. In this article, Bitget Wallet Research will deeply analyze the origins and mechanisms of this strategy, and explore how it continues to shake global financial markets—including the cryptocurrency sector.

1. Decoding "TACO": A Game of Chicken That the Market Has Already Seen Through

The so-called "TACO" strategy is an abbreviation of "Trump Always Chickens Out," literally meaning "Trump always backs down." The term was first coined by Financial Times columnist Robert Armstrong to describe Trump's erratic behavior in major decisions, especially regarding tariff policies. The core logic is this: when a policy triggers severe market volatility or economic pressure, the U.S. government often swiftly retreats.

Source: Trump’s Truth Social posts (left: Trump threatens tariffs; right: Trump softens stance)

The "TACO" strategy typically follows a clear market transmission channel:

Release extreme threats → Trigger market panic selling → Withdraw threats at the brink of market collapse → Market rebounds aggressively

For traders, this nearly transparent script creates massive volatility and gives rise to unique trading patterns. Every panic-driven dip may be seen by savvy speculators as a prime buying opportunity—betting precisely on the fact that Trump won’t actually “pull the trigger.” This pattern is not isolated. Looking back at history, we can clearly see its repeated echoes.

2. Echoes of History: The Script Was Written Long Ago

This high-stakes game of brinkmanship is not playing out for the first time. Over the past several years, traces of the TACO strategy have been visible everywhere—from U.S.-Mexico trade disputes to Sino-U.S. trade tensions—and various asset classes have danced accordingly, forming highly regularized response patterns.

Data note: Data in the table is compiled from publicly available historical sources. Due to policy announcements typically being timed in U.S. Eastern Time, there are discrepancies across different measurement standards. Figures are approximate and intended only to reflect basic market trends.

From historical data, we can clearly observe that the Dow Jones Index, representing economic fundamentals, directly reflects immediate market expectations—falling upon threats and rising upon signs of easing. Gold plays a key role as a safe-haven asset, showing a clear negative correlation with market risk appetite. Meanwhile, in most cases, cryptocurrencies like Bitcoin are categorized as high-risk assets, moving broadly in tandem with U.S. equities but with greater volatility, exhibiting a pronounced "leverage effect."

However, more notably, as this script repeats itself, two subtle yet profound shifts have begun to emerge in market behavior.

First, market reactions have evolved from passive responses to active anticipation. A key piece of evidence is that in recent events, gold prices did not fall back as they previously did following de-escalation signals, instead remaining elevated. This suggests that market concerns over long-term policy credibility and uncertainty now outweigh short-term optimism brought by positive news. Bitcoin’s price action further confirms this: its price began rising ahead of the official easing announcement, already pricing in the reversal expectation, which weakened upward momentum once the good news was confirmed. This shows traders have learned to "front-run"—making the game more anticipatory and complex.

Second, these events highlight Bitcoin’s complex dual nature in the current phase, dynamically swinging between being a "risky asset" and "digital gold." Although during initial market panic, Bitcoin often falls alongside U.S. stocks, displaying pure risk-asset characteristics, its independent safe-haven function occasionally emerges—for example, in August 2019, it rose sharply in sync with gold despite a weak stock market. Such inconsistent behavior indicates that Bitcoin’s market identity remains fluid. Its reaction to geopolitical shocks depends on prevailing market consensus, capital flows, and the nature of the shock itself—and this very volatility is one of its most defining features today.

3. The New Normal for Crypto Markets: When "Governing by Tweet" Becomes Alpha in the Crypto World

The repeated enactment of the "TACO" strategy is profoundly reshaping the crypto market ecosystem, pushing its inherent high volatility to a new extreme.

The most direct impact of this strategy is a full upgrade in market dynamics. Fundamental analysis based on project metrics or on-chain data hasn't become obsolete—but atop it, a new high-frequency macro battleground dominated by "tweets" and "headline news" is quietly emerging, gaining increasing prominence. Notably, the main players in this arena are no longer just native crypto KOLs and whales, but now include deep-pocketed traditional finance (TradFi) capital and influential public figures. This shift isn't merely about changing participants—it's a clear signal that the crypto market is accelerating its integration into global macro narratives.

Under this new dimension, both structural opportunities and risks are amplified. The proliferation of algorithmic trading intensifies the market’s “knee-jerk” reflexes. Programmed models can detect information and execute large-scale trades within milliseconds, making instant “waterfalls” and “rocket launches” increasingly common on price charts. A single tweet posted late at night can trigger cascading derivative liquidations worth hundreds of millions of dollars by dawn in Asian markets—this is both the ultimate manifestation of risk and an inevitable arbitrage window born from the new structure.

But what truly warrants deep reflection is: what long-term consequences will this unique “boy who cried wolf” effect bring?

As traders grow accustomed to the “threat-reversal” script, the market’s initial reaction to similar negative news is gradually becoming numb, with dips often met by resilient buying pressure. Yet this very adaptation harbors a unique and massive risk for the crypto market: if an extreme policy is ever actually implemented without subsequent de-escalation, investors—who are used to contrarian strategies and lack circuit breakers or other buffers found in traditional financial markets—may be caught unprepared, facing devastating losses that could spiral into a full market collapse.

Looking ahead, as long as this political game of manufacturing crises to gain leverage persists, "TACO trading" will not disappear. Traders will increasingly focus on finding short-term opportunities within predictable volatility, shaping sharper and sharper "V-shaped reversals." At the same time, as market understanding of this pattern deepens, the game will grow more complex, with simple reversals potentially evolving into harder-to-predict composite patterns. In this context, winning in the market will no longer depend on predicting trend direction, but on accurately anticipating the timing of the "reversal."

4. Navigating the "Trump Noise": Survival Rules for Investors

Faced with such a volatile market, how should investors position themselves? First, respect leverage and manage risk. "TACO" market conditions are a "meat grinder" for leveraged contract traders. In news-driven extreme moves, any highly leveraged position can be wiped out instantly. Reducing leverage and maintaining ample margin is the primary survival rule for weathering volatility. Second, learn to rise above the noise and return to common sense. Rather than obsessing over predicting when the next reversal will occur, focus on the long-term value of projects. During panic, asking whether you're looking at a "discounted quality asset" or a "falling knife" matters far more than staring at candlestick charts. Finally, in practice, diversify your portfolio and implement multi-layered hedging. Don’t put all your eggs in one basket. Allocating assets of varying risk levels within your investment portfolio serves as an effective buffer against unknown risks.

Conclusion: Uncertainty Is the Only Certainty

At its core, the "TACO" strategy is a projection of geopolitical gamesmanship onto financial markets. From trade wars to crypto market crashes, it repeatedly proves that in today’s highly interconnected world—amplified by social media—a single individual’s words can unleash massive waves across global markets. It reminds us that what drives markets isn’t just cold economic data, but also greed, fear, and the unpredictable nature of human psychology.

For every investor navigating this environment, recognizing and understanding this pattern may not make you invincible, but it can at least help you stay clear-headed when storms hit and make more rational decisions. Because in this era, the greatest certainty might just be the uncertainty brought by macro politics itself.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News