Pantera: BitMine's ETH Alchemy

TechFlow Selected TechFlow Selected

Pantera: BitMine's ETH Alchemy

Through the DAT strategy, BitMine embarks on a path of Ethereum wealth growth.

Authors: Cosmo Jiang, Erik Lowe

Translation: TechFlow

Our investment thesis in Digital Asset Treasuries (DATs) is based on a simple premise:

DATs can increase net asset value per share over time by generating yield and accumulating more token holdings, rather than just holding spot tokens.

Therefore, investing in DATs has the potential to deliver higher return prospects compared to directly holding tokens or investing via exchange-traded funds (ETFs).

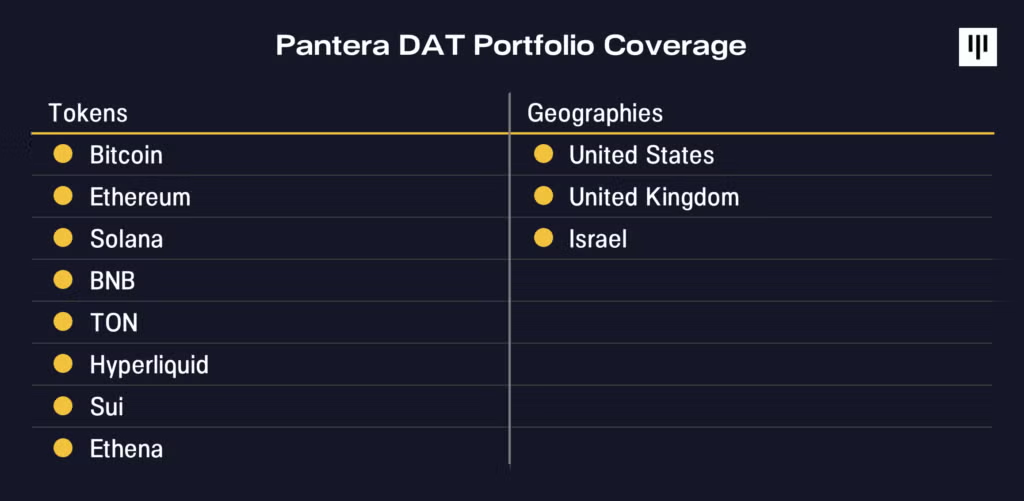

Pantera has deployed over $300 million across digital asset treasuries (DATs) with exposure to different tokens and regions. These DATs leverage their unique advantages to strategically grow their digital asset holdings in a per-share accretive manner. Below is a brief overview of our DAT portfolio exposure.

BitMine Immersion (BMNR) was the first investment made by the Pantera DAT Fund, serving as a model example of a company with clear strategic vision and execution capability. Tom Lee, Chairman of Fundstrat, articulated BitMine’s long-term vision—acquiring 5% of total ETH supply—a goal referred to as the “5% Alchemy.” We believe it is highly instructive to examine how an efficiently operating Digital Asset Treasury (DAT), through BMNR, creates value.

BitMine (BMNR) Case Study

Since launching its treasury strategy, BitMine has become the largest ETH-focused asset manager globally and the third-largest DAT (after Strategy and XXI). As of August 10, 2025, BMNR holds a total of 1,150,263 ETH, valued at $4.9 billion. Additionally, BMNR ranks as the 25th most liquid stock in the U.S., with an average daily trading volume of $2.2 billion (five-day average as of August 8, 2025).

Ethereum Case

The most critical factor for DAT success lies in the long-term investment merit of its underlying token. BitMine's DAT strategy rests on one central thesis: as Wall Street migrates on-chain, Ethereum will become one of the biggest macro trends of the next decade. As we wrote last month, the "Great Onchain Migration" is underway, with tokenization innovation and stablecoins playing increasingly important roles.

Currently, $25 billion in real-world assets already exist on public blockchains—alongside $260 billion in stablecoins, which collectively have become the 17th-largest holder of U.S. Treasuries.

"Stablecoins have become the ChatGPT story of crypto."

– Tom Lee, Chairman of BitMine, Pantera DAT Call, July 2, 2025

Most of this activity occurs on Ethereum, positioning ETH to benefit from growing demand for blockspace. As financial institutions increasingly rely on Ethereum’s security to support their operations, they will be incentivized to participate in Ethereum’s Proof-of-Stake network—further driving demand to accumulate ETH.

Growth in Tokens Per Share (“EPS”)

Once the investment case for the underlying token is established, the core business model of a Digital Asset Treasury (DAT) centers on maximizing growth in tokens per share. Key methods to grow tokens per share include:

-

Issuing equity at a premium to the token’s net asset value per share (“NAV”).

-

Issuing convertible bonds and other equity-linked securities to monetize volatility in both the stock and the underlying token.

-

Earning additional tokens via staking rewards, DeFi yields, and other operational income. Notably, this is an added advantage unique to ETH and other smart contract token treasuries, which early Bitcoin treasuries (like Strategy) lack.

-

Acquiring other digital asset treasuries that trade at or below net asset value (NAV).

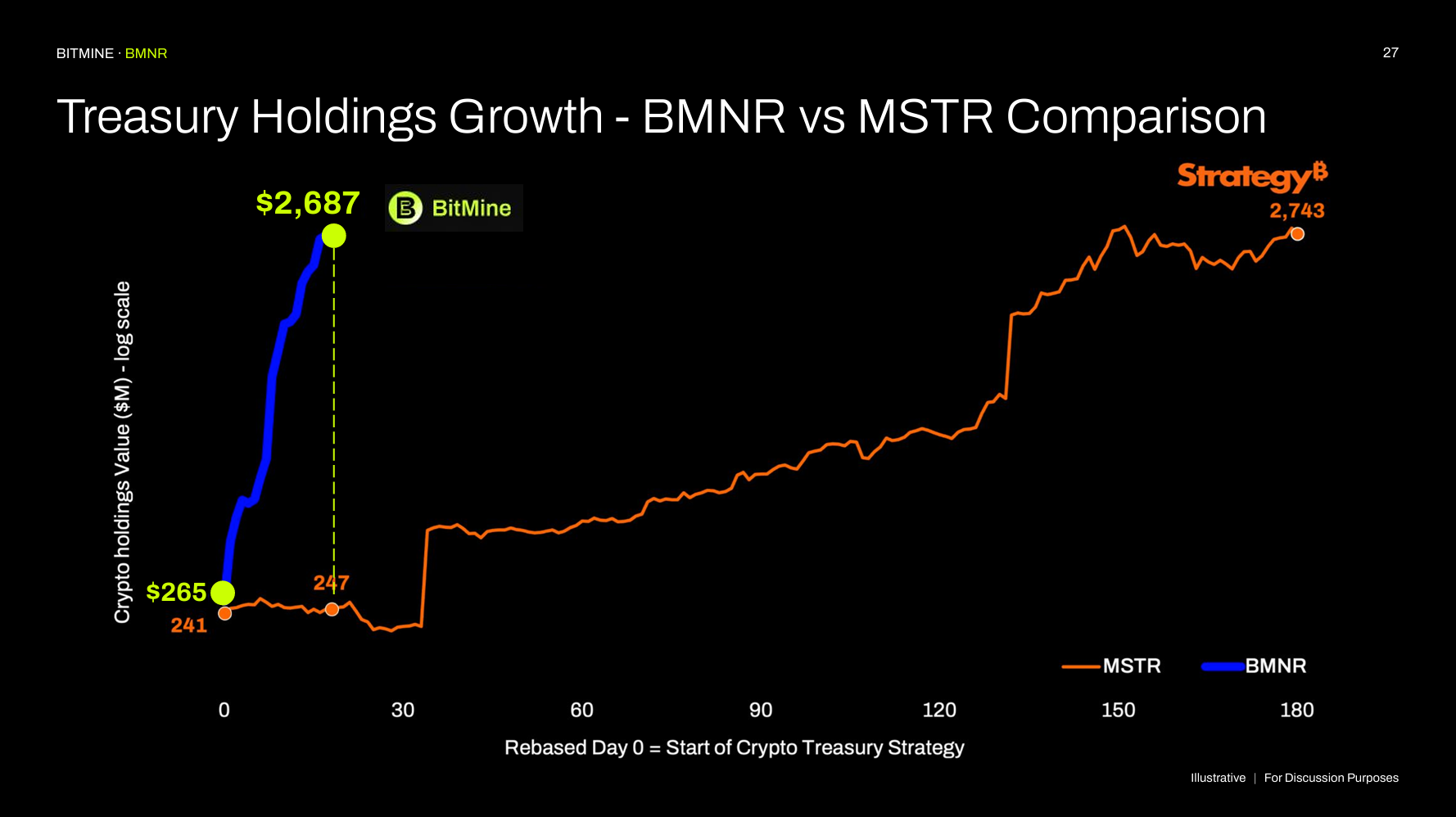

In this regard, BitMine has grown its ETH per share (coincidentally also called “EPS”) at a remarkable pace within the first month of launching its ETH treasury strategy,

TechFlow Note: Earnings Per Share (EPS) refers to net profit attributable to each ordinary share), outpacing all other digital asset treasuries (DATs). By comparison, BitMine accumulated more ETH in its first month than Strategy (formerly MicroStrategy) did during the first six months of executing a similar strategy.

BitMine primarily increases tokens per share through equity issuance and generated staking rewards. We expect BitMine will likely expand its toolkit soon, issuing convertible debt and other financial instruments.

Source: BitMine Corporate Presentation, July 27, 2025

Value Creation Mechanics

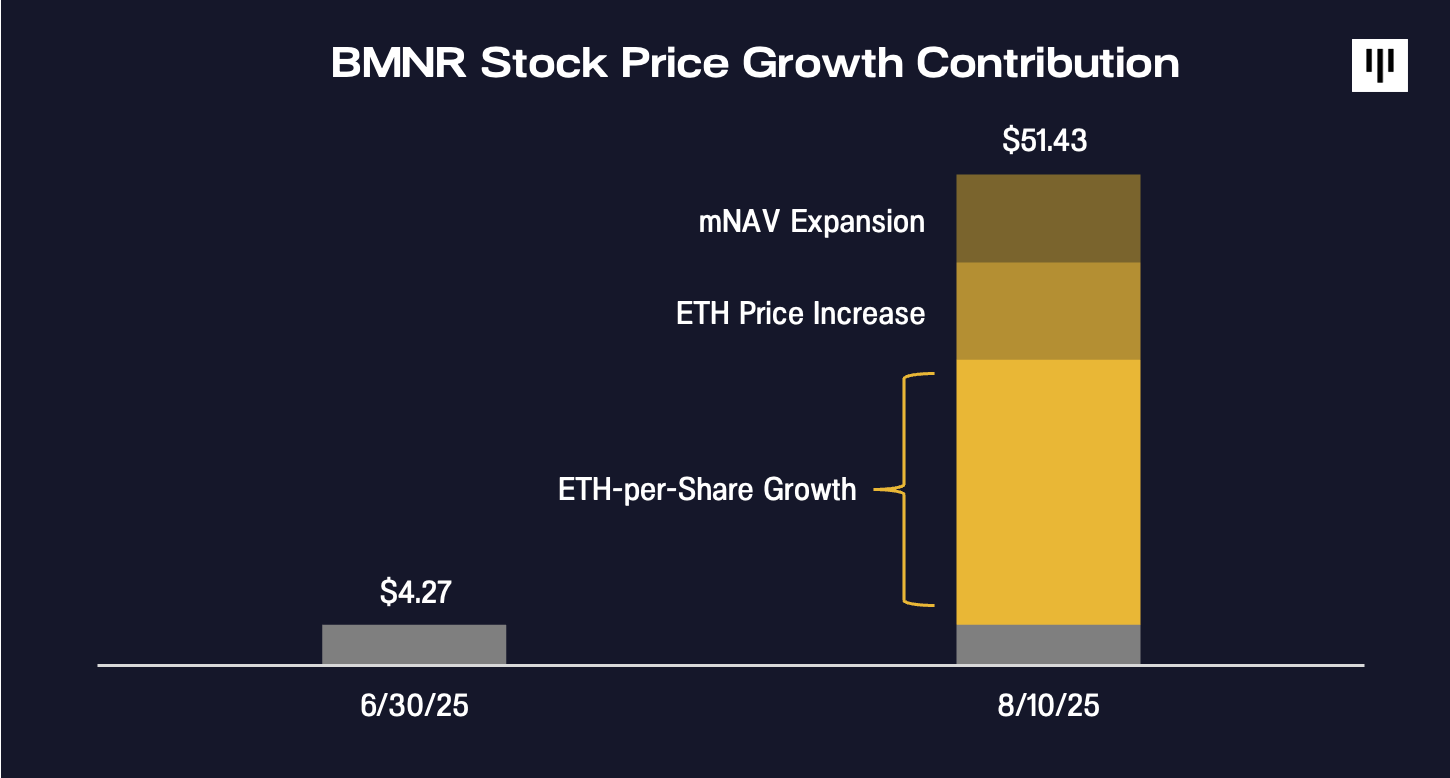

A Digital Asset Treasury’s (DAT) stock price can be decomposed into the product of three components: (a) tokens per share, (b) underlying token price, and (c) net asset value multiple (“mNAV”).

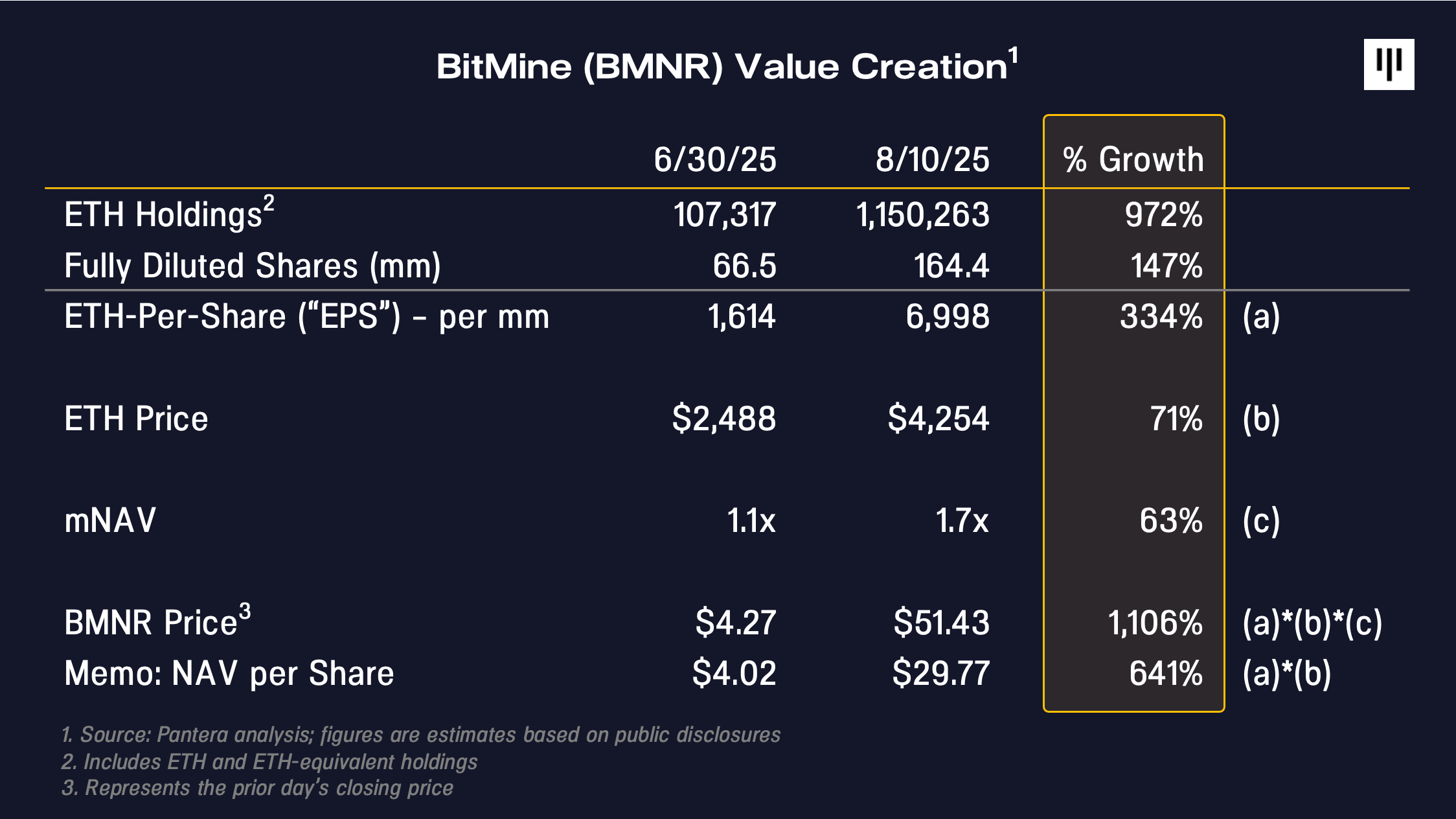

As of the end of June, BMNR’s stock price was $4.27 per share, approximately 1.1x its initial post-DAT fundraising net asset value (NAV) of $4.00 per share. Just over a month later, the stock closed at $51.00, around 1.7x its estimated NAV of $30.00 per share.

This implies a 1,100% increase in stock price over slightly more than a month, driven by: (a) ~330% growth in tokens per share (EPS), contributing approximately 60% of the gain; (b) ETH price rising from $2,500 to $4,300, contributing ~20%; and (c) mNAV expansion to 1.7x, contributing ~20%.

This means the substantial rise in BMNR’s stock price was primarily driven by growth in ETH per share (EPS)—the core lever controlled by management, and what fundamentally distinguishes a DAT from simply holding spot tokens.

The third factor we have not yet discussed is the net asset value multiple (mNAV). Naturally, one might ask: why would anyone pay a premium to a DAT’s net asset value (NAV)?

Here, an analogy can be drawn to balance-sheet-based financial businesses such as banks. Banks generate earnings from assets, and investors grant valuation premiums to those banks consistently producing returns above their cost of capital. For instance, the highest-quality banks typically trade at premiums to net asset value (NAV) or book value—JPMorgan Chase (JPM), for example, trades at over 2x.

Likewise, if investors believe a DAT can sustainably grow net asset value per share (NAV), they may be willing to assign a premium valuation. We believe BMNR’s monthly NAV per share growth of approximately 640% is sufficient to justify its mNAV premium.

Whether BitMine can continue executing its strategy will be proven over time, and challenges along the way are inevitable. Nevertheless, BitMine’s management team and its performance to date have attracted heavyweight supporters from traditional finance, including Stan Druckenmiller, Bill Miller, and ARK Invest. We expect the growth narrative of the highest-quality DATs will, like Strategy, gain increasing favor among institutional investors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News