In-depth Conversation with Sequoia Capital Partner Shaun: Why Can Elon Musk Always Beat His Competitors?

TechFlow Selected TechFlow Selected

In-depth Conversation with Sequoia Capital Partner Shaun: Why Can Elon Musk Always Beat His Competitors?

Shaun not only led SpaceX's controversial investment in 2019, but is also one of the few investors who truly understands Musk's operating system.

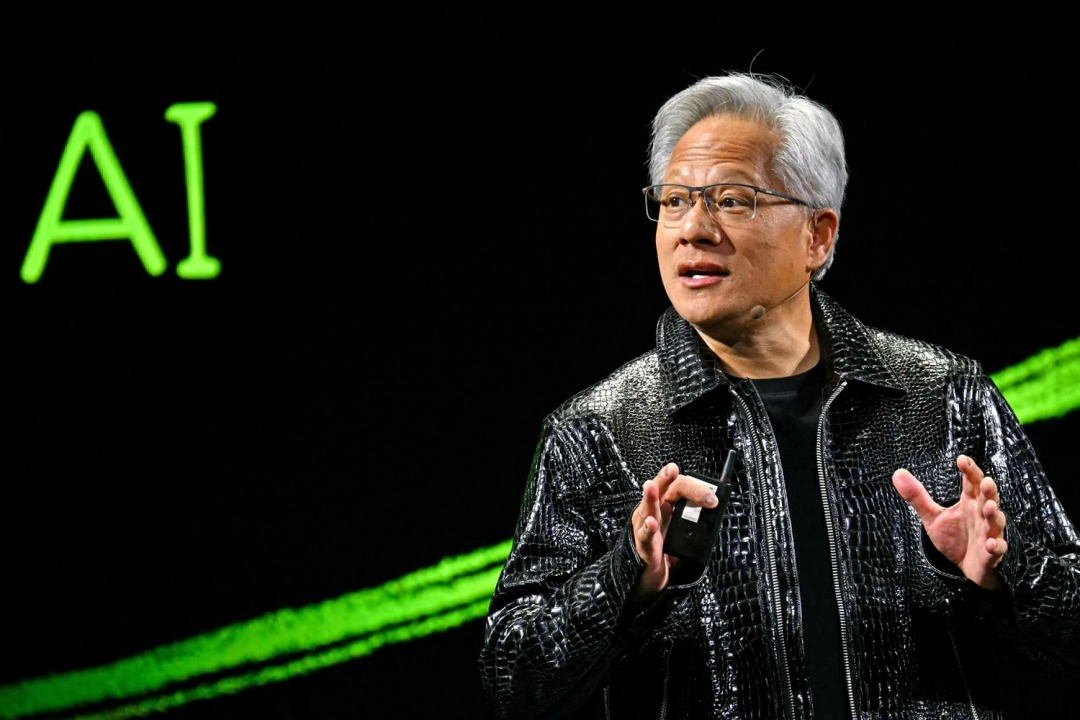

When Musk simultaneously leads multiple disruptive companies like SpaceX and Tesla, and Huang Renxun drives Nvidia to dominate the AI hardware market, the outside world marvels at their "unbelievable capabilities," yet rarely sees the underlying logic. Investor Shaun Maguire, with perspectives from a PhD in mathematical physics, field experience at DARPA, and a career as a professional esports player, reveals in a deep interview the true operations of top innovators and organizations—this is not just decoding two industry giants, but also a profound analysis of elite talent evaluation, organizational management, and investment decision-making.

As the key figure behind the controversial 2019 SpaceX investment, Shaun witnessed the precise coordination of Musk’s “collective intelligence of 20 people,” and openly admitted his mistake of selling Nvidia too early at a $60 billion valuation. He proposes a 15-level hierarchy theory in intellectual domains, revealing how high-cognition individuals accurately assess talent levels, while ordinary people struggle to distinguish differences among top performers; he dissects Musk’s extreme talent mechanism of “giving them rope to hang themselves,” interprets the underappreciated technical difficulty of The Boring Company, and reconstructs the epic persuasion battle behind the SpaceX investment.

From cognitive leaps on the battlefield to team collaboration learned through professional gaming, from childhood bullying to calibration experiences working alongside Nobel laureates, Shaun uses his own journey to demonstrate: extraordinary achievements are never about single-point breakthroughs, but rather multidimensional resonance across talent selection, capital allocation, cognitive frameworks, and organizational culture. This insight-dense conversation will reshape your understanding of innovation, helping you see overlooked signals of capability and critical decision points. Enjoy:

This article comes from WeChat public account: Gao Fei's Electronic Avatar

This is a deeply asymmetric interview. The interviewer is investor Shaun Maguire, who not only led the controversial 2019 SpaceX investment but is also one of the few investors who truly understands Musk’s operating system. Unlike superficial interviews, Shaun brings diverse backgrounds including a PhD in mathematical physics, deployment at DARPA, and experience as a professional esports player. He uses extremely precise language to analyze Musk’s organizational ability, talent assessment system, and why almost everyone underestimates the real strength of Musk’s companies.

This is not a piece of praise. Shaun candidly admits his misjudgment in selling Nvidia at a $600 billion valuation, and frankly recounts humiliating experiences such as being given zero by a high school teacher and forcibly renamed by classmates. It is precisely this unfiltered honesty that makes the dialogue exceptionally insightful—from “how to determine within 30 minutes whether someone's math ability is Fields Medal level or just an average professor,” to “why The Boring Company’s technical difficulty lies between Falcon 9 and reusable Falcon 9,” each judgment has clear underlying logic.

If you want to understand how elite organizations operate, how to make correct judgments under information asymmetry, and why most people can never grasp true innovation—this podcast transcript from the Relentless channel offers an unprecedented perspective.

01 Musk’s "Collective Intelligence": How 20 People Execute One Man’s Will

1. Musk isn’t fighting alone—he’s a finely coordinated system of 20 people

Most discussions about Musk focus on him personally: working 112 hours a week, running multiple companies, being a technical genius. But Shaun introduces a severely overlooked dimension: "Elon is a collective (Elon the Collective)."

This "collective" consists of about 20 core members who have worked with Musk for over 10 years, establishing incredible trust. Key characteristics include:

-

Autonomous execution: These individuals can essentially read Musk’s mind and act on his intent without needing approval

-

Precise judgment boundaries: They know exactly when to escalate decisions and when to handle things independently

-

Cannot be rushed: This kind of默契 takes at least ten years, constantly testing each other’s limits

"These 20 people can directly implement his will—with force, scale, and precision. This mode of operation simply doesn’t exist among other Silicon Valley entrepreneurs."

2. "Give them rope to hang themselves": An extreme talent selection mechanism

Musk’s talent system has two extremes:

-

Rapid promotion track: If you can execute, your advancement speed far exceeds nearly any other organization

-

Zero tolerance for failure: One major mistake, and you're out

This mechanism creates a powerful self-selection effect. "By letting people rise faster than anywhere else, you build intense loyalty with the most capable. You give them what they can’t get elsewhere."

Combined with generous compensation incentives, this system ultimately retains the **top 1% of the organization**—they are the ones truly driving everything forward.

3. World-class talent intuition: Seeing engineering thinking from a resume

Shaun shares a detail: Musk interviewed a young economics graduate and immediately judged, “You won’t go into business development—you’ll become a mechanical engineer,” because he could detect the person’s engineering mindset. That individual later became a highly senior engineer.

This kind of judgment cannot be faked—it is a genuine superpower.

02 The "15-Level Ladder" of Talent Assessment: Why Most People Can’t See the Difference

1. There are 15 clear levels in intellectual domains, but visibility is only downward

Shaun proposes an extremely refined cognitive framework: in intellectual fields like mathematics, there are approximately 15 distinguishable levels, ranging from “easily earning a top-tier university math PhD” to “once-in-a-century mathematician.”

The key insight is: This is a one-way transparent system.

-

High-level individuals can precisely assess someone’s level within a 30-minute conversation (within 1–2 levels of accuracy)

-

But those three or more levels below generally cannot distinguish differences among higher tiers

-

To a high school math teacher, all students scoring 800 on SAT Math look identical—but among them, some may become Fields Medalists, others merely top-tier graduates

2. Analogy with chess ratings: Why a 1000-rated player cannot distinguish 2400 vs 2800

Shaun draws a vivid analogy using the Elo Rating System in chess:

-

2850 (World Champion level) vs 2700 (average Grandmaster): overwhelming dominance, win rate >99%

-

2700 vs 2500 (new Grandmaster level): clear advantage, win rate 85–90%

-

But a 1000-rated player reviewing these games cannot tell the difference at all

-

Conversely, a 2800-rated player can assess an opponent’s level after seeing just 10 moves

"For investors, this is a core skill: my main job is assessing people and talent, especially at the earliest stages. Understanding talent hierarchies is an absolute superpower."

3. Source of calibration: Personal exposure to true top-tier talent

Shaun’s calibration ability stems from repeated close contact with extreme talent:

-

Mathematics: In 2010, participated in Clay Math Institute summer program in Brazil, spending a month with 100 top mathematicians, including 2 Fields Medalists and one winner that year. "We 30 graduate students lived together daily, American and French students competing. The cohesion of the French math community is unimaginable—they almost all come from two schools (ENS and Polytechnique). They’re fiercely competitive, completely unlike American stereotypes of mathematicians."

-

Algorithmic trading: Interned at DRW where colleagues included triple Putnam Competition champions, triple IMO gold medalists, later becoming MIT tenured professors

-

Physics: Knows multiple Nobel laureates (before they won), such as Kip Thorne

The value of these experiences: You’ve seen what the 0.001% looks like, and your benchmark is forever changed.

03 The Underlying Methodology of Investment Decisions

1. The first question is always: What capabilities does this company need?

Shaun’s investment framework is crystal clear:

-

First assess: What traits are required for success? For some companies, intellect doesn’t matter (e.g., a regular garbage collection firm), but for a “garbage-collecting robot,” intellect becomes crucial

-

Then evaluate: At what level does the founder stand on these critical traits?

"It might be sales ability, raw mathematical talent (for AI research firms), or pure resilience under pressure. The key is first identifying what truly matters, then judging the individual’s level on that dimension."

2. Case study: How a cold email revealed 2600+ level technical ability

Shaun invested in Factory, an AI code generation startup, after founder Matan Grinberg impressed him with a cold email:

"The founder mentioned in the email that he co-authored a paper with Juan Maldacena during undergrad. Juan is one of the world’s most renowned string theorists. To me, that single fact meant—this person’s technical ability is at least 2600 level (using chess rating analogy)."

Key insights:

-

Collaborating with Juan at graduate level requires ~2300

-

But undergraduate-level collaboration implies 2600+

-

"He just said 'co-authored with Juan,' not 'Juan Maldacena'—I appreciate this high-signal communication style"

More importantly, this founder has both exceptional technical ability and strong sales skills and empathy—that’s the real magic combination.

3. Why most VCs fail to catch these signals

Shaun bluntly states: "Most VCs wouldn’t recognize any signal from a cold email saying 'co-authored with Juan.'” Because they lack domain calibration.

This explains why truly great opportunities are often missed by “outsiders”—not because founders aren’t good enough, but because evaluators simply can’t see it.

04 The 2019 SpaceX Investment: An Epic Persuasion Battle

1. Why investing in SpaceX back then was “insanely crazy”

In 2019, when investing in SpaceX, Tesla’s market cap was only $40–50 billion—Musk didn’t yet have today’s trillion-dollar companies backing him. The internal debate was the “most controversial, intense discussion” Shaun had ever experienced—one partner even gave it a 1/10 score.

But Shaun refused to accept “no.”

2. Persuasion strategy: Start with a $20 million small bet

Facing massive resistance, Shaun adopted a gradual approach:

-

Step 1: After a month of relentless pursuit, secured a $20 million “test investment” (the team wanted $600 million)

-

Step 2: Over the next six months, sent progress updates every three weeks to all decision-makers

"This achieves two things: one, shows your persistence—it’s not a fleeting idea; two, provides longitudinal data—showing the velocity and acceleration of progress. Often, this changes people’s minds."

This methodology applies universally, including in information warfare: It’s hard to change minds with a single data point, but sustained data flow over time can re-calibrate cognition.

3. Why today’s consensus was once “non-consensus and non-obvious”

Shaun emphasizes: Investing in SpaceX today seems obviously smart, but in 2019:

-

Starlink hadn’t proven feasible

-

Reusable rockets were just starting to work

-

Tesla wasn’t a trillion-dollar company

-

The entire space industry wasn’t understood by mainstream investors

Getting it right wasn’t luck—it was because he had the ability to see talent differentials others couldn’t perceive.

05 Why Almost Everyone Underestimates Musk’s Companies

1. The Boring Company: Misunderstood technical difficulty

Shaun asked Steve Davis (early SpaceX employee, now leading The Boring Company): Where does the tunneling machine for “zero people in tunnel, continuous mining” rank on SpaceX’s technology spectrum?

Steve replied: Slightly harder than Falcon 9, slightly easier than reusable Falcon 9.

This is a shocking assessment: the engineering difficulty of this machine is higher than Falcon 9—yet the outside world completely fails to grasp this.

The reason is simple: People only do linear comparisons. They compare one tunneling machine to another, but fail to see generational differences between Falcon 1, Falcon 9, reusable Falcon 9, and Starship.

2. "Precedents and Superlatives": Cognitive limitations of the human brain

Musk has a saying: People only respond to “precedents and superlatives.”

-

Precedent: When you’ve already broken through non-linear barriers and actually achieved the goal

-

Superlative: Visual shocks like rocket explosions or landings—differences laypeople can intuitively grasp

But people cannot comprehend:

-

Differences in payload mass

-

Variations in orbit reachability

-

Underlying technological complexity gaps

"So The Boring Company today is like SpaceX before 2009—until they hit the milestone of 'zero people in tunnel, continuous mining,' external perception won’t register progress. But once achieved, cognition will jump tenfold instantly."

3. Optimus robot demo: Deliberately crafted “superlative moments”

Shaun saw 20 Optimus robots walk out at a Tesla event:

"They walked toward me from 30–40 feet away—I initially couldn’t tell if they were actors or robots. I looked at their faces—just like humans. Then I scanned down their bodies until I reached the waist—very narrow, not human-like—that’s when I confirmed they were real robots."

This experience created a nonlinear psychological impact, making people genuinely feel “the future is arriving.” This is Musk’s specialty: creating milestone, high-impact moments so people intuitively grasp what’s coming—something charts and data can never achieve.

06 The Art of Capital Allocation: Wisdom in Bet Sizing

1. Musk is “one of the greatest capital allocators in history”

Shaun believes Musk’s capital allocation skills are underestimated:

-

Timing of battery factory investments

-

Timing of autonomous driving investments (actual effective timing)

-

Timing of Starlink’s low-earth orbit constellation

The key isn’t “what to invest in,” but **“when and how big.”**

2. Evolution of the Starlink bet: A masterful rhythm from small to large

SpaceX began researching Starlink around 2013, but kept investment minimal—they were waiting for Falcon 9 reusability. After achieving it in 2016, they spent two more years refining tech details. By 2018, Musk confirmed all elements were in place:

-

Phased array RF technology mature enough

-

Launch costs economically viable (due to reusable rockets)

-

Flight frequency could increase dramatically (no need to build new rockets each time)

"At that point, the small bet upgraded to medium. Once unit economics were validated, it scaled up to a large bet."

3. Hedge fund mindset: Learn with small positions, then scale up

Shaun draws a hedge fund analogy:

"If you have a vague idea about a company but don’t fully understand it, you start with a 1% position—this forces you to learn. From outside, deep learning is hard, but with skin in the game, you care more, pay attention. If the thesis holds, scale from 1% to 5% or 10%."

Musk’s instinct here is severely underestimated—his judgment on bet sizing is as precise as his technical judgment.

07 From Battlefield to Investment: Cognitive Leaps in Extreme Environments

1. The most extreme form of “stepping into the fire”

During his PhD, Shaun was recruited by DARPA to work in Afghanistan. This was completely unplanned (he intended to become a professor), but he said: "I wanted to serve my country—this was the ultimate way to step into the fire."

"In a warzone, your learning speed is unbelievable—because feedback and danger are that intense."

2. A coordinated attack incident: When intuition precedes data

In March or April 2012, Shaun drove weekly from one base to another for briefings. That day, no other vehicles were on the road—the usual 45-minute to 1-hour drive took only 15 minutes.

"I immediately sensed something wrong. Upon arrival, I went straight to the intelligence center asking everyone: What happened? Any reports? Everyone felt the tension, but no intel indicated anything. About 2–3 hours later, a massive coordinated attack occurred—six different bases attacked nationwide."

This experience taught Shaun a profound lesson: When your gut says something’s wrong but data shows nothing—your data system needs improvement.

He spent three weeks thinking “how could we have known earlier”—there were methods, though he won’t disclose specifics in interviews.

08 From Bullying Victim to World Champion: Power of Non-Traditional Paths

1. The absurd renaming incident on the second day of 7th grade

On Shaun’s second day of 7th grade, a student from a wealthy family, Vinnie Terramina (whose father sold a waste company to Waste Management for $500 million), stood on a flower bed pointing at Shaun in the crowd: "You, your new name is Joel."

Then every teacher’s roll call sheet had "Sean Maguire" crossed out and replaced with "Joel." Other students told teachers in advance: "This Sean is a troublemaker; his real name is Joel but he'll trick you." The whole class laughed, teachers confused.

The name stuck throughout high school. Some people didn’t even know his real name was Sean. Years later, Shaun asked Vinnie why—he said: "I was hungover that day, you looked like a kid named Joel Jacobson I knew. Just popped into my head. Sorry."

2. A "Lord of the Flies" school where sleeves were torn off

The school had a PE tradition: students tore sleeves off their T-shirts, which spread until tearing others’ sleeves became a display of dominance.

Shaun and another fast runner, Chris Ringstrom, were chased daily by over 20 students for 15 minutes trying to protect their sleeves—"We were the last two with intact sleeves."

"We’d run into seagull flocks, hundreds taking flight. They defecate when taking off (during digestion), about 5% poop mid-lift. Almost every morning, one or two chasers got bird poop on them."

This explains why Shaun became a pro esports player: He’d rather spend 10 hours daily in Counter-Strike than stay in school.

3. From pro gaming to investor: Key skills learned from games

From grades 8–10 (ages 13–16), Shaun played CS 10 hours daily, joined top North American teams, earned money (~$10k/year).

What did he learn?

-

Networking fundamentals: To reduce 10ms latency, he studied computer networks, used Wireshark to analyze home network jitter

-

Extreme team coordination: 5v5 tactical synergy, communication at professional athlete level

-

Precision angle understanding at pixel level: e.g., on de_Aztec map, two teammates must stand at 90-degree angles so even if the first dies to a faster opponent, the second ensures a kill—worst case 1-for-1, not losing two

"Parents think gaming addiction is bad. My view: Obsession with almost anything is better than apathy."

He failed Algebra 2 in high school, yet eventually earned a PhD in math and physics—because gaming taught him systematic thinking and teamwork.

09 How Key Figures Work With Musk

1. Working styles of Gwynne Shotwell, Steve Davis

Shaun summarizes traits of those who work long-term with Musk:

First, willing to do real work. Antonio Gracias (partner at Valor Equity) slept in Tesla factories during production ramp-ups—"This level of commitment is hard to overstate."

Second, tight-lipped. "Sounds simple, but when trying to change the future’s trajectory, surprise is sometimes essential. Most investors leak secrets. Keeping quiet is a very low bar, yet most fail."

Third, full-time support. Present in good times and bad—Antonio excels here more than almost any investor.

2. Understanding "AlphaGo-style decisions": Moves only visible 17 steps later

Shaun compares Musk to AlphaGo (the AI that beat Go world champions):

"AlphaGo made moves that Go players couldn’t understand at all, but 17 moves later AlphaGo wins, and everyone realizes 'Wow, that move was insane.' Working with Musk is like that—he makes extremely counterintuitive moves you can’t grasp at the time, but 6 months or 1 year later you get it, and he looks prophetic."

Those who don’t understand leak plans, question decisions. Those who do trust the system, trust the direction, remain loyal to teammates, and stay mission-driven—combined with ability and courage to bet on oneself, they thrive.

3. A culture where "anyone can raise their hand to take ownership"

In Musk’s organizations, anyone can say, “I’ll take this on.”

-

If you deliver, great—you get promoted

-

If you raise your hand again and deliver, you get promoted again

-

But if you claim you can do it and fail—you’re done, or stuck

The key is knowing your limits. Saying “I’m not sure I can do it” or “I think someone else is better” is perfectly acceptable—and different from volunteering. Being assigned tasks vs volunteering carry different expectations.

10 Two Major Investment Mistakes and Reflections

1. Selling Nvidia at $600 billion: Underestimating Jensen Huang

Shaun bought Nvidia at its 1999 IPO (when he was 13, due to gaming GPU use), held until $600 billion market cap. At that point, data center and gaming revenues were roughly equal; he thought valuation was too wild and sold.

Where did he go wrong?

First, underestimated Jensen Huang. "Even though I held the stock long-term, I didn’t realize how exceptional Jensen really is. He’s truly outstanding, maximizing his advantages in incredible ways."

Second, underestimated how market irrationality can become self-fulfilling. Shaun thought the market was somewhat irrational, but Huang leveraged that irrationality so well that Nvidia became extremely valuable, while AMD and Intel became cheap, forcing them to cut investment. So Nvidia can now aggressively expand investment, while AMD and Intel’s catch-up plans are largely suppressed.

Third, driven out by “hardware-ignorant money.” Shaun was frustrated: "I’ve studied Broadcom, TSMC, ASML since childhood, know semiconductors inside out. But two years ago, new money poured in that didn’t even know what Mellanox (key networking company acquired by Nvidia) was, yet claimed Nvidia would hit $3 trillion market cap. I thought: fine, I’m out."

Key addition: Shaun considers Nvidia’s 2019 acquisition of Mellanox (~$8 billion) "one of the best acquisitions in history," giving Nvidia a massive interconnect technology moat—a seismic advantage in the data center era.

2. Reflection: Some things can only be calibrated in hindsight

Shaun believes if he had better understood how exceptional Huang was, this error could have been avoided. But he also admits much of the money flooding into Nvidia knows nothing about semiconductors—sometimes ignorance frees you from the constraints of “rational valuation.”

"This is the paradox of investing: Deep expertise can sometimes make you overly cautious."

He also says: "I’ll never short Nvidia, because I fear that irrational force, and I don’t know how large AI infrastructure will grow."

Core Insights Q&A

Q1: Why can Musk run multiple companies simultaneously while other entrepreneurs cannot?

A: Musk isn’t alone—he’s a 20-person “collective intelligence” system. These 20 people have worked with him for over 10 years, built deep trust, can autonomously execute his will, know when to escalate and when to decide independently. This默契 cannot be rushed—it takes at least a decade to build. Combined with the extreme talent filter of “giving them rope to hang themselves” (rapid promotion for performance, immediate exit for failure), the result is the top 1% of the organization—the real core competence. Most Silicon Valley entrepreneurs don’t operate this way.

Q2: How to judge someone’s real ability, especially under information asymmetry?

A: The key is “calibration ability”—built through direct contact with extreme talent (Fields Medalists, Nobel laureates, world champion gamers, etc.), establishing precise perception across levels. Intellectual domains have about 15 clear levels, but it’s one-way transparent: high-level individuals can assess others within 30 minutes (±1–2 levels), but those 3+ levels below cannot distinguish higher-tier differences. Like a 1000-rated chess player watching a 2600 vs 2800 game—they see no difference—but a 2800 player can pinpoint the opponent’s level after 10 moves. Investing is about spotting these signals: what does “co-authoring a paper with a top scholar as an undergrad” mean? Most VCs simply can’t see it.

Q3: Why do almost all people underestimate Musk’s companies?

A: Because the human brain only responds to “precedents and superlatives,” failing to grasp nonlinear progress. People can see rocket explosions versus landings, but miss generational gaps between Falcon 1, Falcon 9, reusable Falcon 9, and Starship. The Boring Company’s “zero people in tunnel, continuous mining” target has technical difficulty between Falcon 9 and reusable Falcon 9—but outsiders don’t get it because they only do linear comparisons (one drill vs another). Deeper still, people can’t grasp Musk’s “AlphaGo-style decisions”—moves incomprehensible at the time, but showing prophetic accuracy 6 months or 1 year later. Those who work long-term with Musk possess the rare ability to “trust the system, wait for validation”—extremely uncommon in an age demanding instant feedback.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News