How much money did Trump make from the presidency?

TechFlow Selected TechFlow Selected

How much money did Trump make from the presidency?

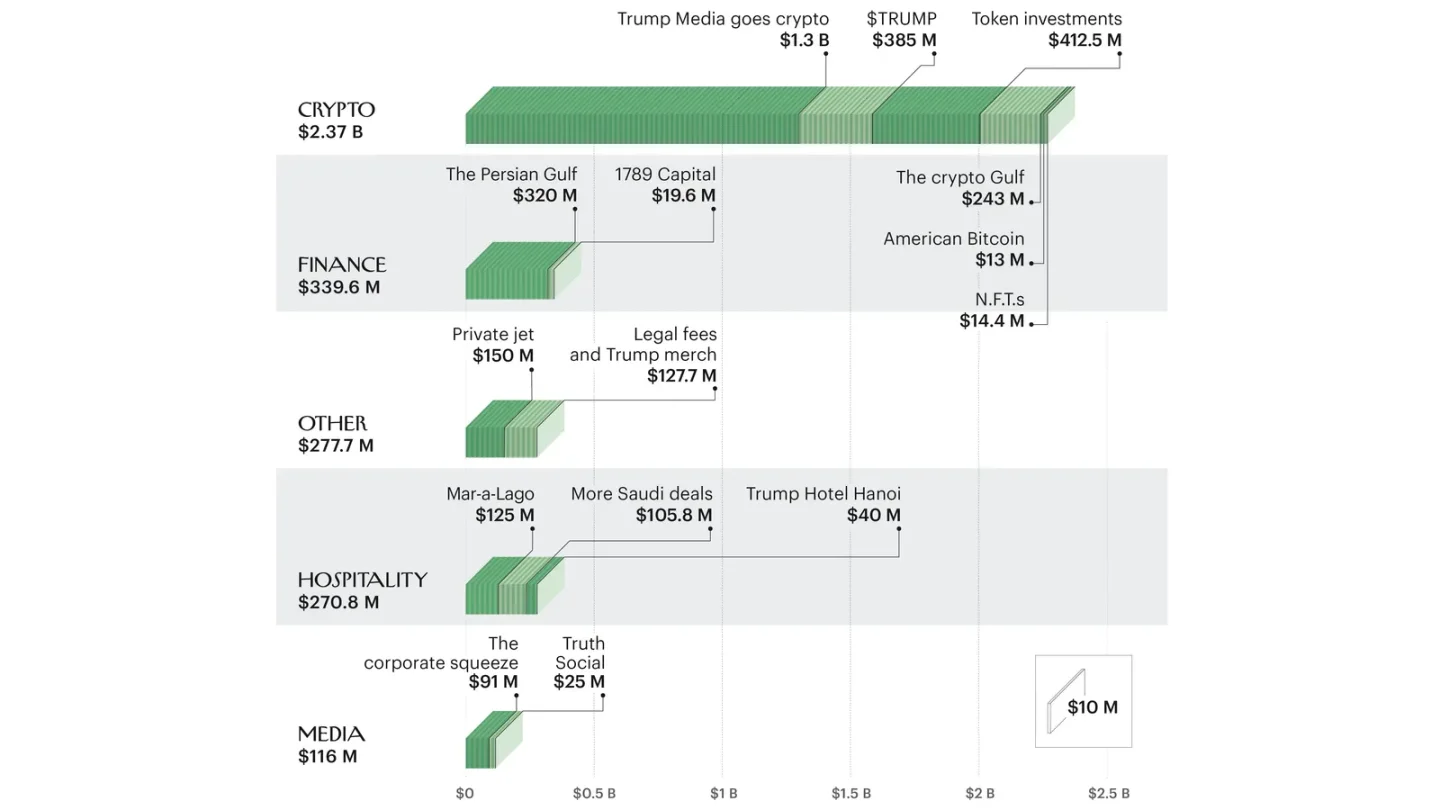

The cumulative earnings of $3.4 billion not only set a new record for monetizing power in U.S. political history, but also blurred the line between public office and private gain.

By David D. Kirkpatrick, The New Yorker

Translated by Luffy, Foresight News

In January 2017, President-elect Donald Trump faced public scrutiny for the first time over potential conflicts between his business empire and official duties. His company, the Trump Organization, earned profits globally through luxury apartments, hotel leases, development projects, and club memberships. He also partnered with various commercial entities to license his name on products. Could people trust him to prioritize public interest over personal gain? How would he assure Americans that money flowing into his businesses wouldn't become disguised bribes?

When asked whether he would release his tax returns like previous presidents, he flatly refused, referring to the loophole allowing presidents to operate outside conflict-of-interest regulations as the "no conflict clause," as if it were a special privilege. He revealed that during the transition period, he had considered a $2 billion Dubai real estate proposal from Emirati tycoon Hussain Sajwani but ultimately declined, citing a desire not to "take advantage." Instead, he handed management of his enterprises to his eldest son, Donald Jr., and second son, Eric. His tax attorney, Sheri Dillon, stated that Trump would not "destroy the company he built" and promised the family would never "abuse presidential power."

Yet these promises unraveled throughout Trump's political career. After the 2021 Capitol riot, Dillon’s law firm terminated its representation; by his second term, the Trump family completely broke their pledge not to pursue new overseas deals, profiting from five major transactions in the Persian Gulf alone. Donald Jr. openly admitted that restraint during the first term did little to silence critics—"There was no point in self-restraint anymore." Today, the scale of funds flowing to Trump and his family is staggering: a $2 billion investment from a Saudi crown prince-controlled fund, a luxury aircraft gifted by Qatar’s emir, cryptocurrency profits, exclusive club membership fees... Ethics reform advocate Fred Wertheimer remarked, "In leveraging public office for private gain, Trump has no precedent."

Although Forbes and The New York Times estimate Trump’s net worth at over $5 billion and $10 billion respectively, these figures include substantial paper gains and assets unrelated to his presidency. Government ethics lawyer Norm Eisen admitted, "We don’t know the full amount." Robert Weissman, co-chair of Public Citizen, added, "We’ll never truly know."

Indeed, quantifying how much value the presidency brought to Trump is a daunting task. But in this article, I aim to fairly and objectively measure the profits the Trump family gained across two presidential terms. Mar-a-Lago, the for-profit club now serving as both a shrine to the "Make America Great Again" movement and a weekend White House, offers an obvious starting point.

Mar-a-Lago

During his 2016 campaign, Trump claimed the presidential race had little impact on his hotel and resort business—except for Mar-a-Lago. This Palm Beach estate, acquired in 1985 for $10 million, experienced its "best year in history" due to the campaign. Unlike past presidents who traded access for campaign donations, Trump directly sold unlimited access to himself and his inner circle.

Mar-a-Lago claims a membership cap of 500, with annual dues originally around $20,000 per person. After 2016, initiation fees surged to $100,000 and were planned to rise to $1 million last year. Financial data show annual revenue jumped from $10 million in 2014 to $50 million, while operating costs remained stable between $12 million and $16 million. Based on this, the additional profit Trump earned from Mar-a-Lago during his presidency was at least $125 million.

Cumulative total: $125 million

Legal Fees and Merchandise

Over the past decade, Trump’s campaign committees spent over $20 million at Trump-owned hotels and resorts, contributing to Mar-a-Lago’s profits. In 2016 and 2024, his campaigns paid $18 million to use his Boeing 757 aircraft—a cost comparable to what Obama and Romney paid to lease campaign jets.

Trump’s innovation lies in operating a private online store selling merchandise that competes with official campaign gear, such as $50 “American Bay” baseball caps and $18 beer cozies. Financial disclosures indicate these sales generated over $17 million in revenue, nearly all profit. Additionally, his licensing income includes guitars ($1.1 million), watches ($2.8 million), sneakers and perfumes ($2.5 million), books ($3 million), and Bibles ($1.3 million), totaling at least $27.7 million.

More significantly, Trump used donations to his political action committees (PACs) to cover legal expenses exceeding $100 million, covering cases involving sexual assault allegations, hush-money fraud, and attempts to overturn election results. This sum amounts to a “$100 million private gift.”

Cumulative total: $125 million + $127.7 million = $252.7 million

Washington Hotel

During Trump’s first term, the Trump International Hotel in Washington was widely viewed by Democrats as a “corruption hub.” Foreign leaders booked entire floors, lobbyists and officials crowded its bars. Yet in reality, the hotel lost over $70 million annually—his presidency attracted some clients but deterred an equal number wary of scandal.

In 2012, Trump agreed to pay the federal government at least $3 million annually to lease the Washington, D.C. building (formerly the Post Office headquarters), investing at least $200 million in renovations. Opened in 2016, he sold it in 2022 for $375 million. Meanwhile, Trump Turnberry golf resort in Scotland received U.S. military lodging payments (at least $184,000 within 23 months through July 2019), but suffered continuous losses over four years before turning profitable in 2022, with U.S. troops continuing stays even under Biden. Overall, government and profit-driven spending at Trump hotels balances out, resulting in zero net gain.

Cumulative total: $252.7 million (unchanged)

Persian Gulf

Arab monarchs in the Gulf region serve dual roles as heads of state and major American asset buyers, offering unique business opportunities for the Trump family. During Trump’s first term, his son-in-law Jared Kushner supported Saudi Crown Prince Mohammed bin Salman, later securing a $2 billion investment from the Saudi sovereign wealth fund after leaving office.

Kushner’s Affinity Partners subsequently raised capital from the UAE, Qatar, and Taiwanese businessman Terry Gou, managing $4.8 billion in assets. By industry standards, the firm could earn $81 million annually in management fees, totaling $810 million over ten years. Conservatively estimating Kushner takes half to two-thirds of the profits, the present value is approximately $320 million.

Cumulative total: $252.7 million + $320 million = $572.7 million

Licensing and Management Agreements in Saudi Arabia and the Gulf

Trump Organization deals in the Gulf exemplify the “presidential premium.” In November 2022, after becoming the Republican presidential nominee, Trump signed an agreement with Saudi real estate firm Dar Al Arkan to manage a hotel and golf course in Muscat, Oman, including a rare 30-year contract with revenue sharing from villa sales. After re-election, Donald Jr. and Eric signed multiple project agreements with the company in Riyadh, Jeddah, Dubai, and Doha.

Basing estimates on the Dubai golf course model (annual profit over $1 million), Trump’s Gulf-region management income, licensing fees, and hotel management revenues total at least $105.8 million, bringing cumulative gains to $678.5 million.

Cumulative total: $572.7 million + $105.8 million = $678.5 million

Private Jet and Media Settlements

In May 2025, Trump returned from a Gulf visit with a royal Boeing 747-8 aircraft “freely gifted” by Qatar’s emir, stating it would be managed by the Air Force and transferred to his presidential library foundation after leaving office. Priced at $367 million new, its secondhand value is about $150 million. Though security upgrades may exceed $1 billion and likely won’t finish during his term, it remains a “personal favor.”

Additionally, Trump secured settlements from media companies via litigation: ABC News paid $15 million, Meta $22 million, X about $10 million, CBS News $16 million—all directed to his presidential library foundation. Melania also received a $40 million documentary rights fee from Amazon, personally keeping around $28 million. Combined, these amount to $91 million.

Cumulative total: $678.5 million + $150 million + $91 million = $919.5 million

Social Media

In October 2021, Trump announced Truth Social, aiming to rebuild influence after restrictions on mainstream platforms. To accelerate上市, he merged with Digital World Acquisition Corp. via a SPAC, forming Trump Media & Technology Group, taking roughly 60% ownership as the largest shareholder.

Despite limited users (around 400,000 daily active) and ongoing losses (over $400 million last year), its stock became a classic “meme stock,” wildly inflated by retail investors due to the “Trump connection,” briefly reaching a $6 billion market cap. Trump Media’s share price fluctuates purely on investor sentiment toward Trump, detached from any intrinsic value. Any attempt by Trump to cash out would trigger panic selling, crashing the price before he could exit. Forensic accountant Bruce Dubinsky, referencing valuation benchmarks for similar social media firms and considering its revenue (~$1 million per quarter), estimated Trump’s stake at around $25 million.

Notably, Trump leveraged his presidency to drive traffic to the platform, issuing major announcements exclusively via Truth Social, even using it as a policy channel—creating a closed loop of “public office feeding private domain.” Despite unclear profitability, this model of “power endorsement plus capital speculation” delivered measurable paper gains.

Cumulative total: $919.5 million + $25 million = $944.5 million

1789 Capital and the 'Executive Branch' Club

Donald Jr. co-founded the "Executive Branch" club with friend Omid Malek (a Trump donor and Mar-a-Lago member), initially capping membership at 200. Insiders reveal 20 “founding members” paid $500,000 each, others nearly $100,000, generating $28 million. Though seen as a “social vanity project,” after deducting $1,000-per-square-foot renovation costs, $19 million remained. Assuming Donald Jr. receives at least one-fifth of the profits, he earned over $3.8 million before opening. Additionally, Donald Jr. serves as a partner at Malek’s 1789 Capital, which raised $1 billion for high-tech and defense investments and seeks Gulf funding. Over a 10-year cycle, partners can expect at least $200 million in profits. As third-ranking partner, Donald Jr. is projected to receive 10%, or $20 million (present value $16 million), plus a $200,000 salary (present value $1.6 million). Combined earnings: $19.6 million.

Cumulative total: $944.5 million + $19.6 million = $964.1 million

NFT Sales

The Trump family’s crypto ventures began with NFTs (non-fungible tokens). In 2022, Trump launched NFTs featuring his likeness—“superhero,” “motorcyclist,” etc.—sold on Truth Social at $99 each. Financial disclosures show he earned $13.18 million from NFT royalties; Melania earned $1.22 million from her own NFTs, totaling $14.4 million. These NFTs are essentially digital ownership certificates, leveraging the “presidential premium.” Buyers are mostly supporters, transactions nearly cost-free, with profit margins approaching 100%. Crypto skeptic Molly White commented, “Trump’s NFTs directly monetize his image, consistent with his business logic—selling names, not physical goods.”

Cumulative total: $964.1 million + $14.4 million = $978.5 million

Crypto Projects and Stablecoins

In September 2024, Donald Jr. and Eric launched World Liberty Financial, a “decentralized finance” venture branding itself as the “only crypto company inspired by Trump,” featuring a photo of Trump fist-pumping as its “Chief Crypto Advocate.” The company raised funds through token sales, with a shell company controlled by the Trump family receiving 75% of revenues, initially holding 60% equity, later reduced to 40%. Chinese-American crypto tycoon Justin Sun bought $75 million in tokens and joined as advisor, helping raise $550 million, with the Trump family share totaling about $412.5 million. Additionally, the company launched the USD1 stablecoin; a company owned by UAE ruling families used $2 billion in USD1 to acquire Binance shares, generating $243 million for the Trump family. Backed by U.S. Treasuries yielding over 4% annually, this is a low-risk, high-return “power-linked business.”

Cumulative total: $978.5 million + $412.5 million + $243 million = $1.634 billion

American Bitcoin

The Trump brothers partnered with stockbroker Kyle Wool to form American Bitcoin, merging with publicly traded bitcoin miner Hut 8 to obtain 13% equity, currently valued at about $13 million. Eric Trump serves as “Chief Strategist,” claiming at crypto conferences the company will “rewrite industry rules.” Bitcoin mining relies on computational competition, with supply nearing limit (95% mined), yet the Trump family leveraged presidential status to heavily promote bitcoin as “digital gold,” urging “every ordinary American to buy as much as possible.” Industry insiders note the company’s stock is overvalued, with the brothers’ shares worth far more than the equipment—estimated at $13 million.

Cumulative total: $1.634 billion + $13 million = $1.647 billion

Trump Media Enters Cryptocurrency

Trump Media & Technology Group (operator of Truth Social) capitalized on the new administration’s relaxed crypto policies, launching a crypto ETF to sell digital assets to retail investors—the only investment vehicle “linked to the president.” The company also raised $2.3 billion through private stock and bond sales to purchase bitcoin and options. As of Q1 2025, it holds $3.1 billion in liquid assets (including bitcoin). Trump owns about 42%, valued at $1.3 billion. Despite Truth Social’s ongoing losses, the company converted meme stock hype into cash via crypto investments—a “slightly more sophisticated version of selling snake oil,” according to accountant Bruce Dubinsky.

Cumulative total: $1.647 billion + $1.3 billion = $2.947 billion

Launching Meme Coins

Three days before Trump’s second-term inauguration in 2025, he launched the TRUMP token, quickly earning $65 million from sales and transaction fees. More controversially, he announced an exclusive dinner for the top 220 TRUMP holders, with the top 25 receiving White House tours—temporarily boosting the token’s price and generating additional trading fees. Melania also launched her own meme coin, MELANIA. Despite extreme volatility, crypto research firm Chainalysis estimates combined profits from both tokens at around $385 million.

Cumulative total: $2.947 billion + $385 million = $3.332 billion

Conclusion

The Trump family’s commercial gains span from Mar-a-Lago membership fees to cryptocurrency meme coins, covering physical assets, licensing agreements, and financial instruments—the core logic always being the “presidential premium.” The $3.4 billion in cumulative profits not only sets a new record for monetizing power in American political history but also blurs the line between public office and private gain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News