Same coin playing, why did you become "illegal operation"?

TechFlow Selected TechFlow Selected

Same coin playing, why did you become "illegal operation"?

Compliance first, don't take the blame.

By Attorney Pang Meimei

"In fact, many web3 professionals Attorney Pang Meimei has encountered—those 'web3 people' who genuinely want to run legitimate businesses in the web3 world—are diligently working to uphold the reputation of cryptocurrencies. In reality, regardless of the form of cryptocurrency-related crime, the core of legal evaluation always lies in the harm caused by the conduct itself, not in the attributes of the technology or tools used."

The cryptocurrency industry has long been a dark forest, needing to guard against on-chain security threats while also remaining vigilant against the legal sword from the real world. The same act of exchanging currency via USDT transfers can lead one person to earn a "favor" among friends, while another may be convicted of "illegal business operations."

1. Regulatory Signals Behind the Elevated Jurisdiction in a Sichuan Cryptocurrency Case

In the 2024 annual list of typical cases under elevated jurisdiction released by the Supreme People's Court on July 29, 2025, Case No. 200—the illegal business operations case involving Wan Mouyuan and others—is an example that sets a precedent and provides broad guidance. Initially accepted by the Muchuan County People's Court in Sichuan Province, the court determined that the case involved issues regarding the characterization of using virtual currencies as a medium for foreign exchange trading. Given differing regional understandings of cryptocurrency legality and practical disagreements over such conduct, the case was referred to the Leshan City Intermediate People's Court in Sichuan for elevated jurisdiction.

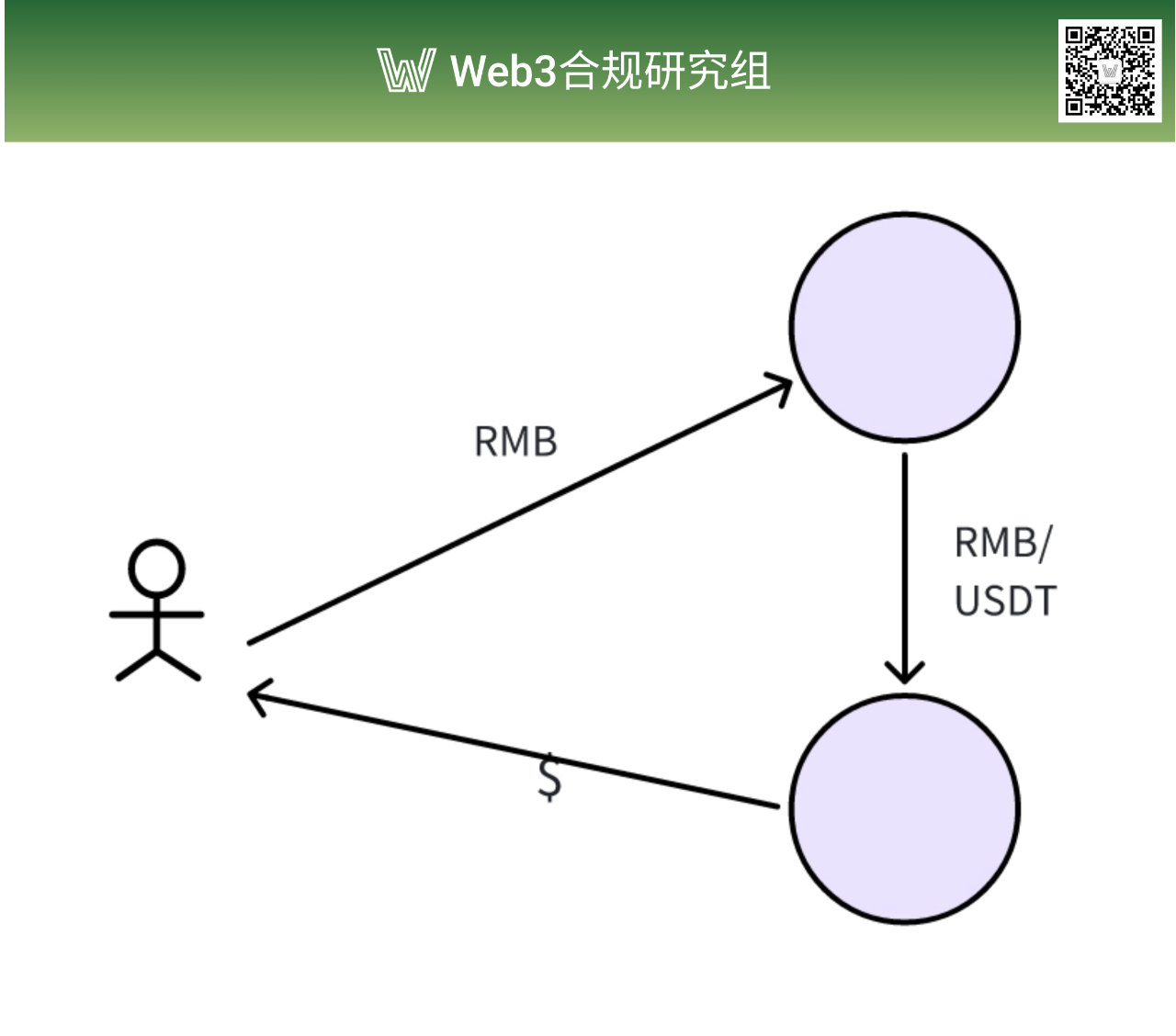

Through data research, Attorney Pang Meimei found that since 2023, over 30% of cryptocurrency-related foreign exchange crime cases have adopted either elevated or designated jurisdiction, indicating that these cases have become a key monitored area within new types of financial crimes. Courts have used this case to clarify adjudication standards. For cases involving deliberate evasion of national foreign exchange regulations through cryptocurrency, people's courts will peel back the layers, lift the "veil" of cryptocurrency transactions, expose the true nature of the acts, and strictly punish all foreign exchange-related illegal and criminal activities. Ultimately, the court ruled that Wan Mouyuan and others conducted foreign exchange transactions via a "RMB–USDT–USD" model and sentenced the ringleader to 13 years and 6 months in prison for illegal business operations.

2. Legal Breakdown: How Did Exchanging Currency via USDT Become Illegal Business Operations?

Many people ask, "I've helped friends exchange currency too—how does that constitute illegal business operations?"

This requires understanding the operational model. The core operation of Wan Mouyuan’s group was: domestic clients transferred RMB into designated accounts; the group then converted equivalent amounts of USDT into USD overseas and deposited them into the clients’ overseas accounts—creating a three-stage process: "domestic RMB – overseas USDT – target currency," with USDT serving as a "currency converter" in the middle.

The Supreme People's Procuratorate specifically pointed out in a 2023 typical case that using virtual currency as a medium to convert RMB into foreign currencies essentially constitutes illegal foreign exchange trading aimed at evading regulation. Even without directly handling foreign currency, such acts may still result in conviction. In practice, we refer to this as "offset-style currency exchange," colloquially meaning the entire process forms a closed loop of "RMB in, USD out."

The ringleader in this case received a 13-year-and-6-month sentence, which is relatively severe compared to similar cases. In practice, when it comes to illegal currency exchange, cases involving cryptocurrency often receive harsher penalties than traditional underground banking cases. Beyond clear sentencing guidelines, judicial authorities also consider the concealment and harmfulness of the criminal methods during sentencing. Due to characteristics like anonymity, convenience, and cross-border capabilities, tracing funds becomes significantly harder with cryptocurrency, naturally amplifying the perceived harm of such cases—and thus resulting in heavier sentences.

3. What Are the Main Forms of Cryptocurrency-Related Crimes?

The decentralized and anonymous nature of cryptocurrencies has offered innovative pathways for digital economic development, but in recent years it has also been seen by criminals as a "natural safe haven." Based on the different roles cryptocurrency plays in criminal activities, Attorney Pang Meimei categorizes them as follows:

1. Crimes targeting cryptocurrency as the object: These directly attack the virtual assets themselves. The core criminal objective is the unlawful possession of cryptocurrency, fundamentally no different from stealing or robbing traditional property—only the target shifts from tangible to virtual assets. Typical charges include robbery, theft, and illegal acquisition of computer information system data. For example, in Case (2021) Hu 02 Xing Zhong No. 197, the defendant altered payee account details and contact information through technical means to transfer Bitcoin belonging to others into wallets under their control and cashed them out. This behavior met the elements of theft—"unlawful intent to possess, secretly taking someone else's property"—and simultaneously violated the crime of illegally acquiring computer information system data. The court ultimately chose the more serious charge, convicting and sentencing under theft, showing that the property nature of cryptocurrency is now widely recognized in the judiciary.

2. Crimes using cryptocurrency as a tool or method: Leveraging its features to achieve illegal purposes. In these cases, cryptocurrency is no longer the target but serves as a "medium" to transfer funds and evade oversight. Its hard-to-trace characteristics make it a critical link in illicit gray-market chains, leading to charges such as operating gambling sites, money laundering (concealment of criminal proceeds), and aiding information network criminal activities. For instance, cross-border gambling platforms require domestic gamblers to convert gambling funds into cryptocurrency before transferring them to designated wallets, using cryptocurrency's anonymity to sever financial traceability. Suspects then use coin mixing and cross-chain transfers to launder illicit funds. In such cases, judicial authorities treat cryptocurrency as a form of equivalent value or settlement mechanism.

3. Crimes using cryptocurrency as a "concept": Fraud disguised as "innovation." These are the most deceptive. Offenders often claim to leverage blockchain decentralization or cryptocurrency appreciation, yet have nothing to do with actual cryptocurrency technology. They simply package cryptocurrency as a lure for investors. Charges include fraud, illegal absorption of public deposits, or organizing and leading pyramid schemes. In these cases, cryptocurrency is little more than an elaborately wrapped stage.

In reality, cryptocurrency itself is not a monster. The underlying blockchain technology holds vast application potential in areas like data authentication and cross-border payments. Cryptocurrency is not merely a product of technological innovation but also an intersection of law and finance—only misused by bad actors to commit crimes, making cryptocurrency the scapegoat for illicit activities.

Indeed, many web3 professionals Attorney Pang Meimei has met—those truly aiming to build legitimate businesses in the web3 world—are carefully safeguarding the reputation of cryptocurrency. In truth, no matter the form of cryptocurrency-related crime, the core of legal judgment always centers on the harm of the conduct itself, not the nature of the technology or tools involved.

4. How to Avoid Pitfalls

For ordinary crypto traders, while pursuing profits, it's even more important to maintain compliance. Remember Attorney Pang Meimei’s practical advice—it's your "protective charm":

1. Choose compliant platforms and use legal transaction channels. Avoid private channels, unlicensed underground exchanges, or community-based trading;

2. Keep transactions small-scale and personal. Understand your country's laws and regulations. While China takes a "personal use is fine" stance toward cryptocurrency, large-scale, commercial transactions or providing related services (such as OTC trading or brokerage) may be deemed illegal business operations. Avoid frequent, high-value transactions to prevent being classified as "profit-driven" business activity. I recommend all traders study the Foreign Exchange Control Regulations;

3. Retain all transfer records and chat logs to prove the legitimacy and personal nature of your transactions. In the crypto world, it's best to "get rich quietly"—avoid publicly promoting cryptocurrency investments, recruiting members, or organizing trading activities, even if you have great investment insight;

4. If planning significant investments or engaging in cryptocurrency-related business, consult a professional lawyer in advance to assess legality and safety. Compliance matters more than profit. Before launching any innovative business, clarify compliance boundaries—otherwise, what you see as a business model might look like a criminal offense in court.

Although mainland China currently maintains strict regulation over cryptocurrency, Hong Kong’s pilot initiatives suggest a promising future. The trend of the web3 era calls for forward-looking legal perspectives. The author also looks forward to the day when web3 practitioners and web3 lawyers can jointly tear away the veil obscuring cryptocurrency!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News