What drives us to max out the leverage and go all-in on meme coins?

TechFlow Selected TechFlow Selected

What drives us to max out the leverage and go all-in on meme coins?

People would rather hold wif or some meme coins, feeling like part of a movement and getting an immediate sense of "being right" by aligning with others.

Author: Chilla

Translation: AididiaoJP, Foresigh News

Crypto market trading is evolving rapidly. The idea of making money easily is overwhelming structured strategies. This phenomenon may seem simple at first glance, but it is in fact far more complex and multifaceted.

It's not just the ever-evolving ecosystem driving this shift—sociological factors are also at play, which may be crucial to understanding future narratives.

Agency and Self-Control

Agency refers to our perception of ourselves as initiators of our own actions and their consequences. This is likely one of the main driving forces that draw people into trading, moving them away from working under others' instructions.

Ultimately, the goal is freedom and independence—achieving financial autonomy through our own decisions so we don't have to submit to someone else's will.

Few things allow for this kind of autonomy—entrepreneurship being one exception. And if you think about it, trading is something procedural, structured, and governed by clear rules—at least broadly speaking. By pressing a series of buttons and maintaining an underlying strategy, you can extract value from the market.

With internet-connected devices everywhere, and instant feedback on every trade, our sense of control grows stronger. This is where the concept of agency comes into play.

Through this process, the brain shortens the time gap between action and consequence, creating an illusion that we truly control what’s happening.

So what gives people a stronger sense of agency and self-control?

Meme Coins

We feel like masters of our fate when we immediately see the consequences of our actions—whether positive or negative expectation—unlike situations where results take time to materialize.

As strange as it may sound, the fact that structured trading requires time, effort, and long-term thinking makes it increasingly distant from what the new generation seeking attention actually desires.

Attention spans are shrinking. If results aren’t instantaneous, people lack the desire or time to sit down and backtest the outcomes of their work.

The result? A trend toward things users can immediately interact with—such as meme coins.

Since we’ve already experienced a dopamine rush after buying (or selling) a meme coin, why place a limit order to provide liquidity to the order book and wait? Dopamine itself delivers a stronger sense of control—even if only subconsciously. In reality, however, the opposite is often true.

Therefore, it’s no surprise that many traders prefer the frenzy of meme coin trading—coins with fleeting value but high perceived self-control—over slower, more structured strategies based on limit orders or mature assets.

But that’s not all. It’s a mix of multiple motivations, all pointing in the same direction. Neuroscience also tends to align with this trajectory.

The Neuroscience Behind Agency

Don’t marry your positions, right? Yes, we’ve heard KOLs say it so many times we should have internalized it by now. Yet this bias exists precisely because of the concept of embodiment.

Unlike mainstream tokens perceived as cold, distant, and institutional, direct—and almost physical—engagement with a niche coin that becomes a symbol of belonging or identity leads the brain (more than the wallet) to seek experiences offering immediate satisfaction and a stronger sense of self.

People would rather hold wif or some meme coin, feeling part of a movement and gaining an instant sense of “rightness” from social alignment, than spend hours refining their trading strategy in tedious detail.

Purchasing a coin provides immediate input and output: you act, you expect reward, and you get psychological satisfaction in the moment—waiting becomes boring.

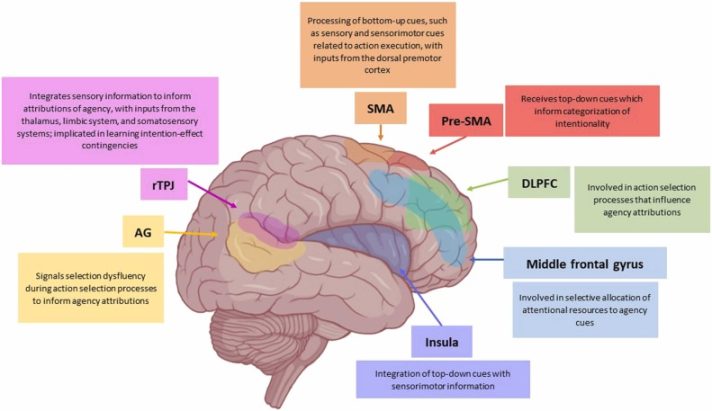

Image from "The sense of agency for brain disorders: A comprehensive review and proposed framework" by Rubina A. Malik, Carl Michael Galang, Elizabeth Finger

From a neuroscience perspective, this is closely tied to how the brain encodes agency. The feeling of “I caused this outcome” involves the premotor cortex, supplementary motor area, and anterior insula—regions that integrate intention, action, and outcome. When output is immediate, dopamine strengthens the link between action and reward, making the experience more satisfying and “right.”

In contrast, strategies with delayed outcomes fail to activate these circuits in the same way, reducing subjective self-control and making the process feel boring—or even “wrong.”

This resonates deeply with me.

Conclusion

Yes, the narrative around perpetual decentralized exchanges is spreading, but that doesn't invalidate the reasoning above. That case is actually a specific derivative of market conditions—where you receive direct rewards via trading points. If anything, it reinforces the argument made here.

What I'm discussing isn't meme coin trading per se, but a different mode of trading where the reward is the action itself—triggering a dopamine hit—not the pursuit of ultimate financial gain.

The sensory stimulation is the goal. Market makers win, users lose—but at least they’re engaged. At least they have the illusion of choice, since consequences follow immediately as a direct response to their decisions.

This is closer to going to a casino than building a strategy. But I shouldn't judge. I myself am far from immune—completely so.

Yet the resulting concept indicates a fundamental shift in the very idea of trading. In this shift, agency plays an increasingly central role.

In practice, emotion dominates reason.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News