The Frenzy and Hidden Concerns of U.S. Treasury Tokenization

TechFlow Selected TechFlow Selected

The Frenzy and Hidden Concerns of U.S. Treasury Tokenization

Why has RWA become the focus after stablecoins? Because blockchain can not only transform the form of money but also has the potential to reshape the underlying architecture of traditional financial markets.

Author: @100y_eth

Translation and editing: Saoirse, Foresight News

Translator’s Note: Amid the wave of real-world assets (RWA), U.S. government bonds stand out as one of the most prominent, with high tokenization activity. This is driven by their exceptional liquidity, stability, relatively high yields, growing institutional participation, and ease of tokenization.

You might wonder whether such tokenization involves complex legal mechanisms. In fact, it does not. It works by transfer agents—responsible for managing official shareholder registries—replacing traditional internal databases with blockchain systems.

To clearly analyze major tokenized U.S. government bonds, this article establishes three analytical frameworks: a token overview covering protocol introductions and issuance volumes, regulatory frameworks and issuance structures, and on-chain use cases. Notably, because tokenized U.S. government bonds are digital securities subject to securities laws and regulations, these rules significantly impact issuance volume, holder count, and on-chain applications. These seemingly unrelated factors actually interact dynamically. Also contrary to common perception, tokenized U.S. government bonds have many limitations. Let us now delve into the development and future of this space.

Tokenization of Everything

"Every stock, every bond, every fund, every asset can be tokenized." — Larry Fink, CEO of BlackRock

Since the passage of the U.S. GENIUS Act, global attention toward stablecoins has surged—South Korea included. But are stablecoins the endgame for blockchain finance?

Stablecoins, as the name suggests, are tokens pegged to fiat currencies on public blockchains. At their core, they remain currencies that must find utility. As explored in the Hashed Open Research x 4Pillars Stablecoin Report, stablecoins can be used in remittances, payments, settlements, and more. However, the area currently seen as the ultimate realization of stablecoin potential is real-world assets (RWA).

RWA (Real-World Assets) refers to tangible assets circulated on blockchains in digital token form. Within the blockchain industry, RWA typically refers specifically to traditional financial assets such as commodities, stocks, bonds, and real estate.

Why has RWA become the focus after stablecoins? Because blockchain can not only transform money but also potentially reshape the underlying architecture of traditional financial markets.

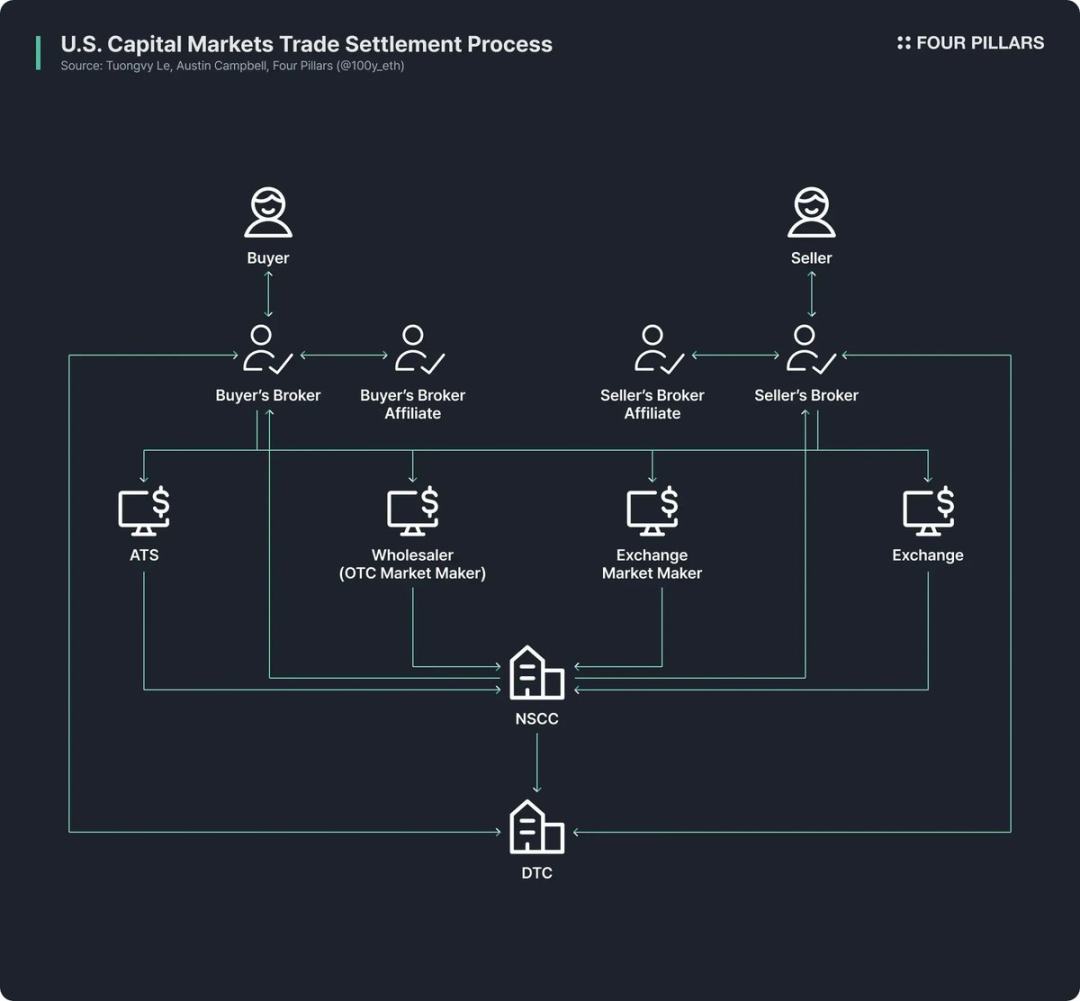

Today's traditional financial markets still rely on extremely outdated infrastructure. While fintech companies have improved front-end experiences for retail users by increasing access to financial products, post-trade operations remain stuck in practices from half a century ago.

Take the U.S. stock and bond trading markets: their current structure originated from reforms in the 1970s following the "paperwork crisis" of the late 1960s. The Securities Investor Protection Act and amendments to securities laws led to the creation of institutions like the Depository Trust Company (DTC) and the National Securities Clearing Corporation (NSCC). This complex system has operated for over 50 years, consistently plagued by redundant intermediaries, settlement delays, lack of transparency, and excessive regulatory costs.

Blockchain offers the potential to fundamentally revolutionize this status quo and create a more efficient and transparent market system: upgrading the financial market back-end with blockchain enables instant settlement, smart contract-driven programmable finance, direct ownership without intermediaries, higher transparency, lower costs, and fractionalized investing.

For these reasons, numerous public institutions, financial firms, and enterprises are actively promoting the blockchain tokenization of financial assets. For example:

-

Robinhood plans to support stock trading via its own blockchain network and has submitted a proposal to the U.S. SEC advocating for a federal regulatory framework for RWA tokenization;

-

BlackRock partnered with Securitize to launch BUIDL, a tokenized money market fund with $2.4 billion in assets;

-

SEC Chair Paul Atkins publicly supports stock tokenization, and the SEC's crypto working group has formalized regular meetings and roundtables on RWA.

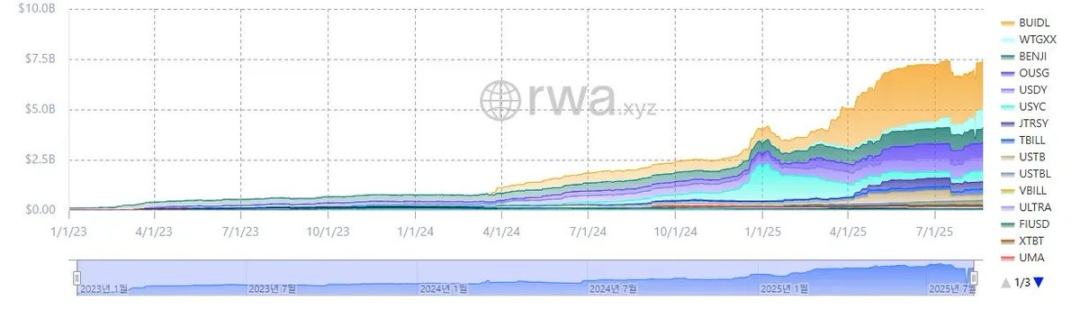

(Source: rwa.xyz)

Beyond the hype, the RWA market is growing rapidly. As of August 23, 2025, the total value of issued RWAs reached $26.5 billion—up 112% year-on-year, 253% compared to two years ago, and 783% compared to three years ago. Tokenized financial assets are diverse, withU.S. government bonds and private credit experiencing the fastest growth, followed by commodities, institutional funds, and stocks.

U.S. Government Bonds

(Source: rwa.xyz)

Within the RWA market, U.S. government bond tokenization is the most active. As of August 23, 2025, the U.S. bond RWA market is valued at approximately $7.4 billion—up 370% year-on-year, showing explosive growth.

Notably, both global traditional financial institutions and decentralized finance (DeFi) platforms are actively entering this space. For instance, BlackRock’s BUIDL leads with $2.4 billion in assets; DeFi protocols like Ondo have launched funds such as OUSG backed by RWA tokens tied to bonds like BUIDL and WTGXX, maintaining around $700 million in scale.

Why have U.S. government bonds become the most active and largest segment in RWA tokenization? Key reasons include:

-

Liquidity and stability: U.S. Treasuries offer the deepest liquidity globally and are viewed as default-risk-free “safe assets,” enjoying strong credibility;

-

Improved global accessibility: Tokenization lowers investment barriers, enabling overseas investors to participate in U.S. Treasury investments more easily;

-

Expanding institutional involvement: Leading institutions such as BlackRock, Franklin Templeton, and WisdomTree are driving the market by issuing tokenized money market and Treasury products, providing trust assurance to investors;

-

Stable and attractive returns: U.S. Treasury yields are stable and relatively high, averaging around 4%;

-

Low tokenization complexity: Despite the absence of a dedicated RWA regulatory framework, basic tokenization of U.S. Treasuries is feasible within existing regulations.

Tokenization Process of U.S. Government Bonds

How exactly are U.S. Treasuries tokenized on-chain? Although it may seem to involve complex legal and regulatory mechanisms, under existing securities laws, the process is remarkably simple (note: issuance structures vary across tokens; this describes a representative method).

A key point to clarify: The current “RWA tokens based on U.S. government bonds” do not represent direct tokenization of the bonds themselves, but rather tokenization of funds or money market funds backed by U.S. Treasuries.

In traditional models, public asset management funds such as U.S. Treasury funds must appoint a “transfer agent” registered with the SEC—a financial institution or service company entrusted by the issuer to manage investor ownership records. Legally, the transfer agent is central to securities recordkeeping and ownership management, holding official responsibility for maintaining investor share records.

The tokenization process for U.S. Treasury funds is straightforward: issue tokens representing fund shares on-chain, and have the transfer agent use blockchain systems for internal operations to manage the official shareholder register. In short, it simply moves the shareholder record database from a private system to a blockchain.

Of course, since the U.S. lacks a clear regulatory framework for RWA, holding tokens currently does not provide 100% legally guaranteed ownership of fund shares. However, in practice, transfer agents manage fund shares based on on-chain token ownership records. Thus, barring hacks or unforeseen events, token ownership typically indirectly secures fund share rights.

Main Protocols and RWA Analytical Framework

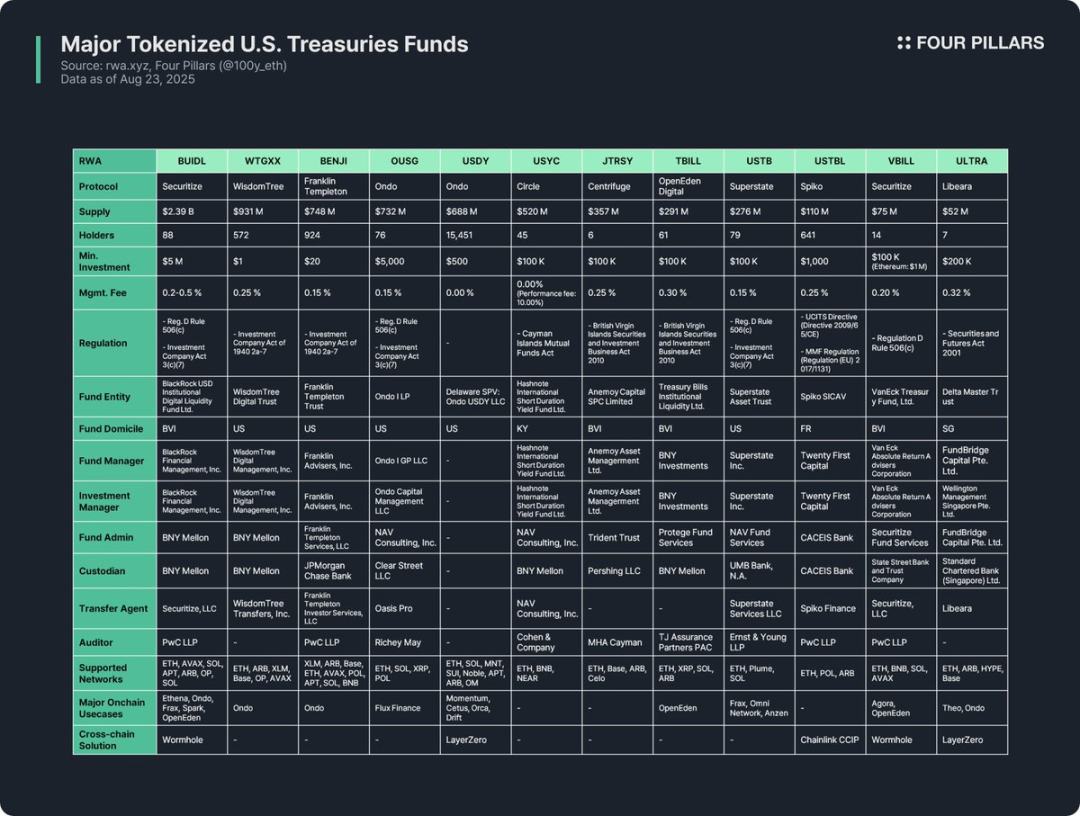

Tokenization of U.S. Treasury fund-based products is the most active area in the RWA industry, leading many protocols to issue related RWA tokens. This article analyzes 12 major tokens across three dimensions:

(1) Token Overview

Covers protocol introduction, issuance volume, number of holders, minimum investment amount, and management fees. Due to differences in fund structure, tokenization methods, and on-chain utility across protocols, analyzing the issuing protocol helps quickly grasp core token characteristics.

-

Issuance volume: reflects fund size and market acceptance;

-

Number of holders: indicates fund legal structure and on-chain use cases. A low holder count often results from securities laws requiring investors to be accredited or qualified purchasers. Such tokens are typically restricted to whitelisted wallets for holding, transfer, or trading, limiting applicability in DeFi protocols.

(2) Regulatory Framework and Issuance Structure

Clarifies the national regulatory rules followed by the fund and outlines the various entities involved in fund management.

Analysis of 12 RWA tokens based on U.S. Treasury funds reveals several regulatory frameworks categorized by fund registration jurisdiction and fundraising scope:

-

Regulation D Rule 506(c) + Investment Company Act Section 3(c)(7)

The most widely used framework. Regulation D Rule 506(c) permits public fundraising from an unlimited number of investors, provided all are “accredited investors,” with issuers required to rigorously verify identities through tax records, asset proofs, etc. Section 3(c)(7) of the Investment Company Act exempts private funds from SEC registration if all investors are “qualified purchasers” and the fund maintains a private structure. Combined, these expand investor reach while avoiding registration and disclosure burdens, applicable to qualifying U.S. and foreign funds. Examples include BUIDL, OUSG, USTB, VBILL.

-

Investment Company Act Rule 2a-7

A framework for SEC-registered money market funds, requiring stable net asset value, investment solely in short-term, high-credit-quality instruments, and high liquidity. Unlike the above, it allows public offering to retail investors, resulting in low minimum investments and broad accessibility. Examples include WTGXX, BENJI.

-

Cayman Islands Mutual Funds Law

Applies to open-ended mutual funds registered in the Cayman Islands (with flexible issuance and redemption), requiring a minimum initial investment of $100,000. Example: USYC.

-

BVI Securities and Investment Business Act 2010 (Professional Fund)

The core law regulating investment funds registered in the British Virgin Islands. “Professional Funds” target professional investors (not the general public), with a minimum initial investment of $100,000. Note: fundraising from U.S. investors requires additional compliance with Regulation D Rule 506(c). Examples include JTRSY, TBILL.

-

Others

Local rules apply depending on fund registration jurisdiction. For example: USTBL issued by France-based Spiko follows the EU’s Undertakings for Collective Investment in Transferable Securities (UCITS) Directive and Money Market Funds Regulation; ULTRA issued by Singapore-based Libeara follows the Securities and Futures Act 2001.

Fund issuance structures involve seven core participants:

-

Fund entity: the legal vehicle pooling investor capital, often structured as a U.S. trust or offshore entity in the BVI or Cayman Islands;

-

Fund manager: the party establishing the fund and responsible for overall operations;

-

Investment manager: the entity making actual investment decisions and managing the portfolio, which may be the same as or separate from the fund manager;

-

Fund administrator: handles back-office tasks such as accounting, NAV calculation, and investor reporting;

-

Custodian: securely holds fund assets such as bonds and cash;

-

Transfer agent: manages the shareholder register, legally recording and maintaining ownership of fund shares;

-

Auditor: an independent accounting firm conducting external audits of fund accounts and financial statements, crucial for investor protection.

(3) On-Chain Use Cases

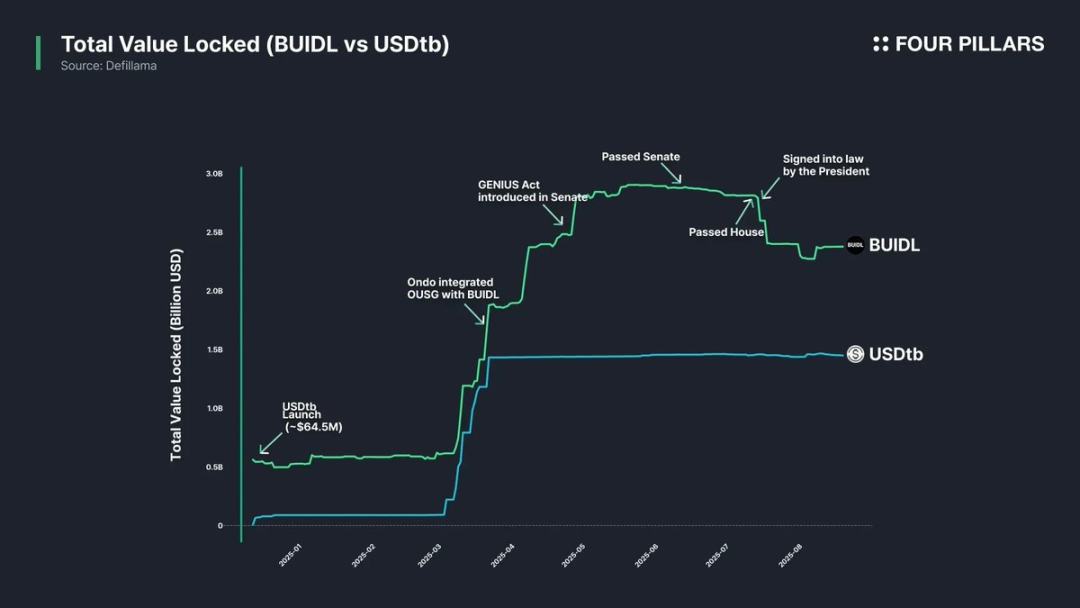

One of the greatest values of tokenized bond funds lies in their potential applications within the on-chain ecosystem. Despite regulatory compliance and whitelist restrictions limiting direct DeFi use, some protocols have explored indirect applications: for example, DeFi protocols like Ethena and Ondo use BUIDL as collateral to issue stablecoins or include it in portfolios, offering retail investors indirect exposure. In fact, BUIDL became the largest bond-backed token largely by integrating with major DeFi protocols to rapidly expand issuance.

Cross-chain solutions are also critical for enhancing on-chain utility. Most bond fund tokens are issued across multiple chains to increase investor choice—even though liquidity need not match stablecoin levels, cross-chain functionality improves user experience by enabling seamless transfers across networks.

Insights

After studying 12 major RWA tokens based on U.S. Treasury funds, the insights and limitations I’ve identified are as follows:

-

Limited on-chain utility: RWA tokens cannot be freely used post-tokenization. As digital securities, they remain bound by real-world regulatory frameworks. All bond fund tokens can only be held, transferred, or traded between KYC-completed, whitelisted wallets, creating a barrier to direct use in permissionless DeFi.

-

Low holder count: Due to regulatory thresholds, bond fund tokens generally have few holders. Retail-focused money market funds like WTGXX and BENJI have relatively more holders, but most funds require accredited, qualified, or professional investors, restricting the eligible pool and resulting in holder counts sometimes below double digits.

-

Primarily B2B on-chain use: For the above reasons, bond fund tokens currently lack direct DeFi applications for retail users and are instead adopted by large DeFi protocols. For example, Omni Network uses Superstate’s USTB for treasury management, and Ethena uses BUIDL as collateral to issue the USDtb stablecoin, indirectly benefiting retail users.

-

Fragmented regulation and lack of standards: Issuers of bond fund tokens are registered in different countries under varying regulatory frameworks. For example, although BUIDL, BENJI, TBILL, and USTBL are all bond fund tokens, they operate under different regimes, leading to significant differences in investor eligibility, minimum investments, and use cases. This fragmentation increases investor complexity and prevents DeFi protocols from adopting them universally, limiting on-chain utility.

-

No dedicated RWA regulatory framework: There are currently no clear rules specific to RWA. Although transfer agents already record shareholder registers on blockchain, on-chain token ownership is not yet legally recognized as equivalent to real-world securities ownership. Specific legislation is needed to bridge on-chain and off-chain ownership.

-

Underutilization of cross-chain solutions: While nearly all bond fund tokens support multi-chain issuance, actual implementation of cross-chain solutions remains rare. Cross-chain technology must be further promoted to prevent liquidity fragmentation and improve user experience.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News