Why are perpetual contracts inherently part of general-purpose blockchains?

TechFlow Selected TechFlow Selected

Why are perpetual contracts inherently part of general-purpose blockchains?

The future trend is: perpetual contracts (and all "killer applications") will make top general-purpose chains even stronger.

Author: World Capital Markets

Translation: Saoirse, Foresight News

The debate between appchains and general-purpose (GP) chains has never ceased. While both models have their strengths, a historical and economic perspective reveals the obvious rationale for building perpetual contracts on general-purpose chains.

In fact, the idea that applications should build their own independent chains is completely backwards. Truly high-quality applications should support general-purpose chains, rather than fragmenting into isolated "information silos."

Finance is about integration, not fragmentation

The evolution of finance has never been about decentralization—it's about continuous consolidation.

In 1921, there were approximately 30,000 banks in the United States; today, that number has dropped to around 4,300—a decline of 86%. Why? The answer lies in shared infrastructure, unified standards, and efficient settlement mechanisms. The fewer the infrastructure layers, the stronger the liquidity and the more pronounced the economies of scale.

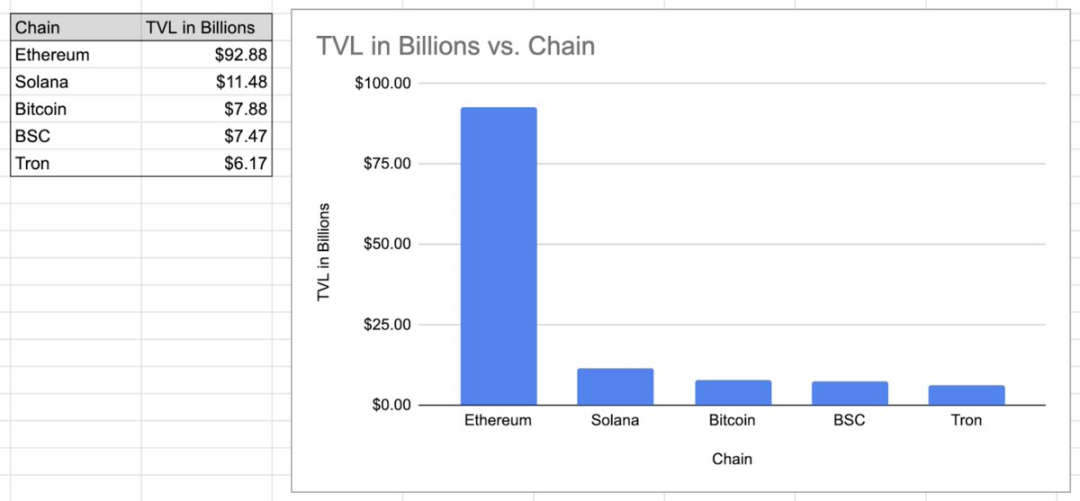

Despite a new wave of blockchain projects emerging every year—alternatives blooming like a Cambrian explosion—Ethereum, a slow and expensive blockchain, still dominates total value locked (TVL), maintaining a massive lead: nearly 10 times that of Solana.

Below are the top five blockchains by total value locked as of August 31, 2025

Data source: https://defillama.com/chain/ethereum

After Ethereum, the list remains dominated by general-purpose chains. Eventually, you reach HyperEVM—a different general-purpose chain that runs Hyperliquid. Hyperliquid is, to date, the only truly successful appchain.

Thus, shared settlement is the ultimate direction for blockchain finance—not fragmented "application-specific silos."

Distribution is king: the core competitive edge in finance

A common argument claims that "general-purpose chains only solve distribution." Only solve distribution? That’s like saying "a drug only cured cancer." In finance, distribution itself is the core competitive advantage.

How different are the financial products you use daily across various providers?

From checking accounts to comparing the NYSE and Nasdaq, beyond "distribution capability" and "established network effects," it's hard to identify any fundamental differences. Hardware like servers is cheap; distribution capability, however, is priceless.

Platform economics: the real lesson

Platforms are powerful distribution vehicles.

Looking back at the evolution of platforms—from operating systems, app stores (App Store), Xbox consoles, the internet, to recent examples like Telegram—the pattern is clear: breakthrough applications, whether by choice or necessity, support platforms instead of breaking away to operate independently.

Consider how critical distribution is to platforms: How many apps on your iPhone did you install without using the App Store? How often do you access websites without a browser? TikTok didn’t build a better OS, Facebook didn’t develop a better browser, and Halo didn’t manufacture a better Xbox console.

In fact, contrary to some current beliefs: high-quality applications actually have an incentive to support platform growth.

Popular apps want the platform to succeed, creating a flywheel effect: apps bring traffic, traffic attracts more apps, which in turn brings even more traffic.

Blockchains, through decentralized governance, solve the single core flaw of traditional platforms—"platform risk" (i.e., the platform arbitrarily changing rules or restricting apps). On a decentralized platform, you won't see another FarmVille collapse due to shifting platform policies. You gain all the benefits of a platform without the risk of being exploited by it. Admittedly, due to the inherent trade-off in current technology between "performance" and "decentralization," MegaETH retains some centralized characteristics; but what matters is the end goal, not the initial state.

Conclusion: Network effects driving winner-takes-all

Finance continues to consolidate, platforms dominate distribution, and distribution power outweighs product functionality.

The only difference between blockchains and historical patterns is that blockchains amplify these effects even further.

The future trend is clear: perpetual contracts (and all other "killer apps") will make leading general-purpose chains even stronger. Because network effects don't disperse—they stack, layer upon layer, growing ever more powerful.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News