The Hype Behind Stock Tokenization: A Roadmap of the Tokenization Narrative Evolution

TechFlow Selected TechFlow Selected

The Hype Behind Stock Tokenization: A Roadmap of the Tokenization Narrative Evolution

Tokenization of U.S. stocks is merely a subset of the broader RWA tokenization process.

By imToken

Earlier this month, Robinhood and others successively announced support for trading U.S. stocks on blockchain, with plans to launch their own proprietary public chains. Meanwhile, platforms like Kraken have also introduced trading pairs for tokenized U.S. stocks such as AAPL, TSLA, and NVDA, sparking a wave of enthusiasm for on-chain stock trading.

But is it really a new concept?

In reality, this seemingly sudden surge in tokenization reflects a seven-year evolution within the crypto world—tracing from early synthetic asset experiments, to the real-world adoption of stablecoins, and now to the structured integration of RWA (real-world assets). The narrative of "assets × blockchain" has never truly broken; it's simply undergoing a more practical, institutional reboot.

Tokenized Stocks: Old Wine in New Bottles

On the surface, stock tokenization appears to be a fresh frontier in Web3—but in truth, it’s more of a revival of an older narrative.

Users who experienced the last cycle of on-chain innovation may recall how projects like Synthetix and Mirror pioneered synthetic asset frameworks. These allowed users to mint on-chain tokens pegged to U.S. equities, fiat currencies, indices, or even commodities (e.g., sAAPL, mTSLA) by over-collateralizing native crypto assets (such as SNX or UST), enabling decentralized, intermediary-free trading.

The model’s key advantages were clear: no need for real-world custody or clearing, no counterparty matching, infinite liquidity depth, and zero slippage. Yet while the theory was compelling, practice proved harsh—oracle inaccuracies, extreme asset volatility, recurring systemic risks, and lack of regulatory alignment gradually led these synthetic assets into obsolescence.

Today’s stock tokenization trend marks a shift from “synthetic replication” to “real-share mirroring,” representing a maturation of the tokenization narrative toward direct linkage with off-chain physical assets.

Take Robinhood’s newly launched tokenized stock products: available information suggests they involve actual stock ownership being brought on-chain, with settlement infrastructure rebuilt around real share custody and funds flowing through compliant brokers into U.S. equity markets.

Objectively speaking, this approach still faces challenges regarding compliance pathways and cross-border operations. However, for users, it opens up an entirely new on-chain investment window:

No account opening, no KYC, no geographical restrictions—just a crypto wallet and some stablecoins are needed to bypass traditional brokerage hurdles and trade tokenized U.S. stocks directly on DEXs. With 7×24 trading, second-level settlements, and borderless access, this experience is unmatched by conventional securities systems—especially for non-U.S. investors.

This paradigm relies on blockchain’s capability as infrastructure for “clearing, settlement, and asset ownership,” marking a significant leap for tokenization—from technical experimentation to real user utility.

More broadly, “U.S. stock tokenization” is merely a subset of the larger RWA (real-world assets) tokenization movement, reflecting the ongoing evolution since the rise of tokenization in 2017—from token issuance, to synthetic assets, and now to anchoring on real-world value.

The Evolution of Tokenization

Looking back at the development of tokenization, it becomes evident that this theme has been central to nearly every wave of infrastructure advancement and narrative progression in the crypto space.

From the 2017 “token sale boom,” to the 2020 “DeFi Summer,” and recent “RWA narratives” culminating in today’s “tokenized stocks,” we can trace a relatively clear trajectory of on-chain asset evolution.

The first large-scale application of tokenization emerged during the 2017 ICO frenzy, when the idea of “tokens as equity” ignited imaginations across startups. Ethereum provided low-barrier tools for issuing and fundraising, turning tokens into digital representations of future rights—equity, usage, governance, etc.

Yet without clear regulation, sustainable value capture mechanisms, or transparent information, many projects devolved into vaporware, fading away as the bull market cooled.

Fast forward to 2020: the DeFi explosion marked tokenization’s second major wave.

Native on-chain financial protocols like Aave, MakerDAO, and Compound leveraged assets such as ETH to build permissionless, censorship-resistant financial systems, enabling complex operations including lending, staking, trading, and leverage—all executed on-chain.

During this phase, tokens evolved beyond fundraising instruments into core categories of on-chain financial assets—wrapped assets (WBTC), synthetic assets (sUSD), and yield-bearing assets (stETH). Notably, MakerDAO began accepting real-world assets like real estate as collateral, paving the way for deeper integration between traditional finance and DeFi.

This moment served as a turning point: tokenization began incorporating more stable, higher-value real-world assets.

Starting in 2021, the narrative advanced further, as protocols like MakerDAO explored integrating real estate, government bonds, and gold into their collateral frameworks. Thus, tokenization expanded from “on-chain native assets” to “off-chain physical asset representation.”

Unlike code-anchored abstractions, RWA represents tangible assets or legal claims being authenticated, fractionalized, and circulated on-chain. With relatively stable valuations, established appraisal standards, and existing regulatory frameworks, RWAs offer on-chain finance much-needed “value anchors” grounded in reality.

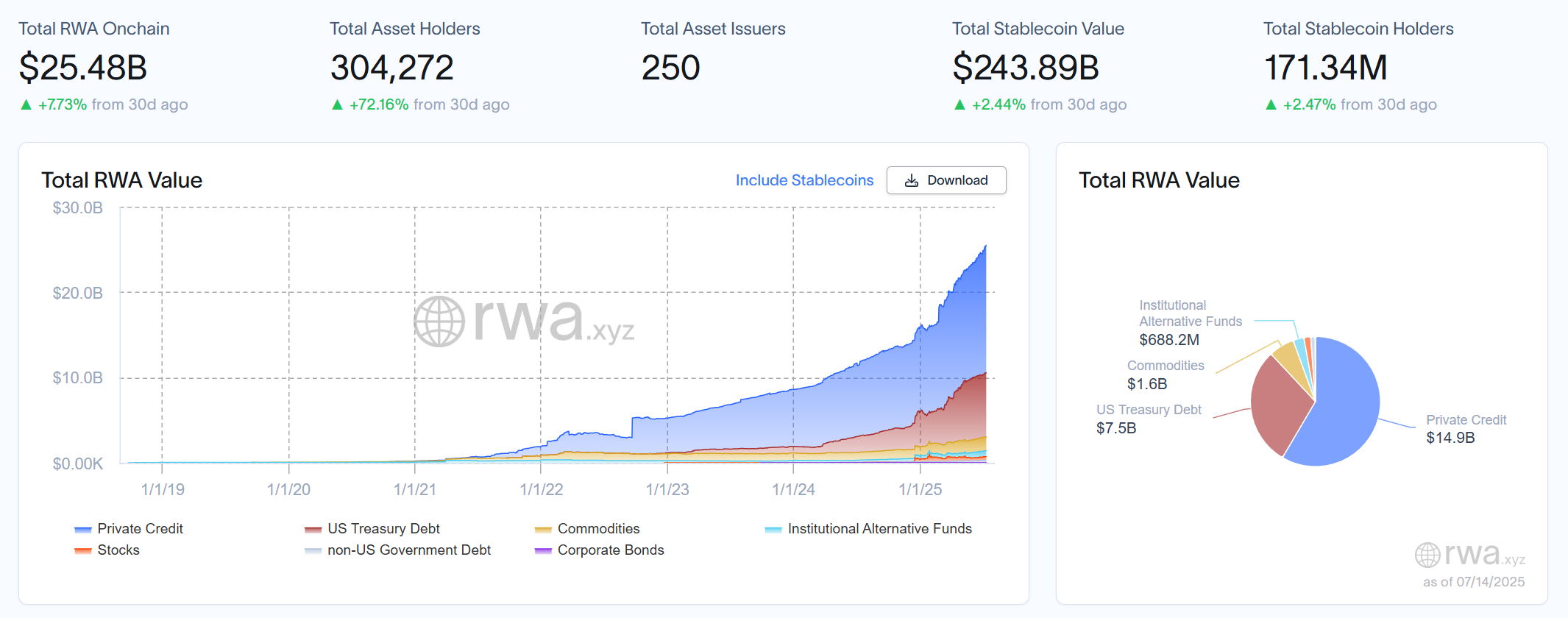

According to the latest data from RWA research platform rwa.xyz, the total RWA market now exceeds $25 billion. BlackRock offers an even more optimistic forecast: by 2030, tokenized assets could reach a market cap of $10 trillion—implying potential growth of over 40x in the next seven years.

So what types of real-world assets will lead the charge in becoming the foundational pillars of on-chain RWA finance?

What Will Be the Bridgehead of Tokenization?

To put it plainly, over the past five years, the most successful tokenization product hasn’t been gold or stocks—it’s been stablecoins.

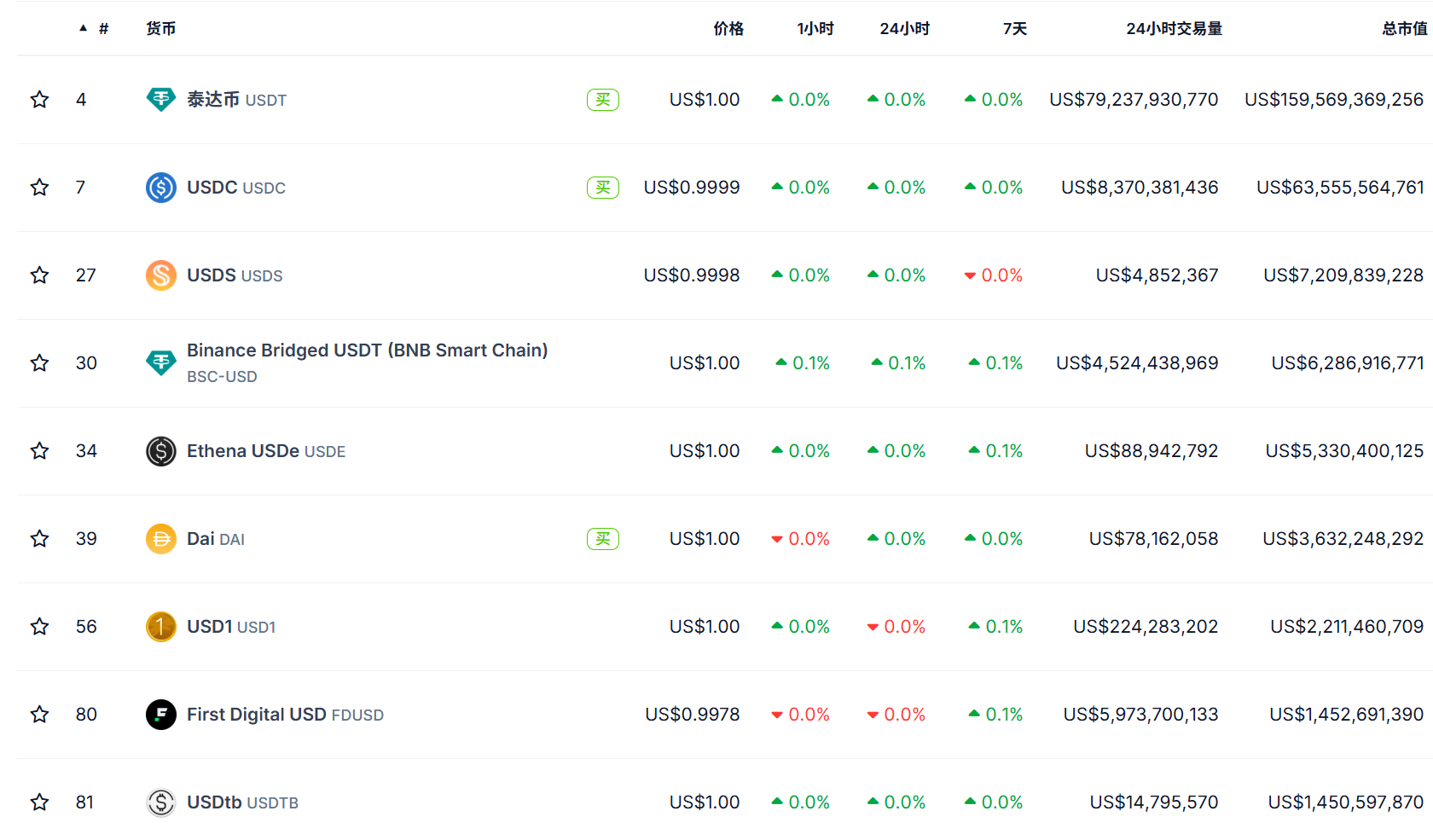

Stablecoins represent the first true example of product-market fit (PMF) in asset tokenization: mapping cash—the most basic and liquid asset—onto the blockchain, forming the first “value bridge” between TradFi and DeFi.

Their operational model is highly illustrative: real-world assets (like USD or short-term Treasuries) are held in custody by banks or regulated entities off-chain, while equivalent tokens (e.g., USDT, USDC) are issued on-chain. Users can hold, transfer, spend, trade, or interact with DeFi protocols using these tokens via crypto wallets.

This preserves the stability of fiat while unlocking the benefits of blockchain: fast settlement, low-cost transfers, 7×24 availability, and seamless integration with smart contracts.

To date, the global market cap of stablecoins exceeds $250 billion—proving that the real success of tokenization hinges not on technological novelty alone, but on solving practical problems related to asset liquidity and transaction efficiency.

Today, tokenized U.S. stocks appear poised to become the next major use case.

Unlike earlier synthetic models reliant on oracles and algorithms, modern “real-share tokenization” increasingly aligns with real financial infrastructure, converging on a standard framework: real share custody + on-chain representation + decentralized trading.

A notable trend is that mainstream players like Robinhood are announcing native chains or proprietary blockchains supporting on-chain stock trading. Based on disclosed information, most of these initiatives rely on Ethereum-based ecosystems (such as Arbitrum), reaffirming Ethereum’s role as the foundational infrastructure for tokenization.

The reason? Ethereum offers not only mature smart contract capabilities, a vast developer community, and robust asset standards—but crucially, its neutrality, openness, and composability create the most scalable environment for financial asset mapping.

In sum, if prior waves of tokenization were driven by Web3-native projects experimenting with decentralized finance, this current wave resembles a professional overhaul led by TradFi—bringing real assets, genuine regulatory compliance needs, and global market demands onto the blockchain.

Could this finally mark the true beginning of tokenization?

We’ll just have to wait and see.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News