Grayscale August Crypto Market Report: Regulatory Breakthrough Imminent, ETH and BTC Trends Diverge

TechFlow Selected TechFlow Selected

Grayscale August Crypto Market Report: Regulatory Breakthrough Imminent, ETH and BTC Trends Diverge

Market attention to regulatory benefits may have contributed to Ethereum's strong performance.

Author: Grayscale

Translation: TechFlow

-

Regulatory clarity for digital assets in the United States has been long anticipated—though the path forward remains unfolding, policymakers have made meaningful progress this year.

-

Market focus on regulatory tailwinds may have contributed to Ethereum’s strong performance. As a leader in blockchain-based financial markets, Ethereum could benefit if regulatory clarity promotes the adoption of stablecoins, tokenized assets, and/or decentralized finance (DeFi) applications.

-

Digital asset treasuries (DATs)—publicly traded companies holding cryptocurrencies on their balance sheets—have surged in recent months, but investor demand may have reached saturation. Valuation premiums for large projects are compressing.

-

Bitcoin prices briefly reached a record high near $125,000, but closed lower for the month. While Bitcoin underperformed in August compared to other assets, mounting pressure on the Federal Reserve's independence reminded investors why Bitcoin has remained attractive.

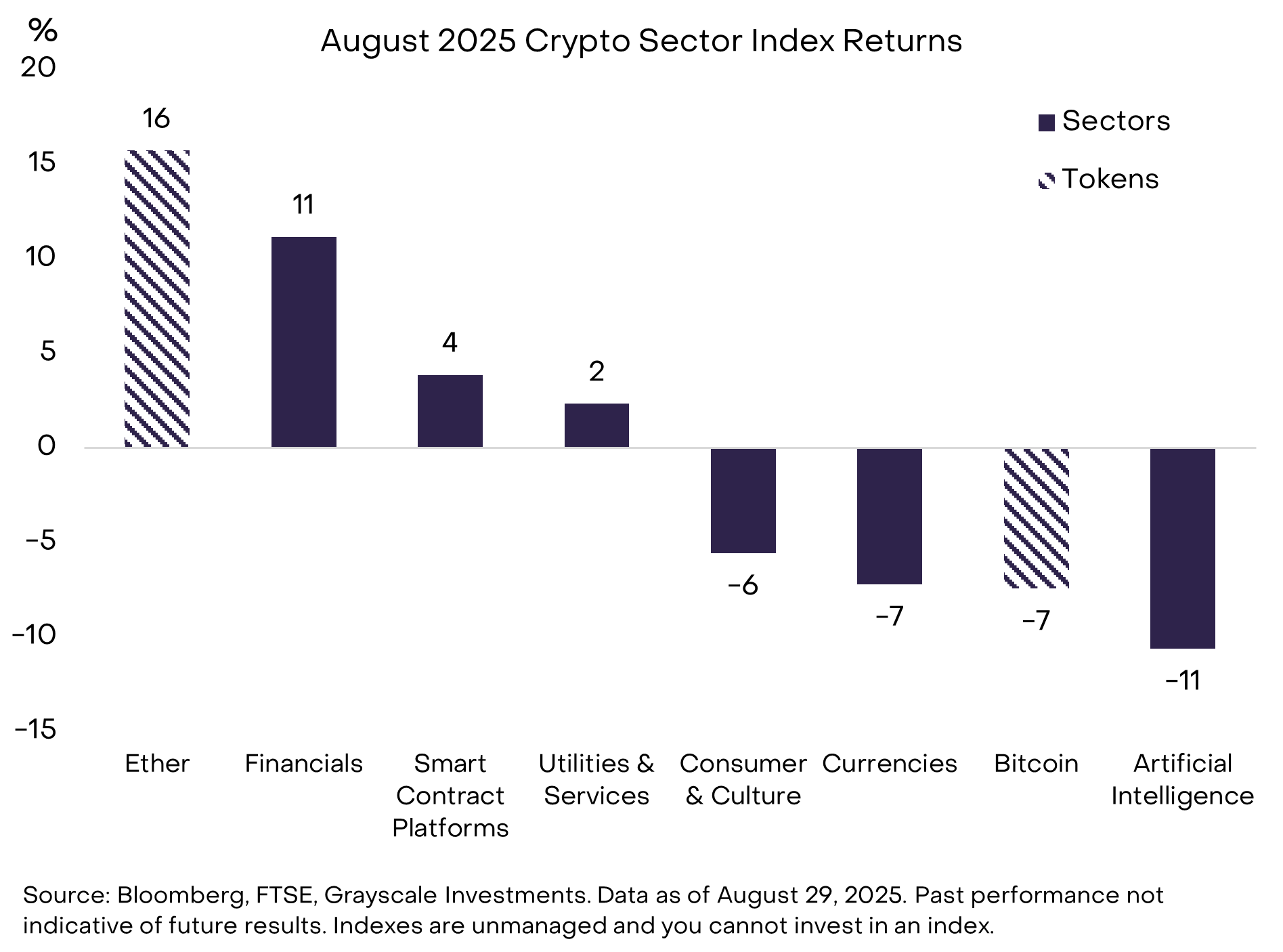

In August 2025, the total cryptocurrency market capitalization stabilized around $4 trillion, though significant sector rotation occurred within the market. Cryptocurrency categories span diverse software technologies with distinct fundamental drivers, so token valuations do not always move in sync.

While Bitcoin declined in price during August, Ethereum rose by 16%.[1] The second-largest public blockchain appears to have benefited from investor attention to regulatory changes that could support the adoption of stablecoins, tokenized assets, and decentralized finance (DeFi) applications—areas where Ethereum currently leads the industry.

Figure 1 shows notable sector shifts in August based on the Crypto Sectors framework (a digital asset classification and index product developed in partnership with FTSE/Russell). The indices for currencies, consumer & culture, and artificial intelligence (AI) crypto sectors all declined slightly, with AI weakness reflecting poor performance of AI-related equities in public stock markets. Meanwhile, the financials, smart contract platforms, and utilities & services sector indices rose during the month. Although Bitcoin posted a monthly decline, it briefly reached a record high near $125,000 mid-month; Ethereum also hit a new all-time high approaching $5,000.[2]

Figure 1: Notable Rotation Across Crypto Sectors in August

The GENIUS Act and Beyond

We believe Ethereum’s recent outperformance is primarily tied to improving fundamentals, most importantly increased regulatory clarity for digital assets and blockchain technology in the United States. One of the most impactful policy developments this year was the passage of the GENIUS Act in July. This legislation provides a comprehensive regulatory framework for payment stablecoins in U.S. markets (see background in Stablecoins and the Future of Payments). Ethereum is currently the leading blockchain for stablecoins by transaction volume and balances. Following the passage of the GENIUS Act, Ethereum’s price rose nearly 50% in July,[3] continuing to drive its momentum into August.

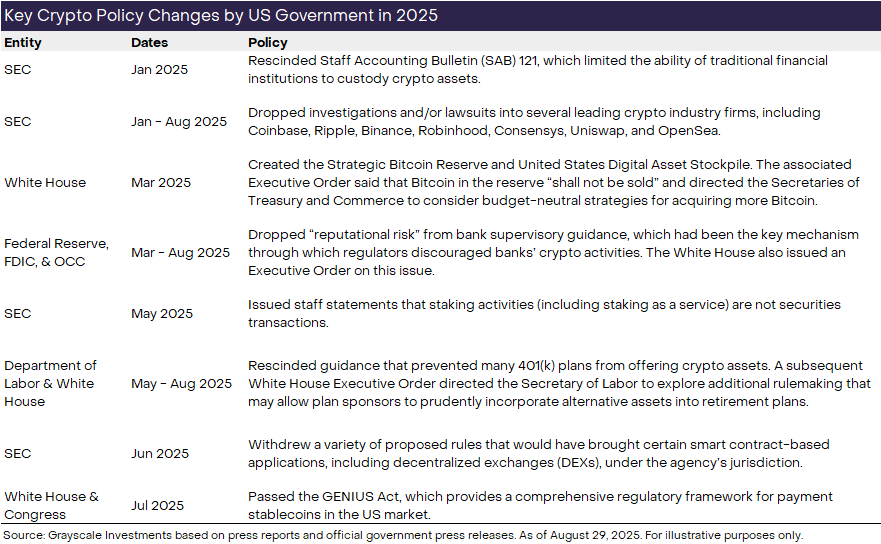

However, U.S. policy changes this year extend beyond stablecoins, covering a range of issues from crypto custody rules to banking regulatory guidance. Looking ahead, these developments could further encourage institutional participation in the crypto industry. Our summary of the Trump administration’s and federal agencies’ most significant policy actions in the digital asset space is shown in Figure 2. These policy shifts, along with potential future measures, are fueling an institutional investment wave in crypto (see March 2025: Institutional Chain Reaction for more details).

Figure 2: Policy Changes Bring Greater Regulatory Clarity to Crypto

In August, both Federal Reserve Governors Waller and Bowman spoke at a blockchain conference in Jackson Hole, Wyoming—an event that would have been unimaginable just a few years ago. The conference followed closely after the Fed’s annual Jackson Hole economic policy symposium. In their speeches, they emphasized that blockchain should be viewed as a financial technology innovation, and regulators must strike a balance between maintaining financial stability and creating room for new technologies to develop.[4]

As September begins, the U.S. Senate Banking Committee plans to consider crypto market structure legislation—a bill addressing issues beyond stablecoins. The Senate effort builds upon the CLARITY Act, which passed the House in July with bipartisan support. Senate Banking Committee Chair Scott stated he expects the market structure legislation will also receive bipartisan backing in the Senate.[5] However, significant questions remain. Industry groups are particularly focused on ensuring the legislation protects open-source software developers and non-custodial service providers. This issue is likely to spark continued debate among lawmakers in the coming months. (Notably, Grayscale is one of the signatories to a recent letter submitted by an industry coalition to members of the Senate Banking and Agriculture Committees.)

Is Demand for DATs Peaking?

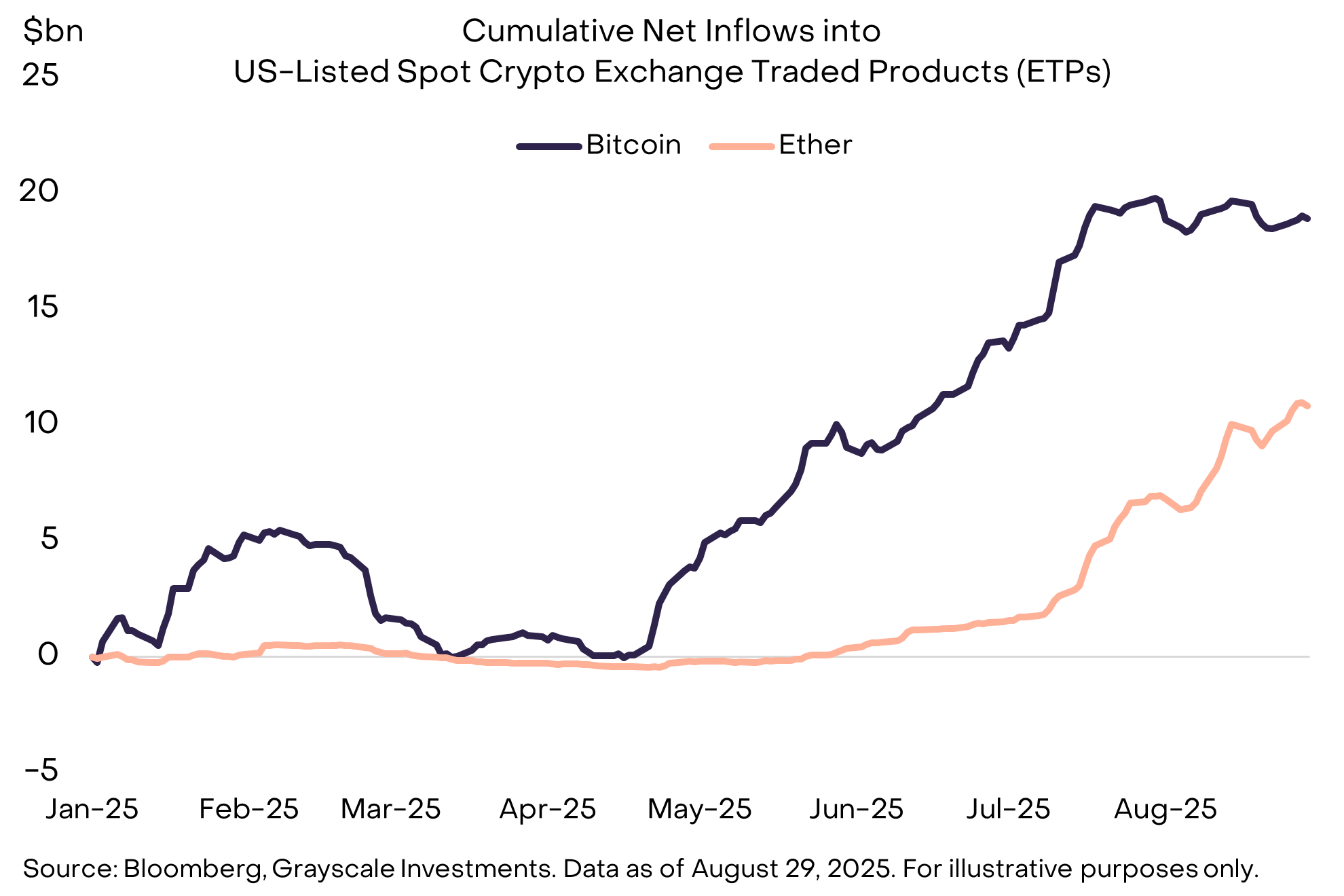

In August, Bitcoin underperformed while Ethereum excelled—a trend clearly reflected in fund flows across multiple trading platforms and products.

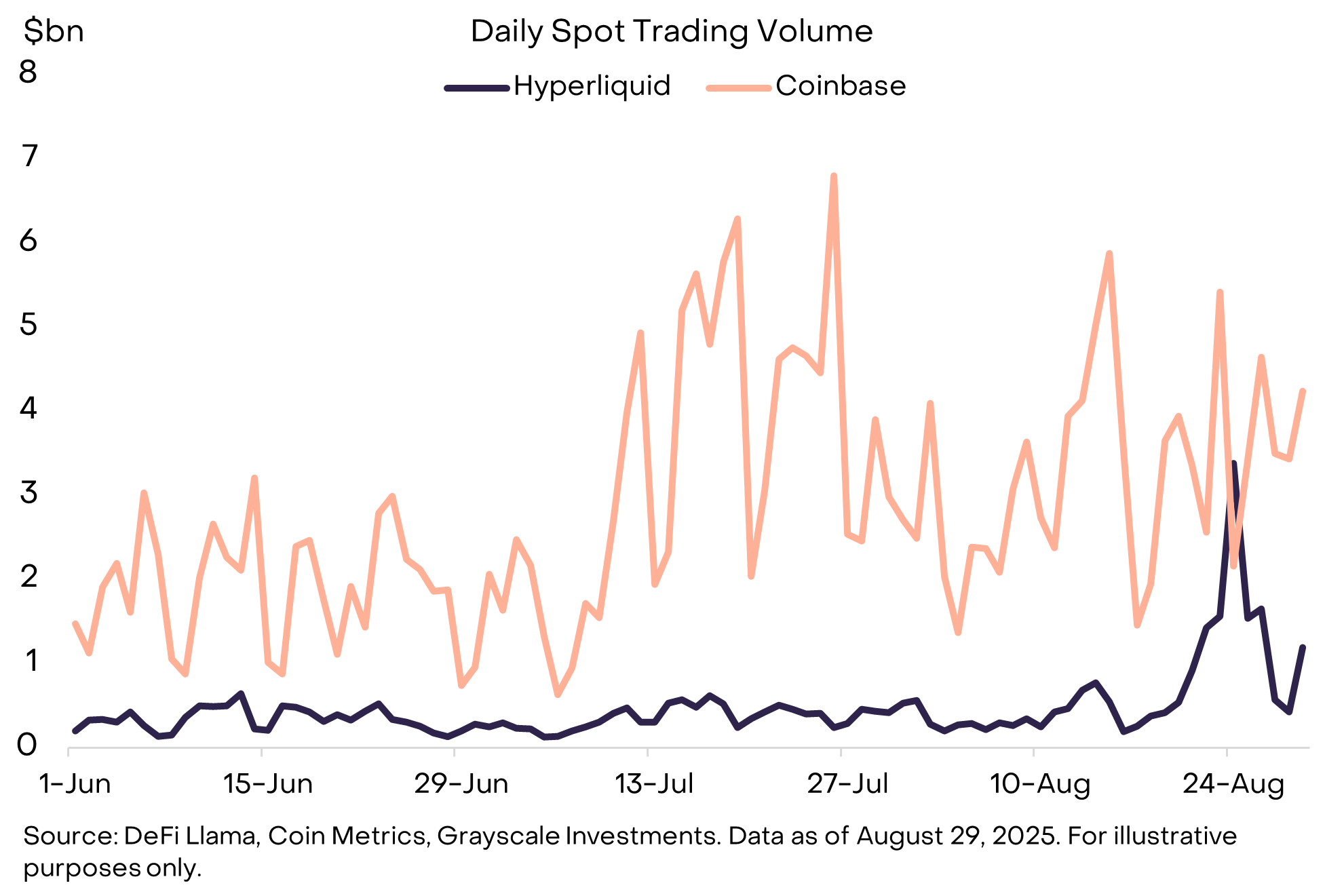

One dramatic episode unfolded on Hyperliquid, a decentralized exchange (DEX) offering spot and perpetual contracts (background in The Appeal of DEXs: The Rise of Decentralized Exchanges). Starting August 20, a Bitcoin "whale" (an investor holding a large BTC position) sold approximately $3.5 billion worth of BTC and immediately purchased about $3.4 billion worth of ETH.[6] While we cannot speculate on the investor’s motivations, such a large risk transfer occurring on a DEX rather than a centralized exchange (CEX) is encouraging. Indeed, on the day with the highest trading volume, Hyperliquid’s spot volume briefly surpassed Coinbase’s spot volume (see Figure 3).

Figure 3: Hyperliquid Spot Volume Surges

A similar ETH preference was evident in net inflows into crypto exchange-traded products (ETPs) during the month. U.S.-listed spot Bitcoin ETPs experienced $755 million in net outflows in August—the first net outflow since March. In contrast, U.S.-listed spot Ethereum ETPs saw $3.9 billion in net inflows in August, following $5.4 billion in net inflows in July (see Figure 4). After two months of surging ETH inflows, both BTC and ETH ETPs now hold over 5% of their respective token’s circulating supply.

Figure 4: ETP Net Inflows Shift Toward ETH

Bitcoin, Ethereum, and many other crypto assets have also been supported by purchases from digital asset treasuries (DATs). DATs are publicly traded companies that hold crypto assets, providing equity investors exposure to cryptocurrencies. Strategy (formerly MicroStrategy), the largest Bitcoin holder among DATs, purchased an additional 3,666 BTC (worth ~$400 million) in August. Meanwhile, the two largest Ethereum treasuries collectively bought 1.7 million ETH (worth ~$7.2 billion).[7]

According to media reports, at least three new Solana DATs are in development, including a project backed by Pantera Capital and a consortium comprising Galaxy Digital, Jump Crypto, and Multicoin Capital aiming to raise over $1 billion.[8] Additionally, Trump Media & Technology Group announced plans to launch a DAT based on the CRO token, linked to Crypto.com and its Cronos blockchain.[9] Recent DAT announcements have also focused on Ethena’s ENA token, Story Protocol’s IP token, and Binance Smart Chain’s BNB token.[10]

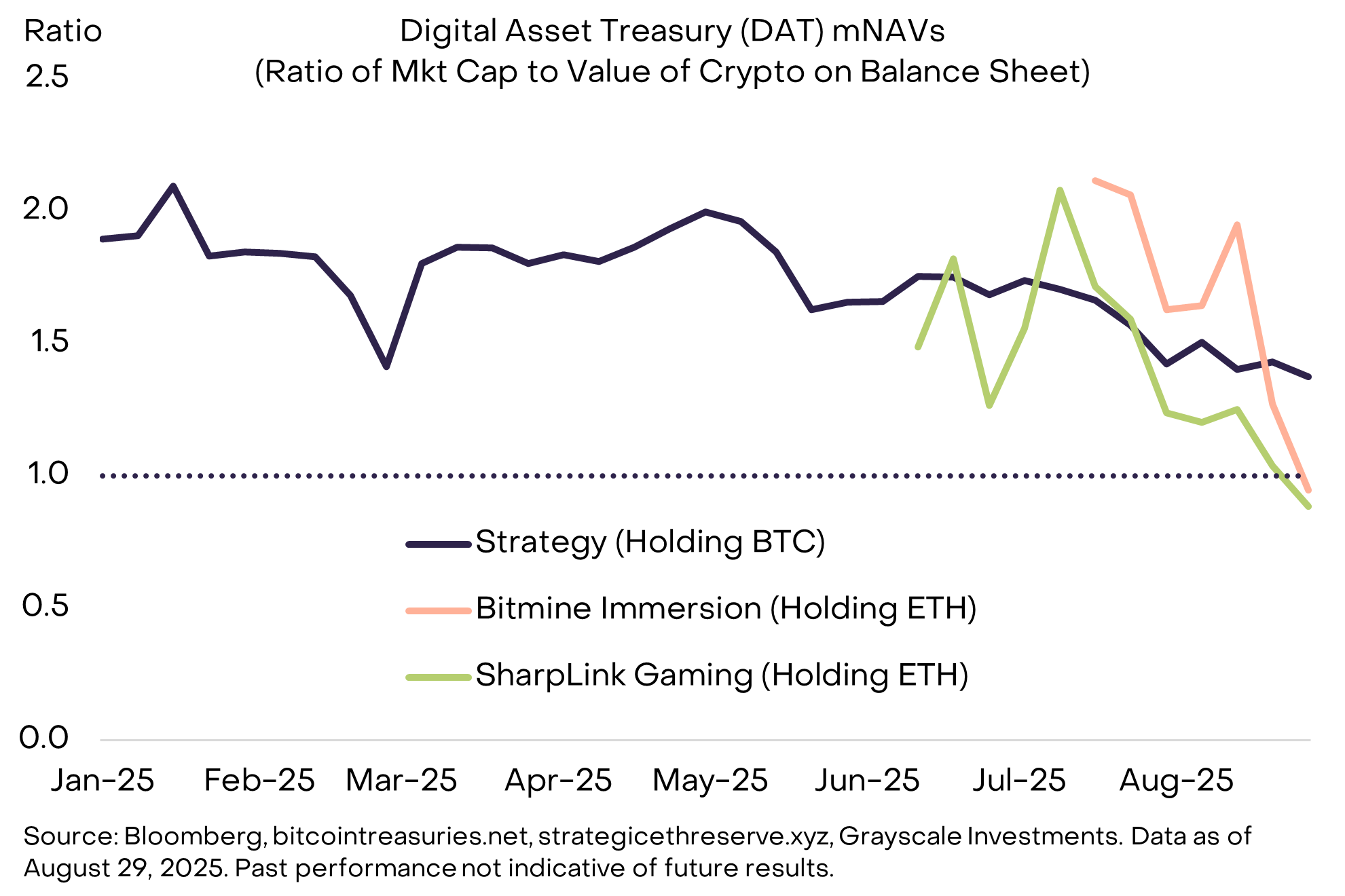

Despite ongoing launches of these investment vehicles, price performance suggests investor demand may be nearing saturation. Analysts often monitor “mNAV”—the ratio of a company’s market cap to the value of crypto assets on its balance sheet—as a gauge of supply-demand imbalance. If demand for crypto via public equity instruments exceeds supply (i.e., insufficient DATs), mNAV may exceed 1.0; if supply exceeds demand (i.e., too many DATs), mNAV may fall below 1.0. Currently, mNAV for several large projects appears to be converging toward 1.0, suggesting DAT supply and demand are balancing (see Figure 5).

Figure 5: DAT Valuation Premiums Are Declining

Back to Basics: The Case for Bitcoin

Like all asset classes, public discourse around crypto markets often centers on short-term issues such as regulatory changes, ETF flows, and DATs. Yet stepping back, revisiting Bitcoin’s core investment thesis may be more important. Among the many assets in the crypto space, Bitcoin exists to provide a monetary asset and peer-to-peer payment system governed by clear, transparent rules, independent of any single individual or institution. Recent threats to central bank independence serve as a reminder of why many investors find such assets compelling.

For context, most modern economies operate under a “fiat” monetary system. This means currency has no explicit backing (i.e., not pegged to a commodity or other currency), and its value rests entirely on trust. Historically, governments have repeatedly exploited this feature for short-term goals (e.g., re-election), potentially leading to inflation and eroding confidence in fiat systems.

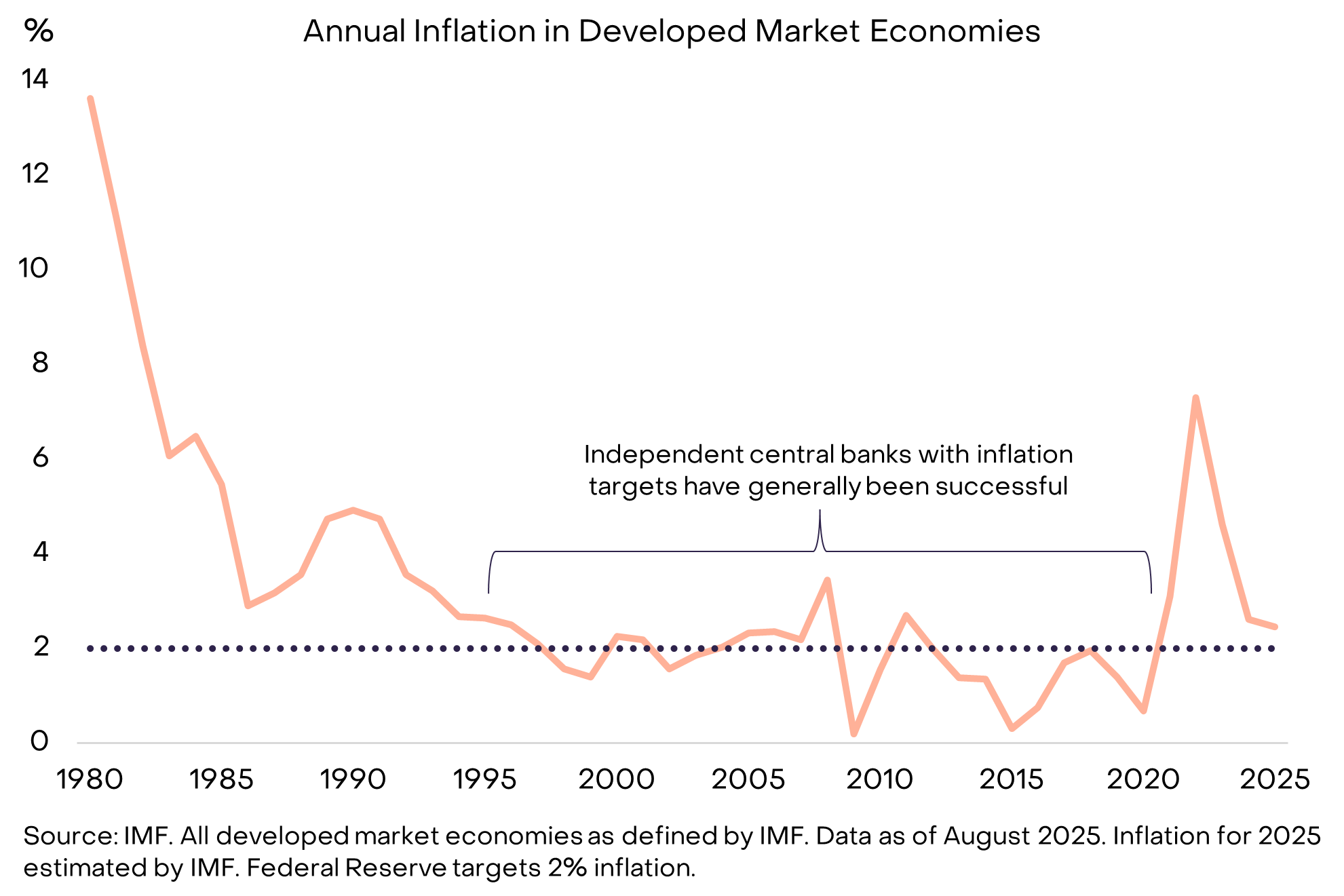

Thus, for fiat money to function effectively, governments must credibly commit to not abusing the system. The U.S. and most advanced market economies achieve this by granting central banks clear mandates (typically inflation targets) and operational independence. Elected officials usually maintain some oversight to ensure democratic accountability. Aside from a brief post-pandemic inflation spike, this system of clear mandates, operational independence, and democratic accountability has delivered low and stable inflation in major economies since the mid-1990s (Figure 6).

Figure 6: Independent Central Banks Deliver Low and Stable Inflation

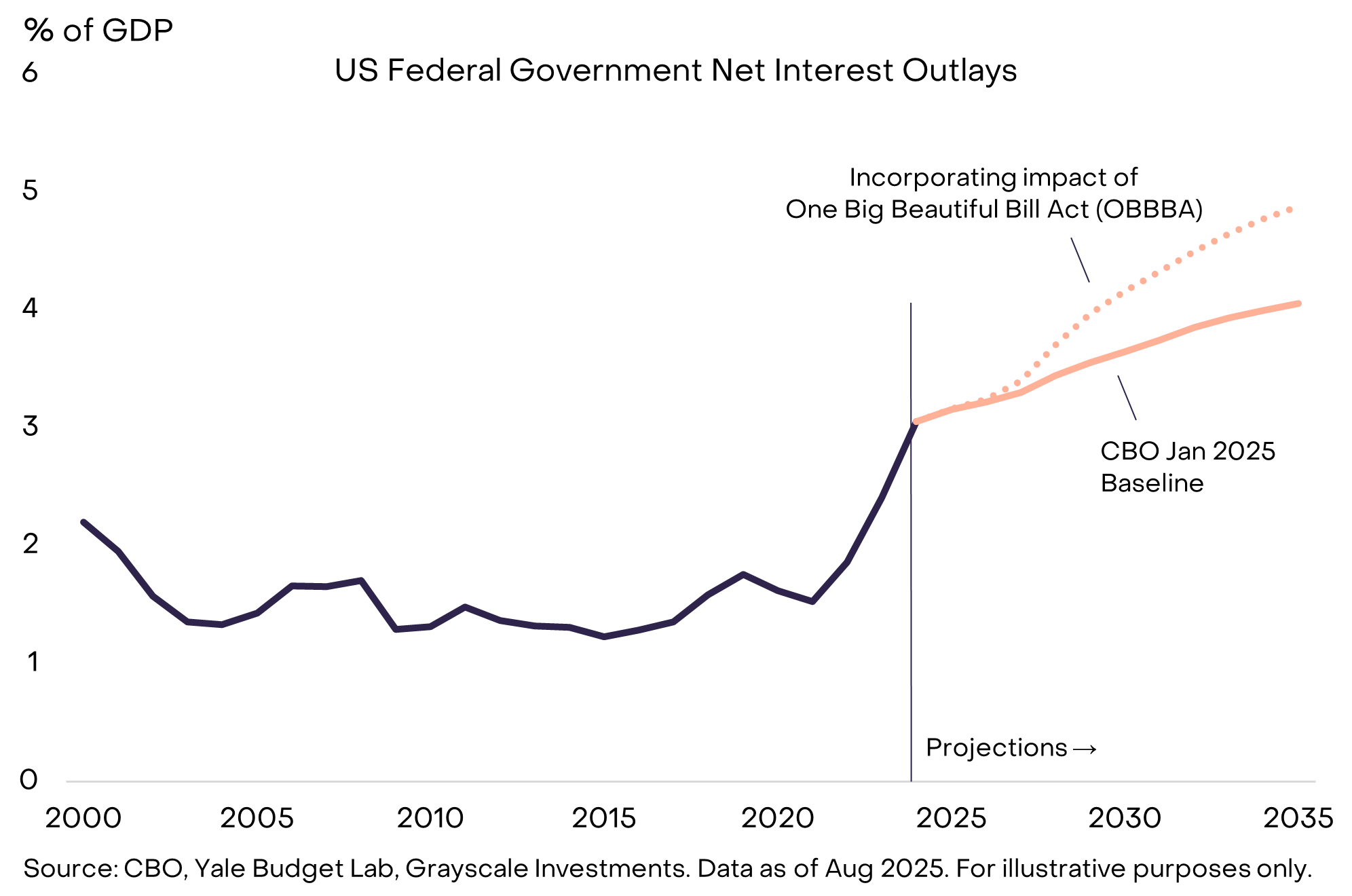

In the U.S., this system is now under strain—not due to inflation, but because of deficits and interest expenses. The U.S. federal government’s total debt is approximately $30 trillion, or 100% of GDP—the highest level since World War II, despite being in peacetime with low unemployment. As the Treasury refinances debt at around 4% interest, interest payments continue to rise, crowding out resources for other purposes (see Figure 7).

Figure 7: Interest Expenses Consume a Larger Share of the Federal Budget

The One Big Beautiful Bill Act (OBBBA), passed in July, locks in high deficits for the next decade. Unless interest rates decline, this implies higher interest expenses and further pressure on other government expenditures. As a result, the White House has repeatedly pressured the Federal Reserve to cut rates and called for Fed Chair Powell’s resignation. In August, threats to the Fed’s independence escalated when Lisa Cook, one of the six sitting members of the Fed’s seven-member board, was removed.[11] While potentially beneficial for elected officials in the short term, weakening Fed independence increases long-term risks of high inflation and currency weakness.

Bitcoin offers a monetary system based on transparent rules and predictable supply growth. When investors lose confidence in institutions safeguarding fiat systems, they turn to more trustworthy alternatives. Unless policymakers strengthen the institutions underpinning fiat currencies—giving investors confidence that low and stable inflation can be maintained over the long term—demand for Bitcoin may continue to grow.

Index Definitions:

-

FTSE/Grayscale Crypto Sectors Total Market Index

-

This index measures the price return performance of digital assets listed on major global exchanges, serving as a benchmark for overall crypto market trends.

-

-

FTSE Grayscale Smart Contract Platforms Crypto Sector Index

-

This index aims to evaluate the performance of crypto assets that support the development and deployment of smart contracts, serving as foundational platforms for self-executing agreements.

-

-

FTSE Grayscale Utilities and Services Crypto Sector Index

-

This index focuses on measuring the performance of crypto assets designed to deliver practical applications and enterprise-grade functionality.

-

-

FTSE Grayscale Consumer and Culture Crypto Sector Index

-

This index assesses the performance of crypto assets supporting consumer-centric activities across various goods and services sectors.

-

-

FTSE Grayscale Currencies Crypto Sector Index

-

This index measures the performance of crypto assets fulfilling one of three core functions: store of value, medium of exchange, or unit of account.

-

-

FTSE Grayscale Financials Crypto Sector Index

-

This index specifically evaluates the performance of crypto assets designed to facilitate financial transactions and services.

-

Sources:

[1] Source: Bloomberg. Data as of August 29, 2025. Past performance is not indicative of future results.

[2] Source: Bloomberg. Bitcoin reached its all-time high on August 14; Ethereum on August 24.

[3] Other organizations have recently announced Layer 1 blockchains targeting stablecoin use cases, including Circle (Arc), Stripe (Tempo), and Bitfinex (Plasma). Google also began promoting its Layer 1 GCUL in August. While Ethereum is currently the market leader, many blockchains will compete for shares of stablecoin transaction volume and related fees.

[4] Sources: Federal Reserve, Federal Reserve.

[5] Source: CoinTelegraph.

[6] Source: mempool.space, hypurrscan.io, etherscan.io, Grayscale Investments. Prices in USD, as of August 29, 2025.

[7] Source: Bitcointreasuries.net, strategicethreserve.xyz, Bloomberg, Grayscale Investments. Data as of August 29, 2025.

[8] Sources: Unchained, CoinDesk.

[10] Sources: CoinDesk, The Block, DL News.

[11] Source: New York Times.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News