Coinbase Panorama Report: The Current State, Risks, and Valuation of the U.S. Compliance Trading Leader

TechFlow Selected TechFlow Selected

Coinbase Panorama Report: The Current State, Risks, and Valuation of the U.S. Compliance Trading Leader

Coinbase has risen more than 11x from its 2022 historical low during this bull market cycle, significantly outperforming Bitcoin's同期 gain and surpassing the majority of crypto assets.

Author: Alex Xu, Research Partner at Mint Ventures

Report data as of: 2025.8.24

1. Research Summary

Coinbase, as the global leader in cryptocurrency trading and services, is one of the key players positioned to capture long-term growth within the crypto industry due to its brand trust, broad user base, diversified product offerings, and early compliance efforts.

Specifically:

-

It has a long history and strong brand reputation for compliant operations, security, and reliability, with numerous institutional partners, which helps attract more institutional and retail clients.

-

Its diversified revenue streams—such as subscription and interest income—are growing well, making its business model more resilient and less dependent solely on transaction fees, thus enhancing its ability to withstand market cycles compared to the past.

-

It maintains a healthy balance sheet, low debt ratio, and ample cash reserves, providing both a buffer and offensive capability during technological innovation, international expansion, and adverse market conditions.

-

Sovereign nations, especially the United States, are trending toward looser regulations that encourage innovation in crypto. The long-term industry outlook remains positive, with blockchain and digital assets expected to increasingly integrate into mainstream finance. Coinbase holds strategic positions across key areas of the industry.

However, although the volatility of its revenue and profits has decreased compared to the previous cycle, significant fluctuations remain unavoidable (see Section 6 on Operational and Financial Performance), a trend already evident in recent quarterly earnings reports.

In addition, Coinbase operates in an intensely competitive environment. Domestically, it faces direct competition from Robinhood and Kraken; internationally, it competes fiercely with offshore exchanges like Binance. Decentralized exchanges such as Uniswap, along with on-chain platforms like Hyperliquid, are also rapidly advancing and challenging the market share of traditional centralized exchanges (CEXs).

Notably, during this bull market cycle, Coinbase's stock price surged over 11x from its 2022 historical low, significantly outperforming Bitcoin’s gains and most other crypto assets.

In short, Coinbase faces both significant competitive challenges and generational opportunities. This report marks Mint Ventures' first coverage of Coinbase, and we will continue long-term tracking going forward.

PS: The views expressed herein reflect the author’s thinking up to the time of publication and may change in the future. These opinions are highly subjective and may contain factual, data, or logical errors. All viewpoints presented here are not investment advice. Feedback and further discussion from peers and readers are welcome.

2. Company Overview

2.1 Development History & Milestones

Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam, headquartered in San Francisco. Initially focused on Bitcoin brokerage services, it obtained one of New York State’s first Bitcoin trading licenses (BitLicense) in 2014.

Since then, Coinbase has continuously expanded its product portfolio: launched the exchange platform “Coinbase Exchange” (later renamed Coinbase Pro) in 2015; began supporting Ethereum and other cryptocurrencies in 2016; entered the blockchain application space through acquisitions like Earn.com in 2018, bringing in former LinkedIn executive Emilie Choi to lead M&A and expansion; acquired Xapo’s institutional custody business in 2019, establishing leadership in custodial services. That year, the company’s valuation surpassed $8 billion. On April 14, 2021, Coinbase successfully listed on Nasdaq, becoming the first major crypto exchange to go public (and still the only one), briefly reaching a market cap over $85 billion. Post-IPO, the company continued global expansion and product diversification: acquired futures exchange FairX in 2022 to enter crypto derivatives and launched an NFT marketplace (though trading volume later declined). In 2023, it launched Base, an Ethereum Layer-2 network, strengthening its presence in the on-chain ecosystem. Amid ongoing U.S. regulatory challenges, it secured licenses in Singapore, the EU (Ireland), Brazil, and completed the acquisition of leading options exchange Deribit in 2025.

After more than a decade, Coinbase has evolved from a single Bitcoin broker into a comprehensive crypto financial platform offering trading, custody, and payment services.

2.2 Positioning & Target Customers

Coinbase's mission is to "increase economic freedom globally," with a vision to modernize the century-old financial system and enable fair and easy participation in the crypto economy for everyone. Positioned as a secure and trusted one-stop crypto platform, it attracts retail users with user-friendly products while delivering institutional-grade services for professional investors.

Coinbase serves three main customer groups:

-

Retail users: Individual investors interested in crypto assets. Beyond trading major cryptocurrencies, Coinbase enables staking for yield, payments, and other features. Its monthly transacting users (MTU) peaked at 11.2 million (Q4 2021). Even during the 2022–2023 downturn, it maintained over 7 million active users per quarter. MTU was approximately 9.2 million in Q1 2025 and slightly dropped to around 9 million in Q2 2025.

-

Institutional clients: Since 2017, Coinbase has targeted institutions with services like Coinbase Prime brokerage and Coinbase Custody. Clients include hedge funds, asset managers, and corporate treasury departments. By end of 2021, it served over 9,000 institutional clients, including 10% of the world’s top 100 hedge funds. Institutions accounted for the vast majority of trading volume (about 81% in 2024). While fee rates are lower, they generate stable custody and transaction revenues.

-

Developers and ecosystem partners: Coinbase treats developers and blockchain projects as ecosystem customers, supporting network development via infrastructure like “Coinbase Cloud” (node services, APIs), and collaborating through investments and listings. Additionally, USDC, co-launched by Coinbase and Circle, sees Coinbase acting as both issuer and primary distributor, sharing substantially in the interest spread and distribution fees from Circle.

Overall, Coinbase enjoys dual advantages of retail-friendliness and institutional trust, bridging retail and institutional markets, playing a pivotal role as the “bridge between fiat and crypto.”

2.3 Equity & Voting Rights Structure

The company uses a dual-class share structure. Class A common shares trade on Nasdaq with one vote per share; Class B shares, held by founders and executives, carry 20 votes per share. Founder and CEO Brian Armstrong controls over 64% of voting power through approximately 23.48 million Class B shares, making Coinbase a highly controlled entity. A few early investors (e.g., Andreessen Horowitz) also hold some Class B shares. In mid-2025, Armstrong slightly converted and sold part of his Class B shares but retained voting power equivalent to about 469.6 million Class A shares. Since Class B shares can be converted to Class A at any time on a 20:1 basis, the total outstanding shares may fluctuate accordingly. This dual-class structure ensures the founding team retains control over strategic direction, though it limits influence for ordinary shareholders in corporate governance. Overall, Coinbase has a highly concentrated ownership structure, giving the founder significant influence, ensuring consistency in long-term vision and strategy.

3. Industry Analysis

3.1 Market Definition & Segmentation

Coinbase operates in the broad cryptocurrency trading and related financial services market. Core segments include:

-

Spot trading market: Matching buyers and sellers of crypto assets, Coinbase’s primary business. Subdivided by asset type into fiat-to-crypto (fiat gateway) and crypto-to-crypto trades, and by client type into retail and institutional trading.

-

Derivatives trading market: Includes leveraged products like futures and options. This segment has grown rapidly, accounting for about 75% of total trading volume in H1 2025 (source: Kaiko). Coinbase entered late and currently operates regulated futures exchanges and overseas platforms.

-

Custody and wallet services: Secure storage solutions for large holders of crypto assets. Closely tied to trading, as large transactions often require compliant custody.

-

Blockchain infrastructure and others: Includes stablecoin issuance/distribution, blockchain operations (Base), settlements, staking, etc.—collectively termed “blockchain finance” services. These expand revenue beyond trading, such as interest and fees from USDC and node staking.

3.2 Historical Size & Growth Rate (Past Five Years)

The overall crypto market is highly cyclical. In terms of trading volume, global crypto trading surged from ~$22.9 trillion in 2017 to $131.4 trillion in 2021, showing extremely high annual growth. It then dropped to $82 trillion in 2022 (-37% YoY) and further declined to $75.6 trillion in 2023. In 2024, driven by renewed market enthusiasm, annual trading volume reached a new high of ~$150 trillion, nearly doubling 2023 levels.

Industry size correlates strongly with crypto prices and volatility: For example, in 2021’s bull run, token prices soared and speculative activity spiked, pushing trading volume up nearly +196% YoY. Conversely, 2022’s bear market saw muted prices and a cliff-like drop in volume by nearly 40%. User numbers also fluctuate with market cycles but show an overall upward trend. According to Crypto.com research, global crypto users grew from ~50 million in 2018 to over 300 million in 2021, rebounded to around 400 million by end of 2023 after a 2022 dip.

Coinbase’s business scales with the industry: Platform trading volume rose from $32 billion in 2019 to $1.67 trillion in 2021, fell to $830 billion in 2022, and further dropped to $468 billion in 2023. In terms of active users, MTUs increased from under 1 million in 2019 to an average of 9 million in 2021, then retreated to a range of 7–9 million per quarter in 2022–2023.

In summary, the industry has shown a long-term growth trajectory amid sharp fluctuations over the past five years.

3.3 Competitive Landscape & Coinbase’s Market Share (Past Five Years)

The crypto trading industry has many competitors, with shifting dynamics.

Globally, Binance rapidly rose to become the largest exchange since 2018. At its peak during bull markets, Binance held over 50% of global spot market share; in early 2025, it maintained ~38%, ranking first. Other major players include OKX, Coinbase, Kraken, Bitfinex, and regional leaders (e.g., Upbit in Korea). Recently, emerging platforms (e.g., Bybit, Bitget) have gained notable shares. Coinbase’s global market share fluctuates between 5–10%: for instance, in H1 2025, Coinbase accounted for about 7% of the combined volume among the top ten exchanges, comparable to OKX and Bybit. Binance alone holds several times that share. Notably, Coinbase focuses on U.S. compliance and avoids extensive altcoin speculation, causing it to rank behind more aggressive, high-volume platforms globally. However, in regulated fiat markets—especially the U.S.—Coinbase holds clear advantages. Since 2019, Coinbase has consistently ranked first in U.S. trading volume and further increased its U.S. spot and derivatives market share in 2024. After FTX’s collapse in 2022, Coinbase’s domestic position became even stronger.

Competitive landscape dynamics

Over the past five years, several notable changes occurred:

-

Market share shifted from concentration to fragmentation. After FTX’s collapse in 2022, Binance’s share rose from 48.7% (Q1) to 66.7% (Q4), then began to fragment as Bybit, OKX, and Bitget gained ground, intensifying competition.

-

Increased regulatory pressure led to regional divergence—fewer competitors in the U.S. domestic market (only Coinbase, Kraken, etc.) while Asian platforms rose (e.g., Upbit in Korea, Gate in Southeast Asia);

3.4 Industry Size & Growth Forecast (Next 5–7 Years)

Looking ahead 5–7 years, the crypto trading industry is expected to keep growing, though the pace depends on multiple factors and scenarios. Industry research reports (from Skyquest/ResearchAndMarkets/Fidelity/Grand View Research) generally predict double-digit annual compound growth rates. Under a baseline scenario (assuming stable macro conditions and no severe regulatory deterioration), the global crypto market cap could rise from today’s ~$3+ trillion to ~$10 trillion by 2030, driving a substantial increase in trading volume. As the market matures, volatility may decline, so volume growth might slightly lag market cap growth, estimated at ~15% annually.

Key drivers for crypto industry growth include:

-

Asset price trends: If flagship assets like Bitcoin continue setting new highs, it will lift the entire market. Rising prices and volatility stimulate trading activity, amplifying volumes.

-

Derivatives penetration: Derivatives now account for ~75% of volume and are expected to grow further. Institutional investors prefer hedging tools like futures, and retail may gradually adopt leverage, expanding total trading value. We assume derivatives reach 85% by 2030, increasing total volume by over 1.2x.

-

Institutional adoption: More traditional financial institutions (asset managers, banks) entering crypto could bring trillions in new capital. Approvals for more ETF types and institutional access (currently, many institutions cannot directly hold crypto exposure, including ETF shares), plus sovereign wealth fund allocations, would deepen the market significantly, boosting trading volume and custody demand. Fidelity predicts institutional inflows could add hundreds of billions annually to crypto market cap in coming years.

-

Regulatory clarity: Clear frameworks reduce participant concerns and attract more entrants. In optimistic cases, where major economies establish reasonable regulations (e.g., widespread licensing in developed economies, ETF legalization/expansion), user base and activity rise. In pessimistic cases, if regulations tighten (e.g., restricting bank support, imposing strict capital requirements), growth could stall or reverse. Currently, with the U.S. Genius Stablecoin Bill officially passed and Clarity Act approved in the House, their示范effect could gradually spread to developed economies, making overall policy clarity foreseeable.

Scenario breakdown: We can project industry size from 2025–2030 using three scenarios:

-

Baseline scenario: Assumes stable macro conditions, friendly but cautious regulation in major countries, and gradual investor acceptance of crypto. Annual market cap growth ~15%, volume growth ~12%. By 2030, global annual trading volume could reach ~$300 trillion, with industry revenue (fees) growing alongside. Leading compliant platforms like Coinbase maintain or slightly gain market share. This scenario implies healthy growth without extreme bubbles.

-

Optimistic scenario: Similar to a “fintech boom,” where major economies (especially the U.S.) fully clarify regulations, large institutions and corporations enter en masse, and crypto tech sees broad adoption (e.g., DeFi scale and adoption leap). Asset prices soar (e.g., Bitcoin possibly hitting seven figures by 2030, as ARK Invest forecasts), annual market cap growth exceeds 20%, volume growth reaches 25%. Under this projection, total trading volume by 2030 could hit $600–800 trillion. Compliant giants like Coinbase reap huge profits amid explosive growth, greatly raising the industry ceiling.

-

Pessimistic scenario: Assumes unfavorable macro conditions or severe regulatory constraints—e.g., strict restrictions from major nations, prolonged stagnation in crypto markets. Industry size may stagnate or grow marginally, even shrinking in some years. Worst-case, volume growth drops to single digits or negative, leaving total volume around $100–150 trillion by 2030. Compliant exchanges like Coinbase might gain market share (as gray-market platforms get shut down or shrink), but absolute business growth remains limited.

Overall, I lean toward a mildly optimistic outlook: Over the next 5–7 years, the crypto trading industry should continue growing cyclically, with overall scale rising annually. Crypto users and industry consortia have become forces national political powers cannot ignore, notably aiding Republicans in overturning Democrats during the 2024 U.S. election. Following this, Democrats adopted noticeably milder stances on bipartisan crypto legislation, with many Democratic lawmakers voting in favor of the Genius Act (effective in both chambers) and Clarity Act (House).

4. Business & Product Lines

Coinbase currently runs a diverse business, with main revenue split into two categories: trading, and subscription & services, comprising multiple product lines.

Below is an overview of each major business line’s model, key metrics, revenue contribution, profitability, and future plans:

-

Retail Trading Brokerage: This is Coinbase’s original and core business—providing individuals with crypto buying/selling services. Coinbase acts as a broker and matching platform, enabling one-click purchases via app or web. It charges relatively high fees (previously 0.5% of transaction value plus fixed fee; changed post-2022 to spread-based and tiered pricing—see PS below). Retail customers historically contributed most of the trading revenue. For example, in 2021, retail trading volume accounted for ~32% of total volume but generated ~95% of revenue (down to 54% in 2024). Key metrics include Monthly Transacting Users (MTU), average transaction size per user, and fee rates. MTU peaked at 11.2 million during the 2021 bull market; dropped to ~7 million during the 2022–2023 downturn. This business is highly profitable, with net margins spiking during bull markets due to fee income (46% in 2021, ~42.7% recently). However, in bear markets, reduced trading volume sharply cuts revenue (retail trading revenue down ~66% YoY in 2022), dragging overall profitability. PS: The “spread” in retail trading applies to categories like “one-click buy/sell / Simple / Convert / card spending,” embedding fees into asset quotes—buy prices slightly above market, sell prices slightly below. The difference is the “spread.” Advanced trading (limit/market orders) uses tiered pricing: lower maker/taker fees for higher 30-day trading volumes.

-

Future plans: Coinbase is enriching retail products to boost stickiness—launching Coinbase One membership (zero-fee allowances, premium benefits), listing new tokens (added 48 assets in 2024, including popular memecoins to attract traffic), improving UX (simpler interface, educational content). Exploring social trading, automated investing. As the market recovers, retail trading remains foundational; growth hinges on crypto market sentiment and Coinbase’s market share gains.

-

-

Professional & Institutional Trading Services: Includes services for high-net-worth and institutional clients, such as Coinbase Prime and Coinbase Pro (now integrated). These platforms offer deep liquidity, lower fees, and API access to attract large traders and market makers. Institutional trading accounts for 80–90% of volume (e.g., $941B in 2024, 81% of total), but fee rates are low (basis points), limiting direct revenue contribution (~10% of trading revenue in 2024). However, indirect benefits are significant: institutions often leave assets on Coinbase for custody and staking, generating custody and interest income. Active institutions also enhance platform liquidity and quote quality, improving retail trading experience. Key metrics: number of institutional clients and Assets Under Custody (AUC). Coinbase’s AUC peaked at $27.8B in Q4 2021, dropped to $8.03B by end of 2022, rebounded to ~$14.5B by end of 2023. Entering 2025, institutional custody remains strong: average AUC reached $212B in Q1 2025, up $25B from last quarter; hit a new high of $245.7B in Q2. While direct profit from institutional trading is modest, custody and financing services generate additional income.

-

Future plans: Coinbase is expanding derivatives to meet institutional needs—launched perpetual futures overseas in 2023, obtained futures commission merchant status in the U.S. to offer Bitcoin and Ethereum futures to American institutions. Established Coinbase Asset Management (restructured from 2023 acquisition of One River Asset Management), planning to launch crypto investment products like ETFs and index baskets to boost institutional engagement. To strengthen its derivatives footprint, Coinbase announced in late 2024 the acquisition of leading crypto options exchange Deribit. Valued at ~$2.9B, including $700M cash and 11M Coinbase Class A shares, this is one of the largest M&A deals in crypto, aiming to rapidly elevate Coinbase’s global standing and scale in crypto derivatives. Deribit, a dominant options platform, recorded $120B in trading volume in 2024, up 95% YoY. Integrating Deribit gives Coinbase dominant share in Bitcoin and Ethereum options markets (Deribit holds >87% in Bitcoin options). This acquisition expands and complements Coinbase’s derivatives lineup (options, futures, perpetuals), reinforcing its position as the preferred platform for institutional entry into crypto.

-

-

Custody & Wallet Services: Coinbase Custody is a leading compliant custody service, offering cold storage primarily for institutions. Revenue comes from custody fees (typically a few basis points of assets) and withdrawal fees. As of 2024, Coinbase Custody held assets representing 12.2% of global crypto market cap. Its reputation strengthened further after major players like Grayscale chose Coinbase as custodian. Though revenue is categorized under “subscription and services” and remains small ($142M, 2.2% of $6.564B total revenue in 2024), its strategic importance is high: it ensures asset security for high-net-worth clients, enabling large-scale trading. Coinbase Wallet, a self-custody app, doesn’t directly generate revenue but helps complete the ecosystem and attract DeFi and on-chain users. Profitability: custody has high margins (almost pure income minus fixed security costs) and synergizes with trading. Revenue has steadily risen (custody fees reached $43M in Q4 2024, up 36% QoQ), providing a more stable fee stream.

-

Future plans: Continue investing in custody technology security to meet regulatory standards (e.g., regulated Custody Trust under NY trust license). Expand into more asset classes and regions—support institutional staking, serve as ETF custodian (selected for multiple spot Bitcoin ETFs in 2024).

-

-

Subscription & Service Income (Staking, USDC Interest, etc.): A key diversified revenue stream cultivated in recent years. Includes:

-

Staking Services: Users delegate crypto holdings via Coinbase to participate in blockchain staking, earning block rewards, with Coinbase taking a cut (typically ~15%). This passive income for users generates revenue-sharing for the platform. Since Ethereum and other major coins opened staking in 2021, this revenue has grown rapidly.

-

Stablecoin Interest Income (USDC): Interest from USDC has become a major revenue component. In 2023, rising rates and larger USDC reserves brought Coinbase ~$695M in interest income (~22% of annual revenue, much higher than prior years). In 2024, with higher USDC rates and circulation, annual interest income rose to ~$910M, up 31% YoY. USDC interest accounted for ~14% of total revenue in 2024—lower share but record absolute amount. In Q2 2025, stablecoin interest reached $333M, 22.2% of quarterly revenue. This stable income stems from a 50/50 revenue-sharing agreement with Circle: both parties split interest from USDC reserves equally, and 100% of interest from USDC stored on Coinbase platforms goes to Coinbase. Thus, USDC interest has become the fastest-growing and largest individual business within Coinbase’s subscription and services segment, providing recurring income beyond trading fees.

-

Other subscription services: Include Coinbase Earn (earn rewards by watching content), Coinbase Card (cashback on debit card swipe fees), and Coinbase Cloud’s blockchain infrastructure revenue. Currently small in scale but complementary, aligning with the goal of building a comprehensive crypto platform. For example, Coinbase Cloud provides nodes and exchange APIs for institutions and developers, helping launch multiple blockchain networks in 2024, potentially evolving into an “AWS for crypto” long-term.

-

Subscription & service revenue has risen from under 5% in 2019 to 40–50% today, serving as a stable income source during trading downturns. With mostly interest and fees, costs are low, yielding ~90% gross margins. Going forward, Coinbase will push subscription growth—launching more frequent-user packages, expanding staking-supported assets, deepening USDC’s global use (e.g., using USDC as margin for U.S. futures trading). This segment could become a key “stabilizer” against trading volatility.

-

In 2023, Coinbase strengthened its strategic partnership with Circle, making major adjustments to their joint governance model via Centre. First, Coinbase acquired equity in Circle, becoming a minority shareholder. Disclosed details: Circle acquired Coinbase’s remaining 50% stake in Centre Consortium for ~$210M in stock, granting Coinbase an equivalent value in Circle shares. This raised Coinbase’s stake in Circle (exact percentage undisclosed, but granted economic interest and some influence). Consequently, Centre Consortium was dissolved, with USDC issuance and governance transferred solely to Circle. Despite Circle taking full control, Coinbase’s influence in the USDC ecosystem rose: under the new agreement, Coinbase holds substantive participation and veto rights on major USDC strategies and partnerships. For instance, Coinbase has veto power over Circle’s proposed new USDC partnerships, ensuring alignment with its interests. Additionally, adjusted revenue-sharing mechanisms (e.g., interest splits) better align incentives for promoting USDC. These moves make Coinbase more proactive in promoting USDC: pushing USDC onto more blockchains, offering USDC incentives in international exchanges and wallets (e.g., higher yields for holding USDC). In sum, the 2023 equity investment and agreement adjustments significantly strengthened the Coinbase-Circle alliance on USDC. Coinbase now deeply participates in USDC governance via equity and actively supports USDC adoption to jointly expand the market influence and market cap of this compliant stablecoin.

-

-

Decentralized Business: Base Layer-2 Network

-

Positioning & Vision: Base is an Ethereum L2 launched by Coinbase in August 2023, built on Optimism OP Stack, aiming to smoothly onboard 100M+ Coinbase users to the on-chain ecosystem. In January 2025, the official roadmap emphasized “completing sequencer decentralization by end of 2025” and sharing network revenue via community governance.

-

Key operational metrics: As of August 2025, Base holds ~$15.46B in value, with 30.7M monthly active addresses, 9.24M daily transactions, and $204K in daily on-chain fees—ranking #1 among all L2s in revenue.

-

Revenue contribution: Coinbase classifies Base “sequencer fees” as “other transaction revenue.” In 2024, Base contributed ~$84.8M (per Tokenterminal, not detailed in official filings); YTD 2025, ~$49.7M. Base has become one of Coinbase’s most promising “on-chain revenue engines” beyond trading and interest income.

-

-

Other potential businesses: Coinbase explores new opportunities, such as its NFT marketplace (launched Coinbase NFT in 2022, but low user activity; scaled back investment in 2023), and payment/commerce tools (Coinbase Commerce allows merchants to accept crypto payments, mainly strategic). These contribute little financially now but strategically help close the ecosystem loop and increase user dependency on Coinbase.

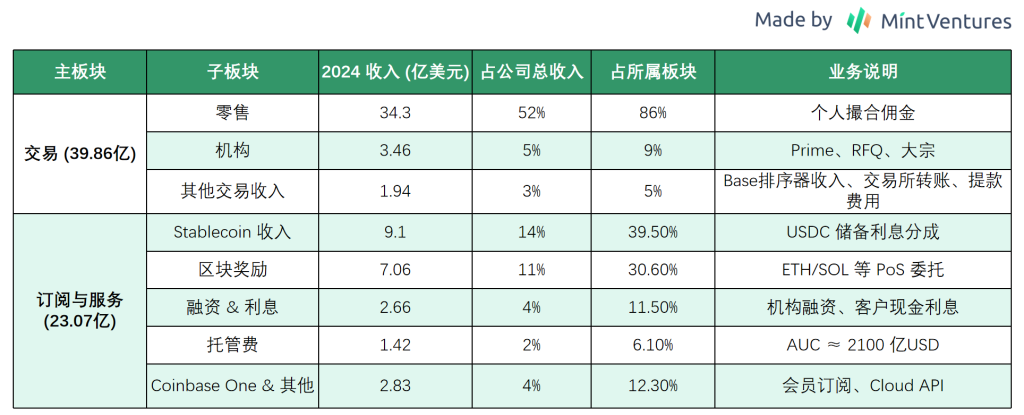

Coinbase’s 2024 revenue composition and breakdown:

Summary of Business & Product Lines

Coinbase has evolved from a single-trading business to multi-engine growth covering trading, custody, staking, and stablecoins. This diversification reduces overreliance on trading fees (non-trading revenue reached 40% in 2024) and enhances user stickiness (users earn staking yields, use stablecoins, reducing migration likelihood). Synergies exist across businesses: trading brings asset retention, which generates staking and interest income, encouraging more trading. This “flywheel effect” is one of the moats Coinbase strives to build. However, the company must balance regulatory and resource commitments to ensure compliance and sustainability—e.g., staking/lending must comply with securities laws, stablecoins need transparent reserves. Overall, Coinbase’s product layout is comprehensive, pioneering an integrated crypto financial services platform, providing a relatively stable revenue structure and growth path amid fierce competition.

5. Management & Governance

In company management, we focus on key dimensions: 1. Executive background and core team stability; 2. Past strategic decision-making quality.

5.1 Core Management Team Background

-

Brian Armstrong – Co-founder, CEO, and Chairman of the Board, holds majority voting power. Born in 1983, previously a software engineer at Airbnb. Founded Coinbase in 2012, one of the earliest entrepreneurs in crypto. Armstrong emphasizes long-term mission and product simplicity, known internally for principled stands (e.g., issued a “no politics” company culture statement in 2020).

-

Fred Ehrsam – Co-founder, Director. Former Goldman Sachs FX trader, co-founded Coinbase with Armstrong in 2012 and served as first president. Left day-to-day operations in 2017 to found Paradigm, a prominent crypto investment fund, but remained on the board, advising on industry trends and company strategy.

-

Alesia Haas – Chief Financial Officer (CFO). Joined Coinbase in 2018, previously CFO at hedge fund Och-Ziff (now Sculptor Capital) and executive at OneWest Bank, with rich experience in traditional finance and capital markets. Led IPO financial preparation, emphasizes fiscal discipline, executed two rounds of layoffs in 2022 to control costs. Also heads Coinbase subsidiary Coinbase Credit, exploring crypto lending.

-

Emilie Choi – President and Chief Operating Officer (COO). Joined Coinbase in 2018 as VP of Business Development, promoted to President and COO in 2020. Previously at LinkedIn, led M&A and investments (e.g., SlideShare acquisition), renowned for strategic expansion. At Coinbase, she drove multiple acquisitions (Earn.com, Xapo custody, Bison Trails) and international growth, regarded as one of the most influential executives after Armstrong. Also oversees daily operations, talent, and strategic initiatives.

-

Paul Grewal – Chief Legal Officer (CLO). Joined in 2020, previously Deputy General Counsel at Facebook and a former federal judge. Leads legal and regulatory affairs, including the 2023 lawsuit with the SEC. His team plays a critical role in compliance and policy lobbying.

-

Other key executives: Chief Product Officer formerly held by Surojit Chatterjee (ex-Google executive), who led product development from 2020–2022 before departing in early 2023; product team now managed by multiple department heads. Chief Technology Officer (CTO) roles previously held by Greg Tusar et al., currently overseen collectively by engineering leads. Chief People Officer (CPO) LJ Brock handles recruitment and culture, instrumental in cultural transformation. Also notable is Chief Marketing Officer Kate Rouch (ex-Facebook marketing director)—talent from Silicon Valley tech and Wall Street bring cross-domain expertise to Coinbase.

Management profile: Young, entrepreneurial founders combined with seasoned professionals from traditional finance and tech giants. This diverse team helps Coinbase balance innovation and compliance execution. Executives hold substantial equity or option incentives, with Armstrong having a special CEO performance equity plan targeting market cap milestones over 10 years.

5.2 Personnel & Strategic Stability

Coinbase has experienced ups and downs in staffing and strategy but maintained overall continuity:

-

Executive turnover: Most core founding team members remain (Armstrong, Ehrsam on board). However, several executives departed in recent years: former CPO Chatterjee left in early 2023; CTO and Chief Compliance Officer roles rotated multiple times. Some turnover correlated with market cycles: 2022 bear market and declining performance led to management streamlining. After Armstrong’s 2020 “no political discussions” announcement, ~60 employees accepted severance (including former CPO). Nonetheless, senior leadership retention remains high—CEO, CFO, COO have served for years and led the IPO; legal head also stable. This suggests a mature management bench with no frequent upheavals in key roles.

-

Strategic continuity: Coinbase’s core mission has never changed since inception (“build a trusted crypto financial system”). Strategic priorities evolve with the industry, but the trajectory is clear: initially focused on Bitcoin brokerage and user growth; later expanded coin offerings and international markets; since 2020 explicitly pursued a “two-legged” strategy—serving retail and deepening institutional services, while adding subscription income for business diversification. Even during market lows (e.g., 2018, 2022), management persisted in launching new products (e.g., USDC stablecoin in 2018, invested in NFT and derivatives in 2022), demonstrating confidence in crypto’s long-term trend. There were course corrections: after NFT cooled, resources were cut in 2023; blind hiring led to two layoffs in 2022, cutting ~2,100 staff (~35% of workforce), prompting improved operational efficiency. Overall, Coinbase shows strong strategic execution, avoiding disruptive shifts or major reckless failures, with decisions largely aligned with industry evolution.

-

Strategic consistency: Quantifying Coinbase’s strategic foresight—tracking early bets on key technologies/markets—reveals it participated in most major industry trends: supported Ethereum early in 2015 (betting on smart contracts), launched stablecoin in 2018 (betting on compliant stablecoins), applied for futures license in 2021 (anticipating derivatives), later launched its own L2. These decisions matched later industry developments, indicating sound judgment. Of course, missteps occurred—missed the 2019–2020 DeFi DEX boom (failed to seize decentralized financial markets until later via Base development). But given Coinbase’s compliance focus, this may have been an intentional strategic choice.

5.3 Strategic Capability Review

Key successes and failures in management decisions:

-

Strategic success cases: Early compliance focus—Coinbase prioritized compliance from day one, voluntarily applying for FinCEN registration and state licenses in 2013. This proved wise: when competitors exited the U.S. due to compliance issues, Coinbase had already built a regulatory moat and earned deep trust from American users (never suffered a major customer fund theft), expanding its domestic market share. Another success: IPO timing—management capitalized on the 2021 bull market peak to go public directly, securing ample capital and brand credibility, rewarding early investors and employees, stabilizing morale. Acquisition strategy: acquiring Xapo’s institutional custody in 2019 made Coinbase one of the largest crypto custodians overnight, seizing early advantage in the institutional market. These demonstrate solid strategic vision and execution.

-

Strategic failure cases: Overexpansion leading to layoffs—during the 2021 bull market, staff ballooned from ~1,700 to nearly 6,000 by early 2022 (~3,700+ now), with many teams bloated. Armstrong publicly admitted being “overly optimistic” in hiring, hurting efficiency. As the market cooled in 2022, the company conducted two major layoffs, affecting morale. Another setback: poor performance of new product NFT Marketplace—invested heavily to launch an NFT trading platform in April 2022, hoping to replicate OpenSea’s success. Due to late entry, lack of differentiation, and a cooling NFT market, monthly volume stayed low, and the company eventually nearly abandoned operations. Management attempts in certain areas missed expectations, with flawed market analysis, though overall losses were limited and timely exits taken.

Overall, Coinbase’s management is solid, with high core team stability, strategic decisions aligned with industry trends, no major missed opportunities. Despite past cost overruns and some failed product experiments, these flaws do not overshadow its strengths.

6. Operations & Financial Performance

This section analyzes Coinbase’s revenue, profit, costs, and balance sheet to assess profitability and resilience.

6.1 Income Statement Overview (5-Year)

Coinbase’s revenue and profit are highly dependent on crypto market conditions, showing roller-coaster-like swings:

-

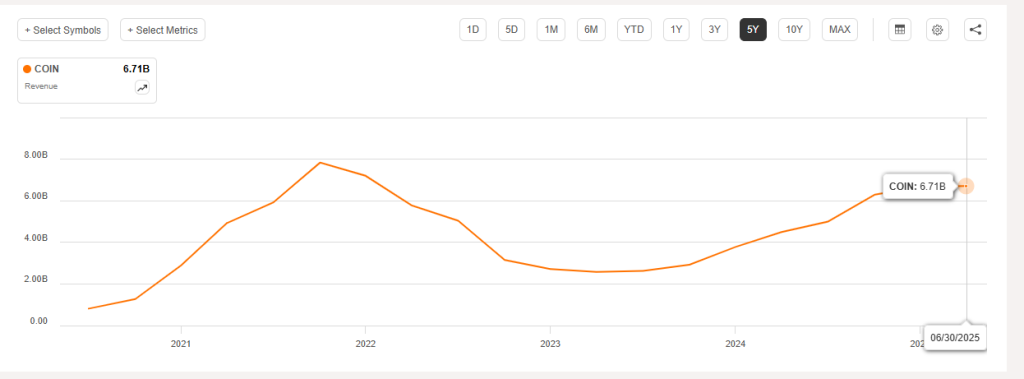

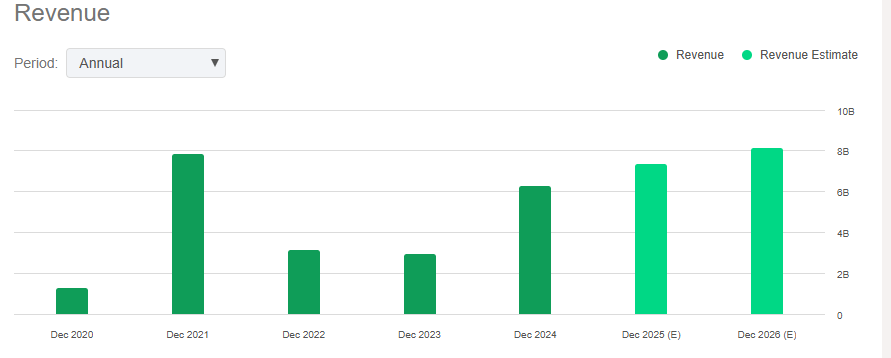

Revenue: Total revenue was only $534M in 2019, rose to $1.28B in 2020 (+140%) due to a small Bitcoin bull run, then surged to $7.84B in 2021 (+513% YoY) during a full bull market. Revenue plunged to $3.15B in 2022 (-60%), dipped further to $2.92B in 2023. In 2024, with market recovery, revenue rebounded strongly to $6.564B, doubling 2023. In Q1 2025, Coinbase continued its strong momentum from late 2024, achieving ~$2.03B in total revenue, up 24% YoY. Q2 2025 revenue saw a sequential decline: ~$1.5B in total revenue, down 26% from Q1’s $2.03B. This was mainly due to a 16% drop in crypto market volatility, weakening investor trading intent and volume. Clearly, Coinbase’s revenue remains highly sensitive to market fluctuations, with obvious short-term swings. However, compared to the same period last year, total H1 revenue still grew ~14%. Overall, revenue over the past five years has followed a “roller-coaster” pattern with extreme cyclical elasticity: CAGR from 2019–2024 ~40%, but annual swings exceed ±50%, with boom-and-bust patterns still evident in H1 2025.

Coinbase Revenue (TTM) Trend, 2020.9–2025.6, Source: seekingalpha

Coinbase Annual Revenue (with forecast), 2020–2026, Source: seekingalpha

-

Revenue structure: Transaction fees have been the main source but are gradually declining in share. In 2021, transaction revenue was $6.9B, ~87% of total; dropped to $2.4B in 2022, 77%; fell to $1.5B in 2023, 52%; rebounded to ~$4B in 2024, ~61%. Meanwhile, subscription and service revenue (staking, interest, custody, etc.) rose from under 5% in 2019 to 48% in 2023, then slightly dipped to ~35% in 2024 (absolute $2.3B). In Q1 2025, transaction fee revenue was ~$1.26B (up 17.3% YoY), over 60% of quarterly revenue; subscription and service revenue reached $698M (up 37% YoY), contributing over 30% of revenue, driven by rising USDC interest and growth in “Coinbase One” subscribers. In Q2 2025, transaction and subscription revenues offset each other: transaction fees ~$764.3M, ~54% of total; subscription and service revenue ~$655.8M, up 9.5% YoY, share rose to ~46%, nearly matching transaction revenue. Subscription growth mainly from USDC interest and custody: average USDC reserve balances rose 13% QoQ to $13.8B, generating substantial stablecoin interest. Staking and institutional custody fees also grew steadily, pushing subscription revenue to new highs. In H1 2025, subscription/service revenue accounted for ~44% of total revenue, up significantly from 35% in 2024, further cementing Coinbase’s business diversification. This structural shift reduces reliance on transaction fees, mitigating revenue shocks from market volatility.

-

Profit: Thanks to its high-margin model, Coinbase becomes highly profitable during high-volume periods. Lost $30M in 2019; earned $322M net profit in 2020 (25% margin); net profit jumped to $3.624B in 2021 (~46% margin), exceeding all prior years combined. Then posted a historic loss of $2.625B in 2022 (-83% margin); slightly profitable at $95M in 2023 (3% margin), turning positive again. Net profit reached $2.579B in 2024 (~39% margin), second only to 2021. Clearly, profits swing dramatically with revenue. Q1 2025 net profit was $66M, seemingly a sharp drop from last quarter, but mainly due to declines in fair value of crypto assets, stock compensation, and litigation costs. Adjusted net profit—excluding after-tax fair value changes and one-time items—was $527M, better reflecting core

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News