The Most Expensive "Employee" in History: How Did Musk Unlock a $1 Trillion Salary, Step by Step?

TechFlow Selected TechFlow Selected

The Most Expensive "Employee" in History: How Did Musk Unlock a $1 Trillion Salary, Step by Step?

A blueprint of a "madman," or an accurate map to the future?

1 trillion dollars.

You read that right. This isn't the GDP of some small country—it's the "mega bonus package" Tesla is preparing to give its CEO, Elon Musk, all by himself.

Recently, Tesla’s board announced a proposal so jaw-dropping it left everyone stunned: they’ve designed an unprecedented compensation plan for Musk. Over the next decade, if he can lead the company to achieve a series of “nearly impossible” goals, he could receive rewards worth up to $1 trillion. This is undoubtedly the most ambitious executive incentive plan in U.S. corporate history.

According to proxy documents filed by Tesla last Friday, the additional shares Musk may receive could increase his ownership stake in Tesla to 25%. Musk has previously publicly stated his desire to reach this ownership level. Shareholders are scheduled to vote on these proposals on November 6.

Of course, this money isn’t free. There’s no such thing as a free lunch—especially not one this big. Tesla has set Musk a series of extremely high targets, including expanding Tesla’s robotaxi, FSD, and robotics businesses, as well as growing the company’s market cap from its current level of about $1 trillion to at least $8.5 trillion.

So here’s the question: how exactly can this $1 trillion move from seeming fantasy to firmly landing in Musk’s pocket? Let’s do the math together and see how Musk might turn this dream into reality.

Car-making is not the end—it’s a ticket to the future

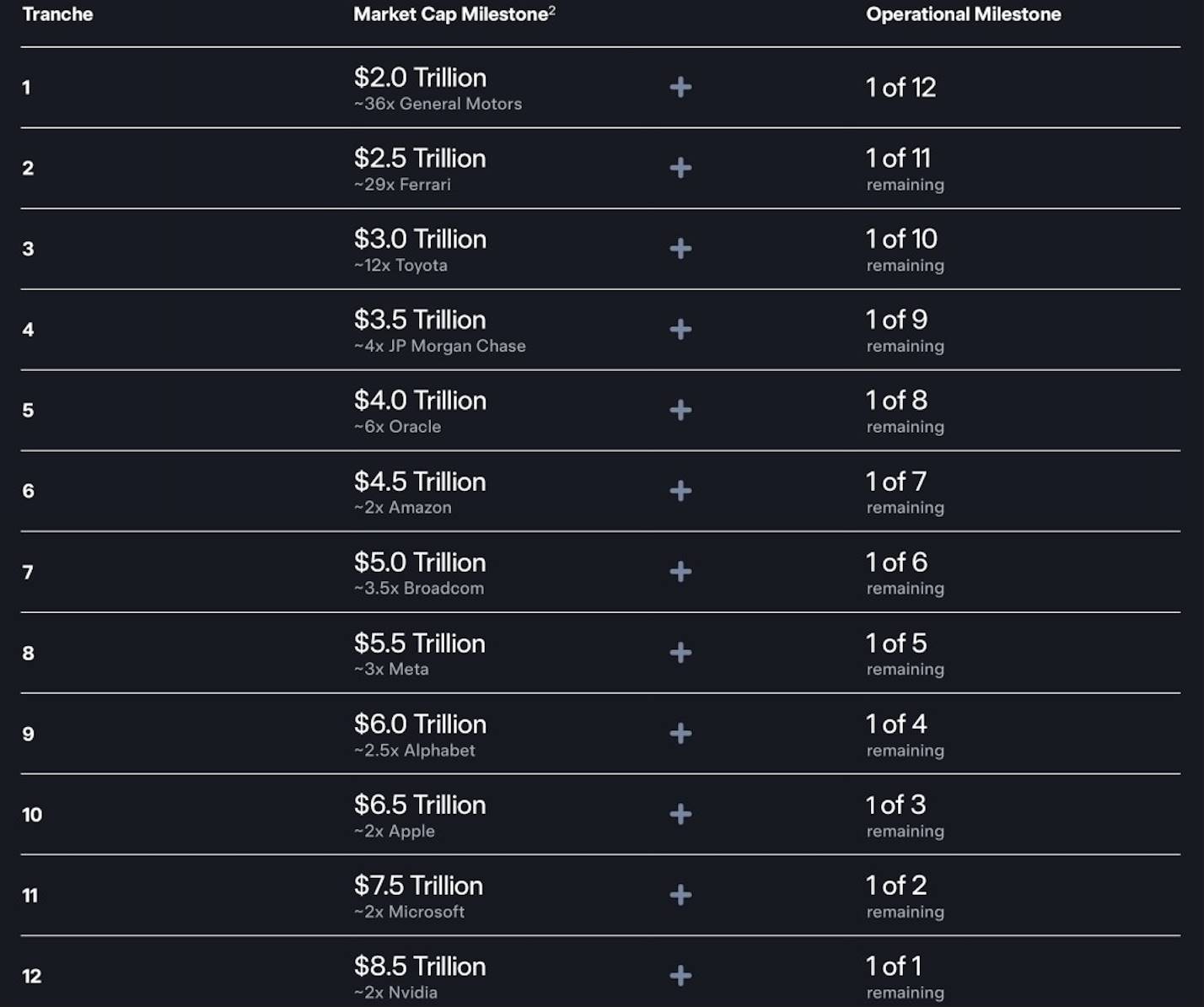

You can think of this as a custom-designed, “hell-mode difficulty” game for Musk. The entire plan spans ten years and is divided into 12 major milestones. Only by completing each stage can he unlock a portion of the equity reward.

Opening each milestone requires two keys turned simultaneously—both are essential.

First key: Company Market Cap

This key is straightforward—make Tesla much bigger. The starting target is $2 trillion (roughly double today’s value), increasing in $500 billion increments per stage, ultimately reaching the staggering $8.5 trillion mark. To put this in perspective, it would be like adding an “Amazon + Google” on top of today’s Tesla.

Second key: Hardcore Performance Metrics

Stock price bubbles won’t cut it—you need real business results to back it up. This second key consists of “milestone achievements” across Tesla’s four core businesses, each pushing the limits:

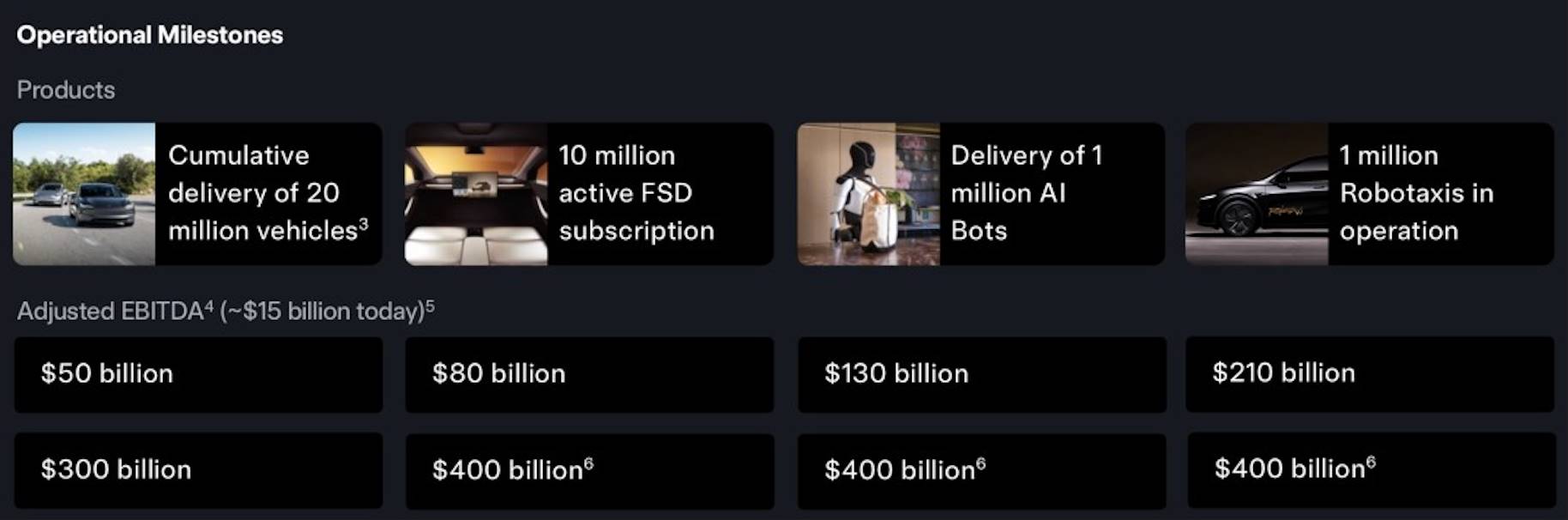

-

Sell another 12 million vehicles: It took Tesla nearly two decades to deliver around 8 million vehicles by 2025. This plan demands selling 12 million more over the next decade.

-

Secure 10 million FSD paying users: This means the FSD (Full Self-Driving) software must become exceptionally reliable and safe, convincing the vast majority of owners it’s “worth every penny,” so they willingly subscribe.

-

Deploy 1 million Robotaxis: This is essentially a ground-up massive undertaking. Moving from sporadic testing to a commercial fleet of a million driverless taxis involves overcoming huge technological, regulatory, and safety hurdles.

-

Deliver 1 million humanoid robots: Mass-producing Optimus robots from sci-fi fantasy to a million units deployed in the market within ten years presents enormous challenges at every step.

Beyond these four pillars, the plan also includes a series of escalating EBITDA (earnings before interest, taxes, depreciation, and amortization) targets, starting at $50 billion and rising to a staggering $400 billion. This ensures that while pursuing scale, Tesla must maintain strong profitability and healthy cash flow.

You might wonder: where does one even begin with such grand goals?

The automotive business is Tesla’s “foundation”—the starting point for all future narratives. The hard metric in Musk’s pay plan calls for a total delivery volume of 20 million vehicles over the next decade. This means building on the current base and ramping annual production from today’s 2 million level to selling three to four million vehicles per year.

Considering potentially more affordable models in the future, let’s assume an average vehicle price of $40,000. At 3.5 million units sold annually, vehicle sales alone would generate $140 billion in revenue per year for Tesla.

To many, car manufacturing is seen as a capital-intensive, low-margin industry with limited valuation potential. But given Tesla’s brand, technology, and profitability, a P/S ratio of 5–7x is justifiable.

More importantly, every Tesla vehicle sold is not just a car—it’s a “mobile terminal” to the future. Therefore, when Tesla hits the 20-million-unit delivery milestone, the automotive business alone could support a valuation of $1–1.5 trillion.

Where will the additional $7.5 trillion in valuation come from?

If Tesla’s cars are the constantly running “body,” then the FSD software is the “soul” infused within.

Another milestone in the plan is achieving 10 million FSD subscribers. Let’s run the numbers: assuming an average global monthly subscription fee of $100, once 10 million users are onboard, that’s $1 billion in monthly revenue—or $12 billion annually!

FSD subscriptions are fundamentally a SaaS business, characterized by high margins and strong customer stickiness. Markets often assign very high valuation multiples to quality SaaS revenue—typically 20–40x P/S or even higher. Given FSD’s uniqueness and central role in the trillion-dollar mobility market, assigning it a premium valuation is reasonable.

Just this $12 billion in annual revenue, if markets believe in its immense growth potential (e.g., licensing to other automakers), could command a P/S multiple exceeding 100x, directly contributing $1.2 trillion in market cap. If pricing increases or service tiers expand, annual revenue could reach $20 billion, supporting a valuation of $1.6–2 trillion at 80–100x P/S.

Once the FSD brain becomes intelligent enough, Tesla’s ace—the Robotaxi (autonomous taxi)—can enter the stage.

The goal here is deploying 1 million Robotaxis, forming a massive, driverless revenue-generating fleet. Today, your personal car sits idle 95% of the time. In the Robotaxi network, each Tesla becomes a 24/7 income-generating tool.

-

Assume each Robotaxi operates 5,000 hours per year, generating $25 in net revenue per hour (after electricity, maintenance, cleaning, etc.).

-

Per-vehicle annual revenue would be around $125,000, so a fleet of 1 million vehicles would generate $125 billion annually.

This is a new, technology-driven, high-profit service network. Its business model resembles Uber or Didi but without driver costs, offering massive profit margins. The market could view it as a hybrid of tech and utility, making a 20–25x P/S valuation entirely plausible. Thus, the Robotaxi network alone could support a valuation of $2.5–3 trillion.

With cars, energy, AI software, and mobility networks in place, Tesla turns its gaze to an even grander vision: Optimus (the Titan) humanoid robots. The target here is to deploy 1 million Optimus robots into factories, warehouses, and even homes.

This isn’t about the $20,000–$30,000 hardware price tag. The true power lies in disrupting the largest market of all—the labor market.

-

Model 1: Hardware Sales. 1 million units × $25,000/unit = $25 billion in annual revenue. This is just the beginning.

-

Model 2: Robotics-as-a-Service (RaaS). A factory worker costs at least $50,000 annually in wages and benefits. Now, a factory rents an Optimus robot, paying Tesla only $30,000 per year in “service fees,” saving $20,000 annually. Annual revenue = 1 million units × $30,000/unit = $30 billion.

Optimus targets the global labor market, valued in tens of trillions. We cannot apply traditional valuation logic. Capital markets will define a new category for it, potentially assigning P/S multiples of 50x or even 100x—pricing based on future potential.

Even using just $30 billion in annual service fees, at an 80x P/S multiple, the valuation reaches $2.4 trillion. If markets believe Tesla will dominate this trillion-dollar emerging industry, valuations of $2.5–3.5 trillion are possible.

Beyond valuation, there’s another extremely stringent target in this pay plan: achieving $400 billion in annualized EBITDA—an ultimate condition to unlock a key part of the compensation. Based on our earlier projections, how far are we from this “final goal”?

Musk’s trillion-dollar compensation plan is no free ride. Beyond pushing the company’s market cap sky-high, there’s an extremely tough final requirement: earning $400 billion in “core profit” annually.

Based on our most aggressive forecasts, let’s sum up the profits from Tesla’s future “cash printers”:

-

Automotive business ($140B revenue, 20% margin) = $28B

-

FSD software ($12B revenue, 90% margin) = $10.8B

-

Robotaxi network ($125B revenue, 70% margin) = $87.5B

-

Optimus robot services ($30B revenue, 80% margin) = $24B

Add in often-overlooked energy and other businesses—we’ll optimistically assign $30B.

Now summing up: 28 + 10.8 + 87.5 + 24 + 30 = $180.3 billion. This figure falls $219.7 billion short of the $400 billion ultimate target—less than half way!

So how do we bridge this $220 billion gap?

First, we need absolute scale effects. The assumed 1 million Robotaxis and 1 million Optimus units are far from sufficient. These numbers need to grow to 2 million, even 3 million. Just 2.5 million Robotaxis alone could contribute over $200 billion in EBITDA, single-handedly closing most of the gap.

Beyond quantity, we must also improve “quality” profits—driving margins even higher. FSD pricing or subscription rates could exceed expectations; Optimus service fees could rise with improved capabilities; vehicle production costs could drop dramatically due to economies of scale.

Additionally, energy is a “hidden boss” in this entire plan. Imagine hundreds of millions of Tesla EVs, countless homes and factories using Tesla batteries worldwide. Connected via a network, they form a global “virtual power plant.” Selling power during peak demand and storing during off-peak times—this simple arbitrage alone could generate tens of billions in profit.

A golden handcuff, a trillion-dollar bet

After discussing the grand, almost sci-fi blueprint, let’s zoom back to examine the human dynamics and business strategy behind it. This astronomical pay package is about far more than money—it’s a high-stakes game played out in the open.

Musk’s intentions aren’t really a secret anymore. He’s repeatedly said publicly that he wants roughly 25% voting power in Tesla—or else he might go off and build his own AI and robotics ventures independently.

After selling large amounts of stock to buy Twitter (now X), Musk’s ownership stake dropped significantly. This new compensation plan, if fully executed, would bring his shareholding back into the 25%–29% range.

So this is less about greed and more about securing legitimate, firm control over Tesla’s future direction. He wants to ensure that his highly risky—and to some, borderline crazy—AI visions won’t be derailed by short-term-focused shareholders or hostile takeovers.

For Tesla’s board, this is a pair of “golden handcuffs” for Musk.

Musk is a hyper-energetic figure who simultaneously runs SpaceX (building rockets), Neuralink (brain-computer interfaces), and wields influence across social media and politics—the “Silicon Valley Iron Man.”

The board’s biggest headache is probably this: how do you keep this “founding patriarch” focused primarily on Tesla?

The answer is this ten-year plan, deeply tied to the future he himself envisioned. It’s the most luxurious, tailor-made pair of golden handcuffs imaginable. Want the reward? Then you must deliver on every promise over the next decade.

So circling back to our original question: how exactly will Musk claim this $1 trillion?

The answer: by personally transforming Tesla from a leading electric vehicle company into a supercharged tech platform integrating AI software, robotics, shared mobility, and energy.

Therefore, for shareholders voting on November 6, the choice is now crystal clear and profoundly significant. This vote isn’t merely about whether to award the CEO a record-breaking bonus. It’s more like a shareholder referendum—asking every investor to use their capital to answer:

Are you investing in a better car company, or in a potential empire that could define the next era of artificial intelligence and robotics?

Regardless of the outcome, this compensation plan itself has already painted a stunning vision of the future. It tells the world in the most direct way possible: in Elon Musk’s dictionary, limits exist only to be broken.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News