Can Etherex fire the first shot before Linea's token launch?

TechFlow Selected TechFlow Selected

Can Etherex fire the first shot before Linea's token launch?

ve(3,3) without lock-up? A 5-minute read on Linea's native liquidity hub Nile's upgraded version, Etherex.

Author: KarenZ, Foresight News

As Linea prepares to unveil the tokenomics and governance details of LINEA by the end of this month, its ecosystem DEX Nile is undergoing a major upgrade.

The Linea mainnet has always lacked a transaction layer capable of hosting cross-chain liquidity while returning value to the community. The upgraded version of NILE—Etherex—aims to fill critical gaps in Linea’s ecosystem regarding exit mechanisms, efficient liquidity aggregation, and incentive design.

Etherex adopts a novel x(3,3) model, which is more flexible than ve(3,3), eliminates staking lockups, and ensures protocol value flows to the most active participants through dynamic incentives and exit penalties.

This article will analyze Etherex's core mechanisms, tokenomics, and innovations.

From Nile to Etherex

Etherex is a decentralized exchange launched through collaboration between Linea, ConsenSys, and NILE, officially going live on July 29, 2025. Partners include Astera, Foxy, eFrogs, MYX, MetaMask, Alchemix, Frax, Zerolend, and Turtle.

According to the Etherex team, as early as 2014—before the Ethereum mainnet launched—Ethereum builders like Vitalik Buterin and Joseph Lubin envisioned a decentralized exchange that would offer a truly trustless, secure, and reliable trading platform, enabling users to freely trade on-chain without relying on centralized entities. EtherEX was born from this vision. Although that original idea never materialized, today’s Etherex pays homage to this early ambition while innovating upon it. In Etherex’s view, it is not merely a rebranded DEX but the "ultimate delivery" of the 2014 EtherEX vision.

In practical terms, Etherex is an upgraded version of Nile on Linea. As Linea’s native liquidity hub, Etherex serves three core functions: targeted incentive distribution, hosting liquidity for LINEA tokens, and directing newly minted tokens to trading pools that benefit overall ecosystem health.

What is Etherex?

Etherex’s innovation centers on its unique x(3,3) model—an evolution beyond traditional metaDEX frameworks—that solves long-standing challenges in aligning incentives.

Traditional metaDEX models have proven the viability of large-scale adoption and sustainable yields but rely heavily on artificial constraints like “mandatory staking” to maintain user engagement—requiring users to lock tokens for years to fairly participate, creating a participation model driven by obligation rather than value.

The x(3,3) model flips this logic: instead of mandatory locks, it uses organic incentives to encourage users to stay engaged. The system rewards active contributors and naturally concentrates value among those who contribute the most. Users can participate without locking tokens, and the exit mechanism ensures only those who genuinely believe in the protocol remain, forming a self-selecting, active community.

How Does Etherex Work?

As mentioned, Etherex breaks new ground by shifting from “forced participation” to “voluntary retention and contribution,” with the core goal of providing native deep liquidity for Linea, optimizing incentives, and delivering a seamless user experience.

How Does the Three-Token System Achieve Incentive Alignment?

Before diving into Etherex’s operational mechanics, it’s essential to understand its three-token system.

Etherex employs an innovative three-token framework designed to maintain flexibility while precisely aligning incentives. While full details haven’t been disclosed, the core logic is already clear:

-

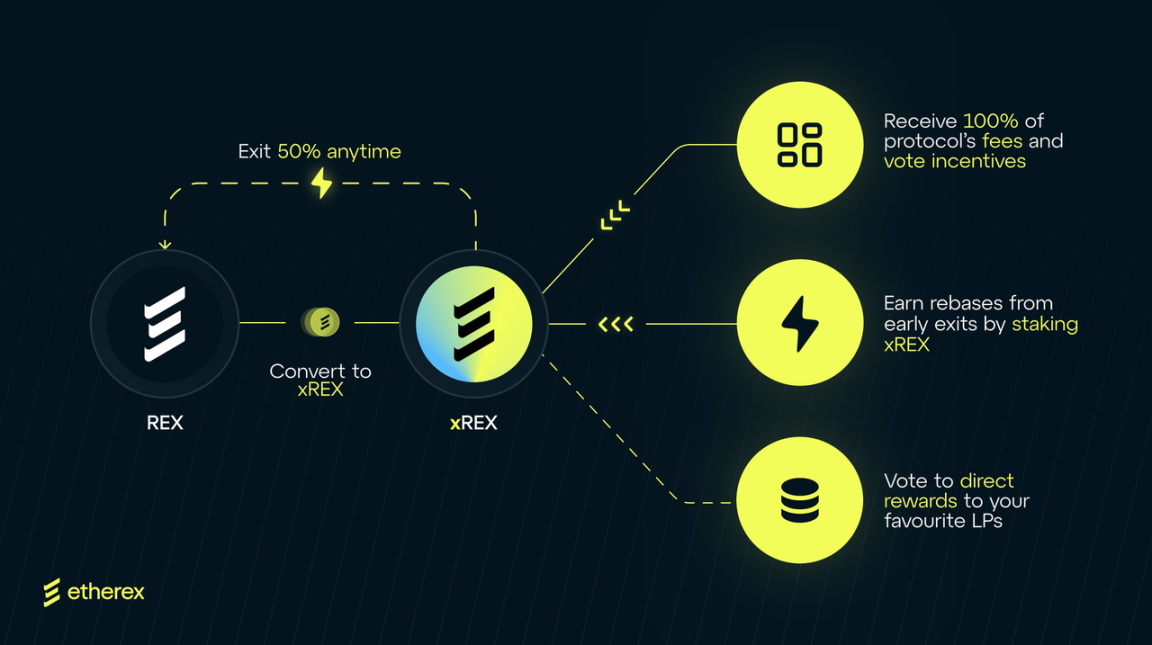

xREX: Governance token. Active stakers of xREX gain voting rights to decide emissions allocation across liquidity pools and receive 100% of trading fees, Exit Rebase rewards, and additional protocol incentives.

-

REX33: Liquid staking derivative of xREX, featuring automatic voting and compounding rewards. It solves the liquidity problem of governance tokens. Initially at a 1:1 ratio with xREX, REX33:xREX increases in favor of REX33 as fees, voting incentives, and Rebase rewards accumulate. Additionally, Etherex implements arbitrage mechanisms to ensure REX33 never trades below the redemption floor price of xREX, offering users a low-friction entry point.

-

REX: Protocol base token, distributed via inflation to liquidity pools. It serves as the primary tool for incentivizing liquidity providers. The emission amount is voted on by xREX holders, ensuring resources flow to the most valuable liquidity pools.

Etherex Operational Mechanics

1. Positive Feedback Loop via Exit Mechanism

Users can exit xREX in two ways: direct redemption (Exit Rebase), which incurs a 50% penalty—the penalized tokens are fully distributed to existing xREX holders—or by trading REX33 (the liquid staking version of xREX) on open markets. This approach addresses token dilution while encouraging long-term engagement, creating a “survival of the fittest” ecosystem.

2. Weekly Epoch: xREX Holders Vote on REX Emissions Allocation

Every Thursday at 08:00 UTC, xREX holders vote on which liquidity pools will receive REX emissions for the following week. Voting weight depends on both xREX holdings and participation levels; pools receiving more votes get higher emissions.

3. Dynamic Fees and Revenue Distribution

Etherex automatically adjusts trading fees (0.05%-5%) based on market volatility and volume, distributing 100% of protocol fees to xREX holders. Trading pairs generate fees, attracting more votes and token emissions, leading to deeper liquidity, higher trading volumes, and increased fees—a positive flywheel effect.

4. Concentrated Liquidity (CL) Optimization

-

Liquidity Providers (LPs) can customize price ranges for liquidity provision, maximizing capital efficiency.

-

Through Competitive Farming, LPs are incentivized to optimize their liquidity ranges, improving trade execution quality.

5. MEV Protection and Value Recycling

An integrated MEV capture module (e.g., REX33 AMO) redistributes arbitrage profits to voters.

Etherex Tokenomics

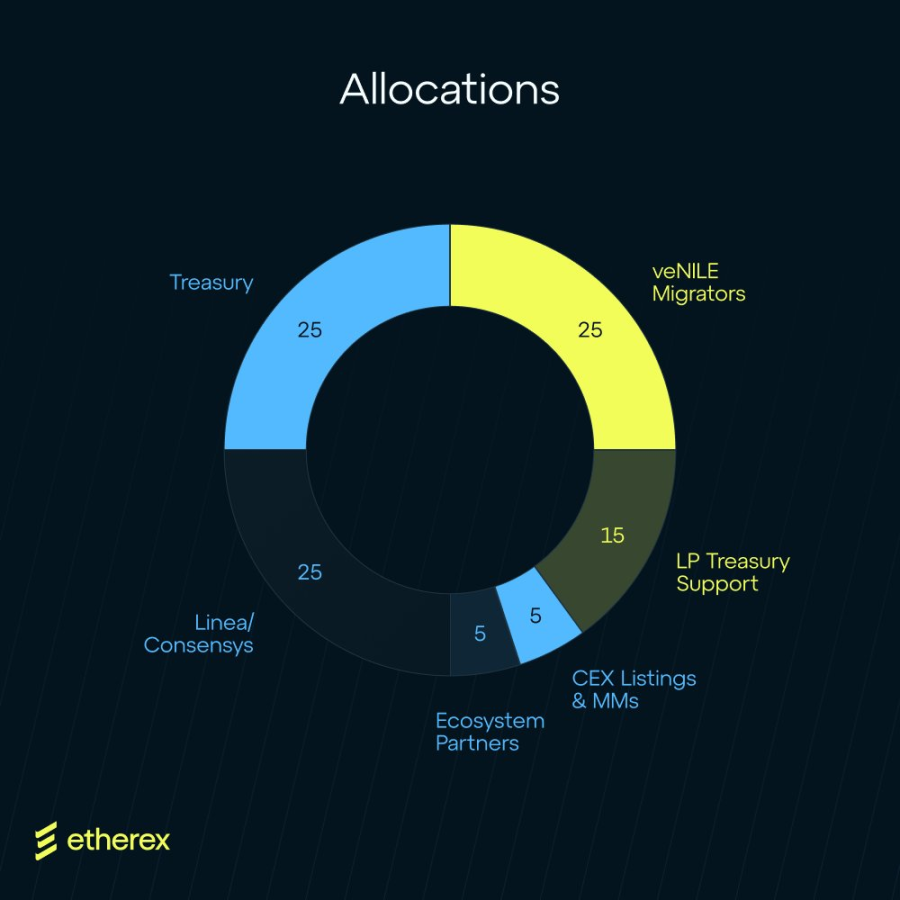

Etherex will launch the REX token on August 6. The initial total supply of REX is 350 million, with a maximum cap of 1 billion tokens. The distribution is as follows:

-

25% allocated to Linea/Consensys (80% as xREX, 20% as REX. Existing veNILE holders can migrate 1:1 to xREX under conditions: minimum 100 veNILE, up to 4-year lockup. Snapshot time: July 26, 11:59 Beijing Time).

-

25% allocated to veNILE migrators (100% as xREX).

-

25% allocated to the protocol treasury.

-

15% for LP treasury support.

-

5% for centralized exchanges and market makers.

-

5% allocated to ecosystem partners.

Except for tokens designated for LP treasury support and CEX listing/market making—which are issued as REX—most allocations take the form of xREX.

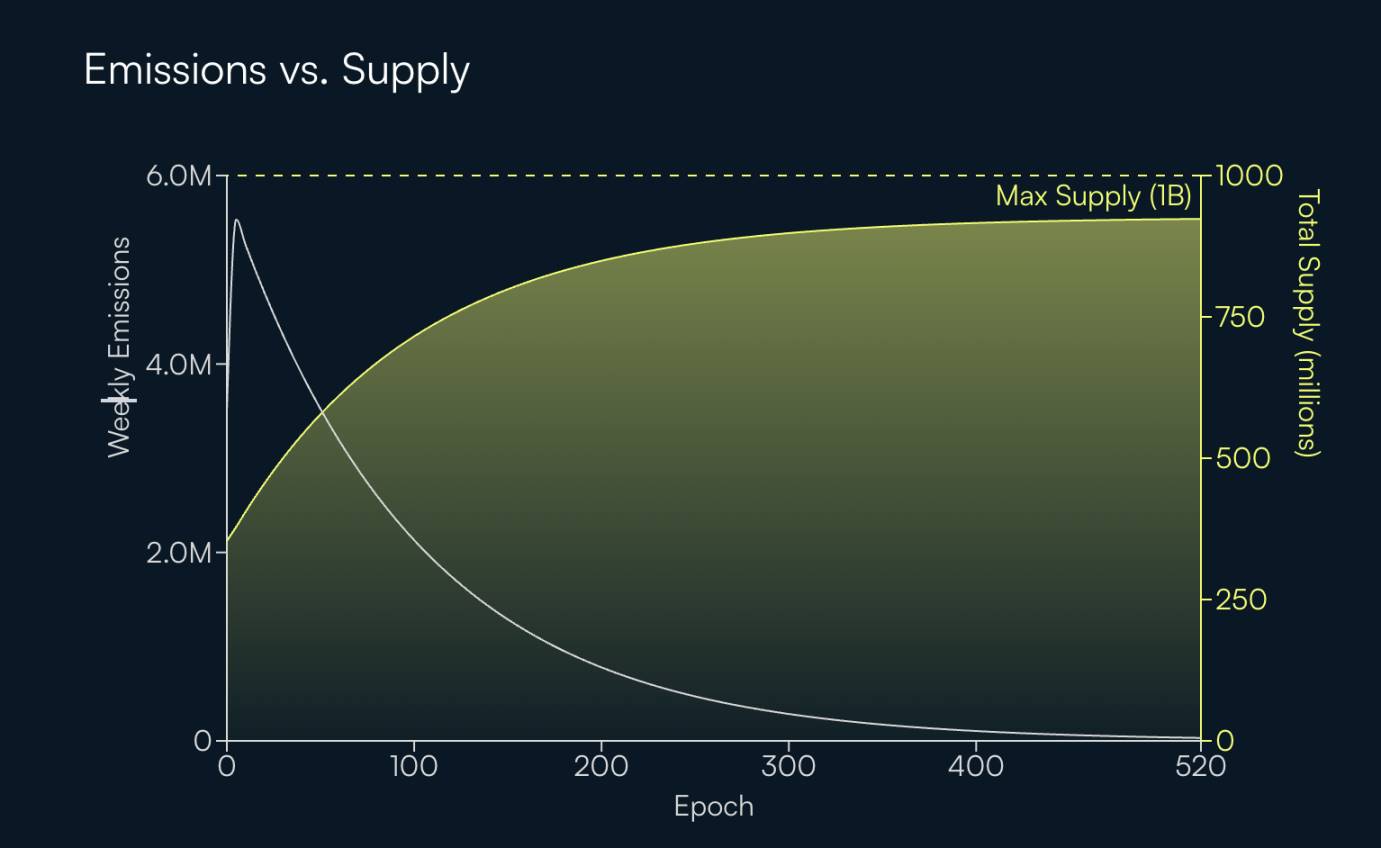

As previously noted, xREX holders vote weekly on REX emissions allocation. Below is an approximation of Etherex’s weekly emissions (white curve) and total supply over the first 500 epochs (approximately 10 years, yellow curve). During Epoch 0, 3.5 million tokens are released. From Epoch 1 to 4, emissions increase by 20% then 10% per epoch. Starting from Epoch 5, emissions decay by 1% each subsequent epoch.

Why Is Etherex a Key Piece of the Linea Ecosystem?

Etherex brings several core values to the Linea ecosystem:

First, its x(3,3) model fundamentally solves the issue of liquidity incentives—shifting from “forced participation” to “value-driven participation”—allowing liquidity to naturally flow to the most efficient areas, while protecting long-term participants’ interests via the Exit Rebase mechanism.

Second, through deep integration with MetaMask and its no-lockup design, Etherex significantly lowers the barrier to entry for users and liquidity providers, injecting broader user adoption into the Linea ecosystem.

Additionally, as Linea’s native liquidity hub, Etherex enables value synergy with the broader Ethereum ecosystem—its incentive design supports not only Linea’s short-term growth but also Ethereum’s long-term vision of becoming a foundational part of the global economy.

It’s also worth noting that SharpLink, an Ethereum treasury company, currently holds over 360,000 ETH, and Joseph Lubin, Ethereum co-founder and CEO of ConsenSys, serves as Chairman of SharpLink Gaming. Community speculation suggests SharpLink may allocate part of its ETH holdings to Etherex.

With its innovative x(3,3) model, well-aligned tokenomics, and seamless user experience, whether Etherex becomes the engine driving explosive growth in the Linea ecosystem remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News