MYX Contract Bags 8.9 Billion: Winners Rely on Strategy, Losers Fall to Greed

TechFlow Selected TechFlow Selected

MYX Contract Bags 8.9 Billion: Winners Rely on Strategy, Losers Fall to Greed

Successful traders profit by taking heavy positions at lows and managing risk at highs, while unsuccessful traders suffer huge losses due to overconfidence and violating risk controls.

Author: WolfDAO

Introduction: Market Echoes in Extreme Conditions

In August 2025, the crypto market was once again ignited by a wave of intense MEME sentiment. A project named MYX surged from a dormant price of around $0.1 to a peak of $2.17 within just 48 hours, achieving a staggering nearly 20-fold increase.

Data source: Binance MYX/USDT market screenshot

This extreme volatility not only created massive waves in the spot market but also triggered a large-scale battle in centralized exchange (CEX) perpetual contract markets. Statistics show that at the peak of MYX's price, Binance’s MYX contract funding rate plunged to an extreme level of -2%, with settlements occurring as frequently as hourly. This phenomenon clearly reflects extremely high hedging demand and persistent short-side pressure despite continuous "penalties" from funding rates.

During this capital frenzy, MYX’s 24-hour futures trading volume surged to $896.3 million, a 31.91% increase over the previous period, while open interest reached $136 million. Accompanying this was a total liquidation amount of $16.22 million—second only to Bitcoin and Ethereum—demonstrating the astonishing domino effect of leverage in the MYX perpetual futures market.

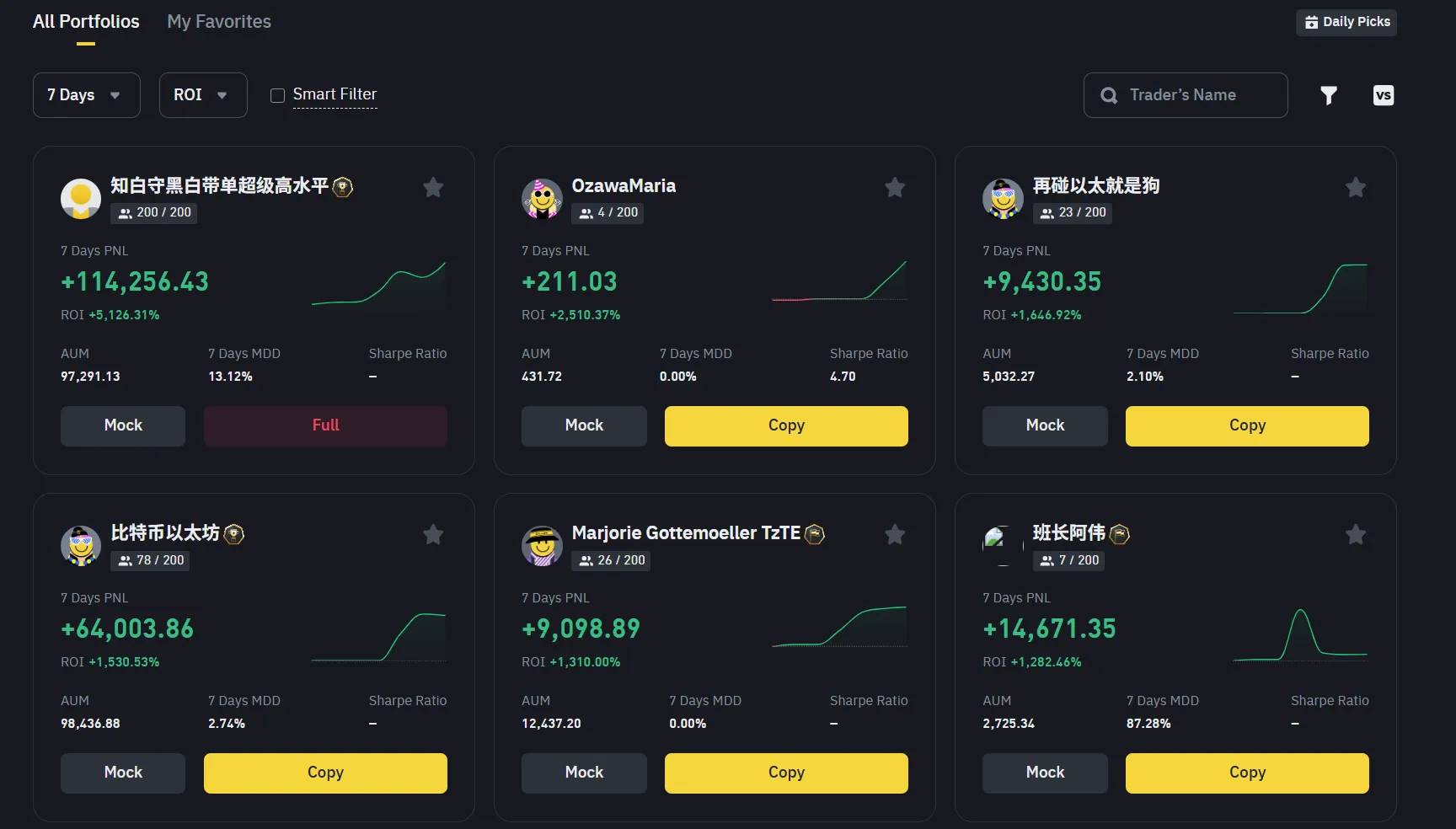

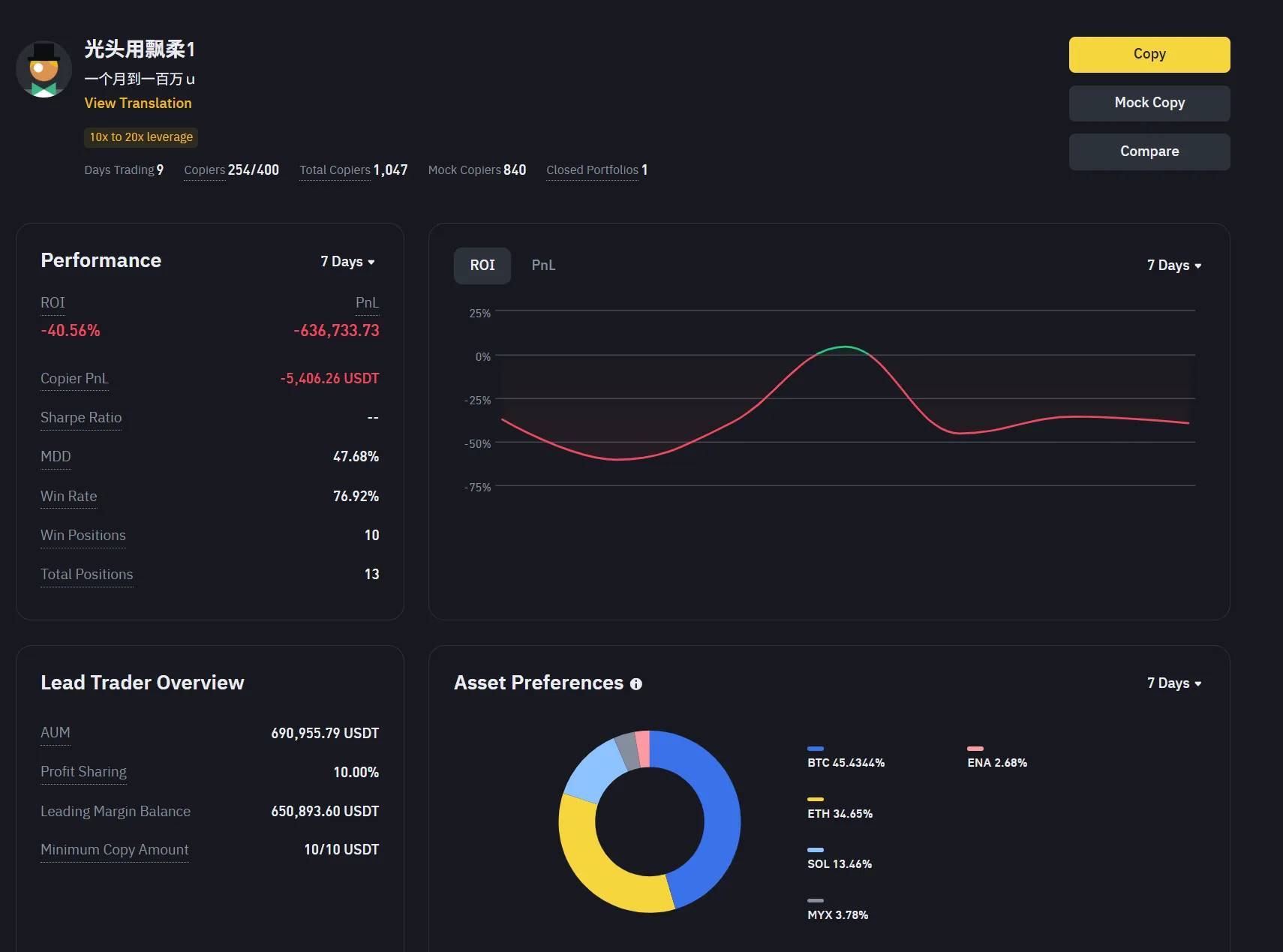

Data source: Binance copy trading leaderboard screenshot

Within the CEX copy-trading ecosystem, MYX's popularity was directly reflected on the leaderboards. Traders who successfully captured the MYX move posted exceptionally strong 7-day PNL (profit and loss) and ROI (return on investment) figures, seemingly unlocking overnight wealth. Yet behind these impressive numbers lay vastly different trading strategies and risk perceptions. This article will analyze two typical cases to deeply explore the contrasting behaviors of successful and failed traders during the MYX rally, revealing their behavioral patterns and psychological battles in extreme market conditions.

1. The Winner Profile: A Phased "Market Hunter"

We begin by analyzing a copy trader who achieved remarkable wealth growth during the MYX surge. Social account data shows that solely through successful MYX trades, he grew his managed assets (AUM) from zero to 100,000 USDT within seven days, with follower slots instantly filled.

His trading strategy was not static, but more akin to an experienced hunter adapting tactics according to different stages of the market.

Data source: Binance copy trader "Zhibai Shouhei Super High Level Copy Trading" details

Phased Trading Strategy and Position Management

Phase One (August 4): Accumulation at the bottom — Precise betting like a "gambler".

When MYX’s price was still in the low range of $0.19–$0.37, he demonstrated strong conviction, boldly building large positions. Single positions reached 100,000 to 300,000 MYX tokens—requiring not only deep insight into fundamentals (or market sentiment), but also substantial capital strength and psychological resilience. This successful "bottom-fishing" gave him a solid initial capital base, laying the foundation for subsequent operations.

Phase Two (August 5): Trend following and swing trading — Flexible switching like "guerrilla warfare".

As prices entered the rapid uptrend between $0.48 and $1.29, he no longer held a one-way long bias, instead flexibly switching between long and short positions. By operating in both directions, he successfully captured the main upward trend and shorted at peaks during pullbacks, maximizing profits. This strategy indicates exceptional adaptability and the ability to adjust tactics based on market dynamics.

Phases Three and Four (August 6–7): High-frequency oscillation trading and top-range博弈 — Risk-taking on the "knife's edge".

After prices rose into the high-volatility zone of $0.89–$1.95, his trading became even more frequent. While maintaining bidirectional trades, some late-stage chasing led to losses. On August 7, he even built large positions in the $1.92–$2.05 peak zone. Though seemingly reckless, strict stop-loss discipline limited his maximum single loss to just $5,765 USDT—relatively manageable compared to his highest single profit of $15,681 USDT.

Data source: WolfDAO Insights Copy Trade Analytics (https://insights.wolfdao.com/)

Psychological Profile Behind Success

The trader’s success was not simply due to "good luck," but rather a combination of key traits:

Staged risk awareness: He understood that bottom accumulation offered high returns with relatively low risk, thus justifying heavy exposure. At higher levels, however, he prioritized risk control, using small-sized, high-frequency trades to capture profits and avoid catastrophic single-trade risks.

Strict stop-loss discipline: Despite later chasing behavior, he prevented losses from spiraling. His profit-to-loss ratio (average gain vs. average loss) reached an impressive 2.73:1, reflecting a core risk management philosophy: let profits run, cut losses early.

Fund management strategy: He used profits earned during early accumulation as "ammunition" for later trades, ensuring that even if later high-risk trades lost money, his principal remained intact. This "risking only what you’ve earned" approach is common among successful traders.

Data source: WolfDAO Insights Copy Trade Analytics (https://insights.wolfdao.com/)

2. The Loser Profile: The Gambler Devoured by "Greed"

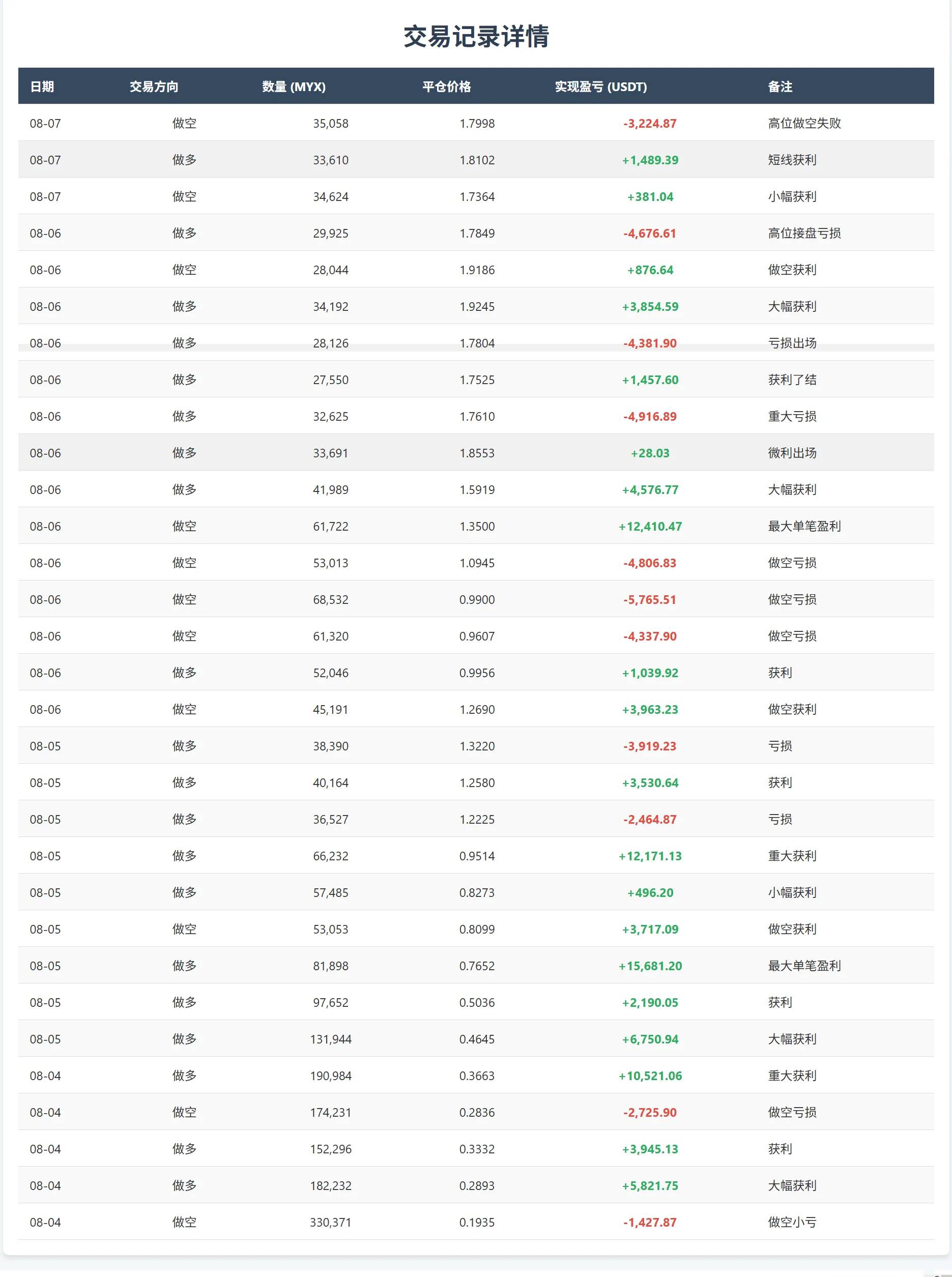

Data source: Binance copy trader "Guangtou Uses Pantene 1" trade history

In stark contrast to the winner, another copy trader suffered devastating losses during the MYX surge. Data shows he lost over 636,000 USDT in seven days, with the vast majority stemming from MYX trades.

Trade Data Analysis

Data source: WolfDAO Insights Copy Trade Analytics (https://insights.wolfdao.com/)

His total realized P&L on MYX was -497,981.50 USDT. Although he executed 63 trades on MYX with a win rate of 55.6%—appearing decent—the bleak outcome reveals one of trading’s harshest truths: win rate does not equal profitability; the profit-to-loss ratio determines survival.

Data source: WolfDAO Insights Copy Trade Analytics (https://insights.wolfdao.com/)

Successful bottom entry, but failed to preserve gains: He correctly went long on August 5 at $0.41–$0.42, accumulating over 15,000 USDT in profit. However, this success acted as poison, inflating his confidence and blinding him to subsequent risks.

Chasing at highs, loss of position control: When MYX surged to around $1.4, he completely lost rationality. He made three consecutive large long entries, with single positions reaching up to 265,000 MYX. This aggressive martingale-style averaging and momentum chasing led to catastrophic results when prices reversed.

Deadly "no stop-loss" approach: His largest single loss reached $265,784.86 USDT—nearly half of his total loss—contrasting sharply with his largest single gain of $10,491 USDT. His profit-to-loss ratio plummeted to 1:18, violating basic risk management principles. Instead of cutting losses early, he doubled down with larger positions trying to "recover," ultimately being devoured by the market.

3. Final Conclusion: The Essence of Trading Is Not 'How Much You Earn,' But 'How Long You Survive'

Data source: WolfDAO Insights Copy Trade Analytics (https://insights.wolfdao.com/)

Detailed Return Comparison:

The starkly different fates of these two copy traders during the MYX event offer valuable lessons:

Trading is risk management, not return prediction: Successful traders prioritize risk control, protecting capital through strict stop-losses and position sizing. Failed traders are blinded by "greed," equating high risk with high reward, ultimately placing themselves in irreversible positions.

Adaptive, stage-based strategy is crucial: Adapting trading strategies to different market phases is essential for professional traders. At the bottom, bold positioning is required; near the top, caution and restraint—or even reversal—are necessary.

Emotional control is a trader’s fundamental skill: Successful trading is a carefully planned campaign, with every decision thoroughly considered. Failed trading is often an emotionally driven gamble, dictated by fear and greed.

In the crypto market—a jungle full of temptation and traps—survival is the ultimate victory. The essence of successful trading lies not in how much one can earn, but in how long one can survive.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News