Understanding Hyperion: Aptos' Unified Liquidity Engine and On-Chain Financial Infrastructure

TechFlow Selected TechFlow Selected

Understanding Hyperion: Aptos' Unified Liquidity Engine and On-Chain Financial Infrastructure

Hyperion has proven itself as the most resilient and vibrant financial infrastructure builder on Aptos, backed by data and products.

Why Hyperion?

As a high-performance public blockchain, Aptos is striving to realize its vision of becoming the "global on-chain trading engine." With technical advantages such as parallel execution, second-level finality, and strong scalability, it has emerged as a leading candidate for next-generation infrastructure. However, in reality, Aptos' early-stage ecosystem still faces typical DeFi pain points:-

Liquidity fragmentation and inefficient capital deployment

-

Dispersed trading paths and fragmented user experience

-

Lack of sustainable, structured yield products, resulting in weak capital retention

How Hyperion Is Reshaping Liquidity on Aptos

-

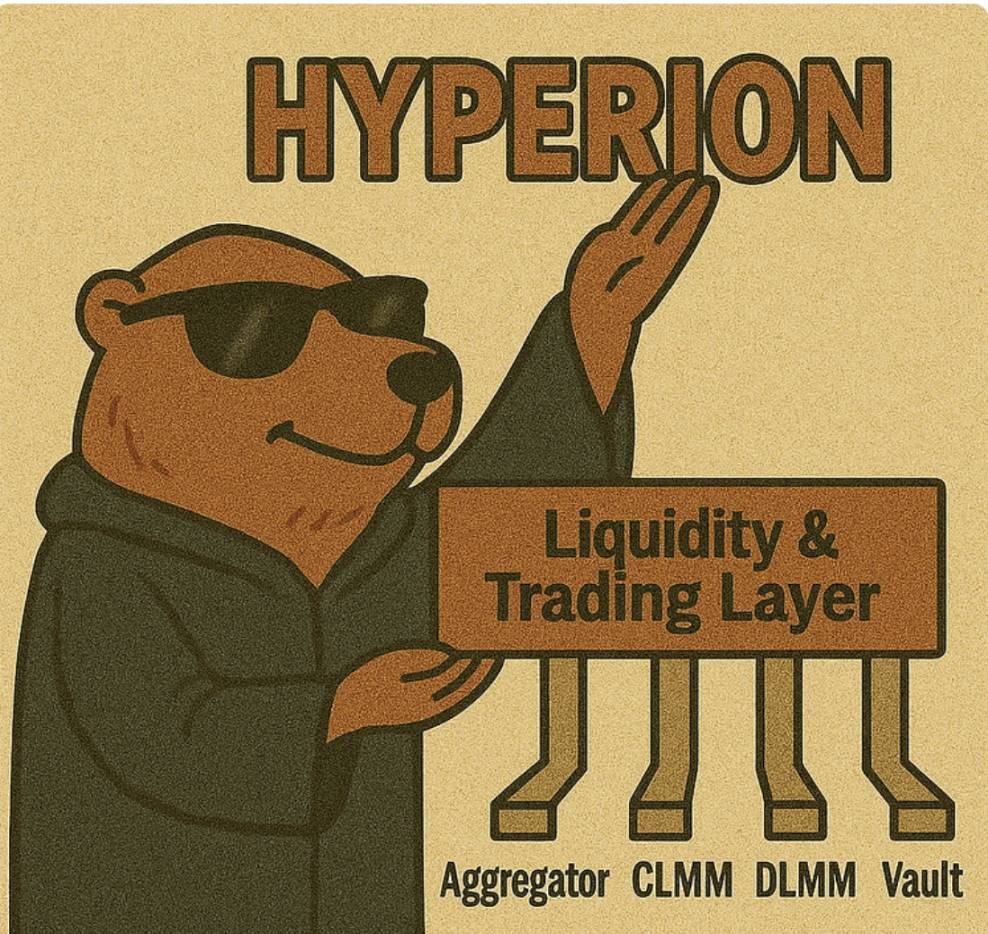

Hyperion has built a unified, efficient, and composable on-chain financial engine that integrates:

-

Smart Aggregator: Intelligent cross-chain liquidity routing with multi-hop order splitting to optimize trade prices and slippage.

-

Concentrated Liquidity Market Maker (CLMM): Based on the Uniswap v3 model, allowing LPs to provide liquidity within specific price ranges to enhance capital efficiency and trading depth.

-

Directional Liquidity Market Maker (DLMM): Supports asymmetric and directional strategies, flexibly adapting to volatile assets and dynamic markets.

-

Open Vault Platform: Strategy providers can freely deploy automated liquidity strategies, enabling regular users to earn high yields effortlessly.

-

-

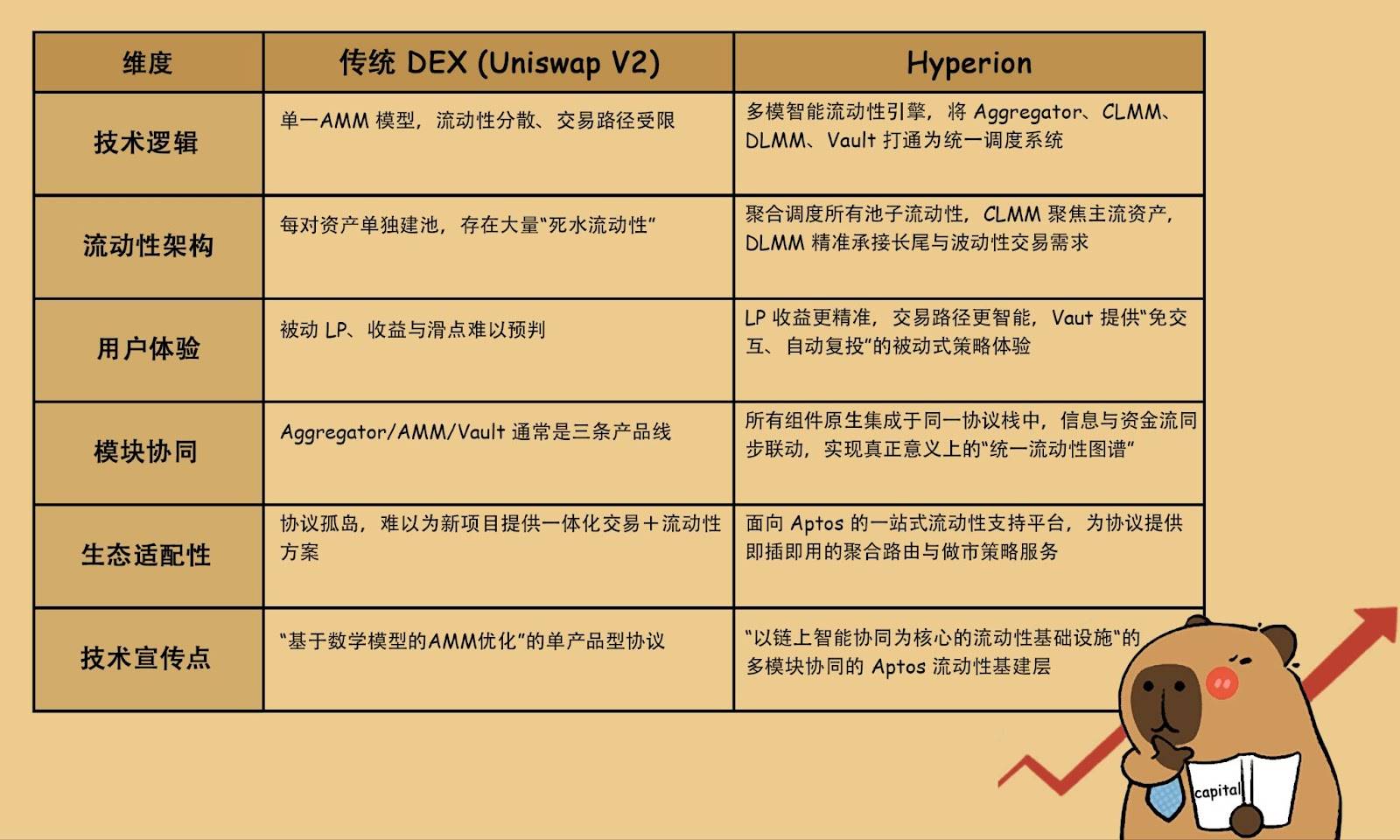

This modular architecture overcomes capital fragmentation inherent in traditional DEX isolated pool models:

-

Mainstream assets gain enhanced trading depth through CLMM

-

Volatile assets are dynamically supported by DLMM-adapted liquidity

-

Smart routing connects full-chain trading paths, reducing slippage and operational costs

-

The Vault platform lowers strategy participation barriers, enabling automated yield generation

-

In the end, Hyperion builds a shared, cross-chain “unified liquidity map,” delivering optimal execution paths for traders while offering LPs sustainable and highly efficient capital utilization.

What Has Hyperion Achieved?

In just the past five months, under the watchful eyes of the Aptos community, Hyperion has proven itself—through data and product excellence—as the core liquidity and financial gateway on Aptos:-

$7.1 billion in cumulative trading volume, establishing Aptos’ primary trading hub: Since launch, Hyperion has surpassed $7.1 billion in total trading volume, firmly ranking as the most active DEX on the Aptos network and among the top ten DEXs globally by volume. Daily trading volumes have repeatedly hit new highs and now consistently range between $125 million and $150 million, demonstrating strong user engagement and market demand.

-

$130 million in TVL, balancing capital efficiency with on-chain yields: Hyperion’s current Total Value Locked (TVL) exceeds $130 million. Through active liquidity strategies, auto-compounding Vault systems, and efficient LP solutions, it delivers a high-yield, low-barrier, and capital-efficient on-chain asset management experience. More importantly, Hyperion effectively aligns trading volume with TVL, continuously improving per-unit capital utilization to ensure every dollar of liquidity actively fuels on-chain trading and ecosystem growth—avoiding idle or inefficient capital.

-

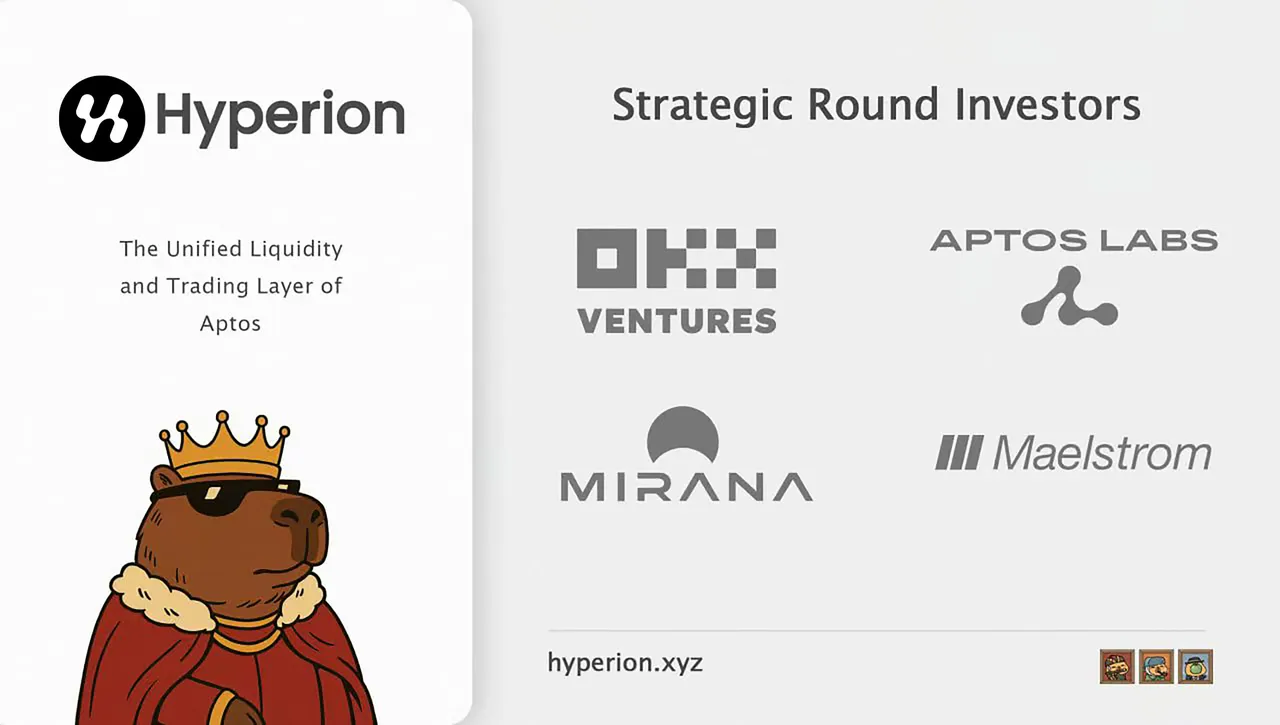

Backed by top-tier capital, with solid ecosystem foundations: Hyperion has completed a strategic funding round led by OKX Ventures and joined by leading institutions including the Aptos Foundation, Maelstrom (Arthur Hayes), and Mirana Ventures. This not only validates the team’s capabilities but also reflects deep confidence in Hyperion’s vision of modular DeFi infrastructure.

-

Auto-compounding mechanisms that reduce operational complexity

-

Highly controllable concentrated LP strategies that boost capital efficiency

-

Diversified multi-asset yield portfolios, expanding investment options—helping users earn steady returns with minimal on-chain complexity.

-

Over 30,000 Discord members

-

Over 130,000 Twitter followers

-

Nearly 950,000 cumulative DRIPs active users

RION and the Next Steps

Hyperion has successfully transitioned from zero to one in product development, with an established user base and growing transaction ecosystem. We believe true infrastructure is more than functionality—it belongs to everyone who helps build it. To this end, RION and xRION will serve as key hubs, empowering builders, traders, and community members to deeply participate and co-create the future, while driving Hyperion into its next phase:- RION: The native, cryptographically secure, and transferable token of the Hyperion platform, serving multiple utility functions—supporting transactions, decentralized settlement, and qualifying for ecosystem access via anchoring with xRION;

- xRION: The governance token of the Hyperion ecosystem. Users obtain xRION by locking RION, representing their governance rights and long-term commitment, aligning incentives with sustained value creation.

The Token Generation Event (TGE) will officially launch in July, followed by the rollout of:-

Advanced Vault strategies to enhance yield experiences

-

AMM upgrades to improve trading efficiency and capital utilization

-

Expansion of BTC markets, deepening connections between Aptos and major asset networks

-

Launchpool programs and cross-chain collaborations to incentivize ecosystem contributions

-

New rounds of trading competitions, referral incentives, and community expansion campaigns

Hyperion: The Financial Foundation of Aptos

Five months. $7.1 billion in trading volume. $130 million in TVL. Backed by top-tier institutions. Hyperion has already proven itself—with data and products—as the most resilient and vibrant builder of financial infrastructure on Aptos. In the next phase, with the introduction of RION, we will continue refining our product suite, connecting more on-chain assets, unlocking richer yield opportunities, and ensuring every participant benefits from Hyperion’s growth. True financial infrastructure should be an evolving, open network. Hyperion aims to be its connector, amplifier, and community. If you’re a builder, developer, long-term user, or contributor in the Aptos ecosystem, we don’t just welcome your involvement—we look forward to building a more efficient, transparent, and sustainable on-chain financial world together with you.Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News