Why is Trump in a hurry, and why does the United States dislike central bank digital currencies so much?

TechFlow Selected TechFlow Selected

Why is Trump in a hurry, and why does the United States dislike central bank digital currencies so much?

Trump: The president is furious, it must pass tomorrow!

By: Bright, Foresight News

Early on July 16, Beijing time, according to a Politico reporter, the U.S. House of Representatives failed to pass a procedural vote on cryptocurrency-related legislation. Meanwhile, Fox News reported that the House planned to attempt another vote on the rules for debating crypto bills around 5:00 p.m. EDT (05:00 Beijing time).

It was reported that President Trump became very "angry" after being rebuffed. Following the House's voting failure, Trump immediately posted: The GENIUS Act will pass tomorrow. He had already met with 11 dissenting representatives in the White House Oval Office today to discuss passing legislative rules including the "GENIUS Act," and reached unanimous agreement that they would support the rules the following morning.

However, the Democratic Party’s whip later stated there were no additional plans for cryptocurrency bill votes in the House today. The vote concluded 196 in favor versus 222 opposed, preventing three crypto bills—including stablecoin regulation—and a defense spending bill from advancing into formal deliberation. The main included crypto bills were:

GENIUS Act (Stablecoin Regulation)

CLARITY Act (Digital Asset Market Structure Regulation)

Anti‑CBDC Surveillance State Act

House Speaker Johnson could only awkwardly state he hoped to try again Wednesday for a procedural vote on the crypto bills in the House.

The Trump Administration Strikes Hard

After the GENIUS Act passed the Senate on June 18, Trump immediately expressed hope to see the bill on his desk before Congress adjourned in August. Market sentiment also unanimously believed the House vote on the GENIUS Act was merely a formality, with its passage considered certain.

Prior to the House's procedural vote on GENIUS, Trump had already taken to social media celebrating, saying: "Happy Crypto Week. The House is about to vote on a major bill—the GENIUS Act—designed to make America the undisputed number one leader in digital assets. Digital assets represent the future, and America is far ahead. Let’s get the first vote done this afternoon (all Republicans should vote yes). This is our moment. All of this is to make America great again—stronger and more exceptional than ever before. We are leading the world, and we will work closely with both the Senate and the House to push through more related legislation."

Why Was It So Publicly Rejected? CBDC Turns Out to Be the Root Cause

Yet the House did not follow the script to complete the series of crypto bill votes. The GENIUS stablecoin bill may not have been the core conflict. A sudden statement by David Sacks, the White House AI and cryptocurrency lead—"crypto tsar"—just before the meeting raised eyebrows. He clearly stated the Trump administration intends to ban the issuance of central bank digital currencies (CBDC).

Hence, the Anti‑CBDC Surveillance State Act may actually be the true battleground between the two parties.

Republicans and Democrats have long clashed over CBDCs, with the Biden administration strongly committed to advancing CBDC development. In March 2022, Biden signed Executive Order 14067, “Ensuring Responsible Development of Digital Assets,” placing research and deployment of a CBDC at the highest priority. In March 2023, Nellie Liang, Treasury Undersecretary for Domestic Finance, announced during a speech at the Atlantic Council that the Treasury would convene an interagency working group to explore CBDC development, enabling the U.S. to “move forward quickly” if a CBDC served national interests.

To elevate CBDC status, the Biden administration even suppressed cryptocurrencies. That March, the White House Council of Economic Advisers released its annual report, dedicating an entire chapter to digital assets. It positioned CBDCs and the FedNow payment system as more promising paths for improving money and finance, while expressing skepticism toward cryptocurrencies, arguing they offered little value beyond speculative risk. This report became the ideological foundation for the Biden administration’s sustained pressure on the crypto industry.

The anti-CBDC camp includes mainstream Republicans, Silicon Valley libertarians, anti-establishment leftists, and cryptocurrency professionals—all united in opposition due to concerns over privacy and government control. By the end of the Biden administration, the Democratic-led vision for CBDC had largely collapsed. The Anti-CBDC Surveillance State Act passed the House in May 2024, though it had not yet come to a Senate vote. The bill explicitly prohibits the Federal Reserve from directly or indirectly issuing retail CBDCs to the public through intermediaries, bans their use in open market operations or any monetary policy tools, and prohibits any form of CBDC testing.

Sure enough, on January 23, 2025, President Trump, having just taken office, immediately signed an executive order banning any agency from issuing or using central bank digital currencies (CBDC) within or outside the United States, relaxed regulations on privately issued digital currencies, and established the President's Working Group on Digital Asset Markets—which later evolved into the White House AI and Cryptocurrency Task Force chaired by David Sacks.

Therefore, the Anti-CBDC Act is effectively the prerequisite legal basis enabling the Trump administration to advance crypto bills like GENIUS. The failure of these three substantial crypto bills to pass essentially reflects the ongoing struggle between the Democratic mainstream supporting CBDCs and the Republican mainstream backing cryptocurrencies.

From a societal perspective, however, CBDC lacks broad public support in the U.S. Previous polls showed only about 16% of Americans support CBDC, while 78% said they were “unlikely to use” it, with over half stating they were “extremely unlikely to use” it.

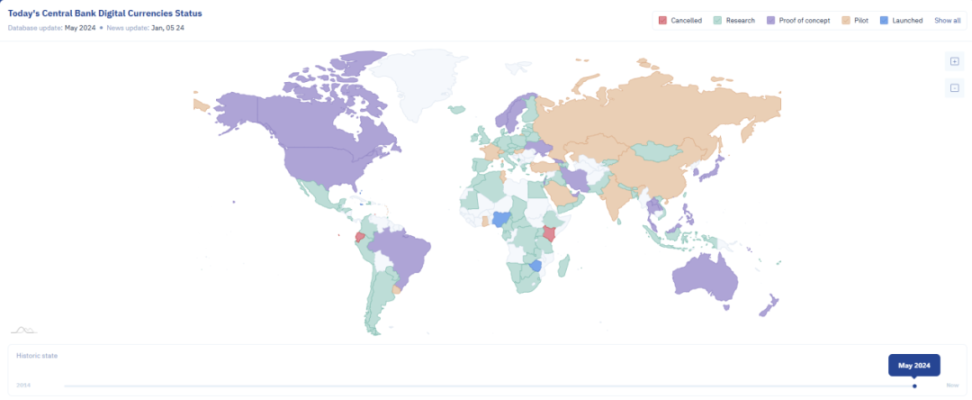

In response, CICC published a research report noting that the Anti-CBDC Surveillance State Act, together with the CLARITY Act and the GENIUS Act, forms a logically closed framework for U.S. digital currency regulation. It reflects a strategic choice by the U.S.: abandoning government-led CBDC in favor of supporting privately issued dollar stablecoins, guiding and regulating them through policy. Amid a global wave of central banks exploring CBDCs, this approach highlights the distinct path favored by traditional Republicans based on the principle of “small government, large market.” In the long run, dollar stablecoins and CBDCs issued by various countries’ central banks will compete, representing in some sense another race between market-driven and government-led innovation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News