Fluid: The New Master of DeFi?

TechFlow Selected TechFlow Selected

Fluid: The New Master of DeFi?

Highlights why it is a capital-efficient protocol.

Written by: Castle Labs

Translated by: AididiaoJP, Foresight News

Money markets are at the core of DeFi, enabling users to gain exposure to specific assets through various strategies. Over time, this vertical has grown in both total value locked (TVL) and functionality. With the introduction of new protocols such as @MorphoLabs, @0xFluid, @eulerfinance, and @Dolomite_io, the range of capabilities offered by lending protocols has steadily expanded.

In this report, we focus on one of these protocols: Fluid.

Fluid has launched several features, with the most interesting being Smart Debt and Smart Collateral. It cannot be considered a typical lending protocol, as it also integrates DEX functionality to provide additional services to users.

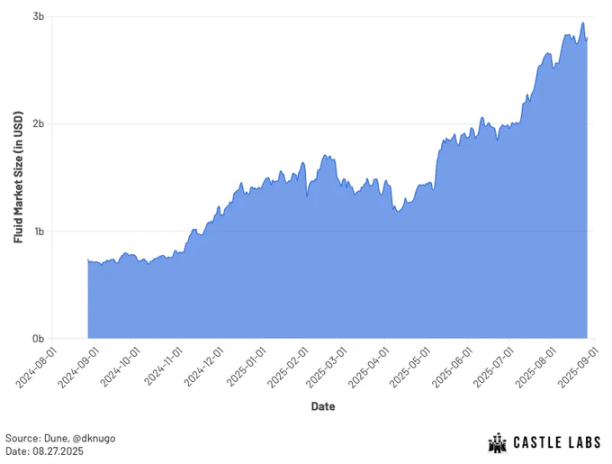

Fluid shows strong growth trajectories in both DEX and lending sectors, with its total market size (measured by total deposits) exceeding $2.8 billion.

Fluid market size, source: Dune, @dknugo

Fluid's market size represents the total deposits within the protocol. This metric is chosen over TVL because debt in the protocol acts as a productive asset, contributing to exchange liquidity.

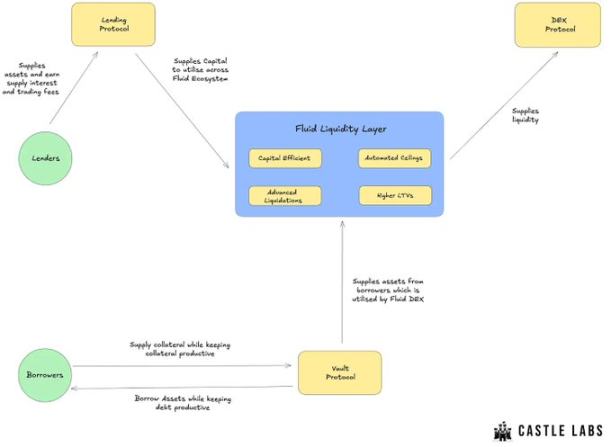

Overview of Fluid Components and Operations

This section briefly outlines the components of the Fluid protocol and explains how it works, emphasizing why it is a capital-efficient protocol.

Fluid uses a unified liquidity model where multiple protocols share the same liquidity pool, including the Fluid Lending Protocol, Fluid Vaults, and the DEX.

Fluid Lending allows users to supply assets and earn interest. The supplied assets are used across the entire Fluid ecosystem, increasing their capital efficiency. It also enables long-term yield opportunities, with the protocol continuously adapting to changing borrower demand.

Fluid Vaults are single-asset, single-debt vaults. These vaults are highly capital efficient because they allow high LTVs (loan-to-value ratios), up to 95% of the collateral value. This number determines a user’s borrowing capacity relative to the amount of collateral deposited.

Additionally, Fluid employs a unique liquidation mechanism that reduces liquidation penalties to as low as 0.1%. The protocol only liquidates the necessary amount to restore a position to a healthy state. Inspired by Uniswap V3's design, Fluid categorizes positions by their LTV tiers or ranges and executes batch liquidations when the collateral value reaches the liquidation price. Then, DEX aggregators use these batches as liquidity: liquidation penalties are converted into discounts for traders during swaps.

The Fluid DEX generates an additional revenue layer for the liquidity tier through trading fees from swaps, further reducing borrowers' position interest while enhancing the overall protocol's capital efficiency. Different DEX aggregators such as KyberSwap and Paraswap utilize Fluid DEX as a liquidity source to access deeper liquidity and increase trading volume.

On Fluid, users can deposit their collateral into the DEX and simultaneously earn lending fees and trading fees, making it Smart Collateral.

If users wish to borrow against their collateral, they can take out assets or enter a Smart Debt position, making the debt productive. For example, a user borrowing from an ETH and USDC/USDT pool can deposit ETH as collateral and borrow USDC/USDT. In return, they receive USDC and USDT into their wallet for flexible use, while transaction fees earned from that liquidity pool are used to reduce the outstanding debt.

Recent Developments and Expansion of Fluid

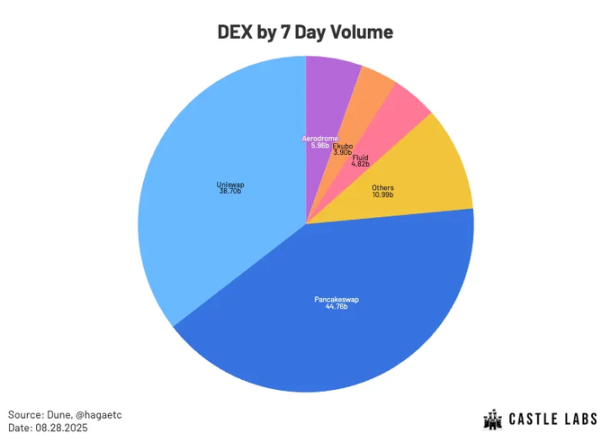

Based on the past 7 days of trading volume data, Fluid DEX ranks fourth, behind @Uniswap, @Pancakeswap, and @AerodromeFi. Fluid's integration with Jupiter Lend has gone live, having been in private testing since the beginning of this month, and Fluid DEX Lite is now live.

In addition, Fluid DEX v2 is即将投入使用.

DEX rankings by 7-day trading volume, source: Dune, @hagaetc

Beyond this, the protocol is expected to conduct token buybacks, as its annual revenue has exceeded $10 million. Fluid recently posted related content on its governance forum; the post initiated discussions on buybacks and proposed three methods.

View the different proposed methods here:

https://x.com/0xnoveleader/status/1957867003194053114

Subject to governance approval (after discussion), buybacks will begin on October 1, with a 6-month evaluation period.

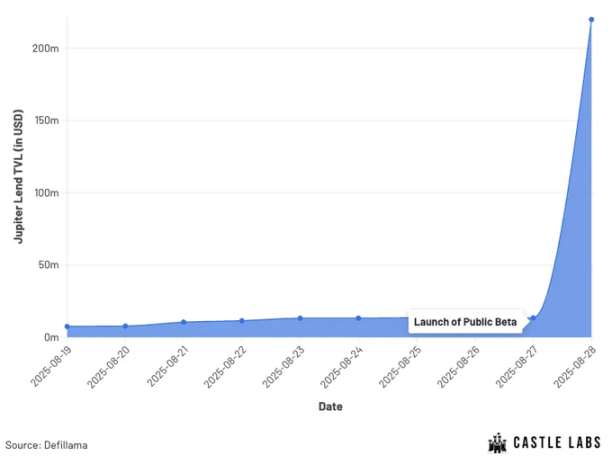

Jupiter Lend: Fluid Enters Solana

Fluid's expansion into Solana was carried out in collaboration with @JupiterExchange.

Jupiter is the largest DEX aggregator on Solana, with cumulative trading volume exceeding $970 billion, and is also a leading perpetuals exchange and staking solution on Solana.

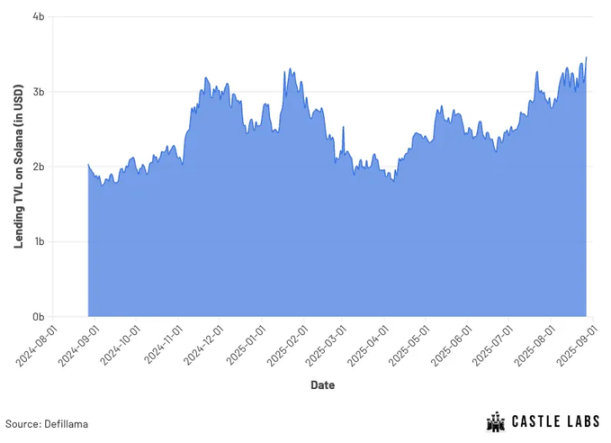

The TVL of lending on Solana currently exceeds $3.5 billion, with @KaminoFinance being a major contributor. The lending vertical on Solana presents significant growth potential for Fluid.

@jup_lend launched publicly after several days of private testing. Its TVL has already surpassed $250 million, making it the second-largest money market on the Solana blockchain, trailing only Kamino.

Jupiter Lend, launched in partnership with Fluid, offers similar functionality and efficiency, with Smart Collateral and Smart Debt expected to launch on the platform later this year.

In addition, 50% of the platform's revenue will be allocated to Fluid.

Iterations of Fluid DEX

Fluid has launched its DEX Lite and plans to roll out V2 soon. This section covers both versions and explains how these iterations will help Fluid grow further.

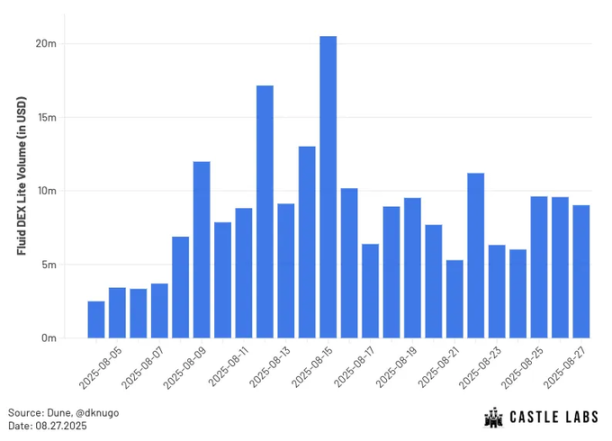

Fluid DEX Lite

Fluid DEX Lite launched in August and functions as a credit layer on Fluid, allowing it to borrow directly from the Fluid liquidity layer. It has started providing trading volume for relevant pairs, starting with the USDC-USDT pair.

This version of Fluid DEX is highly gas-efficient, reducing swap costs by approximately 60% compared to other versions. It was created to capture a larger share of trading volume in correlated pairs, where Fluid is already the dominant protocol.

In its first week of launch, Fluid Lite generated over $40 million in trading volume, with initial liquidity of $5 million borrowed from the liquidity layer.

Fluid DEX Lite trading volume, source: Dune, @dknugo

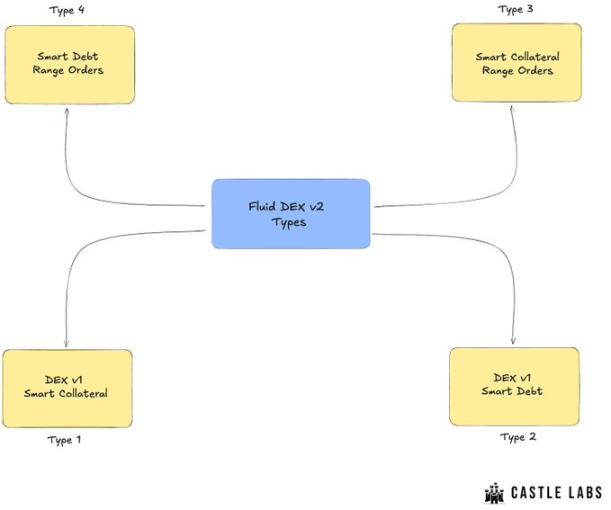

Fluid DEX V2

Fluid DEX V1 launched in October 2024 and accumulated over $10 billion in trading volume on Ethereum within just 100 days—faster than any other decentralized exchange. To support this growth, Fluid is launching its V2 version, designed with modularity and permissionless scalability in mind, allowing users to create multiple custom strategies.

First, V2 will introduce four different types of DEXs within the protocol, two of which carry over from V1. The types of DEXs supported by Fluid will not be limited to these four; more types can be deployed via governance.

The two newly introduced types are Smart Collateral Range Orders and Smart Debt Range Orders. Both enable borrowers to enhance their capital efficiency.

Smart Collateral Range Orders work similarly to Uniswap V3, allowing users to provide liquidity by depositing collateral within a specific price range while also earning lending APR.

Smart Debt Range Orders function similarly, allowing users to create range orders on the debt side by borrowing assets and earning trading APR.

In addition, it introduces features such as hooks (similar to Uniswap V4) for custom logic and automation, flash accounting to improve fee efficiency for CEX-DEX arbitrage, and on-chain yield-accruing limit orders, meaning limit orders earn lending APR while waiting to be filled.

Conclusion

Fluid continues to grow and improve by offering a suite of unique features aimed at increasing capital efficiency.

Smart Collateral: Collateral deposited on the platform can earn both lending interest and trading fees.

Smart Debt: Smart Debt reduces debt by using transaction fees generated from debt to partially repay it, making borrowed debt productive for users.

Unified Liquidity Layer: Fluid’s unified liquidity layer enhances capital efficiency across the ecosystem through features like higher LTVs, advanced liquidation mechanisms, and automatic caps for better risk management.

Its recent expansion into Solana via the Jupiter partnership extends its market share in the lending category to non-EVM networks. Meanwhile, Fluid DEX Lite and DEX V2 aim to enhance user experience and increase trading volume on EVM chains.

Furthermore, DEX V2 is expected to launch on Solana later this year, enabling Fluid to enter both Solana’s lending and exchange verticals.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News