Why couldn't Powell's dovish remarks support the cryptocurrency prices?

TechFlow Selected TechFlow Selected

Why couldn't Powell's dovish remarks support the cryptocurrency prices?

Deep reflection behind Bitcoin's "capricious decline."

Author: Joakim Book

Translation: Tim, PANews

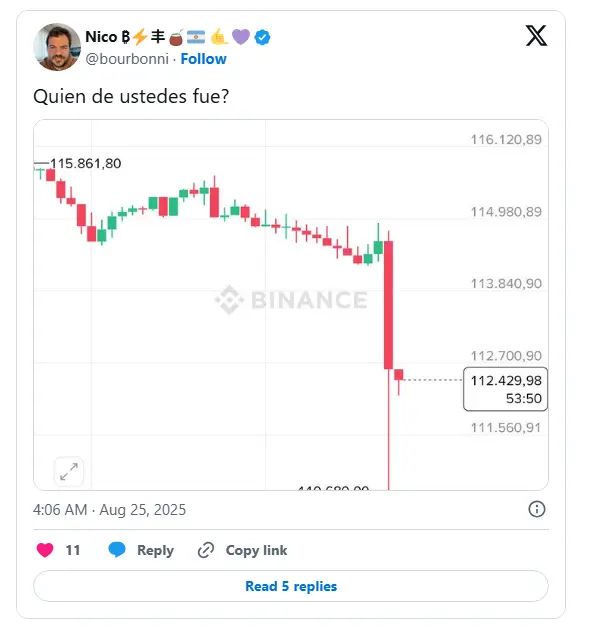

On Sunday night, Bitcoin crashed sharply with a large bearish candle; even stranger, on Monday morning Bitcoin continued to fall, dropping below $111,000.

In the world of Bitcoin price analysis, it's often said that no one knows why prices move. But sometimes we can spot clues—just not as clearly or conclusively as we'd like. Today I'll examine two things: the market turbulence over the past 24 hours and Chairman Powell’s weekend remarks.

The Unruly Nature of Bitcoin Prices

Sunday night in European time was truly nerve-wracking:

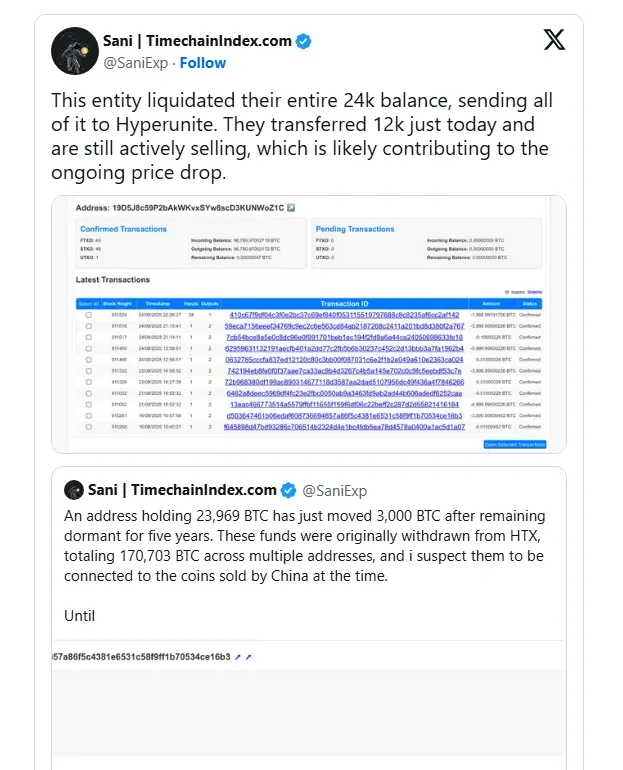

When Bitcoin moves like this, it's hard to claim "nobody knows" the reason. A nearly $3,000 drop within minutes surely has someone behind it who knows exactly what happened. Absent specific macro events like last week, only two scenarios can crash order books this fast: massive sell orders or (essentially equivalent) large-scale liquidations.

Yesterday, signs pointed to both:

Or

This is an immature market—we are so small, Bitcoin's liquidity so absurdly low, that we remain vulnerable to manipulation by individuals. (As usual in the Bitcoin world, some fools always try to spin obvious bad news into something positive.)

Last night’s instant 2.5% Bitcoin drop may have been a one-off event triggered by whale selling or liquidation, but the diagonal decline overnight into Monday morning (with Bitcoin falling below $111,000) is more concerning.

Never mind the restless whales—but then another plunge followed. What exactly is going on? It should be surging upward, yet it’s slowly bleeding down. Good grief!

All global macro trends point upward: so why is Bitcoin moving downward in this range? Any rational assessment suggests its price should double or triple. (No, we didn’t break below $111,000 due to Metaplanet’s purchase announcement, or because of it, or any related factor.)

Bitcoin Moves on Whim, Altcoins Follow Suit

Bitcoin needs psychological therapy: its price action is entirely whimsical, ignoring market logic or rational evaluation. Even under the most optimistic bull conditions, it couldn't care less. I’ve heard this called the “maximum pain theory,” and even Saylor’s “million-dollar cost basis” averaging strategy seems ineffective.

One form of “magic tea leaf” reading (the 128-day moving average) tells us our Bitcoin Magazine Pro team’s current forecast is $108,500. So we might very well reach that level. Saylor and others have already sold their kidneys and chairs to buy Bitcoin—I wonder what they have left to sell.

Even scarier: altcoins will continue to decline, making new lows. Our exclusive explanation: all these altcoins—Mr. Bailey, CEO of BTC Inc, is one of the institutional operators running such projects—recently lost about $41 million. Earlier this spring he gorged on these coins; now he’s being forced to vomit them back up: some buried in liquidation-driven bear candles, others buried in slow, torturous time-weighted price declines.

One crypto OG seems to have realized this situation.

Bitcoin Price and Powell’s Moves

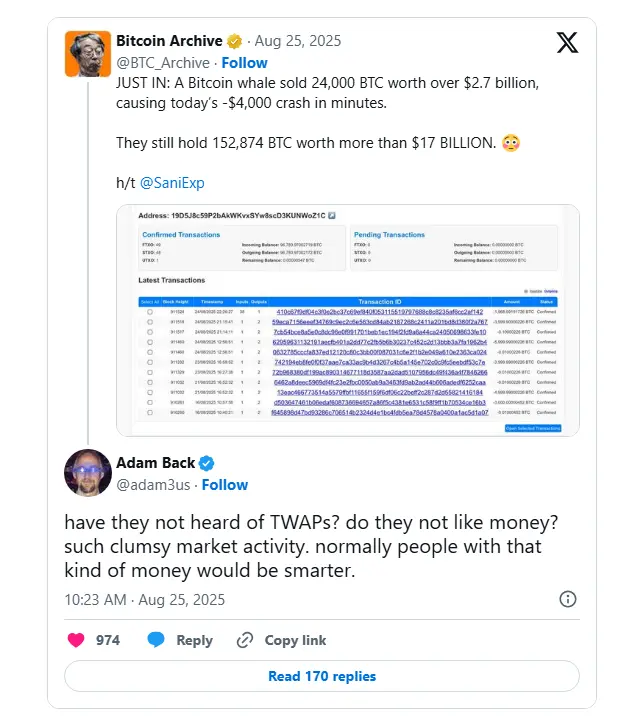

Sometimes we do (somewhat) know what’s happening in the market—like last Friday at 10 a.m. Eastern Time, August 22: the Fed website released its monetary policy framework statement and updated documents. The general interpretation was that looser monetary policy ahead had become inevitable. How do we know? Because every token spiked in that minute while the dollar index dropped immediately:

-

9:59:49: Bitcoin priced at $112,393, according to the Bitcoin Magazine Pro price chart.

-

10:00:49: One minute later, $113,459

-

Shortly after the announcement, Bitcoin surged to $115,000, a 2.3% gain.

This is exactly the kind of news that moves markets, and the instantaneous sharp movement gives us strong confidence about causality.

(Reference data: At 9:59, DXY at 98.7; two minutes later dropped to 98.15; one minute after that, down to 97.8. A 1% drop in seconds—such volatility in the dollar index is remarkable!)

Now we found the reason for the rise: Powell’s dovish remarks. Which part of his speech moved the market?

Data releases like inflation figures or the Bureau of Labor Statistics’ unemployment report trigger simple trading algorithms to instantly scrape websites for real-time updates and make immediate assessments, often leading to second-order trading effects. When humans and smarter systems step in, these moves typically reverse within ten, twenty, or even thirty minutes—ultimately amounting to nothing. But this time was different: Bitcoin remained elevated throughout the weekend (until Sunday when someone spoiled the party).

Powell’s Remarks Last Week

-

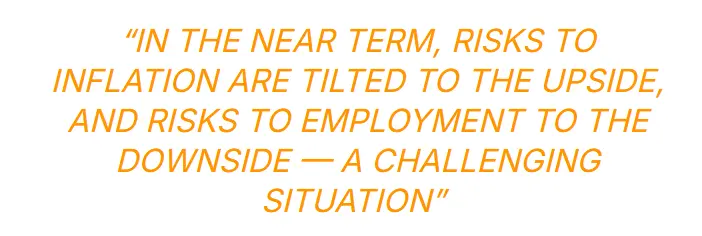

Inflation rose slightly but remains under control and is declining.

-

GDP growth has slowed significantly

-

Unemployment rate remains stable and balanced (but it’s a “strange balance”—supply and demand both falling) → overall risks rising.

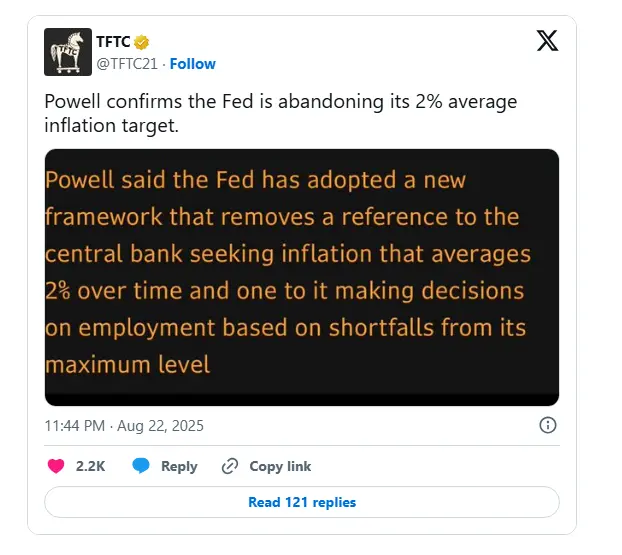

They will abandon the flawed plan regarding average inflation targeting (based on an unspecified time period).

However, Powell concluded that these risks “may necessitate adjusting our policy stance.”

In the minutes and hours following Powell’s speech and statement release, Bitcoin surged to $117,000 before pulling back to $116,000, indicating market participants were organically dissecting and assessing the significance of this new development.

The reason I stick to the idea that “nobody knows” is this: nobody can tell which part of Powell’s statement actually mattered, because new information always intertwines with market participants’ pre-existing expectations—and we almost never know precisely what those expectations were. When we engage in this kind of after-the-fact, makeshift interpretation, we’re essentially playing a game of post-hoc rationalization, which isn’t impressive at all.

All of this is so pathetic. What we need are wealthy Bitcoin players, not broke and stressed-out speculators.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News