Beyond Tokenization: From On-Chain to the Endgame of RWA Financialization with Liquidity

TechFlow Selected TechFlow Selected

Beyond Tokenization: From On-Chain to the Endgame of RWA Financialization with Liquidity

Moving stocks onto the blockchain is just the first domino.

Author: imToken

From BlackRock's entry to Robinhood's self-developed public chain, and Nasdaq's move into stock tokenization, the narrative around real-world assets (RWA) is already set. However, we must clearly recognize that putting stocks and bonds on-chain is merely the first domino in this sweeping transformation.

The true disruption does not lie in what we can "buy" on-chain, but in what new species and innovative use cases we can "create" using these assets carrying real-world value.

This article aims to further explore what comes next for RWA after tokenization, and why it holds the potential to spark a wave of narratives and innovations on par with DeFi Summer (see also: How Crypto Moves Toward an 'External Cycle': Why RWA Is Web3's 'Historic Bus'?).

Tokenization Is Just the Beginning

At its core, moving U.S. equities, gold, and other RWA onto the blockchain only completes the "digital encapsulation" of assets—solving issuance and cross-border transfer—but falls far short of unlocking their full potential.

Imagine a tokenized asset that sits idle in wallets, unable to be combined or reused; such an asset loses the composability advantage inherent to blockchain. In theory, integrating RWA should greatly enhance liquidity and unlock new value through DeFi operations like lending and staking.

It should inject high-quality, yield-generating assets into DeFi, strengthening the overall value foundation of the crypto market. This is reminiscent of ETH before DeFi Summer—it couldn't be lent out, used as collateral, or integrated into DeFi until protocols like Aave introduced functions like "collateralized lending," unleashing hundreds of billions in liquidity.

To break through this bottleneck, stock tokens must replicate this logic—turning dormant tokens into “live assets” that are mortgageable, tradable, and composable.

For instance, users could short BTC using TSLA.M, or bet on ETH’s price movement with AMZNX. These dormant assets then become functional margin collateral, and liquidity naturally emerges from real trading demand.

This is precisely the essence of moving from RWA to RWAFi. Yet unlocking real value requires far more than isolated technical breakthroughs—it demands a systematic solution encompassing:

-

Infrastructure layer: Secure asset custody, efficient cross-chain settlement, and on-chain clearing;

-

Protocol layer: Standardized tools enabling rapid integration for developers and asset issuers;

-

Ecosystem layer: Deep interoperability and coordination among various DeFi protocols including liquidity pools, derivatives, lending, and stablecoins;

This reveals that bringing RWA on-chain is not just a technical challenge, but a systemic one. Only by securely and accessibly integrating RWA into diverse DeFi scenarios can the existing value of traditional assets be truly transformed into incremental on-chain value.

Bringing Real Assets to Life: The Financialization Path of RWA

So where are we stuck now?

The biggest issue in today's RWA token market is no longer a lack of underlying assets, but a lack of liquidity structure.

First, the absence of financial composability.

In traditional U.S. equity markets, abundant liquidity stems not from spot trading alone, but from the depth created by derivatives such as options and futures. These instruments enable price discovery, risk management, and leveraged positions, supporting diverse strategies and attracting institutional capital. This creates a virtuous cycle: active trading → deeper markets → more users.

The problem is that today’s tokenized stock market lacks this critical layer. Most tokenized TSLA or AAPL shares can only be "held"—they cannot serve as collateral to borrow stablecoins on Aave, nor be used as margin to trade other assets on dYdX, let alone support cross-market arbitrage strategies.

Thus, while these RWA assets have arrived on-chain, financially speaking, they are not yet "alive." Their capital efficiency remains untapped, and their path into the broader DeFi ecosystem is blocked.

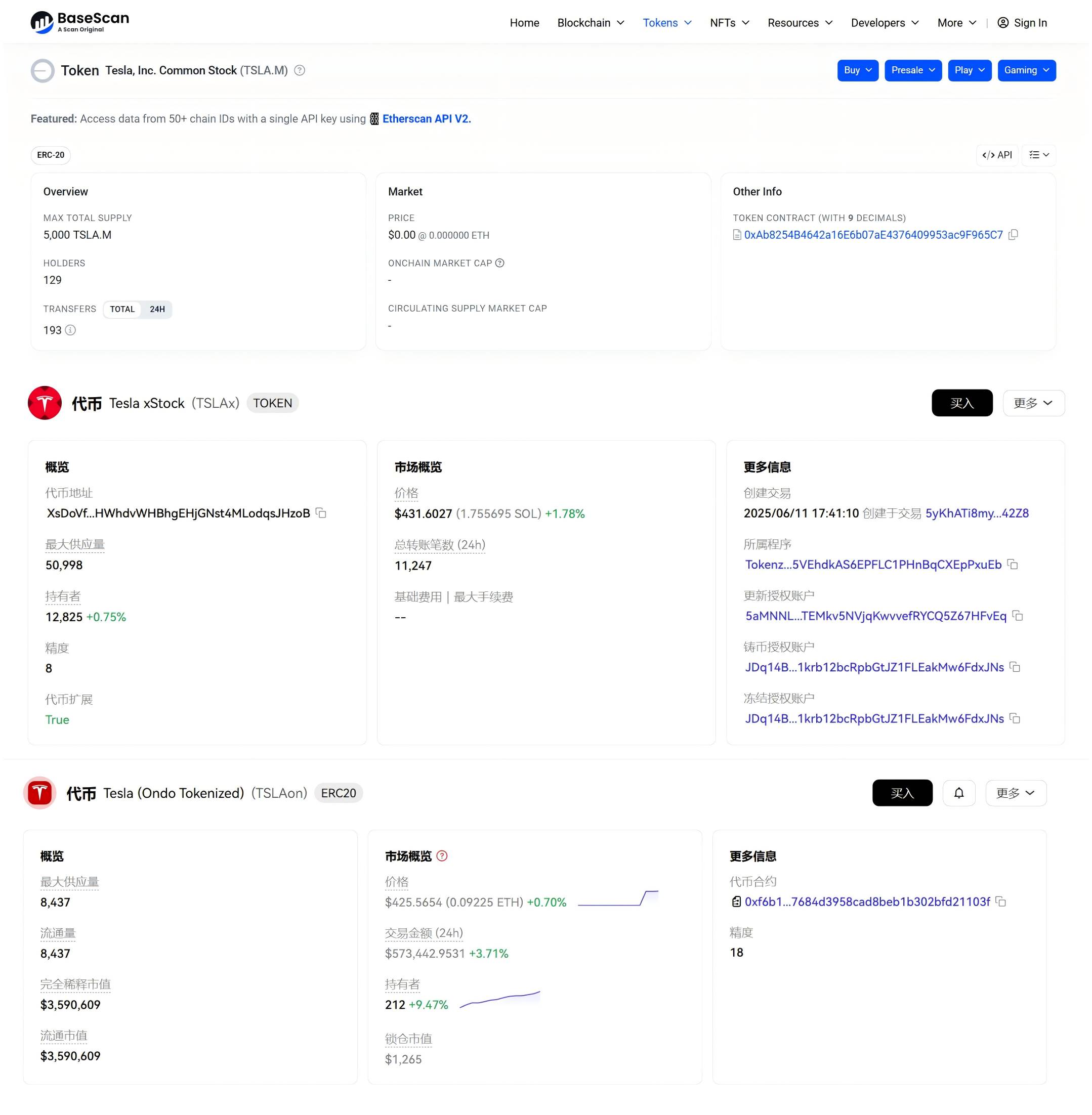

Note: TSLA.M from MyStonks, TSLAx from xStocks, TSLAon from Ondo Finance

Second, fragmented and broken liquidity.

This is an even thornier issue. Different issuers create separate, incompatible token versions based on the same underlying asset—for example, Tesla stock—such as MyStonks’ TSLA.M, xStocks’ TSLAx, and Ondo Finance’s TSLAon.

This "multi-issuer" landscape echoes the early struggles of Ethereum’s Layer 2 ecosystem—liquidity scattered across isolated islands, unable to converge into a deep pool. This severely dilutes market depth and creates major hurdles for users and protocol integrations, significantly hindering the scalable growth of the RWA ecosystem.

How to Complete the Missing Puzzle?

How do we resolve these challenges?

The answer lies in building a unified, open RWAFi ecosystem that transforms RWA from "static assets" into composable, derivable "dynamic Lego blocks."

This makes Nasdaq’s latest moves particularly noteworthy. Once top-tier traditional institutions like Nasdaq begin issuing official stock tokens, the trust issue at the asset source will be fundamentally resolved. Within the RWAFi framework, a standardized RWA asset can then be fully "financialized"—through collateralization, lending, staking, yield aggregation—and generate cash flows while anchoring real-world value on-chain.

Crucially, this financialization isn’t limited to highly liquid assets like U.S. stocks and Treasuries. Even fixed assets with poor liquidity and composability in the real world can be "activated."

Consider real estate—a notoriously illiquid asset in traditional finance. Once standardized and brought into the RWAFi framework, it ceases to be "real property" and becomes a dynamic financial component:

-

Lending participation: Serve as high-quality collateral for low-interest on-chain financing, unlocking dormant capital;

-

Automated yield distribution: Monthly rental income can be automatically and transparently distributed to all token holders in stablecoins via smart contracts;

-

Structured product creation: Separate property "appreciation rights" from "rental income rights" and package them into distinct financial products catering to different investor risk profiles;

This kind of "dynamic empowerment" breaks through the inherent limitations of RWA, injecting DeFi-native, higher-dimensional composability. Thus, Nasdaq’s stock tokenization is merely the first domino. Once they see success with equities, a wave of on-chain adoption will follow—from real estate to commodities.

Hence, the real explosion won’t come from the assets themselves, but from the derivative ecosystems built around them—collateral, lending, structured products, options, ETFs, stablecoins, yield instruments… All the familiar DeFi modules will be recombined and nested atop standardized RWA, forming an entirely new "Real-World Asset Finance (RWAFi)" system.

If DeFi Summer 2020 was a "money Legos" experiment centered on crypto-native assets like ETH and WBTC, then the next wave of innovation driven by RWAFi will be a grander, more imaginative game of "asset Legos" built on the entire spectrum of real-world value.

When RWA evolves beyond being just on-chain assets and becomes foundational building blocks for on-chain finance, the next DeFi Summer may well begin.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News