Whales Vote with $2.2 Billion: Why Are They Selling BTC But Choosing to Stake ETH?

TechFlow Selected TechFlow Selected

Whales Vote with $2.2 Billion: Why Are They Selling BTC But Choosing to Stake ETH?

The value assessment system in the crypto world is undergoing a profound paradigm shift.

Author: Oliver, Mars Finance

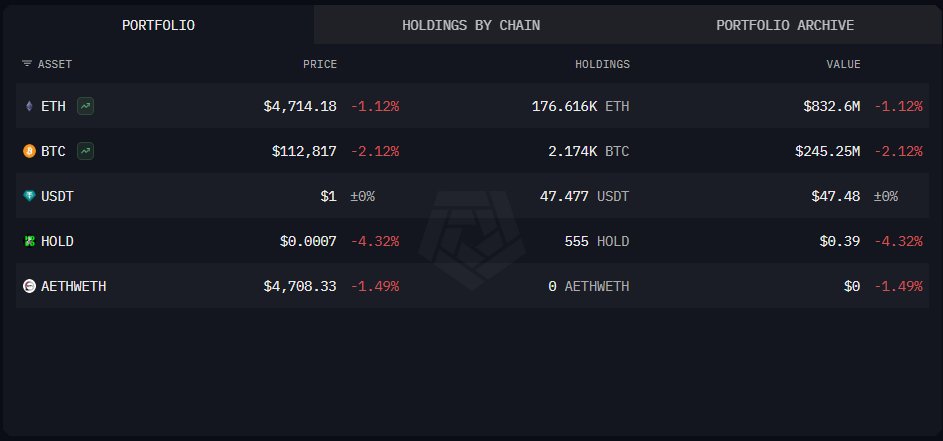

On August 25, 2025, the crypto market witnessed a historic moment. According to Onchain Lens monitoring, an enigmatic "ancient whale" whose holdings trace back to Bitcoin's earliest days executed a move of staggering scale and determination: selling nearly 20,000 BTC (worth approximately $2.22 billion) and converting all into over 450,000 ETH, with the majority (about $1.13 billion) swiftly staked into Ethereum's PoS network.

This action acted like a starting gun, instantly igniting market imagination. It was no longer simple "profit-taking," as the funds did not exit the crypto ecosystem but instead moved precisely from one end—the "value storage"—to the other—"value generation." Meanwhile, the market’s K-line chart had already responded: the ETH/BTC exchange rate has steadily climbed since May this year, reflecting Ethereum's sustained strength relative to Bitcoin.

Was this whale's portfolio shift a lone speculative act, or does it represent a collective turn by a group of "smart money"? Does it validate analyst Willy Woo's theory on Bitcoin's "growing pains"? And how might it resonate with Arthur Hayes' prediction of a "13 trillion stablecoin migration"? This article will dissect this "century transaction" layer by layer to uncover the structural paradigm shift underway in the crypto world.

1. A Monumental Portfolio Shift: Decoding the Asset Revaluation Behind $2.2 Billion

To understand the profound significance of this portfolio shift, we must look beyond price fluctuations and delve into the core of asset attributes.

First, this marks a strategic transition from "non-productive assets" to "productive assets."

Bitcoin's value lies in its indisputable digital scarcity and decentralization, making it "digital gold" against fiat inflation. However, simply holding Bitcoin (excluding lending or derivatives) generates no intrinsic cash flow. It is a passive store of value, dependent entirely on price appreciation for returns.

In contrast, staked Ethereum operates differently. By staking ETH to secure the network, holders earn continuous rewards denominated in ETH. This transforms ETH into a "productive asset" or "digital bond" capable of generating predictable real yield. The fact that this whale immediately staked over half of their newly acquired ETH reveals clear intent: they are no longer chasing mere capital appreciation but seeking steady, ongoing cash flow. This signals a shift among early crypto billionaires—from pure capital gains toward a more mature, traditional finance-style "rentier" model.

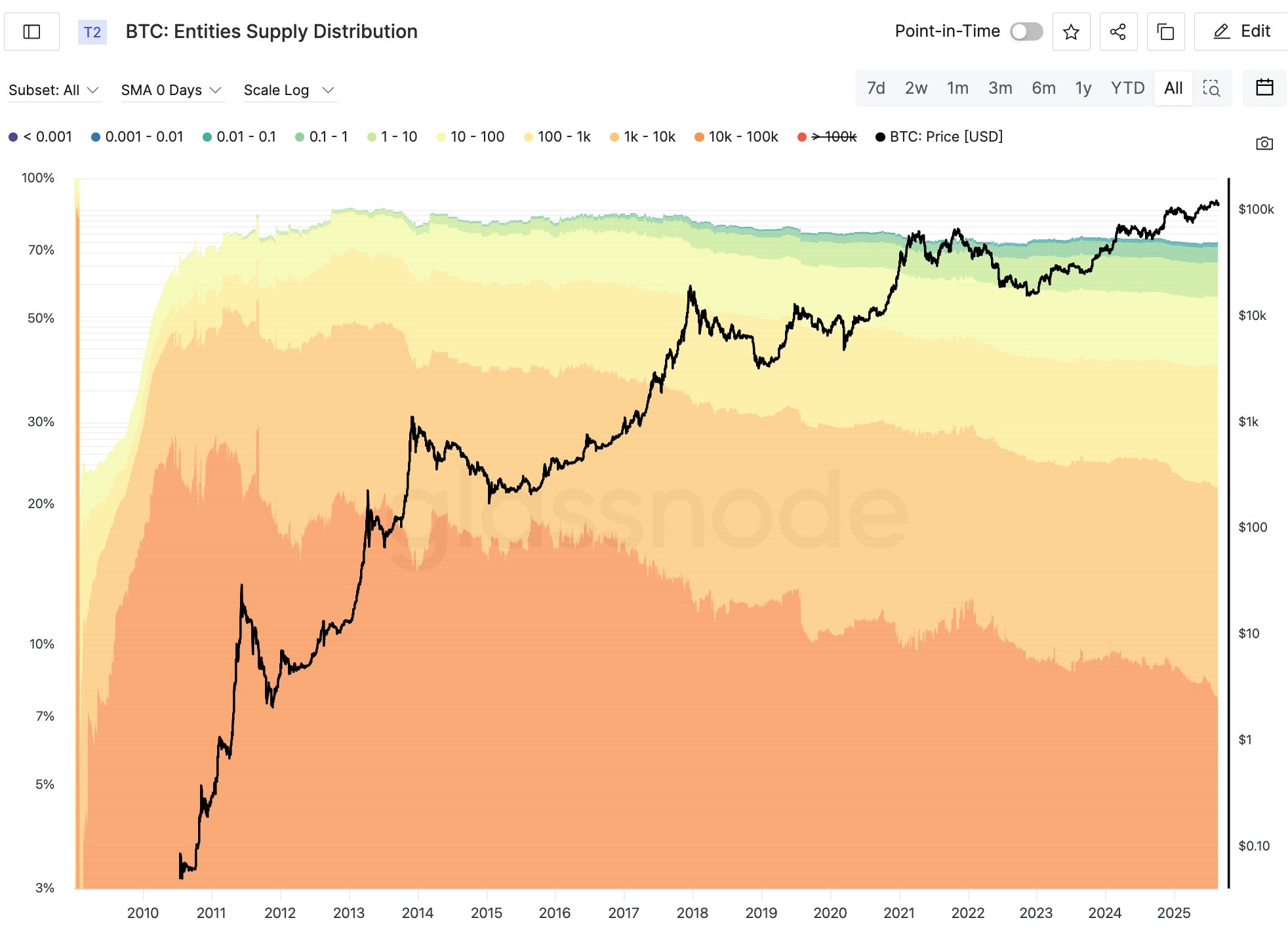

Second, this validates Willy Woo's "ancient sell pressure" theory and reveals where the capital ultimately flows.

Willy Woo made a sharp observation: Bitcoin's sluggish rally stems from whales who bought around 2011 at less than $10 per coin now selling. For every BTC they sell, the market must absorb over $100,000 in new capital. This creates significant upward resistance for Bitcoin.

The whale’s recent swap perfectly illustrates this theory—but goes further by showing us where this massive liquidity from "ancient sell pressure" ends up: Ethereum becomes the new "reservoir." This creates a stark contrast:

Bitcoin side: Ancient supply is being activated, creating persistent sell pressure; the market continuously absorbs historical baggage.

Ethereum side: Absorbs massive existing capital from Bitcoin’s ecosystem and immediately converts it into network "moats" via staking, reducing circulating supply.

This "outflow-inflow" dynamic is the most direct and fundamental explanation for the strengthening ETH/BTC exchange rate.

2. Two Sides of the Same Coin: Bitcoin's Growing Pains vs. Ethereum's Ecosystem Flywheel

The whale’s action is the outcome; underlying fundamental differences are the cause. Bitcoin and Ethereum are operating on two distinct development stages and narratives.

Bitcoin's Sweet Dilemma: The Cost of Maturing After 10,000x Gains

As the pioneer, Bitcoin’s greatest success—delivering unprecedented investment returns in human history—has now become its "sweet dilemma" preventing agile growth. The enormous unrealized profits held by early adopters hang like a Sword of Damocles over the market. Every price rise triggers some "10,000x gainers" to cash out or rebalance portfolios. This process is inevitable for Bitcoin to fully mature and redistribute ownership—a necessary "growing pain." Until this phase completes, Bitcoin’s price performance will inevitably appear relatively "heavy."

Ethereum's Ecosystem Flywheel: Three Engines Driving Organic Growth

Unlike Bitcoin’s "zero-sum game," Ethereum demonstrates strong "incremental" characteristics, with value accrual driven by a positive flywheel powered by three engines:

-

PoS Staking Supply Black Hole: Latest validatorqueue data shows that although there is a withdrawal queue (~846,000 ETH), the queue to enter staking is surging (from 150,000 to 400,000 ETH). This indicates a new wave of institutions and long-term investors, represented by public companies such as SharpLink and BitMine, are embracing ETH staking yields with unprecedented enthusiasm. The staking mechanism acts like a massive "supply black hole," continuously converting circulating ETH into locked positions, structurally reducing market sell pressure.

-

Network Effects of Stablecoin Settlement Layer: Token Terminal data shows USDC usage on Ethereum has reached an all-time high, with monthly transfer volume nearing $750 billion—comparable to large banking systems. This highlights one of Ethereum’s core value propositions: it is becoming the foundational settlement layer for the global digital dollar economy. Every stablecoin transfer and DeFi interaction consumes ETH as gas fees, with part burned via EIP-1559. Demand rooted in "real economic activity" provides solid value support, elevating ETH beyond mere speculation.

-

Deflationary Narrative of "Ultrasound Money": Under the dual forces of staking lockups and gas fee burning, Ethereum’s net issuance turns negative during peak activity, entering deflation. This "scarcer with use" monetary model—known as "Ultrasound Money"—offers a fresh value narrative rivaling Bitcoin’s "digital scarcity," with the added advantage of being dynamic and positively correlated with ecosystem vitality.

These three engines reinforce each other, forming a powerful "ecosystem flywheel": more vibrant ecosystem → higher gas consumption and staking demand → stronger ETH deflation and tighter supply → rising price expectations → attracts more capital and builders, creating a self-reinforcing cycle.

3. Macro Winds: Arthur Hayes’ 13 Trillion Stablecoin Prophecy

If the whale’s swap is a tactical signal and Ethereum’s flywheel a strategic foundation, then former BitMEX co-founder Arthur Hayes’ macro insight provides the ultimate catalyst at the era-defining level.

At the WebX conference, Hayes clearly stated that the primary driver of the next crypto bull run will stem from U.S. geopolitical and fiscal needs. He predicts the U.S. will actively redirect the $10–13 trillion Eurodollar market back into its controllable blockchain-based stablecoin ecosystem. This claim is revolutionary, suggesting that crypto markets are about to receive massive liquidity measured in trillions from the traditional financial system.

Hayes is not just a prophet but also an actor. Just last week (August 22), he publicly announced he had repurchased Ethereum and set a stunning target of "$20,000 in this cycle." This strong bullish signal was immediately echoed by institutions. BitMine, the publicly traded company already actively staking ETH, promptly shared Hayes’ interview to show alignment.

The conclusion is obvious: when this tidal wave of stablecoins seeks an efficient, secure platform rich in financial Lego blocks (DeFi), Ethereum and its thriving Layer 2 networks stand as the only viable choice.

Now, all threads converge: as trillions of dollars in stablecoins flood into Ethereum’s ecosystem for yield (e.g., Ethena) and trading (e.g., Hyperliquid), demand for the base asset ETH will be amplified exponentially. The ancient whale’s decision—not only to stake vast amounts of ETH but also to continue selling BTC for ETH on HyperLiquid—lands perfectly in step with Hayes’ prophecy.

His actions make it clear: he is not merely buying ETH’s base staking yield, but using his $2.2 billion position to front-run a highly certain, stablecoin-fueled new DeFi summer.

Conclusion: Embracing the Paradigm Shift in Value Accumulation

Returning to our initial question: what does a monumental $2.2 billion whale’s portfolio shift signify?

It signifies a deep paradigm shift in the crypto world’s value assessment framework. While the investment logic based purely on grand narratives and digital scarcity remains strong, capital is increasingly tilting toward "productive assets" capable of generating real yield, supporting complex economic activities, and capturing network value.

We are transitioning from an era dominated by "HODL" culture to one defined jointly by "Yield" and "Utility."

This "great rotation" does not herald Bitcoin’s demise. As the most decentralized and censorship-resistant store of value, Bitcoin’s status as "digital gold" remains unshakable, continuing to serve as a cornerstone in macro hedging and asset allocation. Yet, in terms of growth potential and capital efficiency, the spotlight is irreversibly shifting toward Ethereum.

For investors and industry observers, understanding this rotation is key to navigating the current cycle. The ETH/BTC exchange rate is no longer just a trading pair—it is a mirror reflecting the evolution of crypto from 1.0 to 2.0. That ancient whale, using wealth accumulated since Bitcoin’s inception, has cast the heaviest and most credible vote yet for this path. And this, perhaps, is only the beginning.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News