Solana surges—where is the money really in the hands of?

TechFlow Selected TechFlow Selected

Solana surges—where is the money really in the hands of?

Beyond funding, there is also the narrative.

Author: Biteye

SOL has recently strengthened, driven by continuous purchases from multiple public companies, with treasury reserves reaching 17.112 million tokens, directly pushing up the price!

Just as Bitcoin ETFs and Ethereum ETFs reshaped market liquidity, Solana is now experiencing its own "holdings reshuffle."

Previously we analyzed Ethereum's holding structure; this is the second mainstream cryptocurrency holdings analysis.

Who are Ethereum's major backers, and is there still opportunity for ordinary investors?

01 Why Is Analyzing Holding Institutions Important?

The crypto market moves quickly—so who is buying? How much are they buying? Who is selling? Where is selling pressure concentrated?

Which funds are long-term locked, and which could flow out at any time?

These questions determine a token’s price elasticity and potential upside in the next cycle.

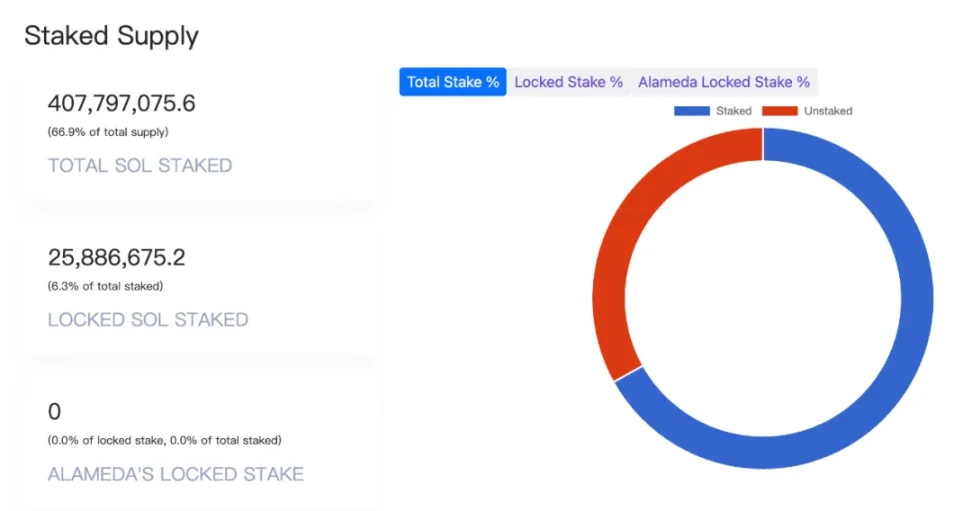

02 Staking, Approximately 66.9%

Data from Solana Compass shows that SOL's total supply is 610 million tokens.

As of September 16, approximately 408 million SOL have been staked across the network, accounting for 66.9% of total supply. This essentially forms a large pool composed of retail stakers, DeFi protocols, public company treasuries, foundations, and institutional whales.

In contrast, ETH's staking rate is only 40%. This makes SOL one of the highest-staked mainstream blockchains in the crypto market, implying limited selling pressure and strong price support.

1. Analysis of Staking Concentration:

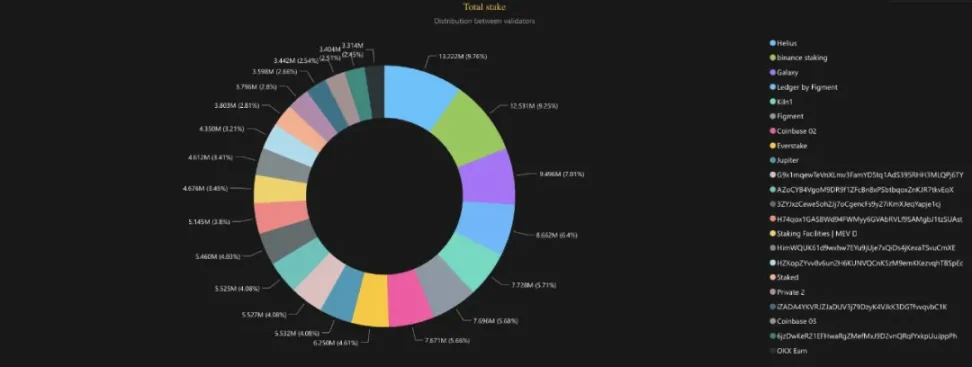

The validator landscape also reveals some insights. According to Everstake data:

-

The top three validators—Helius, Binance Staking, and Galaxy—collectively control over 26%, with Helius alone holding 13.22 million SOL (9.76%)

-

Followed by nodes such as Ledger by Figment, Kiln, Coinbase, and Everstake, each holding between 3–6%

This indicates that Solana's staking landscape exhibits "head concentration + long-tail dispersion": major institutional nodes have significant influence, yet overall decentralization remains intact, avoiding dominance by any single entity.

⚠️ Note: The pie chart below mainly illustrates the distribution among top validators and does not represent the full 408 million staked SOL network-wide.

2. DeFi Protocols

According to DeFiLlama data, Solana's total value locked (TVL) is worth approximately 52.89 million SOL. However, note that a significant portion comes from LST derivatives (e.g., JitoSOL, mSOL, bSOL), not pure SOL holdings. This data overlaps with the 66.9% network-wide staking figure and does not represent independent additional locked supply.

3. Foundation

SOL held by the Solana Foundation and Solana Labs is primarily placed in staking accounts, meaning it is already included within the 408 million staked SOL. The exact proportion is unknown.

4. FTX, Alameda

A unique aspect of SOL is a segment of "legacy holdings"—the stakes formerly held by FTX and Alameda.

During Solana's early ecosystem development from 2020–2022, FTX and Alameda were among the most important supporters, purchasing and holding large amounts of SOL. After FTX collapsed in November 2022, these assets were placed under custody and entered liquidation proceedings. Their future unlocking, auctions, or off-market transactions will impact SOL's supply-demand balance.

Since November 2023, staking addresses linked to FTX and Alameda have redeemed and transferred a total of 8.98 million SOL.

Currently, about 4.18 million SOL (0.69%) remain staked on-chain, unlocking in installments until 2028.

This portion is viewed by the market as potential selling pressure that could trigger price volatility.

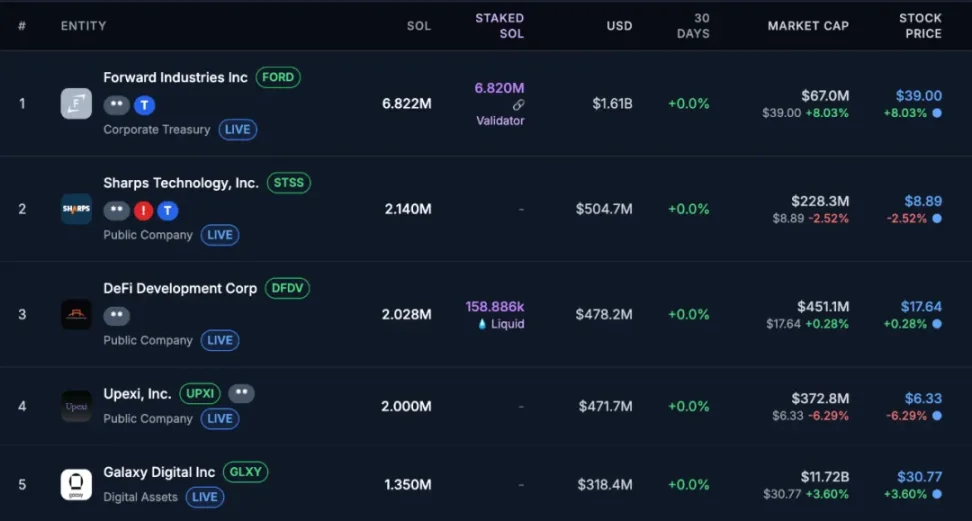

03 Public Companies, ~1.59% (Unstaked Portion)

According to Strategic SOL Reserve data (as of September 16), 17 entities have established SOL treasury reserves totaling 17.112 million SOL, representing 2.8% of current total supply.

Within these holdings, approximately 7.4 million SOL are staked (~1.2% of total supply).

Top holding companies:

-

Forward Industries (FORD): 6.822 million SOL, ~$1.63 billion

-

Sharps Technology (STSS): 2.14 million SOL, ~$510 million

-

DeFi Development Corp (DFDV): 2.028 million SOL, ~$480 million

-

Upexi (UPXI): 2 million SOL, ~$470 million

-

Galaxy Digital: 1.35 million SOL, ~$320 million

In the overall breakdown, only the unstaked portion of 9.71 million SOL (~1.59%) is counted here to avoid double-counting with network-wide staking.

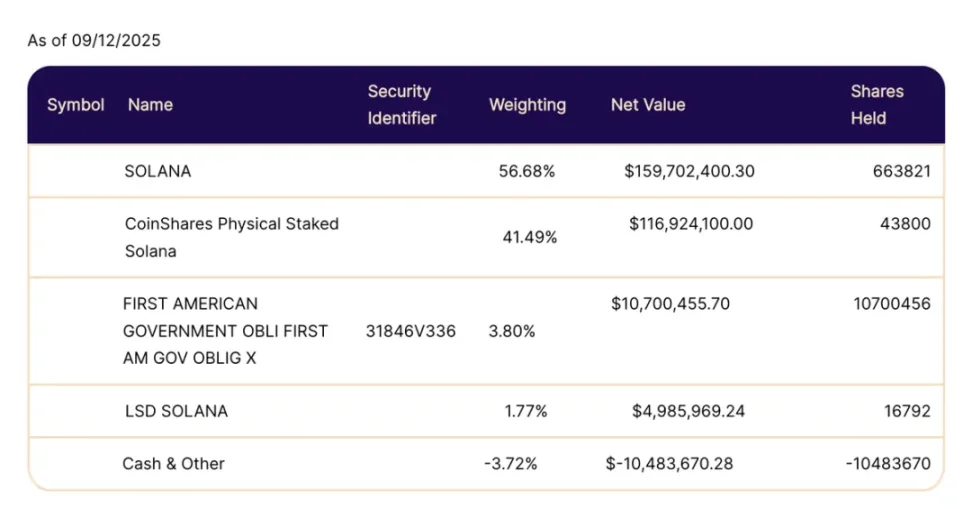

04 ETFs/ETPs, ~1.73% (Unstaked Portion)

ETPs (exchange-traded products) are essentially fund shares listed on exchanges. The following ETPs directly purchase and custody spot SOL, then issue corresponding shares for trading on exchanges.

1. 21Shares ASOL, with assets under management of ~$1.53 billion

2. CoinShares SLNC, with AUM of ~$699 million

At an estimated price range of $200–$260, their combined holdings amount to 8.57–11.15 million SOL, representing 1.41%–1.83% of total supply.

While traditional spot SOL ETFs are still awaiting regulatory approval, REX-Osprey's SOL + Staking ETF (SSK) launched in July 2025, becoming the first U.S. ETF combining spot SOL and on-chain staking yield.

By mid-September, the fund had reached ~$274 million in size, with approximately 56.7% allocated to spot SOL. At $200–$260 per token, this equates to roughly 598,000–777,000 SOL.

In total, the three products hold approximately 9.17–11.92 million SOL in spot exposure, representing 1.50%–1.96% of total supply, averaging around 1.73%. These funds exhibit more long-term stability.

05 Others, 29.78%

1. Whales / Exchanges

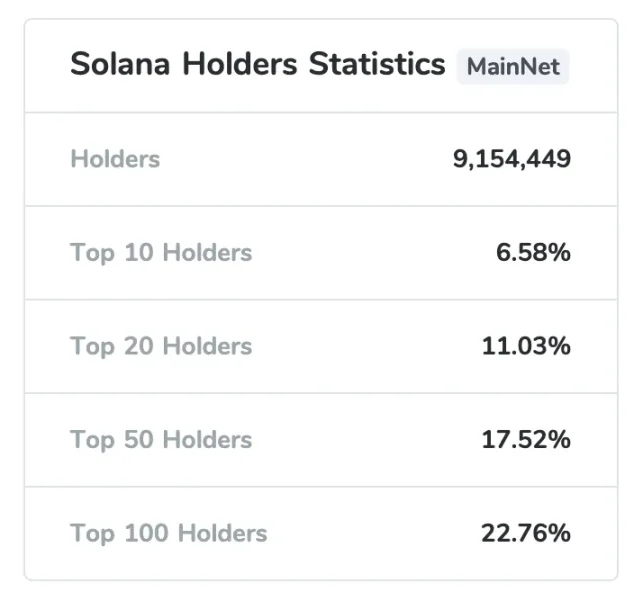

According to CoinCarp Rich List data (as of September 16), the largest whale address holds over 5 million SOL (~1% of total supply). Overall, Solana currently has around 9.15 million addresses, with the top 100 addresses collectively holding only 22.8%. Concentration is relatively low, with most tokens distributed among long-tail users, staking pools, and exchanges.

Note that whale addresses aren't necessarily individual retail holders—they may include early VCs, exchanges, and dormant wallets. Additionally, there is overlap between whale holdings and staked amounts, as many whale positions are already staked.

2. Retail Investors

Widespread but numerous, forming the market's base layer

3. Undisclosed Institutions

Held by certain funds or venture capital firms but not disclosed in public filings

06 Government Holdings

To date, no government or sovereign wealth fund has publicly disclosed direct ownership of SOL.

07 Celebrity Endorsements

Beyond capital, narratives matter. Who is bullish on SOL?

Matt Hougan, Investment Director at Bitwise, recently emphasized in an article that Solana is at a critical juncture marked by ETP approvals and the rise of corporate SOL treasuries—a combination that historically led to significant price increases for Bitcoin and Ethereum.

Raoul Pal @RaoulGMI, former Goldman Sachs executive, described Solana’s long-term structure as “stupidly bullish,” expressing strong long-term optimism for SOL.

Prominent crypto trader Ansem @blknoiz06 recently voiced bullish sentiment around the idea that if treasury-backed companies enter Solana DeFi, it would be extremely positive.

Mert Mumtaz, CEO of Helius Labs, bet that Solana will rise 150% over the next five years, viewing any short-term price movements as mere noise.

👉 From holdings structure to market narrative, SOL has entered a phase of "institutional buying + widespread bullish sentiment." Combined with Hyperliquid's liquidation heatmap, the current price stands at $238:

First target: $250–$275—the initial zone of short liquidations; a breakout could trigger short-term acceleration.

Second target: $275–$315—the densest cluster of short positions; breaking through could lead to stronger short squeezes.

With ETF/ETP adoption and corporate treasury accumulation reinforcing each other, market expectations for Solana will be redefined. If capital inflows persist, SOL could potentially reach $300–$400 in a bull market scenario.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News