Misaligned incentives: Can traders escape the "dead man's charge" dilemma?

TechFlow Selected TechFlow Selected

Misaligned incentives: Can traders escape the "dead man's charge" dilemma?

This game centered on "trading volume" and "short-term speculation" will continue to consume the chips of the "dead man walking" teams.

Author: @0xuberM

Translation: Saoirse, Foresight News

Editor's Note: This article examines the current state of survival for Launchpads, creators, and traders through the lens of incentive mechanisms. It points out a vicious cycle where Launchpads prioritize trading volume, creators lack motivation to support token prices, and traders become "suicide squads." Currently, only VCs and insiders have incentives to push up token prices, leaving ordinary traders trapped. While the article does not offer solutions, it objectively presents the market reality and provides an important perspective on how crypto markets operate. Below is the translated content:

Incentive Mechanisms

Incentive mechanisms are the core driving force behind how the world works. If you want someone to do something, simply create an environment or scenario where they receive rewards for completing that task — this is a fundamental law of human nature.

However, currently, there is a lack of incentive mechanisms to drive price increases for on-chain tokens—especially those issued via Launchpads—and this issue urgently needs attention.

How Launchpads Operate

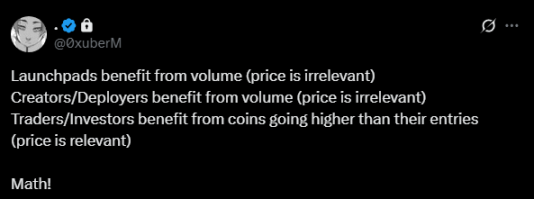

Yesterday I made a sarcastic tweet about this topic, but now I want to make one thing clear: token launch platforms (Launchpads) have no incentive to increase the price of any specific token, unless under certain special circumstances (which we’ll discuss later).

Their business model is essentially similar to a casino; for them, the only important metric is “trading volume.”

This is precisely why “permissionless issuance” and “bonding curves” (a mechanism that algorithmically adjusts supply, demand, and pricing) have become mainstream—they’re like casinos constantly introducing new lottery-style games. Platforms aim to provide as many speculative opportunities as possible, letting a few people “win big” to attract more participants.

So how do token launch platforms make money?

It’s simple: they profit merely by “existing.” On one hand, they provide permissionless token issuance for regular users; on the other, they offer investors speculative tools via bonding curves. To further scale, platforms must compete for market share, typically using two methods:

-

Marketing campaigns: either spreading negative rumors (FUD) about competitors or emphasizing their own “differentiation,” even when there’s no real difference in operations;

-

Driving up select token prices: seen as the “best marketing tactic,” quickly attracting user attention.

I’ve observed a pattern: Launchpad platforms and their teams only aggressively fight for market share in two cases: when they lose market share to competitors and need to reclaim it, or when they deliberately try to undermine a rival and damage its reputation.

Interestingly, whenever these situations occur, a small number of tokens on the platform start rising in price, sometimes reaching high valuations. They slow down mass token launches temporarily, using “green candles” (indicating price increases) and marketing to lure users in. Once users believe they can “make money here,” they restart massive token deployments, drastically increasing trading volume — none of this is criticism, just objective observation.

To be honest, if I were part of a Launchpad team, I’d likely use the same strategy. After all, platforms are businesses, and the core goal of any business is to maximize profits.

Creator Behavior Trends

Like Launchpad platforms, creators (e.g., streamers) also have no incentive to raise the price of their own issued tokens. Current creator revenue models closely resemble the “permissionless issuance” model — a setup that benefits creators just as directly as it benefits those who frequently issue tokens.

You’ve probably heard creators say: “Look, I can earn this much just by turning on my camera!” They use this narrative to attract more creators. More creators mean more token issuances, which in turn generate more speculative opportunities.

For creators, the profit logic is equally simple: just “exist” — turn on the camera, issue a speculative token, and earn. Of course, making serious money requires long-term persistence, but even then, sustained success isn’t guaranteed.

In the crypto space, user attention is fleeting, and long-term success is inherently uncertain. Under such conditions, creators easily fall into a “get-rich-quick-and-exit” mindset — an inevitable outcome of the current incentive structure.

Traders: The Trenches and Suicide Squads of Crypto Markets

What about us traders? What are our incentives, and what are we driven to do?

The answer is harsh: we are incentivized to “prey on each other.” After all, the “trenches” of crypto markets are dug by us (never forget that). The terms “trenches” and “suicide squads” carry clear meanings — ordinary traders like you and me are essentially “expendable cannon fodder,” soldiers on the front lines.

Since no party has an incentive for any asset’s price to rise sustainably, we’re forced into increasingly brutal forms of participation. There’s no player-vs-environment (PVE); only cutthroat competition and mutual harvesting.

Because upside potential for token prices is so limited, we resort to aggressive tactics to boost profit odds — such as using multiple wallets to pre-stake 10% of a token’s supply (“multi-wallet pre-staking”). In this market, “timing” is everything — you must enter early, or else risk becoming someone else’s exit liquidity and getting ruthlessly reaped.

You might ask: How can traders possibly profit? The answer is: we must work harder than others. Unlike Launchpad platforms and creators who profit effortlessly, we must continuously improve our skills, build industry influence, sharpen judgment, expand networks, and stay updated across multiple domains — only then do we stand a chance to earn.

Even when tokens surge in price short-term (like recent CCM tokens), we lack motivation to hold long-term because new “speculative opportunities” (like new lotteries) emerge quickly. The market “machine” must keep producing “lottery tickets” to keep running.

Every new opportunity comes at the cost of heavy losses for many traders, like trenches filled with fallen bodies. For example, for every account profiting from Axiom, hundreds more see their portfolios wiped out.

This may sound like complaining, but I’m also a participant in this “game,” so at best, I might be called a “hypocrite.”

Right now I have three thoughts: Should I “adapt” to the current market rules? Should I quit the game entirely? (Unfortunately, I’m not one to give up easily) Or should I explore other fields? (Actually, I’m already doing that)

Market Cycles and Thoughts on Solutions

Will this “game” go on forever? I don’t think so. History repeatedly shows that such vicious cycles end in one way: winners keep winning while losers get eliminated — until eventually, there are no new “losers” left, and the former winners become the new losers.

When everyone is exhausted and exits, Launchpad platforms will reappear, launching a few “premium new lotteries” to lure people back in — like a snake eating its own tail, forming an unbreakable loop.

Here’s an interesting phenomenon: recently outperforming tokens are almost never those issued via bonding curves, but rather projects where “large portions of tokens are locked by insiders” — we even jokingly call this “cheating.”

Why is that? Again, it comes down to incentives. In today’s crypto landscape, the only parties truly incentivized to sustain long-term token price growth are venture capital (VC) teams and project insiders — because only with sustained price appreciation can they unlock and sell tokens at higher valuations for massive profits.

More ironically, the traders currently “dominating” the market are those buying “VC-packaged low-quality assets” — which was exactly the problem bonding curve models were meant to solve.

So what’s the solution? Honestly, I’m not sure. But one thing is clear: if a project team wants their token to succeed, they cannot risk issuing it via a bonding curve — otherwise, you might end up with a 17-year-old using Axiom and multi-wallet setups to grab 10% of the token supply.

As an on-chain trader, I know clearly: the expected value (EV) of participating in this “game” is getting lower and lower. Regardless, the market must change, and incentives must be redesigned — otherwise, this cycle will just repeat endlessly.

I don’t have ready-made solutions, only preliminary ideas whose practical feasibility remains uncertain. I don’t blame anyone for the current state — it’s simply the inevitable result of existing incentive structures. Unless a new institution or model emerges to completely disrupt the status quo, meaningful changes to incentives won’t happen.

I’m just an active trader and a Launchpad user. Writing this down in hope that platform teams might see it (though each cycle reduces my hope a little — perhaps others feel the same).

As the saying goes: everyone looks out for themselves. Until the market truly changes (if it ever does), good luck to all “suicide squads” — may the more experienced and skilled “soldiers” prevail in this battle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News