HashKey OTC Global Deep Dive: The Simpler, the Harder to Replicate Crypto Super Hub

TechFlow Selected TechFlow Selected

HashKey OTC Global Deep Dive: The Simpler, the Harder to Replicate Crypto Super Hub

Institutional-grade deposits and withdrawals are essentially not a simple exchange or transfer of funds and crypto assets, but rather a complex operational capability involving cross-chain, cross-border, and cross-financial-system processes.

The on/off ramp business in the crypto industry has always appeared unremarkable but is actually a critically important gateway service. More importantly, because it connects fiat currencies and digital assets, it faces extremely complex and stringent compliance requirements. Any compliance lapse along the entire process can result in frozen accounts at best and legal violations at worst.

From a business model perspective, it may seem like a low-barrier business purely focused on exchange and fee collection. However, considering future compliance trends, it is actually a highly demanding, mission-critical infrastructure with enormous scalability potential.

1. Why is the on/off ramp business so critical?

First, every fiat onboarding journey begins with selecting an on/off ramp channel. This is especially crucial for large institutions and high-net-worth individuals who, due to privacy, confidentiality, and other related needs, require compliant channels to securely enter the crypto world with substantial capital. Second, cross-border fiat transactions and large-scale settlements demand exceptionally high compliance and auditing standards. If trust is compromised at the entry point, the entire ecosystem of crypto-related operations will face certain limitations.

In fact, from a liquidity standpoint, on/off ramps are not merely about buying and selling—they serve as key hubs for aggregating off-chain funds and distributing on-chain asset liquidity.

For any institution operating in this space, the challenges extend far beyond simple trading; they encompass comprehensive control over cross-border clearing, banking channels, regulatory compliance, and on-chain risks.

2. Institutional OTC on/off ramps appear simple—where lies the underlying complexity?

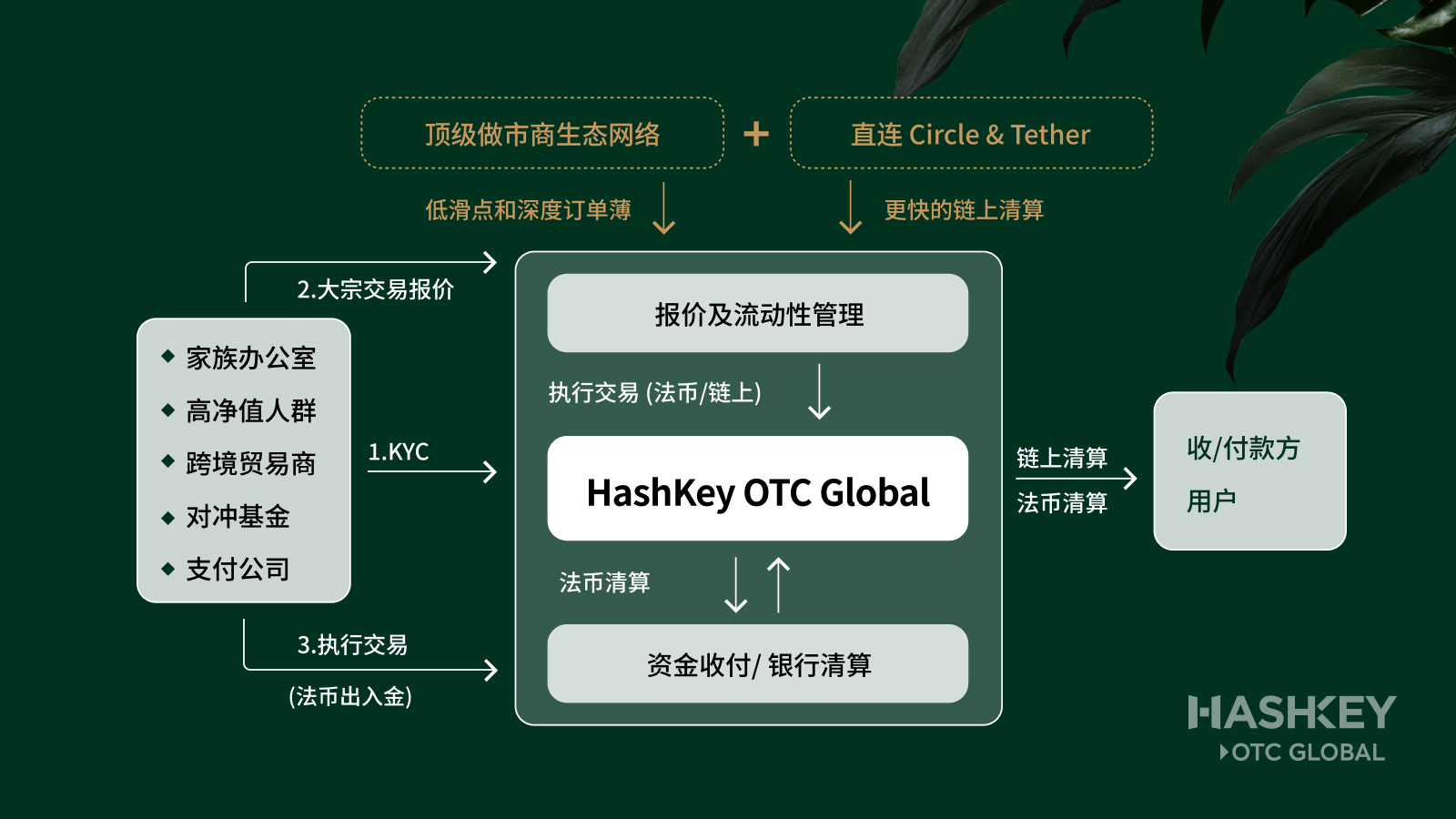

Traditionally, OTC is perceived as direct exchange with instant settlement, but achieving this is far from easy. The actual process is significantly more complex than imagined, involving several key stages, each testing comprehensive capabilities. Taking HashKey OTC Global as an example, the specific workflow is summarized below.

This operational flow is no simpler than any trading system—in fact, due to its integration of traditional banking, blockchain, exchange rates, and regulatory requirements, its complexity and end-to-end difficulty are even higher (a simplified overview is shown in the diagram below).

First is institutional-level cross-border clearing and foreign exchange risk management. Regulatory frameworks, banking channels, and fund inflow/outflow requirements vary greatly across regions, making the process extremely intricate.

Second is multi-layered compliance oversight. The entire operation must comply not only with local regulations but also those of counterpart jurisdictions. Any mistake in any link could lead to fund freezes.

Third is liquidity provisioning and hedging. During extreme market conditions, rapid risk hedging and allocation of multi-chain assets are required—testing both technological capabilities and access to global market-making networks.

Therefore, institutional-grade on/off ramp services are fundamentally not just about simple swapping or moving of funds and crypto assets. They represent a sophisticated operational capability spanning chains, borders, and financial systems, placing extremely high demands on internal resource reserves and operational coordination.

3. What are the core advantages and barriers of HashKey OTC Global?

In today's global crypto market, HashKey OTC Global’s positioning and capabilities are not just present—they may well be unique. Let’s examine its key strengths and moats:

1. Direct connection to stablecoin sources with native minting rights

HashKey OTC Global is among the rare global primary dealers with native USDC minting and redemption privileges from Circle, bypassing all intermediaries to directly access core liquidity. It also has a strategic partnership with Tether, enabling immediate access to the world’s largest USDT network and multi-chain instant settlement.

Circle, the issuer of the largest regulated stablecoin, applies extremely strict vetting criteria, typically granting permissions only to top-tier institutions with the highest compliance standards, significant trading volume, and robust risk controls. Native minting means lowest funding costs, fastest speeds, and most stable liquidity—making it nearly irreplaceable by traditional secondary OTC desks or exchange intermediaries. Moreover, as Circle moves toward a U.S. stock listing, partner requirements will only increase, further enhancing this scarcity.

2. Exclusive bank-named accounts

It is the only institutional OTC provider capable of offering named account services with both Standard Chartered Bank and DBS Bank, ensuring zero intermediary layers in settlement. This enables true T+0, minute-level fund clearing—a major advantage for clients where time value of money matters.

In terms of banking partnerships, both Standard Chartered and DBS impose very high compliance thresholds globally and across Asia. HashKey OTC Global’s ability to collaborate with these elite banks effectively addresses institutional clients’ biggest concerns: frozen funds, intermediary bank risks, and approval delays. This is particularly vital for high-frequency use cases such as arbitrage, hedging, and cross-border trade.

3. Global compliance footprint

A multi-license framework covering Singapore (MAS), Japan (JFSA), and Dubai (VARA) forms a global, multi-hub compliance network. Partnerships with Moody’s for KYC processes and services, and Chainalysis for on-chain audits and tracking, meet the audit requirements of large institutions, family offices, and funds.

Obtaining compliance licenses typically takes years and involves rigorous procedures. Even if competitors were willing to invest immediately, synchronously securing core licenses across multiple jurisdictions would be extremely difficult, giving HashKey OTC Global a clear first-mover advantage that perfectly aligns with the compliance demands of top-tier clients such as global family offices, listed companies, and sovereign funds.

4. Deep liquidity network

Beyond providing deep liquidity, HashKey OTC Global’s own liquidity and market-making network supports block trading via dark pools, ensuring low slippage for large orders without market impact.

With these four advantages, HashKey OTC Global goes beyond mere transactional improvements—it implements an integrated strategy spanning from funding origins (banks, compliance) to on-chain issuance and application-level circulation.

From a strategic moat perspective, native minting rights cannot be obtained through temporary applications, establishing an irreplaceable core node in the stablecoin supply chain. Top-tier banks’ named accounts require years of partnership building and compliance credibility, and carry strong exclusivity. On the licensing front, regulatory moats are clearly defined, while at the core liquidity and pricing levels, extensive market-maker participation and deep on-chain pools represent long-term network advantages that are hard to replicate quickly.

Overall, in the institutional OTC space, globally comparable competitors are extremely limited. HashKey OTC Global is highly likely to become a central hub for the stablecoin ecosystem and large-scale institutional capital onboarding.

4. More than OTC: Why HashKey OTC Global is a pivotal hub

As core Asian markets like Hong Kong and Singapore roll out stablecoin regulatory frameworks, demand for fast, secure, and low-slippage stablecoin conversion will surge. HashKey OTC Global is already among the few providers capable of source-level minting and bank-powered instant clearing, positioning it as the preferred global gateway for stablecoins.

1. A key lever for cross-border payments

Furthermore, in the broader context of stablecoin use—cross-border payments—the global market is worth approximately $150 trillion. High costs and slow processing via traditional banking channels have become industry pain points. HashKey OTC Global’s compliant pathways, T+0 settlement, and direct fiat connectivity are precisely the critical levers needed to revolutionize cross-border payments.

2. Chain linkage stickiness for institutional capital allocation

In the future, more family offices, sovereign funds, and listed companies will need compliant, audit-friendly, and highly liquid crypto asset allocation solutions. HashKey OTC Global offers end-to-end solutions—from KYC/KYB to exit strategies—locking in long-term stickiness for high-net-worth individuals and institutional capital.

3. Ecosystem loop with HashKey Group’s broader business

As HashKey Exchange and HashKey Chain continue to mature and expand, OTC Global can recycle liquidity back into the exchange, on-chain financial applications, and asset tokenization scenarios, enabling continuous integration between stablecoins, tokenized assets, and real-world use cases. It can also provide full-cycle on/off ramp services for HashKey Capital, including funding for VC investments and withdrawal of investment returns. This not only completes a key piece of HashKey Group’s positive flywheel but also allows this capability to be externally replicated, truly establishing it as the central nervous system of compliant finance in the Web3 world.

HashKey OTC Global is a globally strategic infrastructure that appears simple but is in reality extremely complex and highly valuable. It is not just the first entry point for crypto capital, but also the core conduit linking TradFi and Web3 worlds.

In the upcoming era of global digital asset exploration, HashKey OTC Global will serve as a super engine for global stablecoins and large-scale asset flows, carrying the complete value cycle from fiat → blockchain → real-world applications, and becoming an irreplaceable core hub.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News