Solana's Prosperity: Real Manipulation or Real Value?

TechFlow Selected TechFlow Selected

Solana's Prosperity: Real Manipulation or Real Value?

Opinion: When manipulation becomes the only driver of price increases, the Solana ecosystem has entered the end of the cycle.

Author: miya

Compiled by: TechFlow

If you've traded on Solana over the past few months, what have you observed?

Here are my observations. Once, tokens like "N*iggabutt" surged from a $1 million market cap to $8 million simply due to a leaked photo of Mike Tyson's buttocks. Today, the market is gradually shifting toward more rational logic, beginning to treat "bundled bullishness" as the only possible way to drive price increases. The speculative wave in the crypto market is undergoing an interesting transformation.

Y22 is a high-frequency on-chain trader primarily active on Solana

Current market phenomena indicate that only two types of tokens achieve value growth: one is "manipulative tokens," including bundled tokens, FNF tokens (TechFlow note: "Friends and Family tokens," early allocations at favorable prices given to friends, family, or close associates of project founders), and tokens deeply controlled by insider trading; the other is "yield-generating tokens," such as HYPE and ENA. This reveals a harsh reality: either the market is dominated by "manipulation," or it reverts to traditional capitalist value assessment.

When "manipulation" becomes a key indicator for judging whether token prices will rise, we can conclude that the current on-chain cycle is coming to an end. On the surface, the "health" of the on-chain ecosystem may appear better than it truly is, but in reality, some participants are using "manipulative behavior" as a tool to artificially inflate certain token prices through market manipulation.

Analysis of Solana's on-chain ecosystem health

This phenomenon is not new—it’s history repeating itself. A classic example is the Sumitomo Copper Affair between 1985 and 1996. In this incident, a single trader, Yasuo Hamanaka, weaponized manipulation by illegally building multi-billion-dollar long positions, attempting to maintain an illusion of market prosperity despite deteriorating actual market health.

In the short term, capitalism resembles a voting machine driven by sentiment and speculation; in the long run, it is a weighing machine that eventually reveals the truth.

The current "Crime Gap" on Solana (TechFlow note: describes the real health of the market being obscured by opaque operations, unethical practices, or manipulative methods) is precisely such a curtain hiding the truth. When you examine insider trading groups, projects' attempts to control over 70% of circulating supply, and traders treating "manipulation" as a competitive advantage, you begin to see the shadows behind the curtain.

However, this manipulative model will inevitably collapse. Just as Sumitomo’s position was liquidated in mid-1996, copper prices rapidly fell back to prior lows. Solana’s "Crime Gap" will similarly unravel, and the market’s true health will ultimately be revealed. History repeatedly proves that the truth of capitalism cannot be hidden forever.

My view on Solana’s "Crime Gap" is that the apparent activity and prosperity are actually a game orchestrated by insiders involving bundled tokens and artificially manipulated liquidity. Here, manipulation is not concealed—it has become a competitive advantage. Yet, just as in Yasuo Hamanaka’s manipulation of the Sumitomo copper market, this gap will inevitably collapse. So how will it break down?

Solana is a self-extracting casino—surviving only with slow, steady inflows of liquidity. The moment $PUMP decided against a large-scale airdrop, the music stopped. What you hear now is merely an echo of something that once set the entire city ablaze. The "Crime Gap" will eventually collapse—and when it does, it will be brutal.

Why? Because we are already at the end of this cycle. Combine worsening macroeconomic conditions with the fragility of an artificially propped-up on-chain economy, and one outcome emerges: massive capital flight.

The liquidity from manipulators in memecoins has only one goal—exit. There is no future cash flow, no utility, no trust. Only insiders taking turns trying to extract value before the lights go out. This is why memecoins are so dangerous in this cycle. When there is broad consensus that an asset is fundamentally worthless, the only remaining consensus becomes selling. This makes the insiders’ sole objective clear: scam as much as possible before the curtain falls.

When the Crime Gap curtain falls, what will prevail? The answer is capitalism.

The idea that crypto will always be like a big casino, and that because of bad experiences with utility coins, memecoins will forever be the highest positive expected value (+EV) bets, is overly naive. As traders, we start believing in any coin that brings green candles. Memecoins naturally create ideal environments for maximizing gains (especially at cycle ends), because you can "manipulate" without breaking SEC rules and face no accountability. I believe this is merely a natural late-cycle state, not a permanently dominant new normal.

We will see the pendulum swing back toward utility tokens again. Internet capital markets aren’t a flawed concept, but I firmly believe they’ve been deployed on the wrong blockchain. While we might break the feedback loop of utility tokens lacking market enthusiasm, we cannot break the feedback loop driven by human addictive behavior. As for Solana’s culture, I think it has, in a way, self-destructed. This is more my opinion than an observation.

Disclaimer: I’m not saying a trader’s responsibility is to short "manipulation." Absolutely not! If you’re going to act, you should go long on it.

Traders should believe that manipulation carried out by others to pump token prices represents a net gain for holding the asset. In this market (especially on-chain), standing in a moral high ground ivory tower is extremely dangerous. You may end up marginalized because you feel a higher moral obligation not to participate in the scam. The real black pill is that not only this industry, but the entire world, is full of fraud.

I see many traders develop this moral complex after learning the truth about market makers, exchanges, the identities of anonymous traders, and information flows. I myself struggled with the same illusion for months. Don’t be the person screaming at the system—embrace it, embrace Jewish tricks, embrace the worst-case scenario, embrace Israel, embrace Trump’s manipulation, embrace Epstein’s suicide, and eventually you’ll understand the market better than ever before.

So if you don’t plan to hedge risk by shorting, what other options exist?

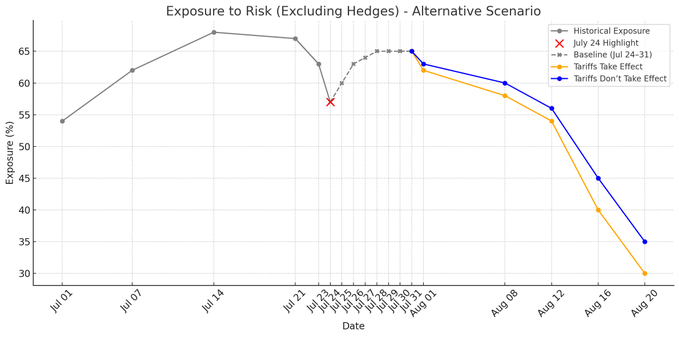

Personally, I’ve decided to significantly reduce risk in August:

Another option is to look at other blockchains, like Base, which has consistently performed well yet receives little attention. Liquidity injections into cryptos like ZORA are absolutely not to be underestimated. Personally, I’ve moved some funds to Base over the past few days and increased my exposure there, rather than investing further into Solana.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News