Huobi Growth Academy | Cryptocurrency Market Macro Research Report: U.S. "Crypto Week" Approaches, ETH Kicks Off Peak of Institutional Arms Race

TechFlow Selected TechFlow Selected

Huobi Growth Academy | Cryptocurrency Market Macro Research Report: U.S. "Crypto Week" Approaches, ETH Kicks Off Peak of Institutional Arms Race

The regulatory breakthroughs during U.S. "Crypto Week" and the capital trends behind Ethereum's bull run are opening an important chapter for the crypto market's move toward maturity.

1. Introduction

This week, the crypto market has witnessed two major catalysts—the legislative push during Washington’s “Crypto Week” and the surge in institutional positioning around Ethereum—jointly forming the "policy inflection point" and "capital inflection point" for the second half of 2025. The underlying logic of this crypto cycle is shifting from Bitcoin to Ethereum, stablecoins, and on-chain financial infrastructure. We believe that U.S. policy clarity combined with Ethereum's institutional expansion marks the industry’s entry into a structurally positive phase, and the focus of market allocation should gradually shift from "price speculation" to capturing institutional dividends from "rules + infrastructure."

2. U.S. “Crypto Week”: Three Key Bills Signal Value Reassessment for Compliant Assets

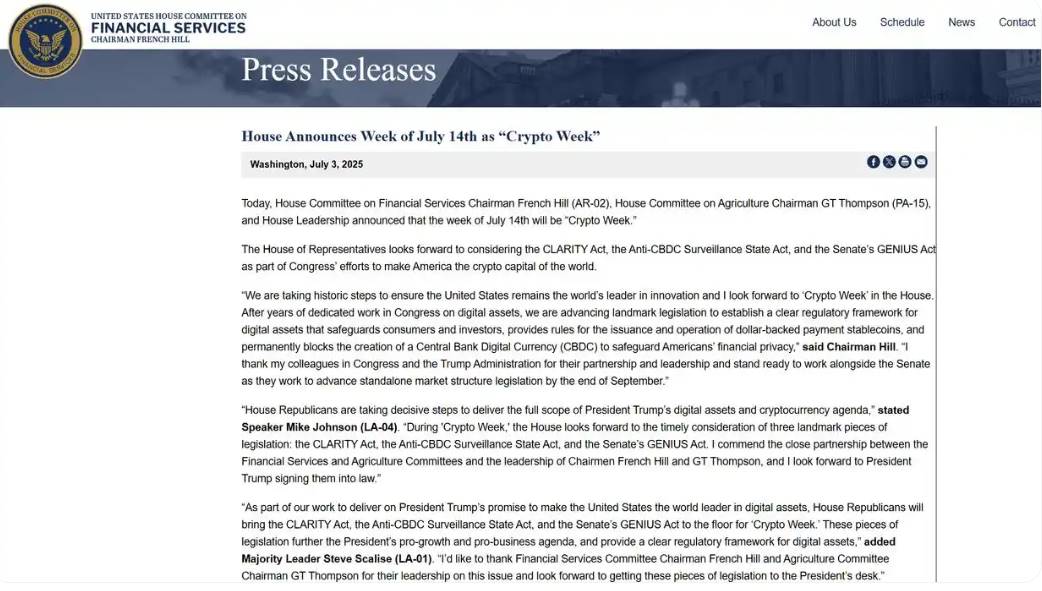

In July 2025, the U.S. Congress officially launched “Crypto Week,” marking the first time in American history that a legislative agenda systematically advances comprehensive governance of crypto assets. Against a backdrop of dramatic shifts in the global digital finance landscape and continuous challenges to traditional regulatory models, the introduction of these bills is not only a response to market risks but also a signal of America’s intent to lead in the next round of financial infrastructure competition.

The most landmark bill is the GENIUS Act, which establishes a complete regulatory framework for stablecoins, covering key elements such as custody requirements, audit disclosures, reserve assets, and liquidation procedures. This means the stablecoin system—long operating outside traditional financial regulation based on “market trust”—will for the first time be incorporated into the U.S. sovereign legal structure. Its high bipartisan support in the Senate (68 votes in favor, 30 opposed) serves as an institutional “reassurance pill” for the entire crypto industry. Once passed by the House and signed by the President, the Act will take effect, making the U.S. the first major economy to establish a unified financial regulatory architecture for stablecoins.

Another critical piece of legislation, the CLARITY Act, focuses on clarifying whether crypto assets are securities or commodities. Its core aim is to define “which crypto assets qualify as securities and which do not,” and to clearly delineate the regulatory boundaries between the SEC and CFTC. In recent years, disputes over whether tokens like ETH and SOL should be classified as securities have driven many companies and projects out of the U.S. market. If this bill passes smoothly, it will end the long-standing uncertainty of the crypto “regulatory gray zone,” providing predictable legal grounds for projects, exchanges, and fund managers, thereby greatly unleashing compliant innovation.

Of greater political symbolism is the Anti-CBDC Surveillance State Act, which prohibits the Federal Reserve from issuing a central bank digital currency (CBDC), preventing the government from using a digital dollar framework to enable real-time surveillance of personal financial activities. Although this bill has not yet passed the Senate, it reflects Congress’s emphasis on financial privacy and market freedom. It also sends another message: the U.S. does not intend to dominate digital financial transformation through state monopoly, but instead supports a market-driven, technology-neutral, and open interconnected crypto ecosystem.

Collectively, these three bills point toward “rule-based innovation,” emphasizing “clear boundaries and reduced uncertainty.” Their core objective is no longer “restriction” but “guidance.” Once implemented, several direct consequences are expected: First, barriers preventing institutional investors from large-scale participation due to compliance concerns will gradually fall, allowing pension funds, sovereign wealth funds, and insurers to legally deploy crypto positions. Second, stablecoins’ role as “on-chain dollars” will be officially recognized, exponentially increasing their efficiency in cross-border settlements, decentralized finance, and RWA applications. Third, compliant exchanges and custodial banks will gain policy endorsement, reshaping the global crypto market’s trust structure.

At a deeper level, this legislative wave represents a strategic response by the U.S. to the reconfiguration of the global financial order. Just as the dollar became the world’s settlement currency after WWII through the Bretton Woods system, stablecoins are now becoming vehicles for the digital extension of dollar influence. By granting them institutional legitimacy via regulation, the U.S. Congress is engaging in a geopolitical power play—one directly responding to China’s central bank digital currency (e-CNY) and the EU’s MiCA regulatory framework. The nation that completes its regulatory system first will set standards and wield influence in the future global financial network.

Therefore, “Crypto Week” is not merely a moment for market reassessment of crypto valuations, but a policy-driven institutional confirmation of technological trends. This institutional pricing signal will inject more stable expectations into the market and provide investors with a path to identify “regulatable, sustainable” assets. We believe this regulatory certainty will gradually translate into valuation certainty, with compliant assets—especially stablecoins, ETH, and their surrounding infrastructure—becoming primary beneficiaries of the next structural revaluation.

3. Ethereum Institutional Arms Race: ETF Entry, Staking Transformation, and Asset Structure Upgrade Proceeding on Three Fronts

Recently, as ETH prices rebound strongly and market confidence recovers, a new “capital arms race” around Ethereum has quietly begun. From Wall Street giants steadily accumulating via ETFs to growing numbers of public companies adding ETH to their balance sheets, Ethereum is undergoing a deep restructuring of its market composition. This signifies not only a new stage of traditional capital recognition for ETH, but also marks Ethereum’s accelerated evolution from a highly volatile, technically complex decentralized asset into a mainstream financial asset suitable for institutional portfolios.

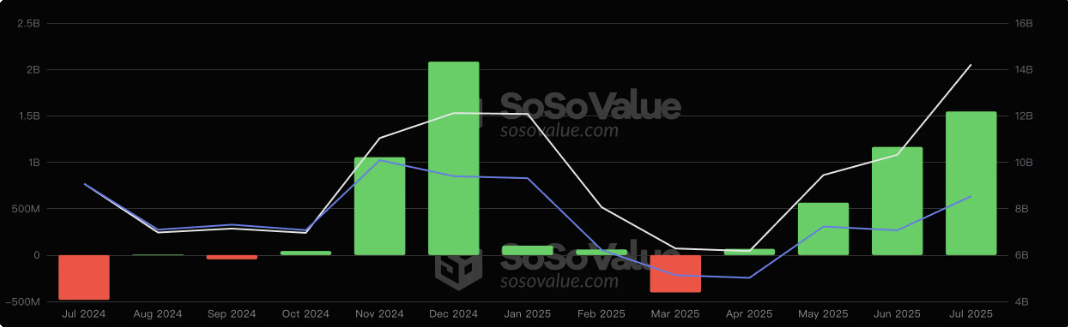

Ethereum spot ETFs, officially launched in July 2024, were initially seen as a major catalyst for price breakthroughs. However, early performance disappointed the market. A combination of negative factors—including declining ETH/BTC ratio, weak prices, and continuous selling by foundations—prevented ETH from gaining upward momentum post-launch, leading instead to a deep correction. Especially when contrasted with the overwhelming success of Bitcoin ETFs, ETH appeared particularly lackluster.

However, by mid-2025, this situation began to quietly reverse. Chain data and ETF inflows show that institutional accumulation of ETH is progressing quietly but firmly. According to SoSoValue statistics, since launch, Ethereum spot ETFs have attracted a cumulative net inflow of $57.6 billion, nearly 4% of its market cap. Despite price fluctuations, capital inflows have remained consistently stable, reflecting long-term institutional recognition of ETH’s portfolio value. This trend has accelerated in the past two months, with multiple Ethereum ETF products recording over $1 billion in monthly net inflows, and traditional players like Bitwise, ARK, and BlackRock clearly increasing their holdings.

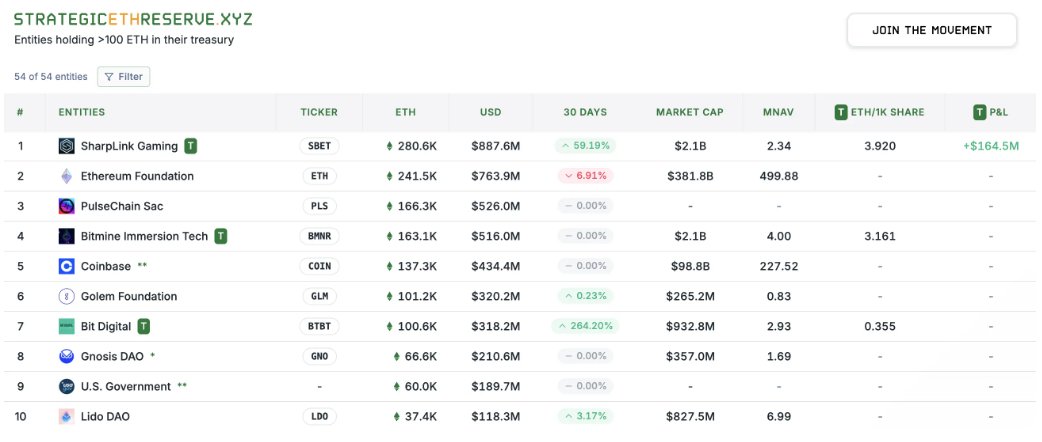

Meanwhile, an even more symbolic change is the rising wave of public companies “strategically reserving Ethereum.” Firms including SharpLink Gaming, Siebert Financial, Bit Digital, and BitMine have successively announced ETH inclusion on their balance sheets, marking a narrative turning point where ETH transitions from a “speculative asset” to a “strategic reserve asset.” Notably, SharpLink now holds over 280,000 ETH—more than the Ethereum Foundation’s current 242,500—making it the largest single institutional holder of ETH globally. This fact, to some extent, has already symbolically shifted “narrative control” in the capital markets.

Currently, institutional participants can be clearly divided into two camps: one is the “Ethereum-native camp” represented by SharpLink, backed by early Ethereum ecosystem players like ConsenSys and Electric Capital; the other is the “Wall Street approach” exemplified by BitMine, replicating the Bitcoin reserve logic and leveraging debt, financial engineering, and financial reporting to amplify capital effects. This dual-pronged institutional accumulation model is moving ETH’s value anchor and price support system away from retail-driven speculation toward an institutionalized, long-term, and structured mainstream capital framework.

The profound impact of this trend extends beyond price—it may reshape governance rights, narrative control, and ecosystem leadership within Ethereum itself. If firms like SharpLink or BitMine continue expanding their ETH holdings, their potential influence over Ethereum’s development direction will become significant. While most of these companies still face financial pressures and hold ETH primarily for speculative hedging and capital maneuvers rather than deep commitment to ecosystem building, their participation has already created amplification effects in capital markets: ETH is being revalued, narratives are shifting, and the space is evolving from crowded DeFi and L2 themes toward a new domain of “reserve asset + ETF + governance rights.”

Notably, unlike Bitcoin’s reserve story, which has Michael Saylor (MicroStrategy CEO) as a “spiritual leader” reinforcing conviction and advocating accumulation, Ethereum currently lacks such a figure who combines ideological credibility with traditional capital influence. While figures like Tom Lee have sparked market speculation, they have not yet achieved sufficient narrative penetration. The absence of such a champion has somewhat slowed ETH’s trust-building trajectory among institutional investors.

That said, Ethereum is not without institutional-level responses. Vitalik Buterin and the Ethereum Foundation have recently spoken frequently, emphasizing Ethereum’s technical resilience, security mechanisms, and decentralization principles, while strengthening a “dual-track” governance architecture designed to embrace institutional capital without allowing any single force to dominate governance. In a recent public article, Vitalik argued that user interests, developer leadership, and institutional compliance must be balanced, and that decentralization must be “operational,” not just a slogan.

In summary, ETH is undergoing a comprehensive capital structure transformation—from a retail-dominated open market to an institutionalized market driven jointly by ETFs, public companies, and institutional nodes. This shift will have far-reaching implications, shaping not only the future trajectory of ETH’s price center but potentially redefining the governance and development pace of the Ethereum ecosystem. In this arms race, ETH is no longer merely a technical stack—it is becoming a pivotal asset in the wave of digital capitalism, serving both as a value carrier and a focal point of power struggle.

4. Market Strategy: BTC Builds High-Level Base, ETH and Mid-to-High Quality Application Chains Enter Catch-Up Phase

As Bitcoin successfully breaks above $120,000 and gradually enters a consolidation phase, the structural rotation pattern in the crypto market becomes increasingly clear. With BTC dominating the narrative, Ethereum and high-quality application chain assets are now entering their own valuation recovery period. From capital flows to market performance, the current market exhibits a classic pattern of “large-cap stability + mid-cap rotation,” with ETH and a group of L1/L2 protocols combining strong narratives and technical fundamentals emerging as the most compelling investment directions following Bitcoin.

1. BTC Enters High-Level Consolidation: Supported Below, Momentum Weakens Above

As the primary driver of this market cycle, Bitcoin has largely completed its main bullish phase fueled by three narratives: spot ETFs, the halving cycle, and institutional reserves. Current price action has entered a sideways consolidation phase. While still within a technical uptrend, short-term upward momentum is waning. On-chain data shows declines in BTC active addresses and transaction volume, while derivatives markets reflect falling options-implied volatility, indicating diminished expectations for near-term breakout.

At the same time, traditional institutional appetite remains intact. According to the latest CoinShares report, BTC ETFs continue to see modest net inflows, suggesting ongoing foundational support. However, as expectations have been largely priced in, further BTC gains are likely to proceed slowly or enter a prolonged consolidation. For institutions, Bitcoin has transitioned into a “core holding” rather than a vehicle for chasing short-term profits.

This implies that market attention is gradually shifting from Bitcoin to other growth-oriented crypto assets.

2. ETH Catch-Up Narrative Forms: Revaluation from “Lost Leader” to “Undervalued Opportunity”

Compared to Bitcoin, Ethereum’s performance since late 2024 was once seen as disappointing, with sharp price corrections and its BTC ratio hitting a three-year low. Yet precisely during this downturn, ETH underwent valuation repricing and ownership structure optimization. Currently, institutional recognition of ETH is rising rapidly—not only are spot ETFs seeing sustained net inflows, but the trend of public companies reserving ETH has taken root, even resulting in corporate holdings surpassing those of the Ethereum Foundation.

Technically, ETH has broken above its previous downtrend line and begun forming an uptrend, reclaiming multiple key moving averages. Combined with capital flow and sentiment indicators, ETH has entered a new phase of market sentiment transition. During BTC consolidation, ETH’s relative attractiveness as a secondary blue-chip asset is rising. Augmented by L2 ecosystem expansion, stable staking yields, and improved security, the market is re-evaluating its long-term value foundation.

From a portfolio perspective, ETH now not only offers “undervaluation” appeal but is also gaining institutional acceptance and narrative completeness comparable to BTC, combining both technical and institutional advantages, making it the top choice for catch-up plays amid capital rotation.

3. Rise of Mid-to-High Quality Application Chains: Solana, TON, Tanssi, and Others Seize Structural Opportunities

Beyond BTC and ETH, the market is accelerating its shift toward mid-to-high quality application chains with genuine narrative support. Chains such as Solana, TON, Tanssi, and Sui—possessing multiple strengths including “high performance, strong ecosystems, and clear positioning”—are attracting concentrated capital inflows during this rebound.

Solana, for example, is witnessing a significant revival in ecosystem activity, with multiple dApps regaining user traction and emerging narratives like DePIN, AI, and SocialFi gaining momentum within its ecosystem. Tanssi, an emerging infrastructure protocol in the Polkadot ecosystem, is solving long-standing issues such as “complex appchain deployment, high operating costs, and fragmented infrastructure” through its ContainerChain model. It is now gaining broad attention from institutions and developers alike, and its listing partnerships with platforms like Huobi HTX indicate accelerated commercialization.

Additionally, as Ethereum moves toward a more modular and data-availability-optimized roadmap, intermediate-layer protocols (such as EigenLayer, Celestia) and L2 rollup solutions (like Base, ZkSync) are gradually unlocking value, becoming important “valuation anchors” between base layers and application layers. These protocols combine scalability, security, and innovation, emerging as new frontiers for capital concentration.

4. Market Strategy Outlook: Focus on “Value Rotation” and “Narrative Pre-positioning”

Overall, the capital rotation logic in this crypto market cycle is becoming clear: BTC peaks → ETH catches up → application chains rotate. The current strategy should focus on the following:

(1) Maintain BTC core holdings, but avoid aggressive increases: Hold core positions steady, but refrain from chasing higher prices; monitor potential policy or macro disruptions.

(2) Position ETH as the core rotation asset: Technical recovery plus strengthening institutional narratives make ETH suitable for medium-term allocation. Further upside is possible if ETF inflows accelerate.

(3) Focus on mid-to-high quality public chains and modular protocols: Chains with technological innovation, strong ecosystems, and institutional backing (e.g., SOL, TON, Tanssi, Base, Celestia) have sustained upward potential.

Move early, proactively seek emerging opportunities: Monitor early-stage assets in DePIN, RWA, AI chains, and ZK directions. These narratives are currently in the capital pre-positioning phase and may become the next rotation drivers.

In conclusion, the market has transitioned from a single-asset-driven phase to a structural rotation phase. With BTC’s primary bull run pausing, ETH and high-quality new public chains will become key engines for the second half of the cycle. Strategically, investors should abandon the惯性 of “chasing leading assets” and shift toward medium-term positioning based on “valuation rebalancing + narrative diffusion.”

5. Conclusion: Regulatory Clarity + ETH Bull Run, Market Enters Institutional Cycle

With the advancement of three key bills during the U.S. “Crypto Week,” the industry has entered an unprecedented era of policy clarity. This regulatory clarity not only eliminates years of unresolved compliance uncertainty but also lays a solid foundation for the institutionalization and formalization of crypto markets. As strategic accumulation races around core assets like Ethereum accelerate, the market is gradually entering a new cycle dominated by institutional frameworks.

In the past, much of the volatility and uncertainty in crypto markets stemmed from regulatory ambiguity and policy instability. Crises such as the FTX collapse and the Luna incident exposed deep risks from regulatory gaps and left lasting shadows in investor minds. Now, with regulations like the GENIUS Act, the CLARITY Act, and the anti-CBDC bill taking shape, market expectations for compliance are rising significantly. The entry barrier for institutional capital is steadily lowering, and asset trustworthiness and liquidity are greatly enhanced. This helps reduce systemic risk and builds a “bridge” connecting crypto assets with traditional financial markets, legitimizing and standardizing market participants' identities and behaviors.

Under this institutional catalyst, Ethereum—as the leading smart contract platform—is approaching a critical window for its main bull run. With a clear technology roadmap, vibrant ecosystem innovation, and continuously improving security and decentralized governance, Ethereum has become one of the preferred digital assets for institutions. The combined forces of strategic reserve trends and ETF inflows signify that Ethereum’s value is beginning to be re-evaluated by capital markets. Going forward, Ethereum is poised for long-term, healthy value growth driven by both on-chain application expansion and capital support.

More broadly, the synergistic effect of regulatory clarity and the resurgence of mainstream asset values is helping the crypto market gradually escape the previous “boom-bust trap,” evolving toward a more stable and sustainable institutional cycle. A defining feature of this institutional cycle is that market movements are increasingly guided by fundamentals and policy expectations, rather than chaotic sentiment and regulatory rumors. Price fluctuations reflect a virtuous cycle of capital and technology interaction and steady growth. Deep institutional involvement will also improve market liquidity structures, shifting investment strategies from short-term speculation to medium- and long-term value investing.

Furthermore, the dawn of the institutional cycle implies diversified market structures and multi-dimensional ecosystem upgrades. Technological innovation and governance reforms within the Ethereum ecosystem will drive greater diversity in on-chain applications and enhance network utility, while regulatory clarity will accelerate the compliant development of more high-quality projects, fostering deep integration between on-chain finance and traditional finance. This development model will reshape crypto investment logic, ushering in a new normal characterized by “technology-driven, capital-rational, and regulation-supported” dynamics.

Of course, an institutional cycle does not mean volatility disappears, but rather that volatility becomes more endogenous and predictable. Investors must pay closer attention to fundamentals and ongoing policy developments. Meanwhile, the interplay between market governance mechanisms and the balance of decentralized versus centralized forces will remain a key variable driving ecosystem evolution.

In sum, the regulatory breakthroughs of U.S. “Crypto Week” and the capital momentum behind Ethereum’s bull run are opening a pivotal chapter in the maturation of crypto markets. The market is transitioning from disorderly “wild growth” to institutionalized, standardized “rational development.” This not only enhances the investment value of assets but also drives overall ecosystem upgrades, shaping the core foundation of the future digital economy. Investors should seize the institutional dividend and growth opportunities of core assets, actively position in Ethereum and high-quality application chains, and embrace a healthier, more sustainable new era of crypto.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News