Space Recap | The Stablecoin Competition Heats Up: How Is TRON Building the Strongest Ecosystem Moat for Stablecoins?

TechFlow Selected TechFlow Selected

Space Recap | The Stablecoin Competition Heats Up: How Is TRON Building the Strongest Ecosystem Moat for Stablecoins?

The TRON ecosystem has established a complete stablecoin system consisting of USDT (settlement layer), USDD (yield layer), and USD1 (compliance layer).

The crypto market in September is seeing renewed turbulence. Top-tier decentralized derivatives protocol Hyperliquid has launched its native stablecoin USDH in high profile, signaling yet another strong player entering the battlefield.

Once upon a time, the stablecoin race followed a simple script of "dual dominance" between USDT and USDC. But today, the landscape has completely transformed. Stablecoins are no longer merely "utility tokens" used by traders to hedge against volatility—they have evolved into the foundational liquidity bloodline of the entire crypto financial system.

When examining the overall stablecoin ecosystem, TRON stands out as an undeniable force. Thanks to its high-throughput, low-fee network characteristics, TRON has long become the primary battleground for stablecoins, especially for the issuance and circulation of USDT. At the same time, the TRON ecosystem has developed the decentralized stablecoin USDD and deeply integrated with the compliant stablecoin USD1, forming a comprehensive stablecoin matrix covering payment settlement, decentralization, and compliance needs—making it a crucial pole in today’s stablecoin landscape.

So why has the stablecoin become core infrastructure fiercely contested by all top protocols? Will the future bring coexistence of multiple players or return to monopolistic dominance? On September 16, during a special roundtable AMA co-hosted by SunPump and 1783DAO, several industry veterans dove deep into these questions. This article recaps the insightful perspectives and intellectual clashes from the event.

Why is the Stablecoin the Battleground of the Crypto World?

"The most fascinating aspect of the stablecoin space is that, like exchanges, it's one of the two most profitable businesses in crypto," pointed out Block Tiger during the roundtable discussion. "Issuing a stablecoin is equivalent to establishing a central bank within the crypto realm." Taking TRON's stablecoin ecosystem as an example, USDT issued on the TRON network has consistently accounted for over 50% of the global total, firmly ranking first worldwide, and is widely used in high-frequency global transfers and cross-border payments, fully demonstrating the immense value of stablecoin operations. Block Tiger concluded by highlighting the key factors for success in the stablecoin business: User scale and use cases are both indispensable.

Amber analyzed from the perspective of business fundamentals: "Stablecoins are like a faucet—once you control settlement, you can generate cash flow endlessly. The closer a business is to settlement, the more profitable it becomes." She noted that beyond explicit interest income, stablecoins also hold enormous potential to replicate every traditional finance playbook on-chain.

Web3 Miya supplemented from practical application scenarios: "Stablecoins are essential because they serve as the best bridge connecting the traditional world and the crypto world." Comrade Jianguo also pointed out that the current 10–12% annualized yield offered by stablecoins presents a highly attractive entry point for traditional-scale capital.

In this strategic game centered around profitability, strategic positioning, user base, and regulatory compliance, various forces are engaged in fierce competition. Whether new entrants like Hyperliquid or seasoned players like TRON who have already built complete ecosystems, all are striving to find breakthroughs in this challenging yet opportunity-rich red ocean.

Stablecoin Competition Heats Up: Coexistence or Winner-Takes-All?

Regarding the current competitive landscape, roundtable guests unanimously believe that the stablecoin market will evolve into a multi-currency, multi-oligopoly structure, rather than a single absolute winner-takes-all scenario. K1KO made an elegant analogy using internet history: "Just like WeChat and Alipay dominate 90% of the mobile payment market, but Douyin and JD still build their own payment systems; Chrome and Firefox lead browsers, yet Quark and UC Browser still exist." He noted that different verticals will each have their own dominant player. Amber agreed and added: "For now, USDT still dominates due to its scale and derivative depth creating usage inertia, but in different scenarios, there will be a leading stablecoin."

Within this diverse ecosystem, the TRON ecosystem has established a three-layer stablecoin strategy, forming a complete product matrix covering payment settlement, decentralization, and compliance needs. This multi-tiered approach perfectly aligns with the future trend of layered, scenario-specific coexistence in the stablecoin market.

l First Layer: USDT—Core Infrastructure Dominating the Market

The TRON network has become the primary platform for USDT issuance and circulation. Data from September 5 shows that the market cap of stablecoins on TRON exceeded $83.3 billion, with TRC20-USDT issuance surpassing 82.6 billion, solidly maintaining the global number one position. Currently, over 68 million accounts on the TRON network hold USDT, fully demonstrating its global adoption and cementing TRON's leadership as core stablecoin infrastructure.

Leveraging TRON's low-fee, high-throughput network features, TRC20-USDT has become the preferred choice for numerous cross-border payments and daily transactions, widely applied in financial trust, telecom transfers, travel settlements, and international payments, and increasingly supported by mainstream platforms.

l Second Layer: USDD—Innovative Breakthrough in Decentralized Stablecoins

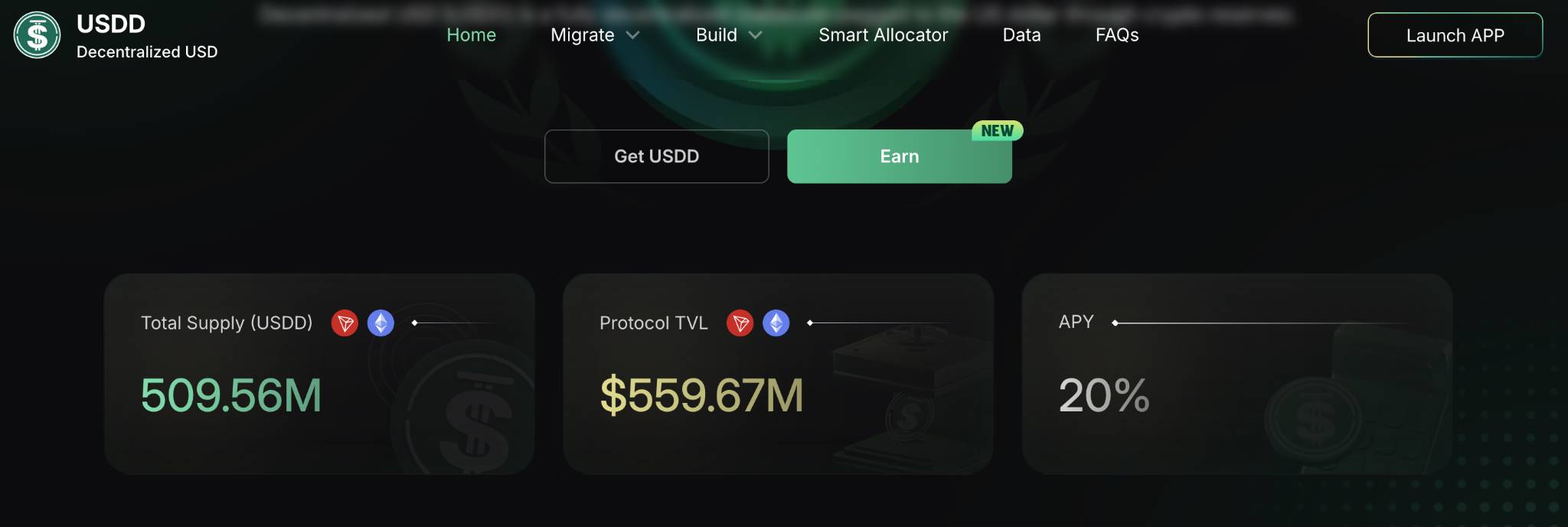

As a "dark horse" in the decentralized stablecoin market, USDD has maintained long-term stable operation and rapid growth since launch. Its upgraded 2.0 version launched in January this year reached over $100 million in circulation within just two weeks, showing strong momentum. Currently, USDD 2.0 supply has surpassed 500 million with an APY (annual percentage yield) as high as 20%.

On September 8, USDD was officially natively deployed on Ethereum, launching a reward program offering up to 12% APY on the Ethereum mainnet. This move marks USDD's expansion into a multi-chain ecosystem, injecting new vitality into the decentralized stablecoin market.

l Third Layer: Integration of USD1—Strategic Move Toward Compliance

USD1, a compliant dollar-backed stablecoin issued by WLFI, a project linked to the Trump family, quickly gained market recognition since its March launch due to its "high transparency and strong compliance." As of September 17, USD1's circulating supply exceeded $2.6 billion, making it the sixth-largest stablecoin globally.

Notably, the TRON ecosystem has completed full deployment of USD1—from technical integration to DeFi infrastructure. On June 11, USD1 officially began minting on the TRON network, with an initial mint of 1,000 tokens, marking its formal integration into the TRON ecosystem. On July 7, SUN.io, TRON’s all-in-one decentralized exchange,率先 launched multiple USD1 trading pairs, providing users with convenient trading access. Shortly after, on August 19, the lending protocol JustLend DAO fully enabled USD1 deposits and loans, greatly expanding the yield use cases for this stablecoin.

As of September 17, USD1 issuance on the TRON network has surpassed 54.47 million, with a 24-hour trading volume exceeding $350 million, holder addresses surpassing 20,000, and total on-chain transactions exceeding 88,000. These figures fully reflect USD1’s rapidly growing liquidity and user adoption within the TRON ecosystem, showcasing its significant potential as a next-generation compliant stablecoin and bringing diversified energy to TRON’s stablecoin ecosystem.

Through this three-tiered stablecoin system, TRON has created powerful synergies: USDT provides liquidity and market coverage, USDD drives decentralized innovation, and USD1 meets compliance demands. This multi-layered strategy enables TRON to remain competitive under varying market conditions and regulatory requirements, delivering comprehensive stablecoin solutions to users.

As the stablecoin market continues to grow, TRON’s strategic layout is proving increasingly valuable. Whether facing new entrants like Hyperliquid’s USDH or the arrival of traditional financial institutions, TRON’s established ecosystem advantage positions it strongly in the future stablecoin race.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News