10 Billion Dollar Bet on Solana: Is This Crash a Golden Buying Opportunity?

TechFlow Selected TechFlow Selected

10 Billion Dollar Bet on Solana: Is This Crash a Golden Buying Opportunity?

Three top institutions plan to raise $1 billion to acquire Solana (SOL) tokens, forming the world's largest SOL reserve.

Author: White55, Mars Finance

Institutional Giants Bet on SOL: A $1 Billion Treasury and Opportunities Amid the Crash

According to Bloomberg, three top-tier institutions—Galaxy Digital, Jump Crypto, and Multicoin Capital—are advancing a $1 billion fundraising initiative dedicated to acquiring Solana (SOL) tokens, aiming to build the world's largest Solana-specific reserve.

The trio has hired Wall Street investment bank Cantor Fitzgerald as lead underwriter, planning to acquire an unnamed publicly listed company to establish a centralized digital asset reserve entity. If completed as scheduled by early September, the fund’s scale would exceed twice the size of the current largest Solana reserve pool.

The Big Three’s SOL Ambition: Restructuring the Crypto Reserve Landscape

All three institutions involved in forming this treasury have been long-term supporters of the Solana ecosystem.

-

Last year, Galaxy Digital led the acquisition of Solana assets from the FTX estate, raising over $600 million;

-

Jump Crypto is developing Firedancer, a new validator client for Solana aimed at enhancing network transaction throughput;

-

Multicoin Capital is an early institutional investor in Solana, with its portfolio deeply tied to the ecosystem’s development. This strong alignment makes the $1 billion plan a significant endorsement of Solana’s long-term network value.

A Paradigm Shift in Reserve Strategy

This initiative marks a shift in "corporate crypto reserve" strategy—from Bitcoin and Ethereum toward broader public chain ecosystems.

Inspired by Michael Saylor’s MicroStrategy Bitcoin reserve model, accumulating cryptocurrencies through listed entities has become a new trend among institutional investors this year.

Similar strategies focused on Bitcoin and Ethereum have already significantly driven up prices—digital asset treasury companies (DATs) focused on Ethereum now hold approximately $20 billion worth of ETH, directly contributing to its recent all-time high.

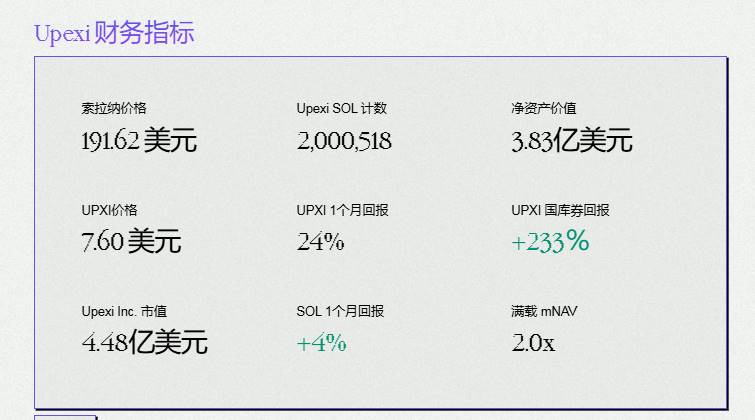

The current largest public holder of Solana is supply chain management firm Upexi, which holds about $380 million worth of SOL (over 2 million tokens).

But this record is about to be broken: apart from the big three’s plan, DeFi Development Company (DDC, formerly Janover), led by former Kraken executives and transformed into a Solana-focused reserve firm, saw its stock surge tenfold within four months and has filed with the SEC for a $1 billion capital raise to further buy SOL.

Another institution, Sol Strategies, has also clearly positioned Solana as its core reserve asset, forming a “MicroStrategy of Solana” cohort.

SOL Amid Market Chill: Divergence Between Technicals and Fundamentals

Sharp Price Volatility

While institutions are actively positioning, Solana’s market performance shows sharp volatility.

Over the past two days, SOL dropped rapidly from a high of $213 to around $187, a nearly 12% decline, erasing most gains made during the Powell night rally and retesting the critical support zone of $170–$180.

Technical charts show the SOL/USD pair forming a descending channel on the hourly timeframe. A break below $172 support could push prices further down to $162 or even $150. Market sentiment has swiftly shifted from “greed” to “fear,” with the Crypto Fear & Greed Index falling from above 70 to 44—the lowest since June.

Battle of Technical Formations

Despite short-term pressure, medium-to-long-term technical structures still suggest upside potential. Since April, SOL has formed an “ascending triangle” pattern on the weekly chart, with a horizontal resistance at $200 and an upward trendline support near $176.

If the daily close breaks above $200 with rising volume, it could trigger a bullish move targeting $220–$260, and in extreme scenarios, even reach $362.

Analyst Crypto Jelle notes that SOL is “quietly building higher lows,” and once it clears the $200 resistance, the “bull train may be hard to stop.”

Ecosystem Resilience Underpinning Value

Solana’s fundamentals continue to improve. Data shows its decentralized exchanges (DEXs) consistently lead other blockchains in trading volume, while increased protocol buyback activity reflects growing confidence among project teams.

Meme coin platform Pump.fun contributed nearly 90% of Solana’s Launchpad revenue last week, reinforcing its status as the preferred chain for speculative tokens. The upcoming Alpenglow upgrade aims to further boost network performance and could serve as a catalyst for future value discovery.

SOL/ETH Exchange Rate Finding Bottom: Historical Support at 0.04

Another key signal comes from the SOL/ETH exchange rate. It has fallen from a high of 0.089 to around 0.042, approaching the historical support level of 0.04. This level has previously triggered strong rebounds of SOL against ETH, suggesting a potential strategic entry point again.

If the institutional reserve plans materialize, they will tighten SOL supply in the spot market, boosting its relative outperformance.

The Double-Edged Sword of Institutional Accumulation: Opportunity and Risk

Liquidity Siphoning Effect

The creation of a $1 billion reserve will directly reduce market liquidity. At current SOL prices, the plan equates to locking up approximately 5.3 million SOL (over 1% of total supply). Such large-scale staking could trigger a liquidity siphoning effect similar to that seen with Ethereum DATs—when ETH treasury holdings reached 3% of total supply, price surged to new highs amid tightening supply.

Systemic Risk Concerns

Galaxy CEO Michael Novogratz warns that the crypto reserve frenzy may have peaked, leaving latecomers exposed to harsher conditions. Prolonged market declines could trigger cascading forced selling, especially if leveraged positions face liquidation pressure. Hong Kong’s upcoming Basel crypto capital rules require banks to apply a 1250% risk weight to exposures in permissionless blockchain assets, potentially dampening traditional financial institutions’ appetite for allocation.

Strategic Crossroads at a Market Turning Point

The contrast between the big three’s $1 billion treasury plan and SOL’s sharp price drop is striking.

For astute investors, the downturn may open a strategic window. As institutionally backed treasuries begin absorbing spot SOL, as ecosystem DEX volumes continue leading across blockchain sectors, and as the SOL/ETH rate nears historical support, the market may be turning “fear” into “opportunity.”

Yet caution remains warranted due to crypto’s inherent volatility—a break below $170 would severely damage the technical structure, potentially triggering deeper corrections toward $150.

Amid this institutional reshaping of the crypto landscape, Solana stands at the tipping point of a liquidity transformation. The $1 billion treasury is not just a vote of confidence but a prophecy of market structure: as circulating supply is increasingly locked up by institutional treasuries, Solana’s recovery could unfold with a steeper trajectory.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News