$WLFI launches tonight, what should it be worth?

TechFlow Selected TechFlow Selected

$WLFI launches tonight, what should it be worth?

From concept and voting to actual delivery, WLFI is completing the transition from a "political symbol" to a "tradable asset."

Written by: BlockBeats

After months of controversy and anticipation, WLFI has finally reached its decisive moment.

On August 26, Trump family-backed crypto project WLFI announced the launch of its Lockbox page, allowing holders to transfer tokens in preparation for unlocking. On September 1 at 8:00 AM Eastern Time, WLFI will complete its first release—20% of initially allocated tokens will officially enter circulation.

For a governance token once described in its whitepaper as "potentially never tradable," this step almost symbolizes a turning point in the project's narrative: moving from concept and voting toward actual realization, WLFI is transforming from a "political symbol" into a "tradable asset."

The Architects Behind WLFI

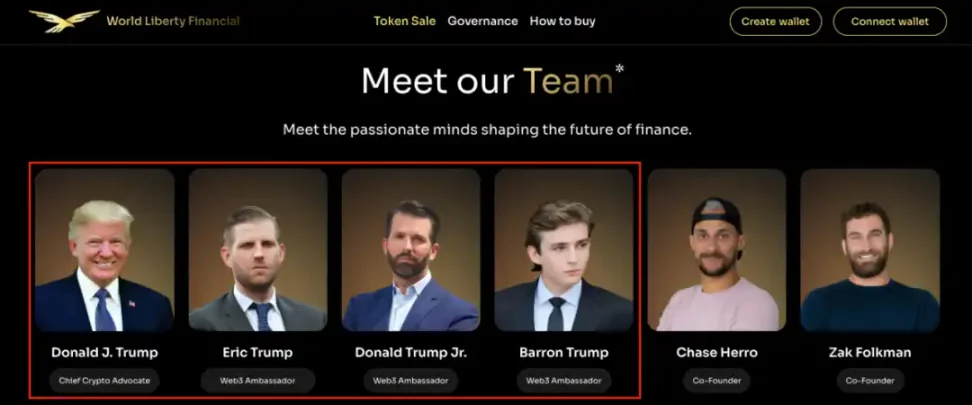

World Liberty Financial (WLFI) was launched on September 16 last year, guided by real estate magnate Steve Witkoff and his son Zach. Co-founders also include crypto influencers Chase Herro and Zak Folkman.

The Trump family holds prominent roles: Donald Trump is listed as the "Chief Crypto Advocate," while his sons Eric, Donald Jr., and Barron serve as "Web3 Ambassadors."

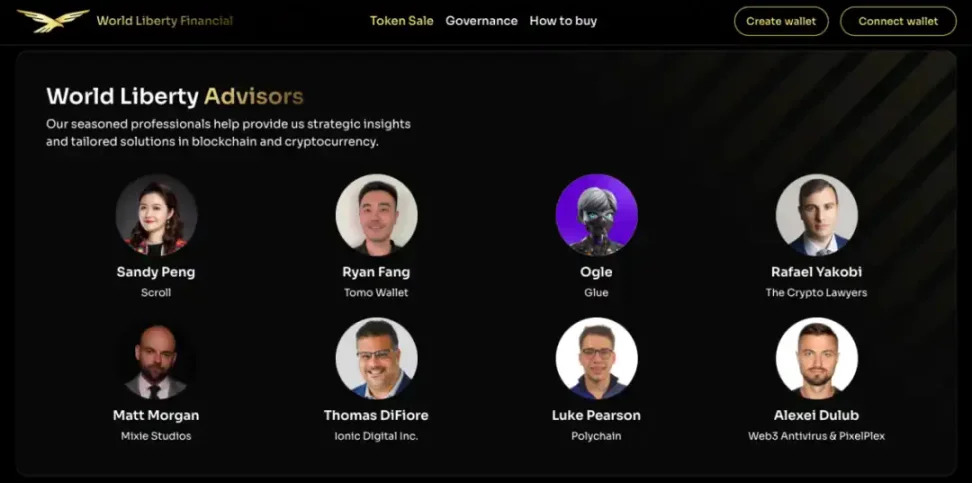

In addition, WLFI has three technical leads:

1. Rich Teo: Head of Stablecoins and Payments, founder of exchange itBit and stablecoin firm Paxos, currently CEO of Paxos Asia. Rich is also an advisor to SocialFi project RepubliK.

2. Corey Caplan: Head of Technical Strategy, co-founder of DeFi platform Dolomite, responsible for integrating lending and trading features.

3. Bogdan Purnavel: Chief Developer, formerly a developer at Dough Finance.

One of World Liberty Financial’s first moves was selling its own token. The ICO began on October 15, 2024, selling 20 billion $WLFI tokens at $0.015 each, earning the company approximately $300 million.

On January 20, 2025—the day of Trump’s inauguration—WLFI announced a second token sale, citing "huge demand and strong interest." Another 5 billion tokens were issued at $0.05, a 230% increase from the initial price. The second sale concluded nearly two months later on March 14, fully achieving its $250 million target.

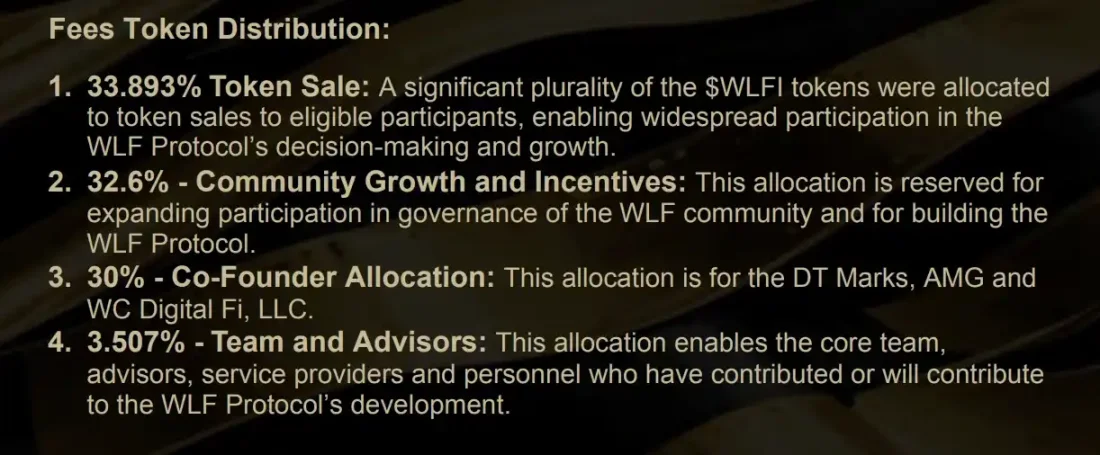

According to WLFI’s “Gold Book,” WLFI tokens grant holders voting rights on key protocol matters such as upgrades. The planned token distribution allocates 33.893% through token sales, 32.6% for incentives and community development, 30% to "initial supporters," and 3.5% to the "core team and advisors."

The project’s whitepaper states: “$WLFI tokens are issued to raise funds, purchase mainstream project tokens with growth potential, and allow $WLFI holders to share in portfolio appreciation.” It explicitly clarifies that purchased $WLFI tokens are solely governance tokens, and the $550 million raised already belongs to the project team.

However, repeated crypto ventures by the Trump family seemed to foreshadow that WLFI would not remain merely a non-transferable "identity verification" token. Now, with the opening of the Lockbox feature, WLFI’s token issuance logic has formally entered the "fulfillment phase," with the previously sold 55 billion tokens gradually being released under community governance.

What Is WLFI’s Token Valuation?

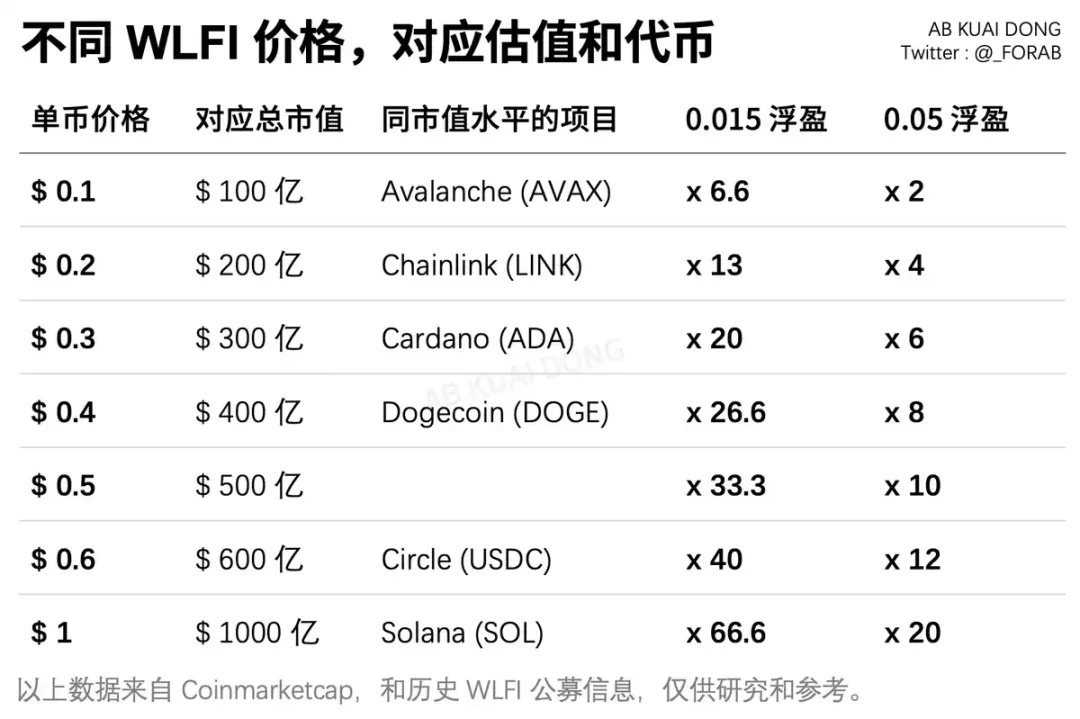

In the initial unlock rules published on August 23, only early presale users’ token portions will be unlocked when WLFI officially launches. Specifically, 20% of WLFI purchased during the $0.015 and $0.05 rounds will be unlocked per address; the remaining 80% unlock schedule will still be decided by community governance votes. Tokens allocated to founders, team members, advisors, and partners remain locked and are not included in the initial unlock.

The market widely views WLFI’s circulation launch as a potential moment of "price repricing." The initial 20% unlock serves both as a test of capital interest and could become a critical juncture determining whether WLFI’s market cap can reach higher levels.

If based on the first-round valuation of $1.5 billion ($0.015/token) and second-round valuation of $5 billion ($0.05/token), the current off-exchange price of $0.24 implies WLFI’s valuation has grown over 16x in the past eight months.

In horizontal comparison, the market generally sees WLFI as a heavyweight counterpart to the TRUMP token. The latter surged to an $80 billion market cap upon launch, while WLFI’s preliminary market cap forecast is approaching $30 billion, leaving ample room for market expectations.

Who Are the Major Holders?

According to joint disclosures by Accountable.US and Bloomberg, among WLFI’s top 50 addresses, at least 14 users hold tokens via U.S.-sanctioned exchanges, collectively holding over 6.7 billion WLFI tokens (worth approximately $335 million). The most notable holder is undoubtedly Justin Sun.

In November 2024, TRON DAO under Justin Sun became the largest independent investor in World Liberty Financial (WLFI), purchasing up to 3 billion WLFI tokens for $30 million. According to insiders, the deal price was far below the then-market-expected $0.015 issue price, settling at $0.01, meaning Sun entered at a roughly 34% discount. This pricing not only secured him early investment gains but also cemented his central role in the WLFI project.

Subsequently, on November 27, 2024, WLFI officially announced that Justin Sun had joined the project as an Advisor, though no mention of Justin appears on the WLFI official website.

Aqua1 Fund

But recently, a fund has overtaken Sun’s top position: on June 26, Web3-native fund Aqua1 announced a strategic purchase of $100 million worth of Trump family crypto project World Liberty Financial’s governance token WLFI, aiming to participate in governance of the decentralized finance platform and accelerate the construction of a blockchain financial ecosystem. On-chain data shows Aqua1 Fund holds 800,000,000 WLFI tokens.

In addition, Aqua1 plans to establish Aqua Fund in the Middle East and jointly incubate RWA tokenization platform BlockRock with WLFI.

DWF Labs

In April 2025, Abu Dhabi-based crypto investment and market-making firm DWF Labs announced it had invested $25 million to acquire tokens issued by the Trump family-controlled crypto project World Liberty Financial (WLFI).

Mike Dudas

Mike Dudas, founder of 6th Man Ventures and The Block, purchased over $145,000 worth of WLFI tokens—approximately 970,000 WLFI—on January 20, 2025, just before Trump’s inauguration ceremony.

Troy Murray

BarnBridge DAO member Troy Murray purchased approximately 666,000 WLFI tokens.

Sigil Fund (alias Fiskantes)

This Gibraltar-based fund’s CIO, using the alias "Fiskantes," spent 40 ETH (about $130,000) to buy WLFI tokens. Based on the WLFI issue price, this amounts to roughly 400,000 WLFI.

From a "non-tradable" governance token to Lockbox-unlocked circulating assets; from "presidential ambassadors" to on-chain holdings; from a stablecoin fundraising tool to an international investment对接platform—WLFI presents an unusual narrative: political and capital forces are converging through cryptocurrency. The September 1 initial unlock marks WLFI’s entry into real market competition, and a crucial test of whether the triple narrative of "politics-finance-crypto" can be fulfilled.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News