Rate Cuts, DAT, and the Sell-Off: Has the Crypto Bull Market Peaked or Is It Still Midway?

TechFlow Selected TechFlow Selected

Rate Cuts, DAT, and the Sell-Off: Has the Crypto Bull Market Peaked or Is It Still Midway?

Many people around me plan to sell, but they don't want to sell at the current price.

Author: Ignas

Translation: Luffy, Foresight News

As I write this article, the biggest short-term uncertainty in crypto is the direction of interest rates. Two key events to watch are Powell's speech at Jackson Hole (Thursday, August 22) and how the Federal Reserve sets rates at the FOMC meeting on September 16–17.

-

If dovish signals are released → 2-year Treasury yield and USD index decline → Bitcoin / Ethereum rise

-

If hawkish cuts or prolonged high rates emerge → risk assets sold off, altcoins drop first

This is the conclusion from ChatGPT-5’s reasoning model and Deepseek’s Deepthink model. Many on X share this view, which also explains the recent drop in altcoins.

To be honest, it's frustrating how dependent crypto is on macro factors, but last cycle's peak amid global rate hikes proves we can't ignore them.

Yet as Wintermute trader Jack noted, my AI models also paint a bullish picture: rate cuts will eventually come. The uncertainty lies in “when, how many times, and by how much.”

If so, we’re now in the opposite situation compared to the end of the last cycle: rate cuts are coming—does that mean the bull market peak is still far away?

I hope so, but everyone I talk to plans to sell. So who is buying to offset the selling pressure?

The retail speculators we relied on in the last cycle haven’t entered yet (evident from iOS app store data for crypto apps). The current biggest buyers are:

-

Spot ETFs

-

Digital Asset Treasuries (DATs)

My concern: Can institutions, digital asset treasuries, and other large players absorb wave after wave of retail selling? Or will their buying power eventually dry up?

Ideally, this is a multi-year process where steady price increases gradually weed out weak-handed investors.

The most interesting outcome might be: even as most crypto "natives" sell, crypto continues rising, fueling further upside.

Either way, digital asset treasuries are both a major risk and a key bullish factor—I’d like to briefly discuss this.

Now It All Depends on Digital Asset Treasuries

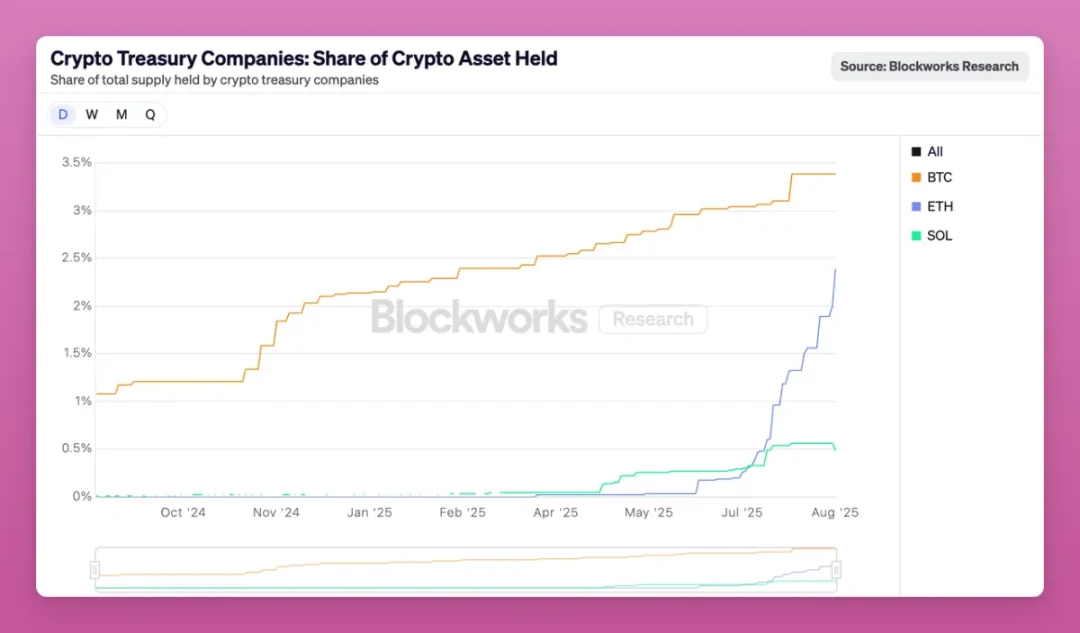

Just look at how fast digital asset treasuries are acquiring Ethereum.

Ethereum-focused digital asset treasuries have acquired 2.4% of Ethereum’s total supply in under three months.

To put it another way: the largest Ethereum-focused digital asset treasury (Bitmine) now holds as much ETH as exchange Kraken, more than OKX, Bitfinex, Gemini, Bybit, Crypto.com, and even more than the amount held in Base chain’s cross-chain bridge.

At this pace, Ethereum-focused treasuries could surpass Bitcoin-focused ones in holdings within months. In the short term, this is bullish for Ethereum, but risks emerge if a treasury needs to liquidate its ETH holdings.

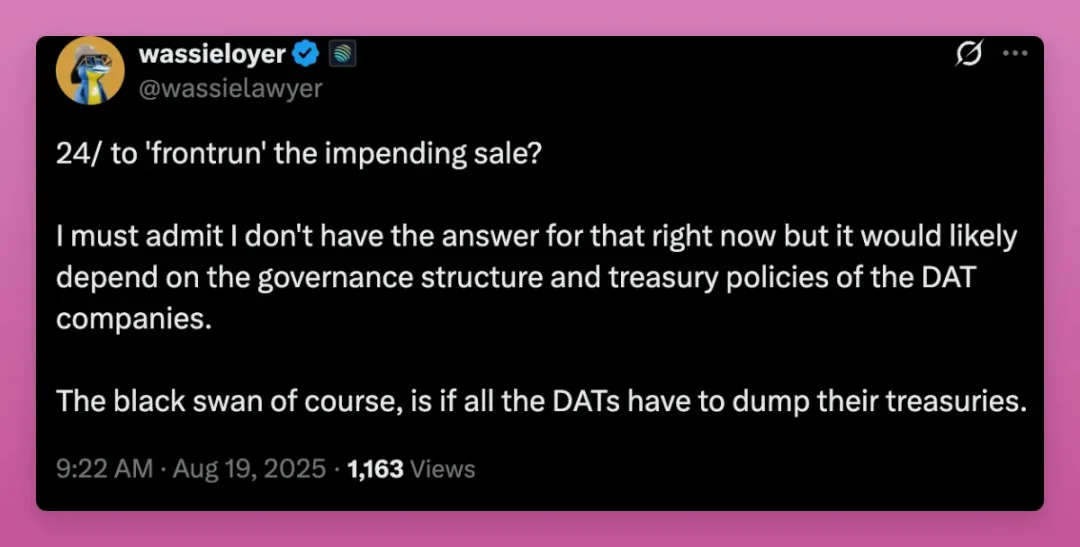

Even Wassie admits it’s unclear what happens when a treasury’s modified Net Asset Value (mNAV) turns negative.

There’s plenty of speculation on X, but my advice is: keep tracking DAT data, especially whether mNAV stays below 1.

As I write this, SBET and BMNR trade slightly above mNAV 1, while BTCS trades below 1.

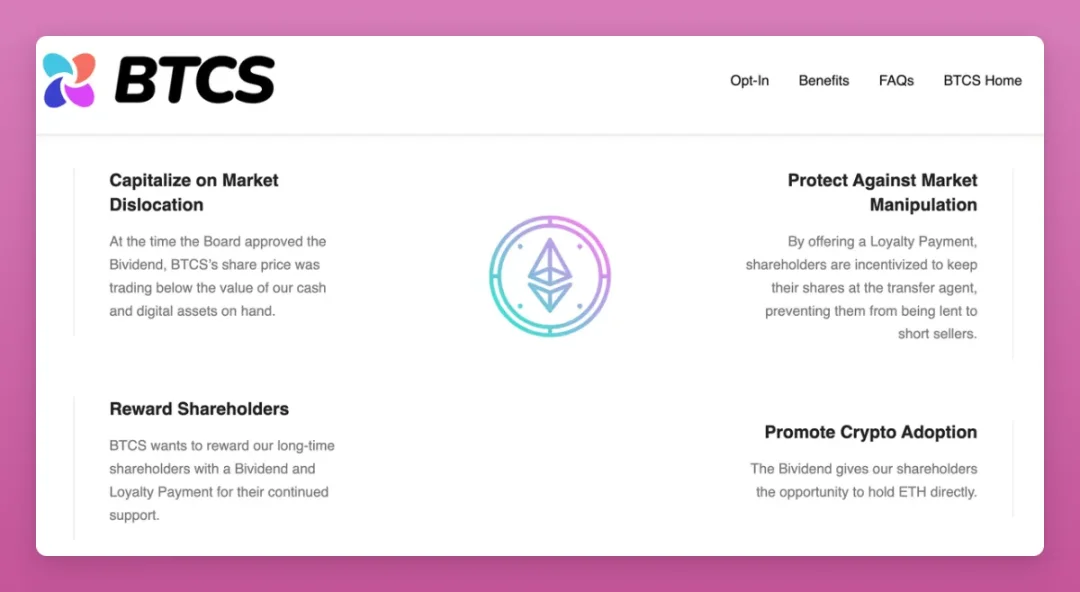

So what is BTCS doing?

To attract more stock buyers, BTCS announced its first “dual dividend”: a one-time $0.05 ETH dividend per share plus a $0.35 cash dividend.

Most importantly, they offer... please read carefully... “a one-time $0.35 Ethereum loyalty reward per share to shareholders who transfer their shares into our transfer agent’s registration and hold until January 26, 2026.”

To crypto natives, BTCS’s move resembles traditional finance’s “staking mechanism,” designed to stop shareholders from selling stock. Their motivation stems from mNAV being below 1 and a desire to “prevent market manipulation”—stopping shares from being lent to short sellers.

Also, where are these dividends coming from? They’re paid using the Ethereum the company has acquired.

Doesn’t look great, right?

At least they haven’t publicly sold ETH yet. I suspect smaller companies unable to attract stock buyers will be the first to break and dump crypto assets. So track the dashboards below to identify digital asset treasuries and study how they manage their crypto holdings.

Crypto Twitter may overlook small DATs, but their moves can help us anticipate actions by larger, systemically important ones.

Here are some dashboards worth watching:

Note that different dashboards report slightly different data, adding complexity to analysis. We must closely monitor other digital asset treasuries’ movements.

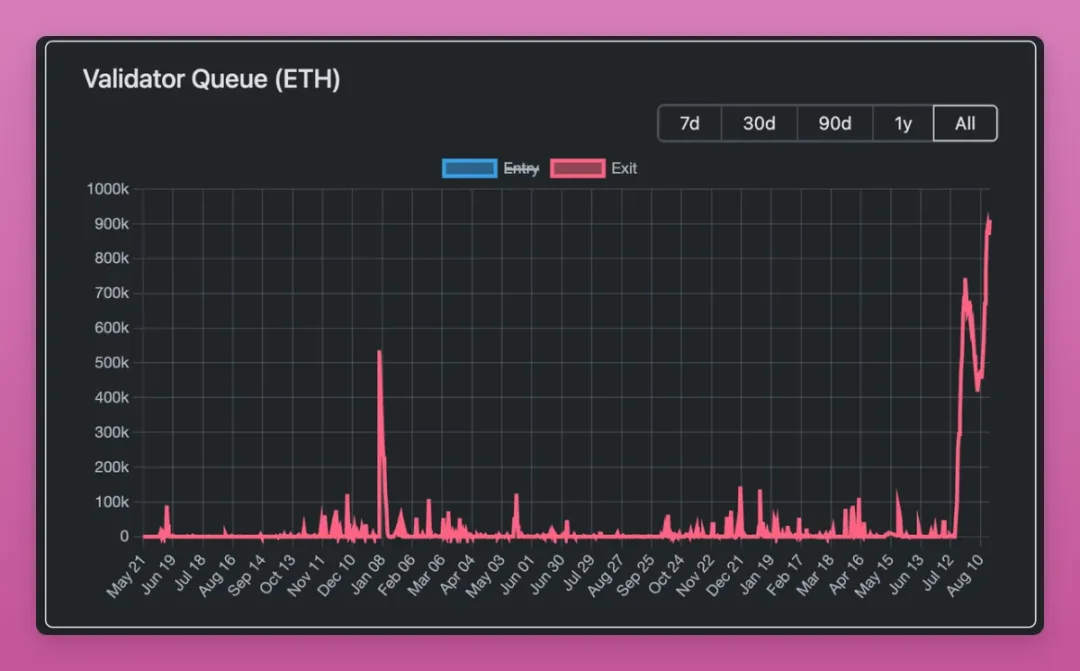

Still, given the current low mNAV premium and record-sized Ethereum unstaking queue, it’s no surprise if Ethereum’s rally slows for days or even weeks.

Before moving on, one addition: I’m growing increasingly optimistic about altcoin digital asset treasuries.

Bullish Case for Altcoin Digital Asset Treasuries

This cycle has seen a record number of new token launches. While most are valueless memecoins, the cost of launching a token has effectively dropped to zero.

Compare previous cycles: PoW forks required mining hardware (e.g., Litecoin, Dogecoin), or building staking infrastructure (e.g., EOS, SOL, ETH). Even in the last cycle, launching a token required technical knowledge.

Prior to this cycle, the number of notable tokens was “manageable”—a few lending protocol tokens, DEX tokens, several layer-1 tokens, infrastructure tokens, etc.

Now, with token launch costs near zero, more projects are issuing tokens, especially with the rise of Pump.fun, making it harder for altcoins to gain attention and capital inflows.

Example: I’ve listed 11 numbers below—but what if there were thousands? Finding a Schelling point (the default consensus point without communication) becomes impossible.

In the past, it was just Bitcoin vs. “everything else.” With MicroStrategy continuously buying, only Bitcoin could rise.

Altcoin digital asset treasuries change that dynamic.

First, very few altcoin projects can orchestrate a digital asset treasury acquisition. It requires specific knowledge and skills most lack.

Second, only a limited number of altcoins are “worthy” of having a digital asset treasury—such as Aave, Ethena, Chainlink, Hype, or a DeFi token index.

Third, and perhaps most importantly: digital asset treasuries give ICO projects an “IPO moment,” attracting institutional capital previously out of reach. As I wrote on X:

I once thought altcoin digital asset treasuries were crazy Ponzi schemes. But upon reflection, they allow altcoins to “go public”—from ICO to IPO. BNB’s digital asset treasury is like Binance’s IPO, something Binance might never have achieved otherwise. Similarly, an $AAVE treasury allows traditional finance capital to invest in the future of lending. Let’s see more of these.

Finally, unlike Bitcoin and Ethereum, altcoins lack ETFs to attract institutional investors.

Therefore, altcoin digital asset treasuries are an area I’ll be closely watching. They bring differences—absorbing OTC VC sell-offs, acquiring tokens at discounts, etc.

Ethena is an early example, but I’m curious what happens when a high-circulating-supply altcoin gets a digital asset treasury.

Should You Sell?

As I mentioned earlier, many around me plan to sell—but not at current prices.

Why? Because all indicators still look surprisingly healthy. CryptoQuant’s “All-in-One Momentum Indicator” tracks bull/bear cycles via profit/loss metrics.

Key conclusions (largely unchanged from months ago):

-

Bitcoin is in mid-bull market phase.

-

Holders are taking profits, but extreme euphoria hasn’t hit.

-

Prices can still rise before becoming overvalued.

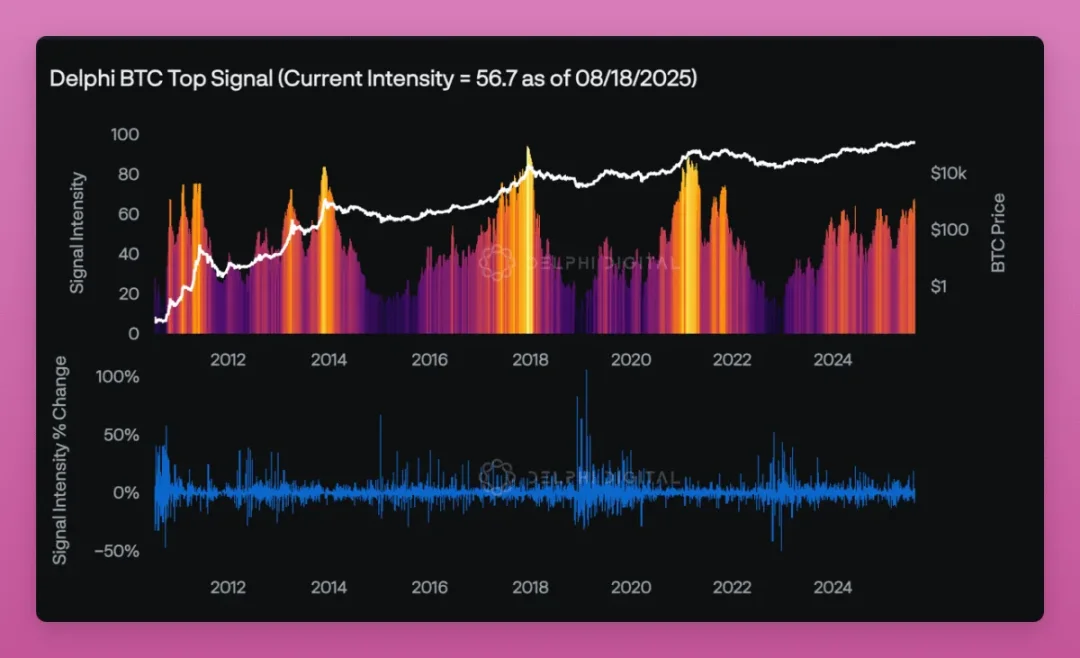

Still, Delphi’s Bitcoin Top Signal dashboard shows the market nearing overheating but still within control: strength score is 56.7, while tops usually occur around 80.

The Fear & Greed Index has returned to neutral.

Additionally, none of Glassnode’s tracked 30 indicators suggest a market top.

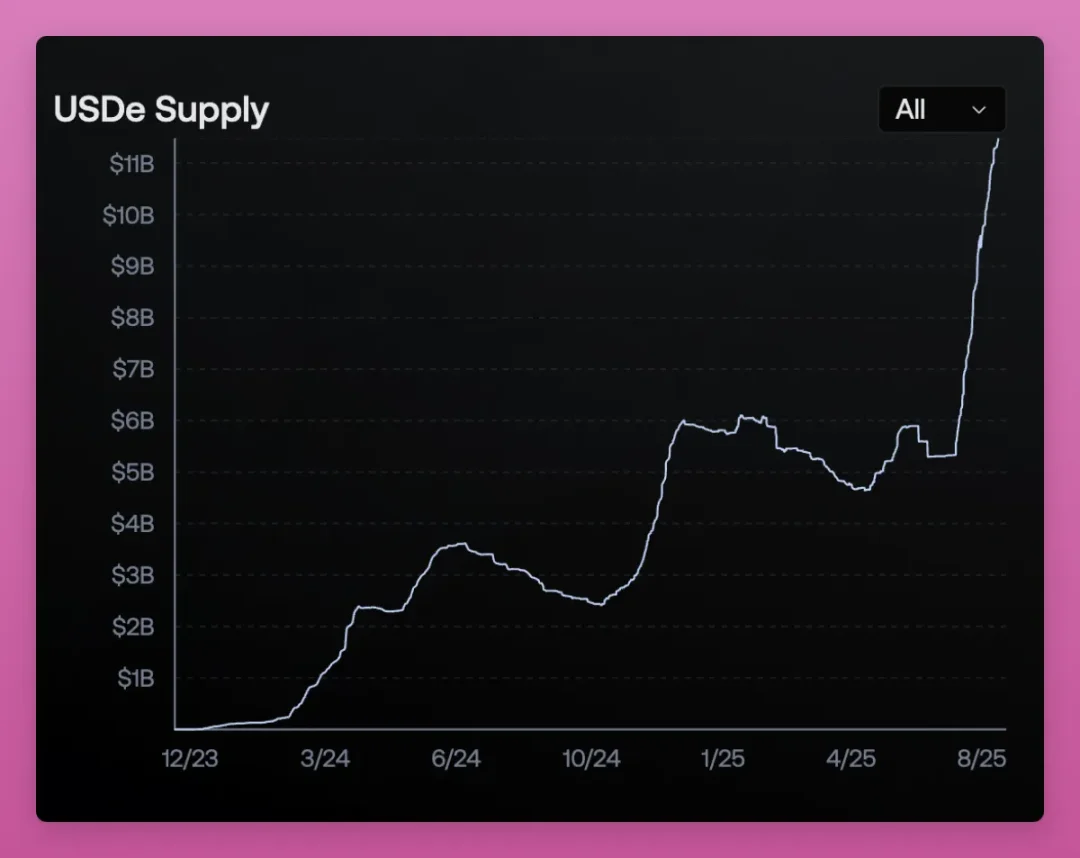

I used to rely on funding rate peaks to spot market tops, but now I question if Ethena has distorted this signal.

High funding rates used to mean too many long speculators, often preceding sharp drops. But Ethena’s USDe breaks this pattern.

USDe mints stablecoins by going long spot and short perpetuals, earning funding fees as yield. When funding rates rise, more USDe is minted, increasing short positions and pushing rates down—a self-regulating loop.

So high funding rates no longer necessarily mean market overheating—they might just reflect Ethena expanding USDe supply.

Then why not track USDe supply instead? Viewed this way, the market is indeed hot—USDe supply doubled in a month.

Overall, I think market conditions are decent. However, many retail speculators from cycles three and four hold “life-changing” unrealized gains, so every big rally faces selling pressure.

Hopefully, digital asset treasuries and Ethereum can absorb this.

Also, a bear market could unexpectedly return due to macro turmoil, potentially exposing hidden leverage in crypto we haven’t yet discovered.

Earlier in the “Market Status” series, in my first article, I mentioned several areas with potential leverage:

-

Ethena: USDe collateral has shifted from mostly Ethereum to Bitcoin, and now to liquid stablecoins.

-

Restaking: Though the narrative has cooled, Liquid Restaking Tokens (LRTs) are integrating into mainstream DeFi infrastructure.

-

Circular arbitrage: Speculators chase high yields through leveraged farming loops.

Ethena used to be my biggest worry, but now digital asset treasuries are the main focus. What if there’s hidden leverage we’re completely unaware of? That keeps me up at night.

What to Do After Selling?

After moving my tax base to Portugal, my crypto investment strategy changed.

In Portugal, capital gains tax is 0% if you hold assets over 365 days; also, trading between cryptocurrencies is tax-free.

This means I can switch to stablecoins, hold for a year, and earn tax-free returns.

The question is: where should I deposit stablecoins to maximize yield while sleeping soundly?

Surprisingly, there aren’t many truly reliable protocols. Chasing high yields means constantly switching between protocols, watching for “treasury migrations” (e.g., contract upgrades), and facing hacker risks.

Aave, Sky (Maker), Fluid, Tokemak, Etherfi are most discussed, but others exist—Harvest Finance, Resolv, Morpho, Maple, etc.

So which protocol lets you safely park stablecoins for a year? Personally, I’d only fully trust two.

First is Aave. But USDe growth and LST ETH/ETH circular arbitrage make me wary of mass liquidations (though Aave’s new “umbrella” mechanism helps).

Second is Sky. But S&P Global gave it a “first-ever stablecoin system credit rating” that’s concerning—it rated B-, meaning “risky but not near collapse.”

Weaknesses include:

-

Depositor concentration

-

Governance still deeply tied to Rune (MakerDAO founder)

-

Thin capital buffer

-

Regulatory uncertainty

This means Sky’s stablecoins (USDS, DAI) are considered credible but fragile. Fine in normal times, but vulnerable during stress events like mass redemptions or loan defaults.

As PaperImperium said: “For mainstream stablecoins, this is a disastrous rating.”

Traditional finance has far lower risk tolerance than crypto natives, but putting all stablecoins into one protocol is definitely unwise.

This also shows crypto is still early—true “passive investing” doesn’t really exist yet, except for Bitcoin and Ethereum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News