Hotcoin Research | Rate cuts on the horizon: How to position assets?

TechFlow Selected TechFlow Selected

Hotcoin Research | Rate cuts on the horizon: How to position assets?

Although a Fed rate cut in September is likely at this point, historically September has been a weak month for cryptocurrencies, and the market may face some downward pressure.

Crypto Market Performance

The current total market cap of cryptocurrencies is $3.87 trillion, with BTC accounting for 58.09% at $2.24 trillion. Stablecoin market cap stands at $288.1 billion, up 1.7% over the past seven days, with USDT representing 59.2%.

Among the top 200 projects on CoinMarketCap, a small portion rose while most declined: M gained 248.24% over 7 days, PUMP rose 38.69%, IP increased 33.08%, SKY climbed 18.29%, and POL advanced 17.46%.

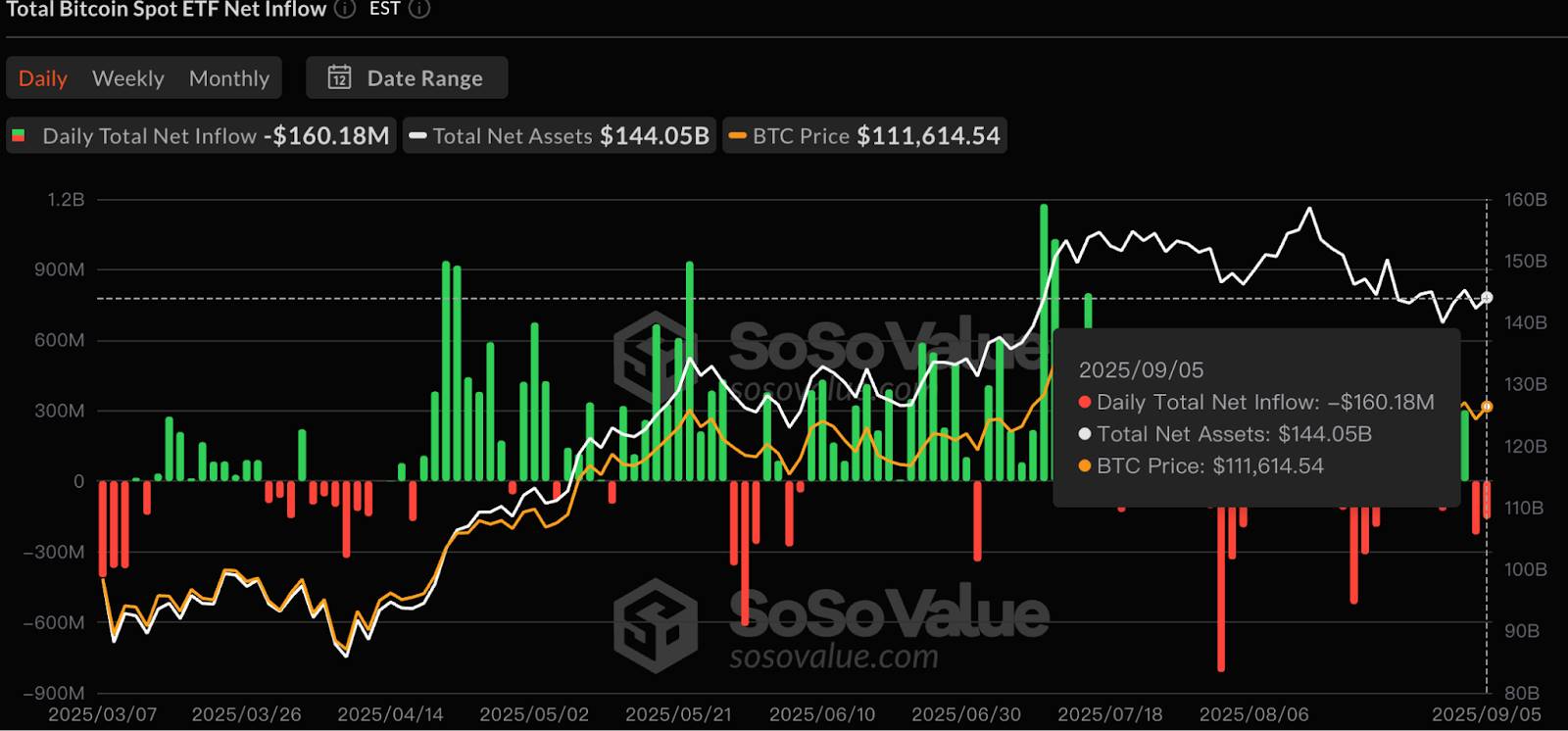

This week, U.S. spot Bitcoin ETFs saw net inflows of $250 million; U.S. spot Ethereum ETFs recorded net outflows of $787 million.

Market Outlook (September 8–13):

The current RSI stands at 48.34, indicating neutral-to-weak momentum. The Fear & Greed Index is at 49 (higher than last week). While a September rate cut by the Federal Reserve is highly likely, historically September tends to be a weak month for crypto, potentially bringing downward pressure to the market.

BTC core range: $107,000–111,000. Short-term traders may consider light long positions near support and light short positions near resistance.

ETH core range: $4,200–4,400. Short-term traders can adopt a buy-low, sell-high approach, following the trend if price breaks out of the range.

The broader market remains in a consolidation phase. Focus could be placed on relatively strong assets such as SOL, which shows technical breakout potential, and XRP, which has concluded litigation with the SEC.

Understanding the Present

Recap of This Week's Key Events

1. On September 1, cryptocurrency entered Australia’s self-managed pension sector, accessing a savings pool of approximately $2.8 trillion;

2. On September 1, the Ethereum Foundation officially announced that the Holešky testnet had reached its planned end-of-life and would soon cease operations;

3. On September 2, U.S. Treasury Secretary Bessent stated that the Federal Reserve is and should remain independent, though it has indeed made many mistakes. Milan, nominee for Federal Reserve Governor, is very likely to take office before the Fed's September meeting. Expressed confidence that the Supreme Court will uphold President Trump's tariffs;

4. On September 4, according to The Information, Polymarket, the world's largest prediction market, received approval from the U.S. Commodity Futures Trading Commission (CFTC) and is set to return to the U.S. market;

5. On September 4, American Bitcoin (ticker ABTC), a mining firm backed by the Trump family, surged nearly 17% to $8.04 per share on its first trading day, peaking at $14. Trading volume exceeded 29 million shares;

6. On September 5, Bitmine, the top institutional holder of Ethereum, increased its holdings by 48,225 ETH, worth $207.54 million;

7. On September 5, the U.S. Securities and Exchange Commission (SEC) proposed a safe harbor for cryptocurrencies and reforms to broker-dealer rules. The proposed changes could affect SEC guidelines on broker-dealers, custody, and reporting, potentially allowing crypto firms to operate in the U.S. under reduced regulatory burdens and lowering legal risks;

8. On September 5, prior to being blacklisted by WLFI, Justin Sun transferred 50 million WLFI tokens, leaving a remaining balance of 545 million WLFI valued at $102.3 million.

Macroeconomics

1. On September 4, U.S. initial jobless claims rose to their highest level since June, further signaling a cooling labor market. Data showed that for the week ending August 30, initial claims increased by 8,000 to 237,000. The median forecast in institutional surveys was 230,000. Continuing claims remained flat at 1.94 million;

2. On September 4, according to CME's "Fed Watch," there is a 97.4% probability of a 25-basis-point rate cut by the Federal Reserve in September, and a 2.6% chance of a 50-basis-point cut;

3. On September 5, the U.S. added 22,000 non-farm jobs in August, below the expected 75,000.

ETF

Data shows that from September 1 to September 5, U.S. spot Bitcoin ETFs saw net inflows of $250 million. As of September 5, GBTC (Grayscale) has seen cumulative outflows of $23.961 billion, currently holding $19.91 billion, while IBIT (BlackRock) holds $83.778 billion. The total market cap of U.S. spot Bitcoin ETFs is $146.032 billion.

U.S. spot Ethereum ETFs saw net outflows of $787 million.

Looking Ahead

Upcoming Events

1. EDCON 2025 will take place in Osaka, Japan from September 16 to 19, gathering members of the global Ethereum community to discuss protocol upgrades, ecosystem development, and the future of Web3;

2. Korea Blockchain Week 2025 will be held in South Korea from September 22 to 28.

Project Updates

1. Nasdaq-listed Bit Digital will hold a shareholder meeting on September 10, 2025, proposing to increase authorized capital from $3.5 million to $10.1 million to support growth strategies, including purchasing Ethereum;

2. The deadline for claiming MITO Genesis airdrop from Mitosis is September 11 at 21:00. The Mitosis Foundation confirmed that MITO used to cover gas fees for claiming has already been deposited into users’ registered claim addresses.

Key Events

1. At 20:30 on September 11, the U.S. will release unadjusted YoY CPI data for August;

2. At 20:30 on September 11, the U.S. will release initial jobless claims (in thousands) for the week ending September 6;

Token Unlocks

1. Aptos (APT) will unlock 11.3 million tokens on September 11, worth approximately $48.97 million, representing 2.2% of circulating supply;

2. Axie Infinity (AXS) will unlock 652,500 tokens on September 9, worth approximately $1.55 million, representing 0.25% of circulating supply.

About Us

Hotcoin Research, the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into practical tools for investors. Through our flagship reports “Weekly Insights” and “In-Depth Research,” we dissect market trends. With our exclusive column “Top Picks” (powered by AI and expert dual-screening), we help identify high-potential assets and reduce trial-and-error costs. Each week, our analysts also engage directly with users via live streams to explain hot topics and forecast trends. We believe that warm, consistent support combined with professional guidance empowers more investors to navigate market cycles and seize value opportunities in Web3.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly recommend that investors fully understand these risks and conduct investments within a strict risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News