With a ~40% growth in 3 days and TVL surpassing $1.1 billion, how to participate in the Linea ecosystem incentive program?

TechFlow Selected TechFlow Selected

With a ~40% growth in 3 days and TVL surpassing $1.1 billion, how to participate in the Linea ecosystem incentive program?

Linea Suger points campaign goal: Increase TVL to $3 billion.

Author: Xiyu, ChainCatcher

Editor: Marco, ChainCatcher

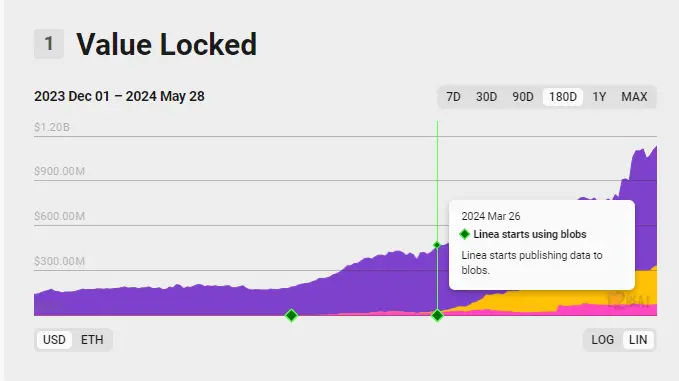

Since the launch of Linea Surge's points incentive program on May 17, TVL on the Linea mainnet has entered a period of rapid growth, increasing from around $700 million to over $1.1 billion within three days—an increase of more than 40%.

According to data from L2beat, as of May 29, TVL on Linea reached $1.13 billion, ranking sixth among all Layer2 networks.

As a zkEVM Layer2 scaling solution developed by Consensys, the parent company of MetaMask, every move by Linea attracts significant attention from the crypto community.

Despite being a flagship project among Layer2 networks, Linea’s on-chain development has remained lukewarm compared to other zkEVM projects such as StarkNet and zkSync—without any breakout applications or well-known native projects. Its TVL had long stagnated around $100 million, with relatively low user engagement.

Recent points incentive campaigns have driven explosive growth in TVL, prompting the community to reassess this Layer2 network.

Two Key Drivers Behind Linea's Growth: Lower Gas Fees and the Surge Incentive Program

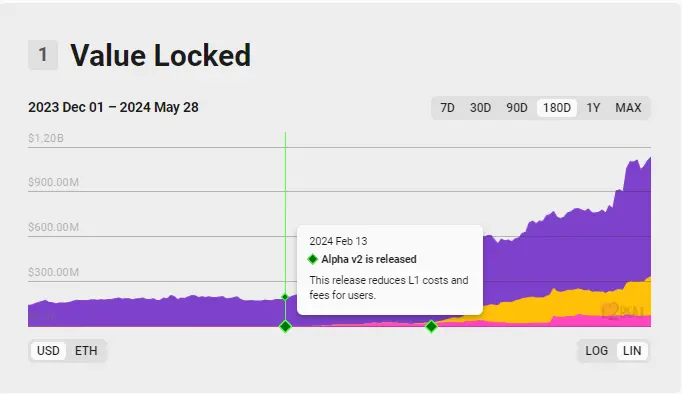

From a data trend perspective, since February this year, TVL on Linea began an upward trajectory, rising steadily from its long-standing level of $180 million to reach $1.13 billion on May 28.

Two major factors are driving Linea’s on-chain data growth: reduced network gas fees and the Surge points incentive campaign.

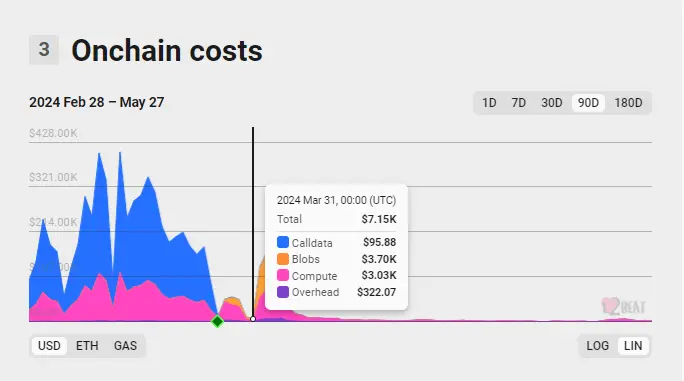

In terms of gas fee optimization, Linea has undergone two notable upgrades.

First, on February 16, Linea launched Alpha v2, which optimized features like data compression, reducing costs for posting data to Ethereum L1 by 90% compared to the original V1 version. This upgrade marked the beginning of Linea’s TVL growth trend.

Then, following Ethereum’s Cancun upgrade in March, Linea adopted EIP-4844 and introduced the new Blob data format on March 26 to further reduce data availability (DA) costs when submitting data to L1, thereby lowering network gas fees again.

According to L2beat, after adopting the Blob format, Linea’s daily cost for posting data to L1 dropped from around $200,000 to just thousands—or even hundreds—of dollars. The average on-chain gas fee fell below $0.02, less than 1/400th of previous levels.

The day after successfully implementing the Blob format (March 28), Linea announced its ecosystem points incentive program, "Linea Voyage: The Surge," scheduled to launch in April. The initiative aims to attract users to provide liquidity to DeFi applications, boost network TVL, and foster ecosystem development. At that time, Linea’s TVL stood at $471 million.

According to official documentation, the primary goal of the Linea Surge campaign is to increase on-chain liquidity (TVL) and activate ecosystem growth. Users can earn points tokens (LXP-L) by providing liquidity to selected DApps.

LXP-L is a new points token derived from the original LXP system (which stopped generating new points on May 12). Like its predecessor, it is a non-transferable soulbound token (SBT) used to track users’ liquidity contributions on Linea.

A Target of $3 Billion in TVL

The Surge incentive program consists of six phases ("Volts"), each lasting one month, with different featured DApps per phase. The program will end once either all six phases are completed or TVL reaches $3 billion—whichever comes first.

Additionally, the total issuance of LXP-L will decrease by 10% each phase. This means earlier participation yields higher point rewards.

On May 17, the first phase of Linea Surge officially launched, featuring mainly DeFi applications such as DEXs, lending protocols, and cross-chain bridges.

Although delayed by nearly a month from the original plan, the Surge program was still widely embraced upon launch. A large influx of capital and users flooded into the Linea ecosystem, triggering a surge in TVL.

Within three days of the first phase launching, Linea’s TVL jumped from an initial $780 million to $1.1 billion, attracting over $300 million in new capital during that short window.

As of May 28, Linea’s TVL had risen to $1.13 billion, securing sixth place in the overall Layer2 market ranking.

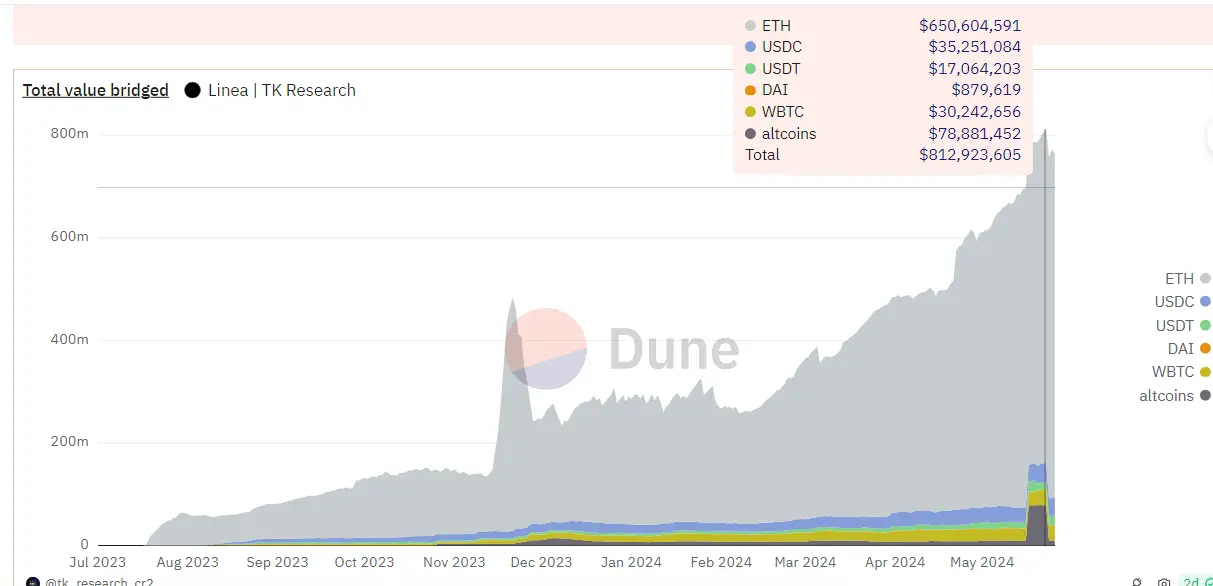

According to Dune analytics, on May 23, the total value bridged to the Linea mainnet surpassed $812 million, setting a new record high.

How Can Projects and Users Participate in the Linea Surge Campaign?

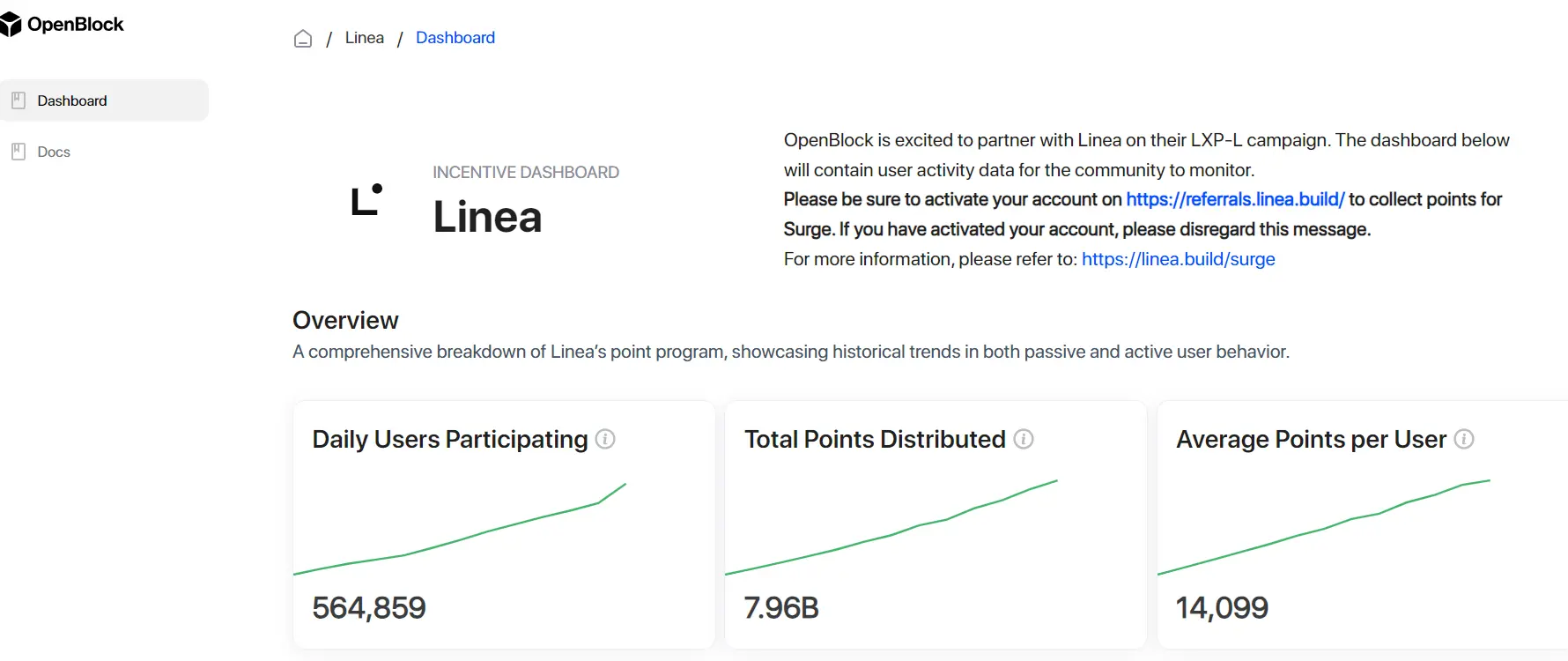

"Participate in Surge and earn LXP-L points" has become a new mission for the Linea community. According to OpenBlock’s data page, as of May 29, more than 565,000 users participated daily on Linea, with over 7.96 billion LXP-L points already distributed—averaging over 14,000 points per user.

For DApp developers, joining the Surge program offers excellent exposure and user growth opportunities, along with support from Linea’s official traffic and resources. Official reports indicate that over 300 DApps are now deployed on Linea.

To qualify for the Surge program, DApps must pass Linea’s review process and meet at least one of the following two criteria:

1. Have operated on another EVM-compatible chain for at least one year with a peak TVL exceeding $50 million;

2. Provide an audit report for their contract version deployed on Linea and implement at least one real-time vulnerability detection solution provided by a Linea partner.

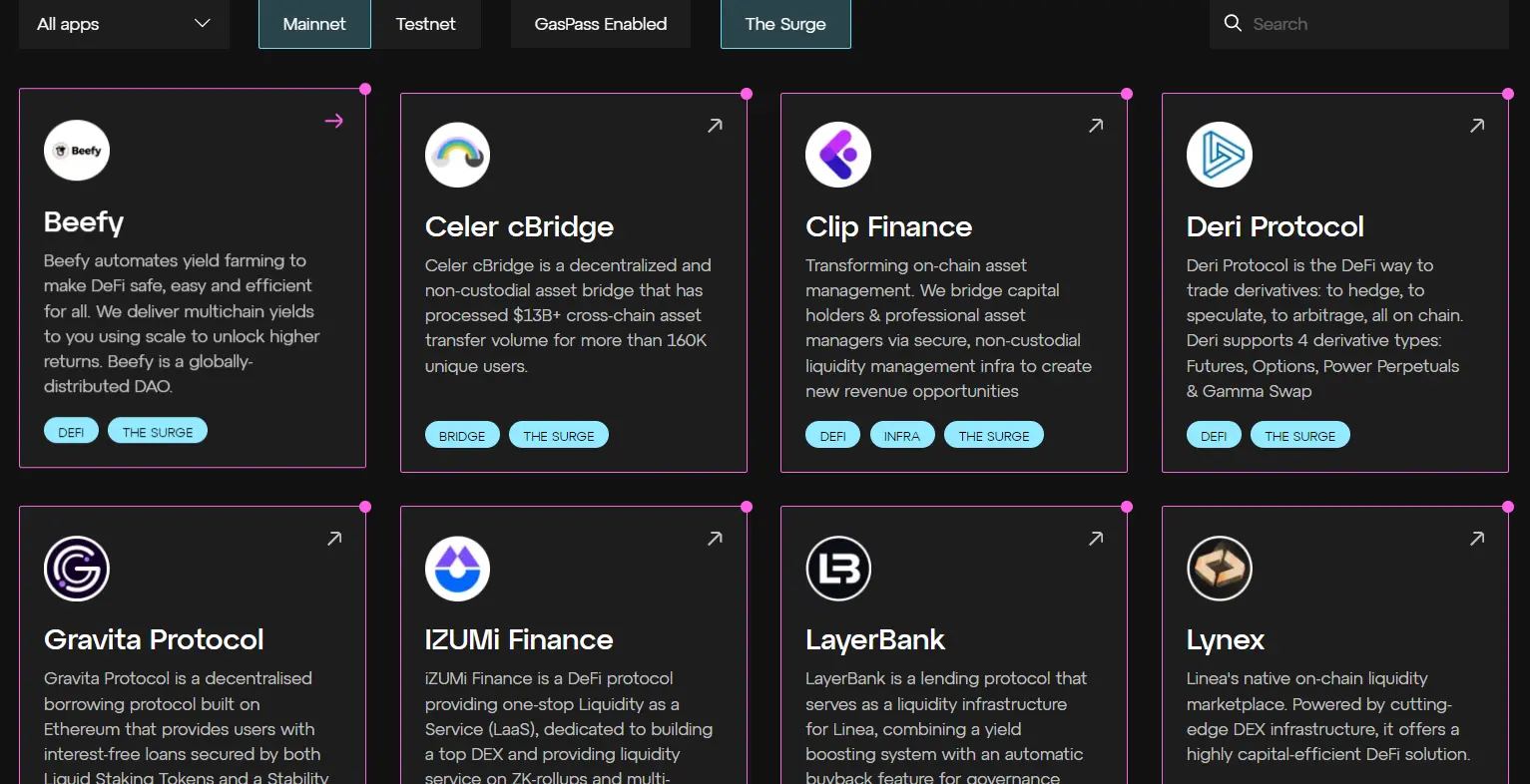

According to the Surge campaign page, 21 DApps are participating in this phase.

The participating products include:

-

Cross-chain interoperability protocols: Connext, Stargate, Celer Network;

-

DEX platforms: PancakeSwap, Sushi, SyncSwap, Velocore, SpartaDEX, iZUMi Swap, NILE, Lyve Finance;

-

DeFi asset management platforms: Teahouse Finance, Overnight;

-

Yield aggregation automation tools: Lynex, Clip Finance;

-

Launchpad platform: Secta;

-

Lending protocols: Mendi Finance, Gravita Protocol, ZeroLend;

-

Decentralized derivatives protocol: Deri Protocol;

-

Restaking protocol: Renzo;

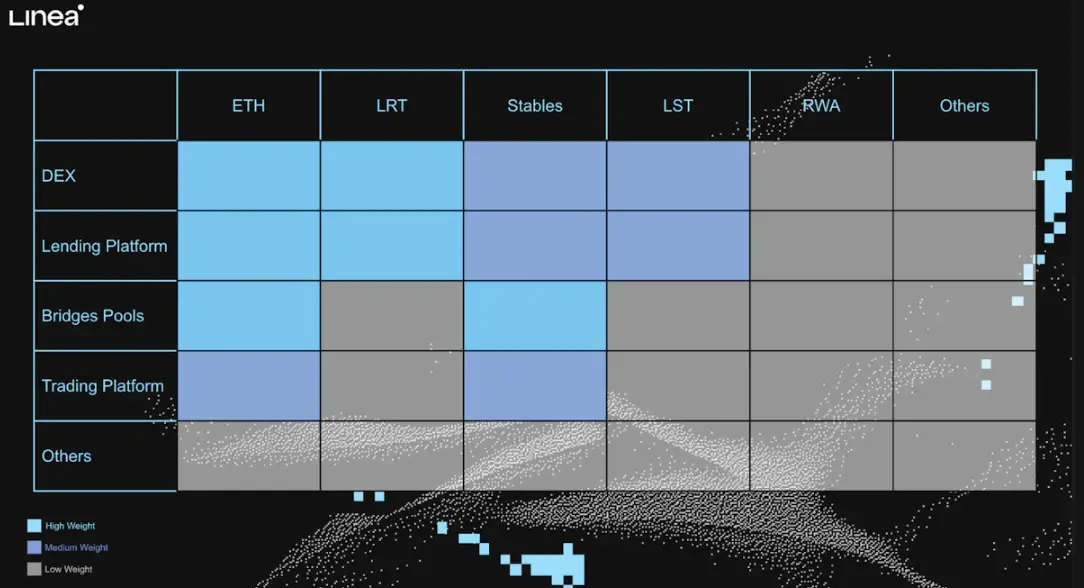

Point reward weights vary depending on application type (e.g., DEX, lending, cross-chain) and asset class, with higher weightings given to ETH and LRT assets on DEXs, lending platforms, and cross-chain bridges.

For users, participation in the Surge campaign requires an invitation. Once invited, users simply need to bridge assets to the Linea network and deposit them into the listed protocols to start earning LXP-L points based on their capital size.

Moreover, early participants who held more than 0.1 ETH on the Linea mainnet before the campaign launched receive bonus LXP-L points.

Currently, users can earn LXP-L points in two ways: (1) Ecosystem Points—by bridging or depositing assets into Linea and interacting with ecosystem DApps to provide liquidity; and (2) Referral Points—by inviting others using a Linea Surge referral code.

Users can monitor participating DApps, asset liquidity, and points issuance via the OpenBlock Linea data dashboard.

Linea Holds Only 2.4% Market Share

Amid expectations of a potential token airdrop, the Surge points campaign has attracted a large number of users and capital seeking short-term gains, leading to a sharp rise in TVL. Many speculate that the Surge campaign could be Linea’s final incentive event before a potential token launch.

Compared to last November’s Linea Voyage (“Great Navigation”) DApp incentive campaign, the current Surge initiative has clearly been more successful in terms of user engagement and TVL growth.

In terms of ecosystem development, despite a series of initiatives launched after opening the mainnet to the public in July last year, results have largely fallen short of expectations.

In August last year, Linea announced the formation of the Linea Ecosystem Investment Alliance (EIA), comprising over 30 venture capital firms—including Amber Group, Animoca Brands, and IOSG Ventures—to support projects building on Linea.

In November, the Linea Voyage LXP points campaign was launched, but failed to generate significant momentum. TVL continued to fluctuate around $180 million until showing improvement this February.

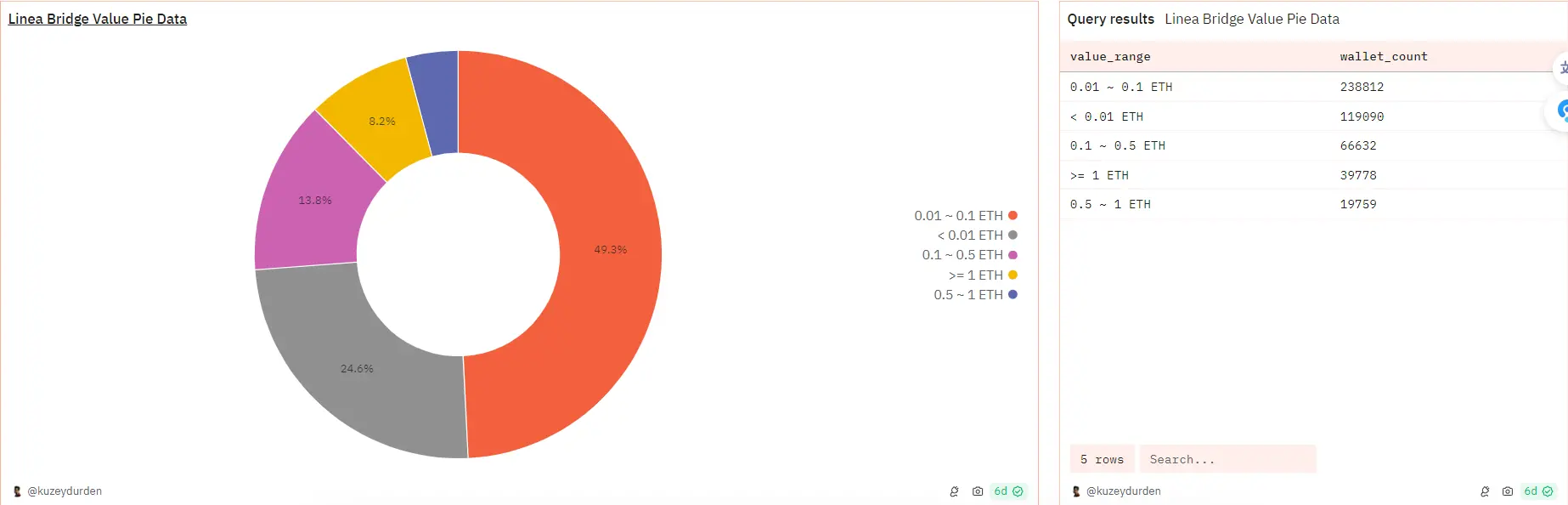

While the Surge campaign has temporarily boosted TVL, most participants are small-capital users. According to Dune data, over 71% of addresses on the Linea mainnet hold less than 0.1 ETH.

Given growing community backlash against what some see as manipulative “points farming” practices, the sustainability of this TVL growth remains uncertain.

According to L2Beat, total TVL across the Layer2 market stands at $45.69 billion, meaning Linea holds only a 2.4% market share.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News