Powell: Monetary policy faces "two-way challenges," no risk-free path

TechFlow Selected TechFlow Selected

Powell: Monetary policy faces "two-way challenges," no risk-free path

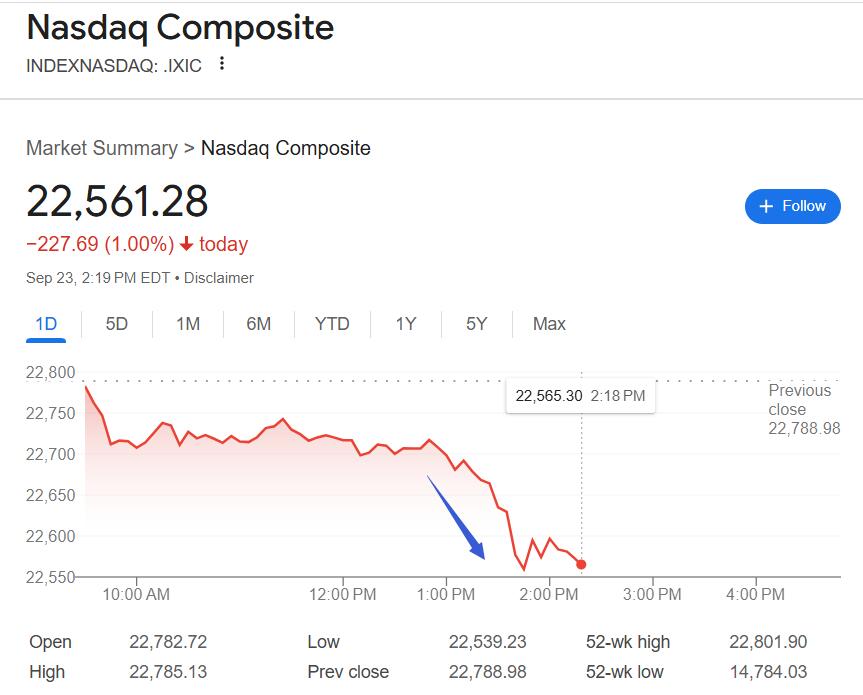

During the Q&A session, Powell warned that stock market valuations were too high, triggering a decline in the U.S. stock market.

By Li Dan, Wall Street Insights

In his first public speech since the Fed announced a rate cut last week, Fed Chair Powell left room for further cuts, just as he did at last week's press conference, and hinted at cautious easing amid challenging risks. During the Q&A session, Powell warned that stock valuations were too high, triggering a drop in U.S. equity markets.

In his speech on Tuesday, September 23, Eastern Time, Powell reiterated that both sides of the Fed's dual mandate—maximum employment and price stability—are under threat. These two-sided risks mean there is no risk-free policy path. If rate cuts are too large or too fast, they may fail to effectively contain high inflation, allowing it to persist above the Fed’s 2% target. Conversely, if monetary tightening lasts too long, it could unnecessarily hurt the labor market.

Powell noted, "Inflation poses upside risks in the near term, while employment faces downside risks—a challenging situation." With a "sluggish and somewhat soft labor market," the downside risks to employment have increased. It was precisely this rise in employment-related risks, shifting the overall risk balance, that led the Fed to decide on a rate cut last week.

On tariffs, Powell reiterated that the reasonable expectation is for tariffs to have a temporary effect on inflation, causing only a one-time price adjustment. However, a "one-time" adjustment does not mean it happens immediately—it could last several quarters. Powell still believes the Fed must closely monitor any persistent effects from tariffs, ensuring they do not evolve into sustained inflationary pressures.

Powell's remarks gave no indication of whether he would support another rate cut at the next Fed monetary policy meeting in October.

David Russell, Global Head of Market Strategy at TradeStation, commented that Powell is laying the groundwork for expected inflation increases due to tariffs in the fourth quarter. He said Powell is doing so to maintain flexibility in responding to political pressure from the Trump administration, while also calming public concerns by emphasizing that tariff impacts are temporary. Russell added:

"Powell doesn’t want to antagonize the White House, but he won’t yield either. He’s preserving flexibility to respond to potential future inflation pressures. Powell isn’t intentionally taking a hawkish stance, but he’s trying to avoid yielding to strong calls for aggressive rate cuts."

TechFlow: Powell Keeps Door Open for Rate Cuts, Indirectly Responds to Beisenthal Criticism

Nick Timiraos, a veteran Fed reporter known as the "New Fed Wire," observed that Powell's prepared remarks largely repeated what he said during last week’s press conference following the rate cut announcement. One notable point in this speech, compared to last week, was Powell’s assessment that despite the recent cut, the policy rate remains "moderately restrictive."

Based on this assessment, Timiraos believes it means that if Fed officials continue to view recent labor market weakness as outweighing inflationary pressures, there remains room for further rate cuts this year. In his view, Powell’s comments show he is keeping the door open for future easing.

U.S. Treasury Secretary Beisenthal criticized the Fed on September 5, arguing that institutional bloat and mission creep are the main reasons why the Trump administration questions the Fed’s independence. Timiraos pointed out that in this speech, Powell indirectly responded to such criticisms from Beisenthal and others.

Powell reviewed how the 2008 financial crisis and the 2020 pandemic forced the Fed to take extraordinary measures to prevent deeper economic crises. His conclusion was:

"Despite two unprecedented major shocks, the U.S. economy has performed robustly compared to other major advanced economies—and even better."

Stocks Hit Session Lows After Powell Says Equity Valuations Are 'Quite High'

During the Q&A after Tuesday’s speech, Powell stated that the U.S. labor market can no longer be considered solid—he now sees clear signs of material softening. Financial stability risks have not increased. The banking sector remains well capitalized, and household finances are healthy. Current financial stability risks are low.

On tariffs, Powell said they are not a significant factor for inflation. The transmission mechanism of tariffs is less pronounced than expected. Most forecasts suggest tariff effects will persist through 2026.

Powell believes certain asset prices are elevated relative to historical norms. By many measures, stock valuations are quite high.

When asked how much attention Fed officials pay to market prices and whether they are more tolerant of higher levels, Powell replied:

"We look at overall financial conditions and consider whether our policy is affecting financial markets in the way we intend. But you’re right—by many indicators, such as stock prices, valuations are currently quite high."

Powell believes businesses are hesitant because they don't know what to do. The U.S. economy is in a state of low layoffs and low hiring. A low-unemployment, low-employment economy is difficult for young workers.

On artificial intelligence (AI), Powell said it’s too early to assess its impact. AI will eliminate some jobs. Research shows AI is not a primary reason for slower hiring. Hiring slowdowns are partly linked to uncertainty around public policy.

Powell also stressed that the Fed’s monetary decisions are not influenced by partisan politics. Many people don’t believe this, he noted, criticizing claims that the Fed acts for political reasons as "baseless."

After Powell mentioned elevated stock valuations, the Dow turned negative, pushing all three major U.S. indexes into negative territory. Shortly after Powell finished speaking, the indices hit new session lows, with the Nasdaq down nearly 1.1%, the S&P 500 falling over 0.7%, and the Dow dropping slightly more than 100 points, or over 0.2%.

Full Text of Powell’s 'Economic Outlook' Speech

Below is the full text of Powell’s speech titled “Economic Outlook”:

Chair Jerome H. Powell’s Remarks at the Greater Providence Chamber of Commerce 2025 Economic Outlook Luncheon in Warwick, Rhode Island

Thank you. It’s great to be back in Rhode Island. The last time I had the opportunity to speak at the Greater Providence Chamber of Commerce was in the fall of 2019. At that time, I said, “If circumstances change materially, policy will respond accordingly.”

Who could have imagined that just months later, the COVID-19 pandemic would erupt? Both the economic landscape and policy underwent transformations far beyond what anyone anticipated. Alongside actions taken by Congress, the administration, and the private sector, the Federal Reserve’s decisive response helped prevent an economic blow of historic severity.

The world was already navigating a long and difficult recovery from the global financial crisis when the pandemic struck. These two global crises have left deep scars, with lasting consequences. Across democratic nations, public trust in economic and political institutions has been tested. For those of us in public service, these turbulent times demand an even greater focus on fulfilling our duties responsibly.

During this period of upheaval, central banks like the Federal Reserve had to innovate policy tools to meet crisis challenges—not for routine economic management. Despite two unprecedented major shocks, the U.S. economy has performed robustly compared to other major advanced economies—and even better. As before, we must continue reflecting on these difficult years and drawing lessons, a process now over a decade in the making.

Looking ahead, despite major shifts underway in trade, immigration, fiscal policy, regulation, and geopolitics, the U.S. economy has demonstrated strong resilience. These policies continue to evolve, and their long-term effects will take time to fully emerge.

Economic Outlook

Recent data indicate a slowing pace of economic growth. The unemployment rate, though low, has edged up. Job gains have slowed, and downside risks to employment have increased. At the same time, inflation has risen recently and remains elevated. Over recent months, the balance of risks has clearly shifted, prompting us at last week’s meeting to adjust the stance of monetary policy toward a more neutral setting.

GDP growth in the first half of this year was about 1.5%, below last year’s 2.5%. The slowdown in growth primarily reflects a deceleration in consumer spending. The housing market remains weak, but business investment in equipment and intangible assets has grown faster than last year. As the September Beige Book, which gathers economic information from across the Federal Reserve districts, noted, businesses continue to cite uncertainty as affecting their outlook. Consumer and business confidence indexes fell sharply in the spring and have since rebounded somewhat, though they remain below年初 levels.

In the labor market, both supply and demand have slowed significantly—an unusual and challenging development. In this sluggish and somewhat soft labor market, downside risks to employment have increased. The unemployment rate rose modestly to 4.3% in August but has remained low over the past year. Employment growth slowed dramatically over the summer, averaging only 29,000 jobs per month over the past three months. This pace of job creation appears to be below the “neutral” level needed to keep the unemployment rate stable. However, other labor market indicators remain generally steady. For example, the ratio of job openings to unemployed persons remains close to 1. Measures of job openings and initial unemployment claims have also held roughly steady.

Inflation has declined significantly from its 2022 highs but remains above our 2% longer-run goal. The latest data show that total PCE prices rose 2.7% over the 12 months ending in August, up from 2.3% in August 2023. Core PCE prices, which exclude the more volatile food and energy components, rose 2.9% over the past 12 months, also above year-earlier levels. Goods prices, which fell last year, have begun to rise again and are now a key driver of inflation. Available data and surveys suggest these price increases largely reflect higher tariffs rather than broader pricing pressures. Service-sector inflation, including shelter costs, continues to trend downward. Shorter-term inflation expectations have generally risen this year amid news about tariffs. However, most longer-term inflation expectations over the next year or so remain consistent with our 2% inflation objective.

The overall economic impact of major changes in trade, immigration, fiscal, and regulatory policies remains to be seen. The reasonable expectation is that the effect of tariffs on inflation will be temporary—a one-time price adjustment. A "one-time" adjustment does not mean it happens immediately. Higher tariffs may take time to ripple through the entire supply chain. Thus, a one-time increase in the price level could last several quarters, leading to somewhat higher inflation over that period.

Nonetheless, uncertainty about the inflation outlook remains high. We will carefully assess and manage the risks of higher and persistent inflation. We will ensure that this round of price increases does not become a sustained inflation problem.

Monetary Policy

Recent risks tilt upward for inflation and downward for employment—a challenging situation. Two-sided risks mean there is no risk-free path. If monetary policy is eased too much, we may fail to control inflation effectively and may need to tighten policy later to achieve our 2% inflation goal. If policy remains restrictive for too long, the labor market could weaken unnecessarily. When these objectives conflict, our policy framework requires maintaining balance in pursuing our dual mandate.

The increased downside risks to the employment outlook have shifted the balance of risks. Therefore, at our last meeting, we decided to move further toward a more neutral policy stance by lowering the target range for the federal funds rate by 25 basis points to 4% to 4.25%. I believe the current policy stance remains moderately restrictive, but it allows us to better respond to changing economic conditions.

Our policy is not on a preset course. We will continue to determine the appropriate stance of policy based on incoming data, the economic outlook, and the balance of risks. We are committed to supporting maximum employment and returning inflation sustainably to our 2% goal. Achieving these goals is essential for all Americans. We recognize that our policy actions affect communities, families, and businesses across the country.

Thank you again for inviting me today. I look forward to our discussion.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News